I was bullish on the luxury tourism company Lindblad Expeditions Holdings (NASDAQ:LIND) when I last wrote about it in January. And in the ensuing months, it rose by 14%, just shy of the lower end of my expectation of a 15-20% upside. But it has been steadily declining since early August. As a result, its stock price is down by 22% year-to-date [YTD]. This makes it a good time to revisit to see if the earlier rating still stays ahead of its third quarter (Q3 2023) results due on November 2.

Price Chart (Source: Seeking Alpha)

A look back

There were four factors working in LIND’s favour when I last checked, at which time its numbers for the first nine months of 2022 (9M 2022) were available. First, its revenue growth was strong, reflecting a continued recovery from the pandemic. Next, its forecasts for the full year 2022 were good too, supported by a positive travel demand outlook as such. As a luxury tour operator, it certainly had an edge over peers even if growth were to slow down in 2023. And finally, LIND’s market multiples were attractive compared to peers.

There were risks too, with high debts acquired during the pandemic. Its liquidity levels, as measured by the current ratio, were also less than ideal. On the whole, though, the company’s full story was more positive than not.

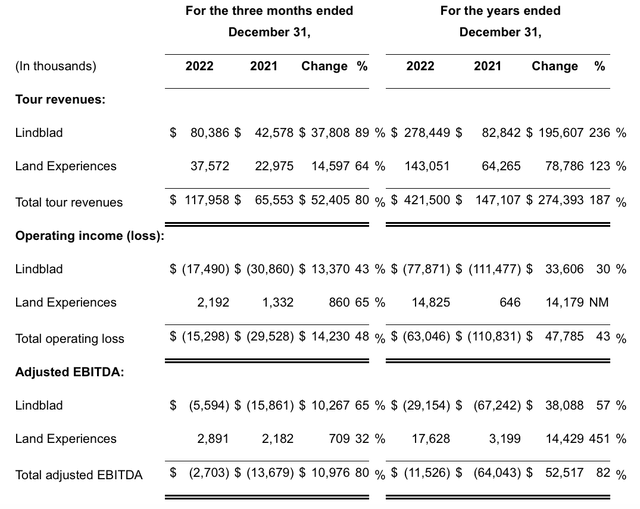

Key Financials, 2022 (Source: Lindblad Expeditions Holdings)

The company’s full-year 2022 results continued to reflect robust growth, with revenue rising by 187%. While it remained loss-making, both the operating and adjusted EBITDA losses shrank significantly from the year before as well (see table above).

Positive outlook

The company’s outlook for 2023 was positive too, with revenue expectations in the range of USD 550-575 million. At the midpoint of the range, this means a 33.5% growth. This is of course a significant come-off from last year’s growth, but that’s clearly an outlier and a spillover from the pent-up travel demand during the pandemic. For context, LIND’s compounded annual growth rate [CAGR] over the past five years has been 12.1%.

It also expected to turn adjusted EBITDA positive in 2023, with a guidance of USD 70-80 million, reflecting recovery after clocking a loss in 2022.

The progress so far

In the first half of 2023 (H1 2023), it has performed better than expectations on revenue growth. Revenues have risen by 69% year-on-year (YoY), which is even higher than the 36.4% growth expected at the upper end of the company’s target range.

Further, with revenues at USD 268 million, it has achieved 47.7% of the midpoint of its revenue forecast range. This is far higher than the 37.7% achieved in H1 2022, indicating that if H2 retains its lead, LIND may well exceed its revenue targets for 2023.

Driving robust sales growth are predominantly its expanded operations resulting in a higher number of available guest nights. Increased prices have also supported higher revenues.

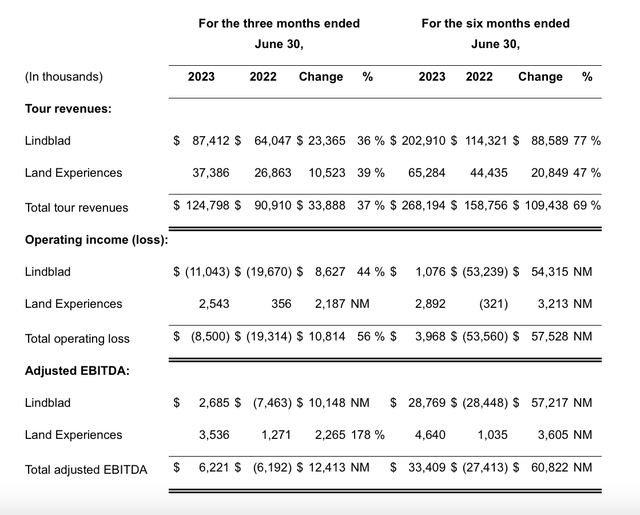

Key Financials, H1 2023 (Source: Lindblad Expeditions Holdings)

LIND also reported a USD 33.4 million adjusted EBITDA profit for H1 2023, reaching 44.5% of the midpoint of the target range. Going by last year’s revenue trends, if a bigger proportion of sales happens in the second half of the year in 2023 as well, then it could comfortably meet its adjusted EBITDA target. But it has not just turned adjusted EBITDA positive, it even reported a small operating profit (see table above), raising hopes of it turning profitable on a net basis sooner rather than later.

Coming to the balance sheet, the company’s current ratio is still less than ideal at 78%, but it is still an improvement over the 54% seen in 2022, indicating improved liquidity. Its debt position has deteriorated somewhat though, with a debt-to-assets ratio of 73% compared to 71% for 2022, suggesting that it still remains something of a risk factor. However, if the company continues on its path to profitability, the concern can ease in the future.

The market multiples

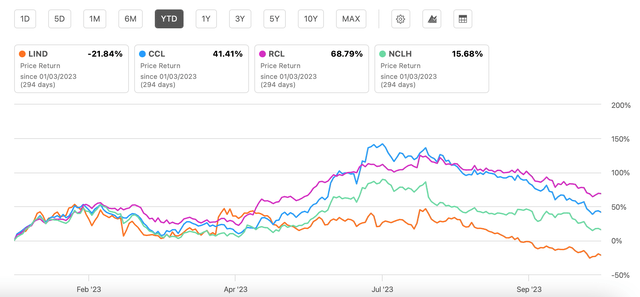

Despite an improved income statement, however, LIND’s price pattern YTD, is completely the opposite of the stocks it compares itself to, which are the cruise operators Carnival Corporation (CCL), Royal Caribbean (RCL) and Norwegian Cruise Line (NCLH) (see chart below).

Price Returns, Comparison with Peers (Source: Seeking Alpha)

There’s a very good reason for this. Its peers have all become profitable at a net level as of the latest quarter for which figures are available, while LIND so far remains loss-making. On the other hand, going by the trends for its peers, it’s possible that it too, will soon start reporting profits soon. Its losses have already fallen by 64% YoY in H1 2023.

This actually indicates that it may well be a good time to buy LIND, while it’s trading at a relatively lower market multiples than its peers. It has a trailing twelve months price-to-sales (P/S) ratio of 0.63x, which is lower than all three peer stocks, with CCL trading the closes at 0.71x. Even taking its high debt levels, its enterprise value-to-sales (EV/S) ratio is the lowest among peers at 1.73x, with CCL coming in next at 2.19x.

What next?

There’s really nothing that has changed in the big picture about the LIND story from the last time I wrote. The only difference is that it has lagged behind its peers as far as profitability goes, which has clearly made them significantly more attractive.

However, with consistent double-digit revenue growth and a return to operating profits in H1 2023, LIND’s prospects look good. The very fact that its peers have turned profitable now, is a good sign too, further supported by a sharp decline in its own net loss. I expect it to turn in a net profit in the forthcoming quarter, or if not, the quarter after, going by these trends, all else staying equal.

There are still challenges for it in terms of liquidity and debt, but there’s potential for improvement as it becomes profitable. Its market multiples look attractive as well. I would be cautious of a possible demand decline next year, but LIND is relatively cushioned as a luxury tour provider. I’m retaining a Buy rating on it.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here