Keyera Corp (OTCPK:KEYUF, TSX:KEY:CA) is as close to a must-own as it can get in 2023. The company is very stable and has outperformed its peers by a landslide in the last year. I don’t see that changing anytime soon. Keyera has focused on maintaining lower debt levels, which has turned out to be quite the advantage in an environment where rates have increased quicker than we have seen in years. Keyera is currently paying out a 6.1% dividend which is well above market and industry average. The dividend is safe thanks to strong cash flows. Their KAPS pipeline is finally in operation and that should only boost numbers going forward. Keyera is a stock you can tuck away in a long-term portfolio, and you can sleep well at night while the dividend piles up.

Back in February, I wrote on Keyera. I liked it then, and I like it now. While I did not expect it to outperform the way it has, I do think that it has separated itself from the pack. With KAPS online, we should see really strong numbers out of Keyera which will only continue to aid the balance sheet and allow greater returns for shareholders going forward. You can’t afford to not own Keyera in 2024.

**Numbers mentioned are all in $CAD and charts are (KEY:CA) given the greater volume on the Canadian side**

What Separates Keyera?

Dividends make the world go round, and in some cases, stocks… or industries for that matter. Looking across the pipeline space, Enbridge (ENB:CA) 7.7%, TC Energy (TRP:CA) 7.5%, and Pembina (PPL:CA) 6.1% you can see the trend. Big paying dividends. Keyera is no different at 6.1%. Why are the other dividends a bit higher even if Keyera got a recent increase? Well looking below, you will see that there has been one clear-out performer over the last year.

TC2000.com

Keyera in red, is up 11.8% in the last year. Enbridge in blue, is down 14.1%, TC Energy in pink is down 16.9%, and Pembina in yellow, is the closest, yet still down 4.1%. That’s quite the difference over the course of a year. When you ask people about the economy over the last year, one of the first things people will speak about is inflation and the cost of living skyrocketing. Well, that environment is the same in the business world. The cost of debt hasn’t been this high in years. The four companies mentioned have the following LTM Net Debt/EBITDA ratios: 4.40x, 6.38x, 5.32x, and 3.87x. Place your bets…..Ranked from lowest to highest: Keyera – 3.87x, Pembina – 4.40x, Enbridge – 5.32x, and TC – 6.38x.

The other part of the equation is KAPS. KAPS is a NGLs pipeline that transports 350,000 barrels per day. This was the company’s largest project to date, and it’s going to pay dividends, literally. KAPS came online this past summer, the project totaled about $2 billion. As Keyera has noted, here are a few things that the completion of KAPS does for the company:

- Fully Integrates its value chain

- Allows them to better compete for volumes and earn full-value chain returns

- Offer customers a much-needed competitive alternative on a newer pipe

- Positions Keyera for additional future growth opportunities

Between returning cash to shareholders, managing the balance sheet, and pulling off the KAPS project without much resistance, there is a lot to like about what’s going on at Keyera.

There are two main risks to owning Keyera. The first, and likely the largest is government. It’s no secret that the current Canadian Federal Government isn’t a huge fine of new pipe in the ground. In good news, in Alberta where Keyera just built KAPS, an oil & gas friendly government was just elected. This should help take some pressure off the company in the short term. The battle to prove that pipelines are crucial to our economy will rage on for years to come. Keyera should be very thankful that they got KAPS done when they did. The second risk is of course commodity pricing. While natural gas seems to be more in favor than oil, related stocks seem to all follow oil pricing. While I do think oil pricing should continue to improve due to geopolitics and inflation, that could change in an instant. I would keep an eye on both of these things if you own Keyera. The good news is the stock is not very volatile. Meaning if there is a change, you should have time to react.

Is The Dividend Safe?

If you are new to the pipeline space, or looking for exposure to oil & gas without jumping into a producer, Keyera is a great way to get exposure and collect a great dividend while doing so. Many see the “high” yield and panic that they are due to cut. After all, a payout ratio of 128% screams cut right? It would in most industries, but pipelines use Distributable Cash Flow (DCF) to calculate the payout ratio. The main reason for this is that net income is somewhat irrelevant due to the depreciation of assets. This usually makes things look a lot worse than they are with respect to net income.

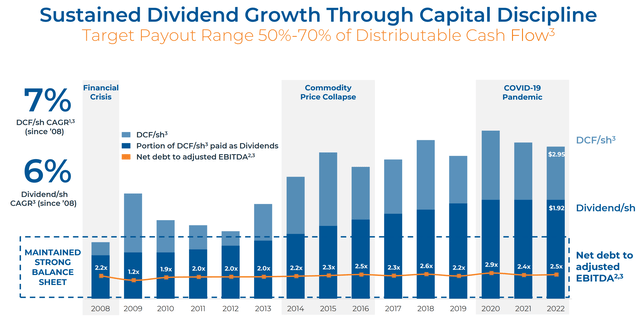

So how does this translate to shareholders getting paid? Keyera like to target a payout range of 50-70% DCF. Looking below, you can get a glimpse of exactly how this has played out over the years. In 2022 for example, we saw $2.95 DCF/share and a dividend of $1.92 per share. That works out to ~65% meaning Keyera is at the top end of their target range.

Keyera Corp

One thing to keep in mind with respect to the 2022 ratio being on the higher end was the AEF turnaround which led to higher maintenance capital spending. This happens once every four years. I’m very curious to see what the second half of 2023 looks like for Keyera now that KAPS is online. The dividend was recently increased to $2.00 per year, 2023 will pay out $1.96, but I would expect the increases to continue for years to come.

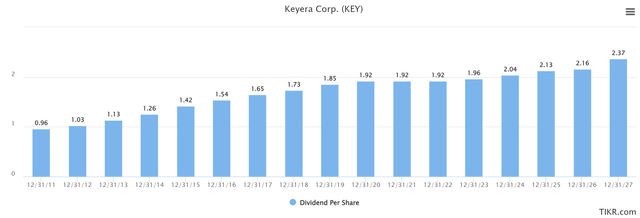

TIKR.com

Keyera has been dishing out a lot of cash in the last few years as they built KAPS. With that completed, the focus will shift. As of now, Keyera lists the top priority for 2024-2025 as “Increasing cash returns to shareholders”. Keyera reports Q3 results later this week. I imagine after year-end results we will get a better idea as to what we can expect in further returns with respect to the dividend and share buybacks.

What Does The Price Say?

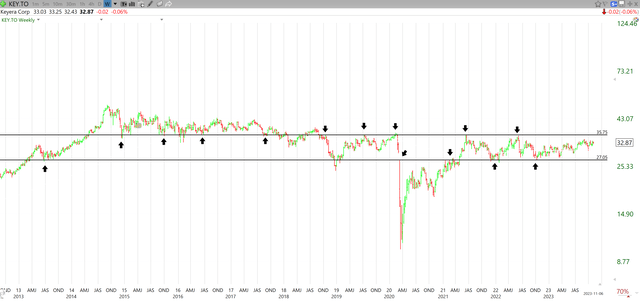

While I would normally say that the real goal here is to sit and collect dividends, Keyera does provide potential capital gains upside as well. As I mentioned, the stock is up 11.8% in the last year. Add in the dividend and you’ve got yourself a 17.9% return. Not too bad for a stock that isn’t meant for capital gains, especially in a year’s time. Diving into what we can expect over the next year, I currently have a price target of $35.75. That leaves an upside potential of just over 8%. The main reason for this is outlined in the chart below.

TC2000.com

You can see from the chart just how important the two levels outlined are, and why this is such an attractive investment at the current price. $35.75 is an important price dating back to 2014. This was the support that broke, and eventually led to the 2020 crash. We have had a couple of tests of the new resistance at $35.75 since but have not been able to crack it. The stock has been very range-bound. This also helps set the stop. Looking above, we can also see $27.05 outlined. This is an important mark dating back to 2013. If the stock broke this level, it would be time to step aside and re-evaluate where things are heading. It would take about 18% to the downside from current levels to get there. In a stock that isn’t typically very volatile, that leaves a lot of room for error. More importantly, time to collect the dividend should things head south.

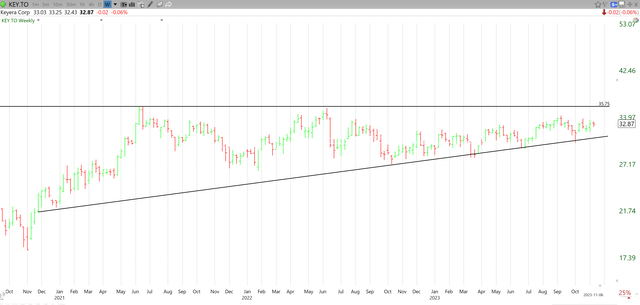

While I prefer horizontal price levels, I know a number of people like to look for ascending triangles, which is exactly what we have here.

TC2000.com

This is a pattern that shows a tightening of a range. Being that this is happening over the course of 3 years at this point, the direction in which the price breaks COULD set the trend for the next few years. Again, you can see the top of this triangle is that $35.75 mark. If you don’t already own the stock, you could wait to see which way this triangle breaks. Looks like we should have an answer shortly.

While I bought Keyera for the dividend, I also perform technical analysis to set price targets and stops. If the technicals don’t match the fundamental story, I steer clear. This is a case where there is a really good setup on both sides of the coin.

Wrap-Up

As you can see, there is a lot to like about what’s happening at Keyera. The company is in great shape thanks to management’s focus on the balance sheet over the last few years. While many companies piled up debt, Keyera made sure they were in a spot to keep the debt at a respectable level. All while paying out a top-tier dividend. I fully believe that with KAPS coming online, we will continue to see annual increases to the dividend along with share buybacks. Trouble sleeping? Buy Keyera. I happily have it tucked away in a long-term portfolio. It is my only pure pipeline exposure at this time. Thanks for reading!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here