Investment Thesis

Jabil’s (NYSE:JBL) share price has nearly doubled in the past year, but we believe it is still undervalued. Our research reveals that Jabil is more than a traditional EMS provider, but a digital manufacturing and supply chain innovator. With a strong foothold in high-margin markets, a culture of innovation, and efficient cost management, Jabil is well-positioned for sustained growth and margin expansion. Investors can expect substantial returns as the market recognizes the company’s true value, making Jabil an attractive long-term investment opportunity.

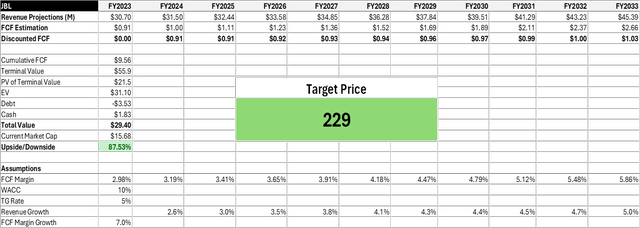

We give Jabil a Buy with a target price of $229.

A Manufacturing and Supply Chain Management Company

Jabil Inc is a manufacturing solutions and supply chain management company with over 250,000 employees across 100 locations in 30 countries. The company offers engineering, design, manufacturing, supply chain, and product management services to various industries, such as healthcare, automotive, aerospace, defense, energy, consumer products, industrial, and cloud. It operates through two segments: Diversified Manufacturing Services (DMS) and Electronics Manufacturing Services (EMS). It generates revenue from product sales and service fees based on long-term contracts with its customers.

EMS: Competitive Market with Low Margins

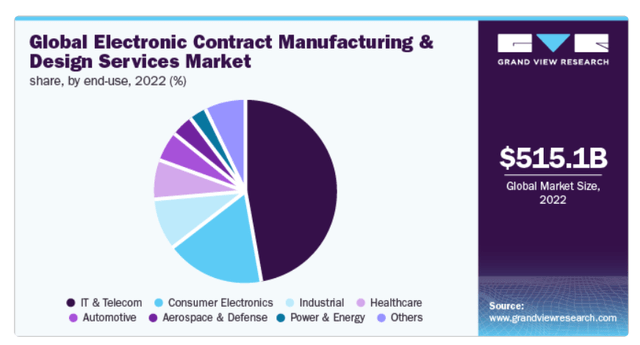

According to a market research report by Grandview Research, the global electronics manufacturing services (EMS) market size was valued at $515 billion in 2022 and is projected to reach $1 billion by 2030, growing at a CAGR of 9.7% from 2022 to 2030.

Global Electronics Manufacturing Services Market (Grandview Research)

The main drivers for this expected growth are the increasing demand for consumer electronics, smart devices, medical equipment, electric vehicles, renewable energy and industrial automation.

Jabil operates in a highly competitive and dynamic industry, where it faces many rivals that offer similar or alternative services to its customers. Some of these competitors are Foxconn, Flex, Plexus, Sanmina, Celestica, and Benchmark Electronics. The typical characteristics of these EMS companies are that they operate on low margins, high volumes, and fast turnaround times. They also have to deal with complex supply chains, dynamic customer requirements, and stringent quality standards. To remain competitive, they have to constantly invest in new technologies, equipment, and facilities. These are all cost drivers that increase the capital and operating expenses and reduce the profitability of the EMS companies.

GTM Strategy: Target High-Margin End Markets

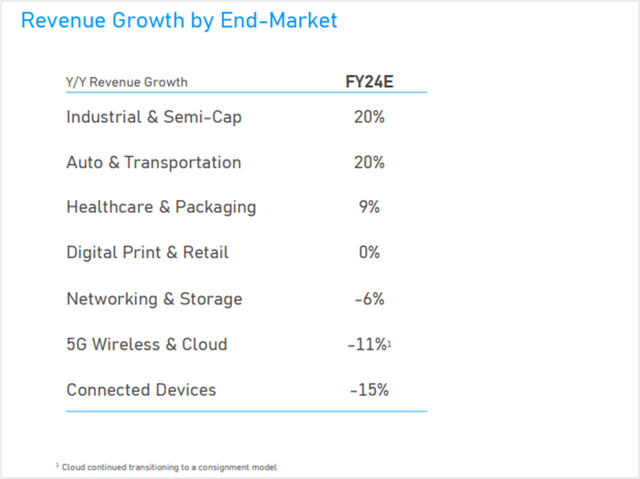

Jabil targets end-markets that have strong growth potential and high-margins. As per the Q4 earnings presentation, Jabil’s healthcare business grew by 12% year-over-year in fiscal year 2023 and is expected to grow by another 9% in fiscal year 2024. Jabil’s automotive business grew by 42% year-over-year in fiscal year 2023 and is expected to grow by another 20% in fiscal year 2024. Jabil’s semi-cap business grew by 10% year-over-year in fiscal year 2023 and is expected to grow by another 20% in fiscal year 2024. By having a diverse range of customers and industries, Jabil can cope better with economic challenges or industry disruptions.

Jabil FY24 Revenue Growth Guidance (Jabil FY23 Q4 Earnings Presentation)

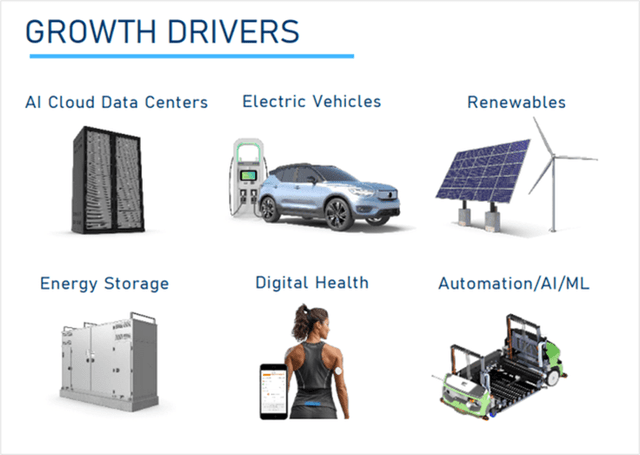

We see that many EMS companies are targeting high-growth and high-margin segments, such as Healthcare, Electric Vehicles, Renewables and Cloud. However, Jabil stands out from the crowd with its key capabilities that give it a competitive edge in the market;

- Jabil has a strong technological expertise that enables it to design and develop innovative products and solutions for its customers.

- Jabil has built a digital supply chain over years that allows it to optimize its operations and resources, as well as to provide real-time supply chain visibility and intelligence.

- Through its regionalization strategy, Jabil has created a globally distributed manufacturing network that enables it to localize its production and delivery, as well as to adapt to local market conditions and customer preferences.

With these capabilities, we think Jabil is not only a contract manufacturer, but rather a strategic supply chain partner for its customers.

Jabil Business Growth Drivers (Jabil FY23 Q4 Earnings Presentation)

Regionalization Strategy

Regionalization is the process of shifting manufacturing and supply chain operations closer to the end markets, which can lower costs, risks, and environmental impacts. Jabil has implemented a regionalization strategy to strengthen its supply chain resilience and diversify its manufacturing capabilities. We think that this strategy has three main benefits for Jabil:

First, it reduces the dependence on a single supplier or location, which can be exposed to disruptions such as trade wars, or pandemics. Jabil has established production facilities in 30 countries to increase resilience, reduce risks, and adapt to local market trends.

Second, it enhances the agility and flexibility of Jabil’s operations, as it can quickly adjust to changing customer demands, preferences, and regulations in local markets. This capability is strategically important for Jabil’s big multi-national customers, such as Tesla, Amazon, Apple and J&J, who are looking for reliable and innovative global partners to deliver their products closer to their end-users.

Third, it improves the profitability and efficiency of Jabil’s business, as it lowers the transportation costs, carbon emissions, and inventory levels.

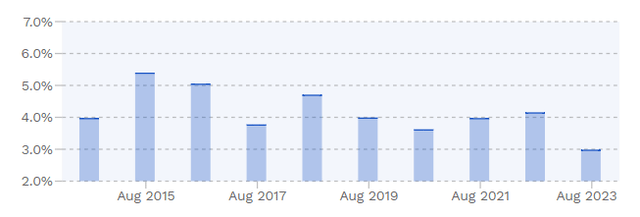

Jabil has also done a great job in executing its regionalization strategy with cost efficiency. When we check Jabil’s capex margin (see below), which measures the ratio of capital expenditures to revenue, it has been decreasing year-over-year, indicating that Jabil is very disciplined and efficient on capex spending. In its Q4 earnings call, Jabil’s management stated that they expect their capex margin to drop further to 2%-2.3% levels in the near future.

Jabil Capital Expenditure Margin (Finbox)

In conclusion, Jabil’s regionalization strategy is a very effective way to grow its business in a dynamic and uncertain world. By regionalizing and digitizing its supply chain, Jabil is increasing its operational resilience, its customer satisfaction, and profitability.

How Jabil Uses Advanced Technologies to Optimize Costs

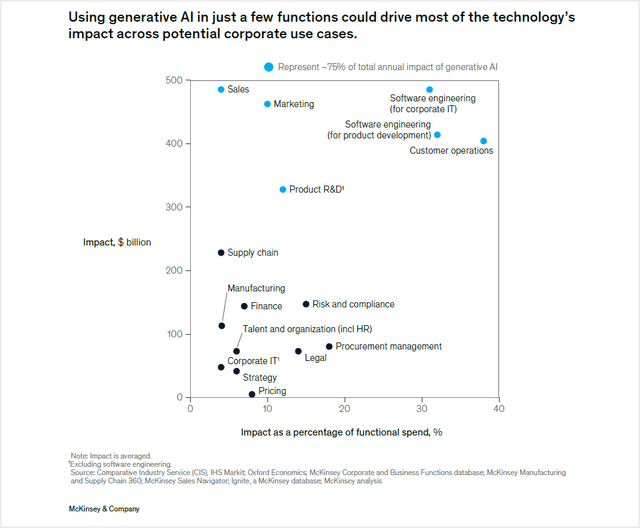

AI is a powerful tool that can generate substantial business value across the entire product life cycle and supply chain. According to the McKinsey’s report, generative AI could add trillions of dollars in value to the global economy. For instance AI can boost marketing productivity by up to 15%, cut customer operations costs up to 40%, save software development costs up to 45%, increase R&D productivity by 15% and more. Similarly, Goldman Sachs Group estimates that AI can increase US companies net margins by nearly 4% over a decade.

The Economic Potential of Generative AI (McKinsey & Company)

Jabil has been using AI, automation and other advanced technologies to make its operations better for several years. The company uses AI and data analytics to enable a digital supply chain, to do AI driven demand forecasting, procurement intelligence, real time inventory management and more. Jabil also uses 3D Printing for its Additive Manufacturing network where a product can be designed, prototyped and manufactured anywhere in the world in a matter of days. This makes Jabil a true distributed manufacturer with a cost-optimized supply chain and accelerated time to market. Few companies can achieve this level of agility in their operations.

We think that Jabil’s heavy adoption of these advanced technologies is resulting in significant margin expansion. Jabil’s digital manufacturing capabilities, along with its high-margin product offerings and operational excellence, will result in consistent growth in operating profits, possibly doubling to reach 10% in the next decade.

Culture of Innovation

Jabil also has a strong culture of innovation which drives its growth and differentiation. Jabil’s vision is to become the most technologically advanced and trusted manufacturing solutions provider. We can see that Jabil pursues innovation in two main ways:

- By creating new products and services for its customers. Jabil has established several innovation centers around the world that provide a collaborative environment for research and development. Jabil also partners with leading universities, research institutes, startups, and customers to co-create innovative solutions.

- By transforming its own operations and processes. Jabil is leveraging transformational technologies such as AI, Robotics and 3D Printers to optimize its R&D, production planning, demand forecasting, inventory management, and supply chain visibility. Jabil has implemented various initiatives to reduce its operating expenses and increase its manufacturing efficiency and flexibility.

Jabil Digital Factory (Jabil FY23 Q4 Earnings Presentation)

We think that Jabil’s culture of innovation is a key competitive advantage that enables it to deliver superior value to its customers and stakeholders. By innovating both externally and internally, Jabil has positioned itself as a leader in the digital manufacturing and supply chain management.

FY23 Q4 Earnings: Mixed Results

Jabil delivered mixed results in the fourth quarter of 2023, surpassing the earnings expectations but falling short of revenue. The company reported a 6% year-over-year decrease in net revenue to $8.5 billion, which missed the consensus of $8.6 billion. This revenue decline resulted from the EMS segment, which saw a 13% year-over-year decline in revenue to $4 billion. The company explained that this was due to the revenue model of its cloud business that changed from turnkey to consignment (which lowered its reported revenue). The DMS segment, however, maintained its revenue level at $4.4 billion, as it balanced out the declines in mobility and consumer products with growth in healthcare, automotive, and 5G.

Margins: Continuous Expansion

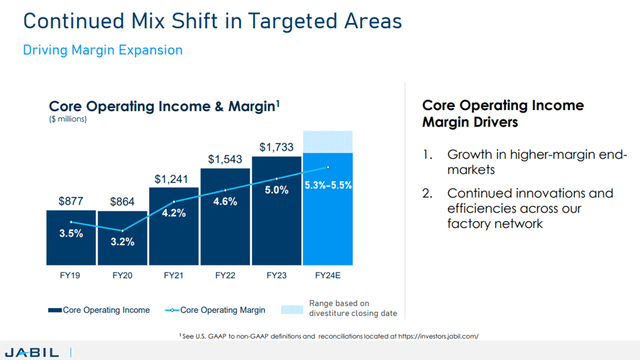

Jabil’s operating income of $441 million for the quarter was up 8% year-over-year and above the consensus of $415 million. The operating margin improved to 5.2%, up 0.4% from previous year. Jabil’s operating margin has been on an uptrend since FY19, when it was 3.2%. The company expects to continue this trajectory in fiscal year 2024, as it guides for an operating margin of 5.4% (see below).

Jabil Operating Margin Trajectory (Jabil)

Balance Sheet: Healthy

Jabil’s balance sheet reveals us that the company has a strong financial position and is well-equipped to face the challenges in the macro environment. Shareholders equity has grown, reflecting the company’s ability to retain earnings and reinvest them back into the business. This is a good indicator of Jabil’s long-term sustainability and its commitment to creating value for shareholders. Jabil has also improved its liquidity and working capital and can easily meet its short-term obligations and fund its operations.

Jabil is in a strong financial position and is using its assets and liabilities effectively to sustain its growth and profitability.

Guidance: Solid

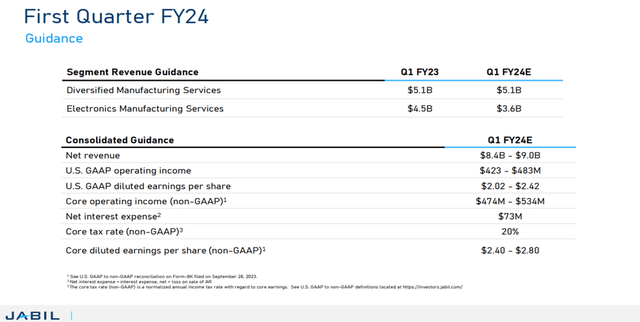

The company provided positive guidance for the first quarter and fiscal year 2024. For the first quarter of fiscal year 2024, the company expects net revenue to be in the range of $8.4 billion to $9 billion (-1% to 5% YoY), operating income to be in the range of $423 million to $483 million (-2% to 5% YoY), diluted EPS to be in the range of $2.40 to $2.80 (up 25% to 45% year-over-year).

We were very pleased with this guidance, as most of Jabil’s competitors guided for revenue declines for the next quarter.

Jabil FY24 Q1 Guidance (Jabil Q4 Earnings Presentation)

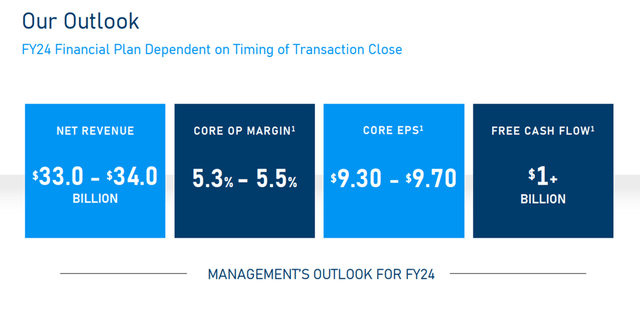

As seen below, for the full fiscal year 2024, the company expects net revenue to be in the range of $33 billion to $34 billion (up 1% to 4% YoY), operating margin in the range of 5.3% to 5.5% (up 6% to 10% YoY), core diluted EPS to be in the range of $9.50 to $10.50 (up 9% to 12% YoY).

Jabil FY24 Outlook (Jabil Fy23 Q4 Earnings Presentation)

Valuation: Undervalued

We performed a discounted cash flow (DCF) analysis to estimate the fair value of JBL. We used a 10% weighted average cost of capital (WACC) to discount the future cash flows. We based our analysis on $30.7B as the FY23 revenue baseline, which excludes the divested Mobility business from our model. We also excluded the Mobility business’s revenues and free cash flows (FCF) for FY24. We projected a 2.6% revenue growth for FY24, aligning to Jabil’s guidance midpoint. For FY25 and beyond, we assumed a gradual revenue increase up to 5% by FY33. We believe this is a conservative assumption, as it is lower than the ECM market growth CAGR of 8.5%. Moreover, we applied a 5% revenue CAGR as the terminal growth rate after the 10-year period.

Our model also assumes a 7% annual increase in FCF margin, consistent with the current margin expansion momentum.

Jabil DCF Model (Author)

According to our DCF calculations, the fair value of JBL business is $29 billion. This valuation implies a 90% upside potential for the stock, suggesting a target price of $229.

It shows that Jabil is undervalued by the market, as it is not fully recognized for its transformation and differentiation from the traditional EMS providers.

Risks

Risks to our rating include:

- JBL is exposed to macroeconomic uncertainties and supply chain disruptions that may affect its customer demand and operational efficiency.

- JBL operates in a highly competitive and low-margin industry that may pressure its profitability and market share.

- JBL relies on a large customers for a significant portion of its revenue and any loss or reduction of business from them may adversely impact its financial performance.

Conclusion

Jabil goes beyond the traditional Electronics Manufacturing Service (EMS) company. It is a digital supply chain and manufacturing company that can bring high-value products to market faster than anyone else.

Therefore, we think that Jabil deserves a better valuation than a traditional EMS company, as it has a more diversified, resilient, and profitable business model. We rate Jabil as a Buy, with a target price of $229.

Read the full article here