Kforce Inc (NASDAQ:KFRC) reported its latest quarterly results with revenue and EPS coming in ahead of estimates amid otherwise low expectations. Shares rallied on the report which helped brush aside fears of a sharper slowdown.

The company recognized as a leader in technology and professional services staffing is at ground zero in terms of feeling the effects of the shifting labor market compared to a pandemic-era boom, with lower hires and industry placements. Even as financials can be described as “resilient”, the main challenge here is the broader macro backdrop and poor growth outlook.

We like Kforce for its unique market positioning and what remains positive competitive advantages, but concerned about the trends over the near term. Our base case is for higher volatility in the stock with an expectation for a more pronounced slowdown in staffing into 2024. The risk here is that earnings can deteriorate and open the door for a deeper selloff in shares.

KFRC Earnings Recap

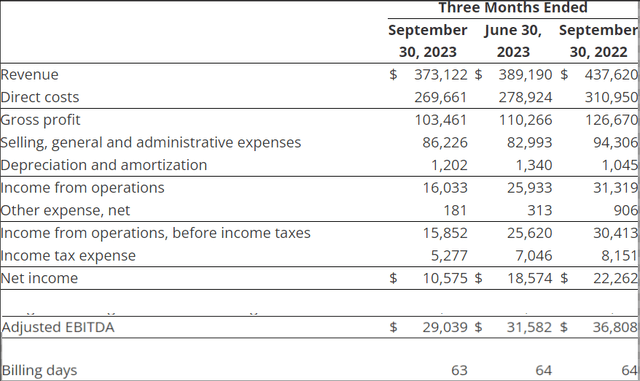

KFRC Q3 adjusted EPS of $0.90 beat the consensus by a solid $0.15, although still down from $1.09 in Q3 2022. Similarly, revenue of $373 million was above the $363 million market forecast yet down -15% y/y.

For a better sense of the current conditions, that weaker top-line momentum flowed into lower profitability. The adjusted operating margin of 6.5% fell from 7.2% in the period last year. Total adjusted EBITDA at $29 million compared to $37 million in Q3 2022.

source: company IR

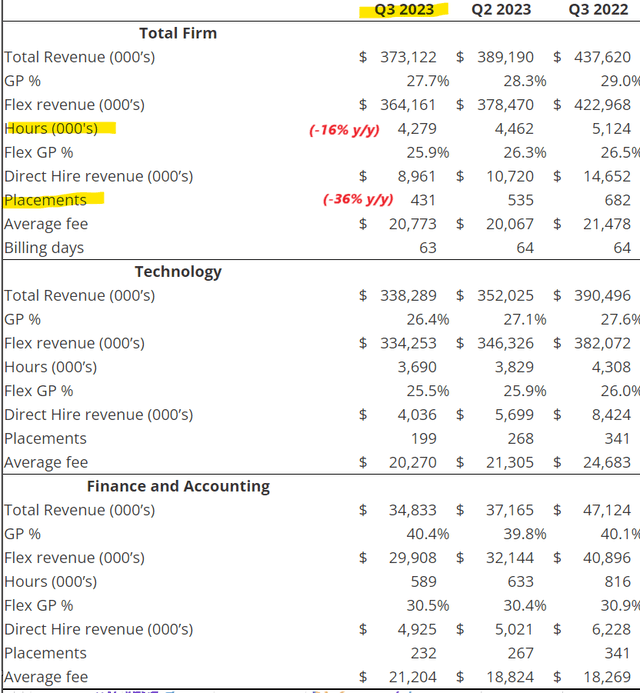

The context here reflects ongoing declines in core operating metrics that have trended lower sequentially since peaking in early 2022. The firm-wide total number of staffing placements at 431 is down from 535 in Q2 and even 682 in the period last year. Consultant billing hours hourly are -16% lower overall.

Again, the bulk of these trends corresponds to the hiring environment where large companies have made headlines announcing widespread layoffs particularly in tech as part of cost-cutting and efficiency measures. Even as the broader labor market has defined expectations in 2023 with an unemployment rate still near historical lows, this segment of professional services is softer.

The good news here is that management noted during the investor conference call that most of its own figures remain higher on a two-year stacked basis and against pre-pandemic benchmarks. The interpretation there is some underlying strength of the brand momentum among industry relationships that have allowed the company to capture market share.

source: company IR

In terms of guidance, Kforce expects Q4 revenue between $359 and $367 million which, at the midpoint, is above the market consensus for the period forecasting $359 million. Management is targeting Q4 EPS between $0.74 and $0.82, largely in line with the consensus of $0.80. If confirmed, the figure would represent a decline of 14% compared to $0.90 in Q4 2022.

The other update here is that the company has been active with share repurchases, buying back approximately $41 million in stock year to date, lowering the average diluted shares outstanding by about 4% from 2022. This is on top of the regular quarterly dividend of $0.36 per share that yields 2.5% on a forward basis.

What’s Next For KFRC?

Our takeaway here is that while the latest results from KFRC are “okay”, but hardly impressive. The company has done a good job of managing expenses and supporting profitability, but it’s hard to see how or why revenues can suddenly rebound higher with a turnaround for its core operating metrics.

Keep in mind that even as the U.S. labor market has been surprisingly strong all year with more than 3 million non-farm payroll jobs added, Kforce has effectively underperformed negative numbers. The concern here is that staffing placements and temporary “flex” consultant hours would face even further declines in a scenario where the labor market turns lower.

Compared to the current U.S. unemployment rate at 3.8%, all indications suggest at least a soft patch into next year with an expectation for that metric to climb above 4%. What we’ve seen from companies during the Q3 earnings season are efforts at cost-cutting and driving operational efficiencies through lower headcounts amid volatile macro conditions. Naturally, these themes don’t bode well for a major new staffing push.

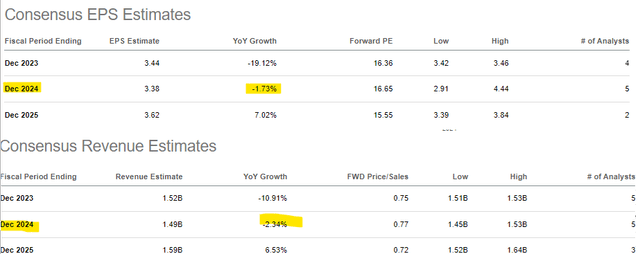

Indeed, the current consensus for KFRC is for another year of lower revenues and a decline in EPS for 2024. We want to see some evidence of stability in the operating metrics before taking a convincingly bullish stand on the stock. We’re not there yet.

In terms of valuation, KFRC’s forward P/E ratio of 17x can be seen as reasonable for this type of segment leader but becomes a harder selling point to justify a significant multiples expansion.

Seeking Alpha

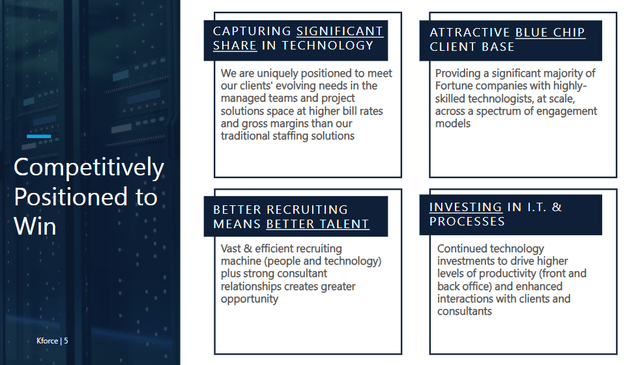

At the same time, we can cover what remains the strong points of the long-term outlook. Kforce believes ongoing digitization of the economy and technology transformations support a tailwind for its type of staffing.

The company’s expertise and brand recognition attracting highly qualified professionals in these often specialized roles means that a “blue chip” client base will continue to trust Kforce for project deployments. The understanding here is that the trends will turn positive eventually.

source: company IR

Final Thoughts

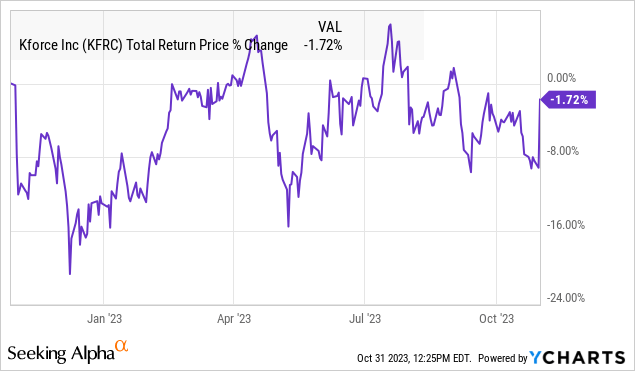

The initial market reaction from Kforce’s Q3 report was a solid spike in the stock climbing by over 8%. Our call here is that given the ongoing uncertainties, further upside should be limited for the foreseeable future. Notably, even with this current rally, shares remain stuck in a relatively tight range over the past year around $60.00.

It would likely take a few more quarters of progressively operating and financial metrics to support a sustained rally significantly higher. We rate KFRC as a hold with monitoring points being the operating margin and staffing trends.

Seeking Alpha

Read the full article here