Shares of Kohl’s Corporation (NYSE:KSS) plunged by over 20% on Thursday, after the company reported disappointing Q1 earnings and cut guidance. This decline has wiped out nearly all of its gains over the past year and has brought shares near multi-year lows. With a lower-income clientele than Macy’s (M), there are concerns Kohl’s is seeing increased pressure, though the stock is now pricing in a fairly dire scenario for the company. I would be a buyer of KSS stock on this drop.

Seeking Alpha

In the company’s first quarter, Kohl’s lost $0.24 vs. expectations of a $0.06 profit, even as revenue of $3.38 billion was broadly in-line. Revenue was down by 5.3% from last year. Q1 results were “below” management’s expectations.

The first quarter is a relatively unimportant one for retailers, as consumers spend less seasonally following the surge around the holidays in Q4. However, the concern is that management has drastically shifted its full-year outlook, expecting the apparent weakness in Q1 to persist into the more financially critical quarter. I view the issue as management’s prior forecast being too optimistic, and this one more consistent with the macro environment.

Looking further into results, same-store sales growth was down 4.4% from last year, a weak performance. Drilling into this, sales of regular priced goods rose by 2.4%, but there was a 6% headwind from lower clearance sales. That is an interesting data point, as one would expect squeezed consumers to migrate towards clearance items, rather than full price ones. I believe Kohl’s tight inventory control may be a factor in this. The company is carrying $3.08 billion of inventories, down about 12.6% from last year. This is a much sharper decline than sales.

Now, I generally view tight inventory management as a positive, as it leaves less capital consumed in the business, and excess inventory can force markdowns and leave stale product on the shelves, reducing sales. Retailers were also carrying too much inventory in late 2022-2023 as consumption slowed, and they have needed to work these balances down. However, less excess inventory also means less product to sell at clearance. To an extent, Kohl’s tight inventory management may be constraining sales.

Now, clearance sales are, by definition, less profitable than full price sales, and as a result, gross margins expanded 50bps to 39.5%. As a consequence, gross profit fell by just $65 million to $1.46 billion, while revenue fell by $177 million, meaning margins & sales mix offset nearly two-thirds of the sales decline. Declining gross profit is obviously a negative, but to the extent most of the sales weakness is coming from lower-margin product as inventory normalizes, this is less of a negative for shareholders.

Still, given lower sales, we have seen the business deleverage below gross profits. SG&A spending was down just 1% to $1.23 billion. Given this slower rate of decline, it rose to 36.3% of revenue, from 34.7%, partly due to higher marketing spend. On the positive side, Kohl’s tight inventory control is helping with cash flow. Q1 cash flow is seasonally weak as it rebuilds working capital following the seasonal release in Q4, but its -$154 million free cash flow was much better than -$316 million last year, as it had a smaller $190 million of working capital headwinds.

Given the magnitude of the decline in inventories, I am not surprised to see sales decline, as inventory productivity can only improve so much. Plus, the fact sales weakness was focused on clearance rather than full-priced items argues to me this sales weakness is more an inventory normalization effect than a loss of consumer engagement. Still, given this quarter, KSS dramatically reset guidance. It now expects comps to fall 1% to 3% and EPS of $1.25-$1.85. It previously expected comp sales growth of 0-2% and $2.10-$2.70 in EPS.

Kohl’s

Frankly, given lower inventories, lower clearance sales are likely an inevitability over the course of 2024—and given lower margins, that is not necessarily a bad thing. Given this fact, previously forecasting positive same-store sales growth seems to have been extremely aggressive, implying regular price sales up 4+%. With clearance comps easing over the course of the year and assuming a similar 2-2.5% pace of regular sales growth, its -1% to -3% comp forecast is reasonable, assuming we see consumer spending stay resilient.

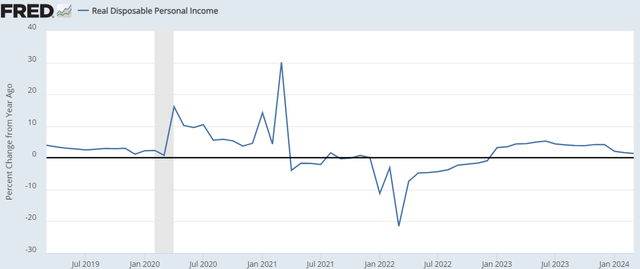

Now, I do not expect a recession and believe consumption overall can rise ~2-2.5% this year. Real incomes have been very volatile since COVID, as government stimulus caused a surge, and then elevated inflation in a drawdown. However, real incomes are 1.4% higher than a year ago. While inflation has been sticky, wages have held up well as well. This is not a fast pace of growth, but rising real incomes and a buoyant labor market should support modest ongoing spending growth, in my view.

There has been a bit of a deceleration recently that bears watching. However, I view the inflation problem as one of it not declining further rather than starting to rise again, and so I expect real income growth to stay positive.

St. Louis Federal Reserve

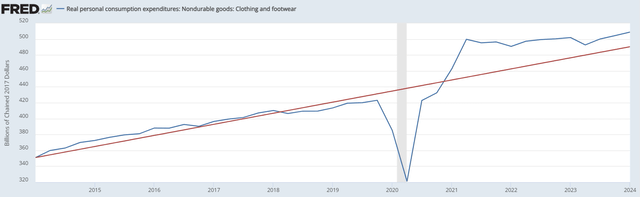

The question is where consumers spend their money. In 2021, there was a surge in apparel spending way above trend. This spending then abruptly stalled from 2022 onwards, which is why retailers were left with excess inventory. However, as it has stopped growing, apparel spending has gradually converged towards its pre-COVID trend and is now within 3%. Whereas consumers were once buying an unsustainable amount of clothing, by the end of this year, we are likely to be around trend. This normalization of excess spending should create the path for modest apparel spending growth.

St. Louis Federal Reserve

I am looking for apparel spending growth of 0-2% this year—positive but slower than total consumption, given this. With the apparel spending backdrop improving, that is a positive for companies like Kohl’s, and it is noteworthy its full-priced sales growth is in line with this trend. This overall spending forecast is why I view its previously implied ~4% full-priced sales growth as overly ambitious. Ultimately, while lower inventories are a headwind for clearance activity, I do not see a reason to expect full-priced sales to slow further.

As a consequence, I am looking for a 2-3% comp store decline, which assuming a modest decline in SG&A should generate about $1.50 in EPS and ~$450 million in free cash flow, given its planned $500 million cap-ex spend, down from $577 million last year. This free cash flow safely covers its $2/share dividend, which costs about $220 million. I expect all retained cash flow to go to balance sheet improvement.

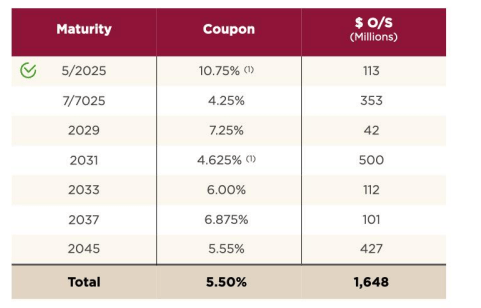

Kohl’s has $228 million in cash and $1.6 billion of debt, alongside $5.4 billion of lease obligations. It is paying down its $113 million 2025 maturity this quarter, and after that is having just one more maturity before 2029. With its retained cash flow, it should be able to pay down its July 2025 maturity largely if not entirely with cash on hand, then providing it with significant financial flexibility and the prospect of buybacks if the business is stable starting in 2026.

Kohl’s

Kohl’s should generate about $4 in free cash flow this year, giving the stock a 20% free cash flow yield. That is nearly double Macy’s at 10%, but as I wrote on Macy’s, that business has shown signs of turning. Kohl’s performance is weaker, but with inventory and clearance sales at more sustainable levels, its business is in a healthier place, even if that has caused a drag on sales. Importantly, I do not expect sales to deteriorate further, given a modestly positive macro backdrop for apparel consumption.

With 2x dividend coverage, I view the KSS payout as safe. At its current valuation, the market is pricing in an ongoing decline in the business, and free cash flow could fall by ~10% per year and still provide a 10% return to shareholders; given lost operating leverage in a declining environment, sales growth could likely be -2% for several years to deliver such an outcome. As the year goes on, as we see full-priced sales stay positive, that should create more optimism that Kohl’s is not a “melting ice cube,” and in fact could return to sales growth in 2025 when the clearance headwind is out of comparisons.

With now a 10% dividend yield, investors are being paid to wait, and I expect the $20 area to be a floor as a result. Kohl’s laddered debt maturities also add to flexibility. Kohl’s will likely not converge to Macy’s valuation, but even as comfort grows in the stability of the franchise, assuming I am right about resilient full-priced sales, I believe Kohl’s Corporation stock can rally back into the upper $20s, or a ~15% free cash flow, halfway between the current terminal decline fears and the Macy’s succeeding turnaround valuation. I would buy into this weakness.

Read the full article here