Lockheed Martin (NYSE:LMT) shares have been treading water ever since their initial bounce that followed Russia’s invasion of Ukraine.

Despite the growing geopolitical tension in several parts of the world and an impressively growing backlog, shares have been essentially flat for the last two years.

Let’s try to understand why.

Background – Two Years Of Stagnation

I’ve been covering Lockheed Martin on Seeking Alpha for over a year. Back in March of 2023, I rated the stock a Strong Buy, as I viewed its supply chain disruptions and several other headwinds as temporary.

Back then, the company’s management was adamant about their ability to return to mid-single-digit growth in 2024 and was quite confident in their target to deliver 156 F-35 fighter jets annually, starting in 2025.

Two quarters went by, and I decided to downgrade the stock to a Hold as I understood two crucial aspects of my investment thesis were wrong.

First, management clearly stated they do not expect to see a margin benefit from the increased demand, cementing a big worry of mine that the company has no pricing power at all.

Second, it became increasingly clear the industry is too “heavy”, to be able to go through a much-needed transformation to become a faster and more agile chain. I feel funny even doing the comparison, but we can look at another capital-intensive industry in semiconductors, which has demonstrated the ability to capitalize on demand shocks whenever they arrive.

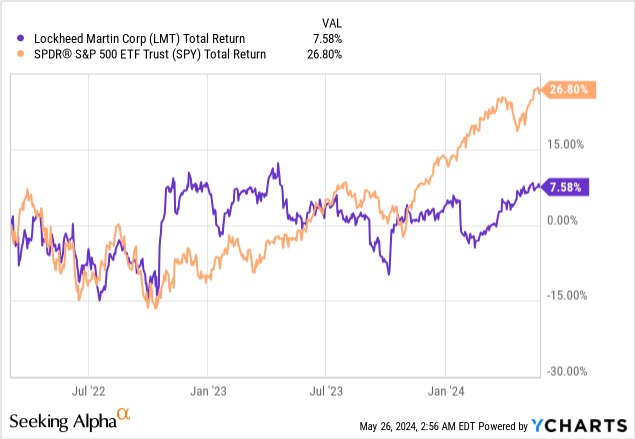

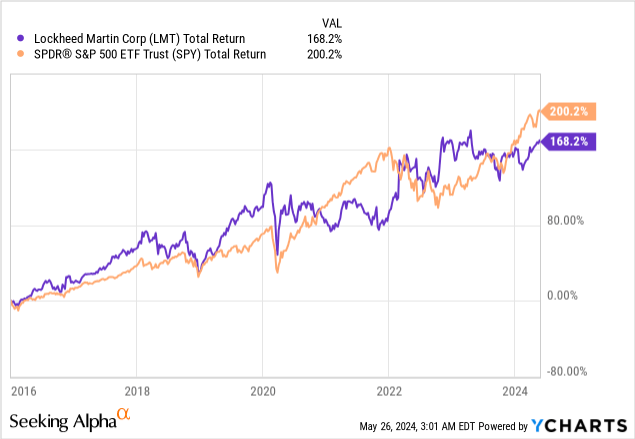

Indeed, ever since that post-invasion bounce, Lockheed Martin has significantly underperformed the market, with a 7.6% total return compared to the S&P 500’s 26.8%.

Actually, you’d have to go back to 2015 for a baseline that results in Lockheed outperforming the market on a total return basis, meaning we’re almost at a full decade of underperformance.

With that backdrop in mind, let’s look ahead.

Rising Geopolitical Tension & Growing Defense Budgets

One thing I tried to make as clear as I can in my three bearish articles since July of 2023, is that demand is not the problem for Lockheed. I still received a handful of comments saying I’m wrong about the company because demand is so strong. Therefore, I think I need to dedicate a full section to this notion.

It’s not a secret that geopolitical tension is rising across the world. Aside from the Russia-Ukraine war which has been ongoing for over two years now, we have a war in the Middle East between Israel and Iran’s proxies, which has escalated to direct attacks between Iran and Israel as well. Also, we can see Islamic and pro-Palestine supporters are rising all over the world, increasing the tension within countries all over the world, and especially in Europe. In addition, China and the U.S. relations continue to deteriorate.

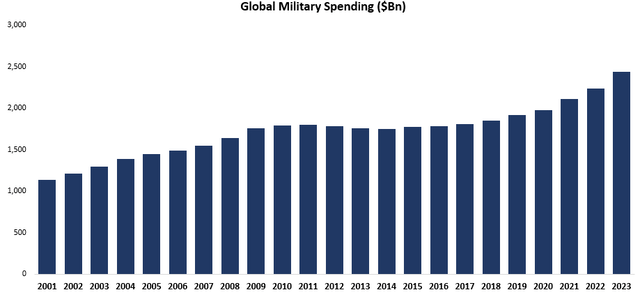

Created by the author using data from Statista.

As geopolitical tensions rise, so do the defense budgets, which reached a record of $2.44 trillion in 2023, up 6.8% in real terms from 2022. NATO’s portion of the spending is 55%, led by the U.S. with $916 billion, followed by European members which combine for $375 billion in spending.

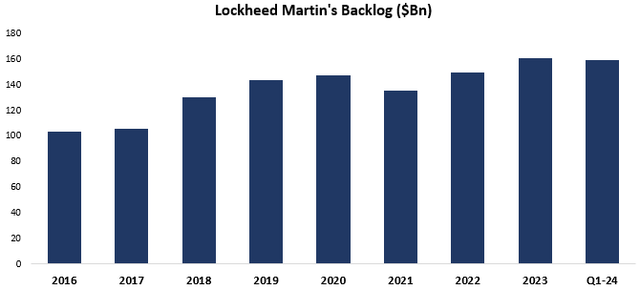

Created by the author using data from Lockheed Martin financial reports.

NATO members are Lockheed Martin’s customers, and their increase in spending is clearly reflected in the company’s backlog, which grew by 7% in 2023, to reach a record $160 billion.

So, let me be clear, Lockheed Martin does not have a demand problem. Even though the backlog declined slightly in Q1-24, it’ll most likely end the year higher.

Struggling To Capitalize On Growing Demand

Demand is only one side of the equation. If a company enjoys great demand, it still needs to capitalize on it, either through having enough supply and increasing volumes or through increasing prices.

However, Lockheed has a problem with the pricing option because it’s a government contractor, whose pricing is essentially capped by cost-plus agreements.

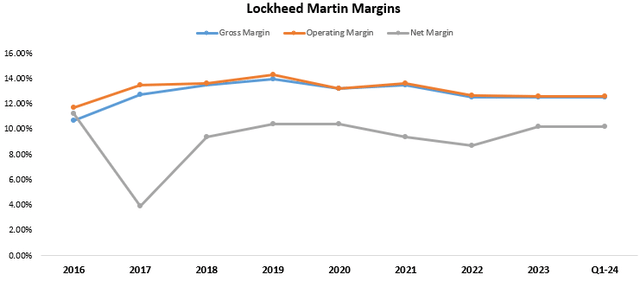

This is best reflected in the company’s margins, which remain steady, for the good, and for the bad:

Created and calculated by the author using data from Lockheed Martin financial reports.

Therefore, the company is left with one option, and that is, to increase volumes. The problem here lies in what we discussed earlier, which is the slow and heavy supply and production chain.

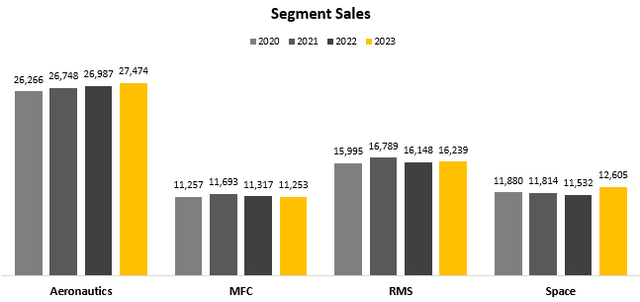

Created by the author based on data from Lockheed Martin financial reports; MFC = Missles & Fire Control; RMS = Rotary & Mission Systems.

We can see that in the four years following the pandemic, the company’s sales stagnated, with CAGRs of 1.5%, 0.0%, 0.5%, and 2.0% in Aeronautics, MFC, RMS, and Space, respectively.

With that said, in the first quarter, we saw a significant acceleration in each of the segments, resulting in 13.7% consolidated growth. That would have been a big sign of improvement if management didn’t make sure to cool off excitement, as they reaffirmed their previous guidance for 2.5% growth in 2024, attributing the strong growth in the quarter to an easy comparable.

In addition, recent reports indicate some issues are delaying some F-35 upgrades, which remain parked in Lockheed’s lots.

Valuation & Stock Performance Drivers

I hope that I was able to establish two important points here. One is demand is strong. Two is Lockheed is struggling to capitalize on it.

Now, it’s important to remind ourselves what drives stock performance. Generally speaking, for a stock to outperform the S&P 500, which should be the ultimate goal for most investors, it needs to grow faster than the market weighed average.

There’s room to argue about what is the exact metric on which a company needs to outgrow the market. Some might say FCF per share, some may say EPS per share, and some might say revenue growth.

For me, it’s not either/or, but a combination of all of those, as each of these metrics has both pros and cons.

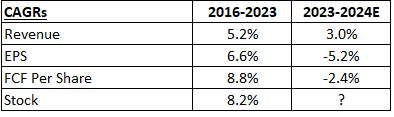

Created by the author using data from Lockheed Martin financial reports and Seeking Alpha.

For LMT, we can see that the stock performance came closest to its FCF per share CAGR between 2016-2013. Looking ahead, consensus estimates for 2024 expect 3.0% revenue growth, and 5.2% & 2.4% declines in EPS and FCF per share.

In the long-term, revenue is expected to grow at a low-single-digit pace (~3%), while EPS and FCF per share are expected to grow mid-single-digits (~5%), outpacing revenues almost solely due to buybacks.

Lockheed isn’t the kind of company that handily beats estimates or brings too many surprises. Therefore, we can assume it’ll come close to these numbers, which are not market-beating numbers.

We’re then left with only one path to market-beating returns, and that is valuation.

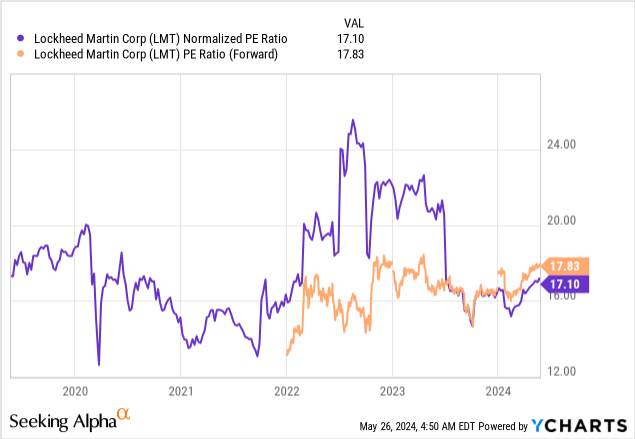

LMT is currently trading at 17.8 times projected EPS for 2024, which is 7% above its 5-year average on a GAAP basis and 12% on a non-GAAP basis.

Unfortunately, this does not seem too attractive either.

Conclusion

Lockheed Martin is a slow-growing, complex business, with a capped potential due to the nature of its contracts.

Investors should expect market-average returns at best from Lockheed Martin, with slightly less volatility, resulting from low-to-mid single-digit growth, combined with a steadily increasing dividend starting at a 2.7% yield.

While this might be attractive to a certain group of investors, I believe the majority of individuals should either seek to outperform the market or go the passive investment route.

Therefore, I reiterate a Hold rating for LMT.

Read the full article here