I am updating my ongoing analysis on Lumen Technologies, Inc. (NYSE:LUMN). I had previously rated Lumen a sell for the following reasons:

- Growth in every segment, except the public sector, was lagging the overall telecom industry

- The 2025 growth strategy was not delivering any results, in fact, business continued to decline

- Discounted cash flow (“DCF”) analysis generated a price target of $1.23 signaled 20% downside.

Since then, Lumen has fallen slightly more than 32% while the S&P 500 (SP500) rose 6%.

LUMN Price Trend (Seeking Alpha)

Lumen has fallen much further and faster than I expected, even with my previous sell rating. I now believe that the market has gone much too far, and the stock’s value exceeds the current price with a wide margin of safety.

At the low end of management guidance, DCF analysis suggests 17% upside even on the struggling business. Beyond the current business, Lumen is sitting on significant assets worth over $2 billion net of debt at conservative sale price assumptions. In addition, insider trading and valuation multiples are both flashing green.

With the above in mind, I raise my rating on Lumen from sell to buy at a price target of $1.22.

DCF Analysis Upside On Current Guidance

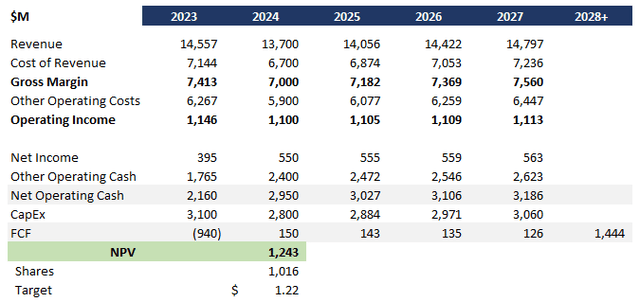

I updated my DCF analysis for Lumen with the following assumptions:

- Lower-end of management guidance based on challenging Q1, although management reiterated the same guidance from year-end 2023

- 12% discount rate based on stressed balance sheet and risk premium as stock approaches $1

- 3% revenue and cost growth both near-term and long-term, assuming no margin expansion and slightly behind overall industry CAGR.

This analysis yields a price target of $1.22, a 17% upside from today’s pricing, largely in line with my previous price target of $1.23.

LUMN DCF (Data: SA; Analysis: Mike Dion)

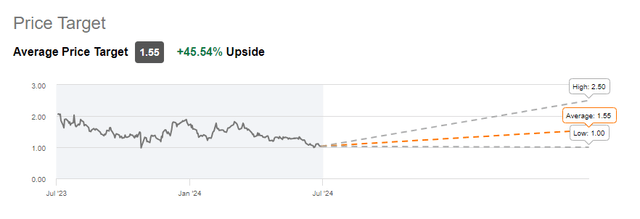

Wall Street lands even higher with an average price target of $1.55, 45% upside to today’s pricing, and with the low end of their price target forecast in line with today’s pricing.

LUMN Wall Street Rating (Seeking Alpha)

Value Of Assets Exceeds Market Cap

In addition to the DCF generated price target based on current operations, Lumen holds significant real assets that exceed the market cap.

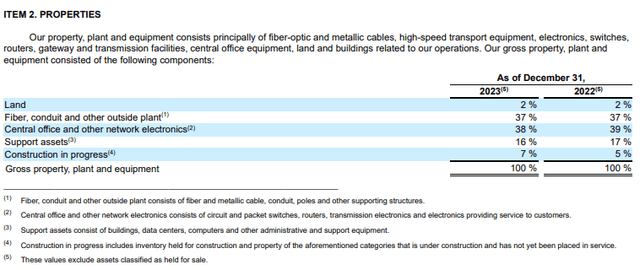

As of Q1 2024, Lumen had $19.9 billion of Property, Plant, and Equipment net of depreciation broken down as follows:

Breakdown Of PPE (LUMN Investor Relations)

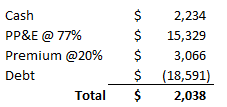

Land, fiber, conduit, plant, central office, and network electronics would be of value to another telecom, representing 77% of the assets. Telecom M&A premiums are currently running between 30 and 60%, depending on the deal (Source 1, Source 2). I am weighting the premium on Lumen down to 20% to account for the mix of legacy wireline versus fiber. Accounting for cash and debt, here is a rough value of assets:

Asset Valuation (Data: SA; Analysis: Mike Dion)

This represents nearly $1 billion of side to the current market cap, providing a significant margin of error.

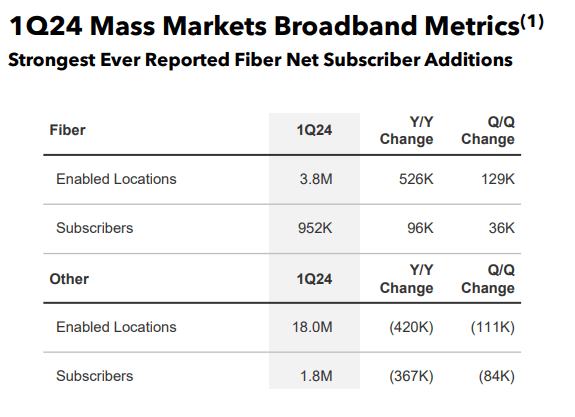

And it is not just the value of the assets to consider, Lumen also has a large subscriber base for fiber. Raymond James values 5G/fiber telecom customers at approximately $520/customer. Verizon purchased Tracfone’s prepaid customer base for $300/share, a clean comparison since they owned no spectrum. Assuming a mid-point of $400 due to Lumen’s challenged business, this represents a value of $381 million for the fiber subscribers alone.

Broadband Metrics (Lumen Investor Relations)

At very conservative premium assumptions, Lumen is sitting on at least $2.4 billion in sale value versus a market cap just above $1 billion.

Other Signals

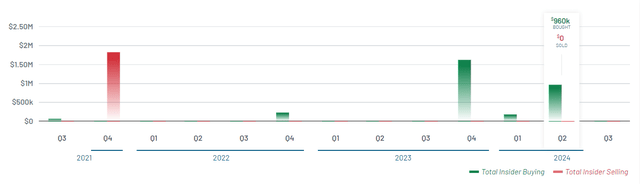

Insider trading activity has increased substantially over the last three quarters after stagnant for nearly two years. Nearly all transactions have been buys with negligible sales. The most interesting transaction was President Kathleen Johnson’s increase in her holdings by 9% with a $960 thousand purchase.

Insider Trades (Market Beat)

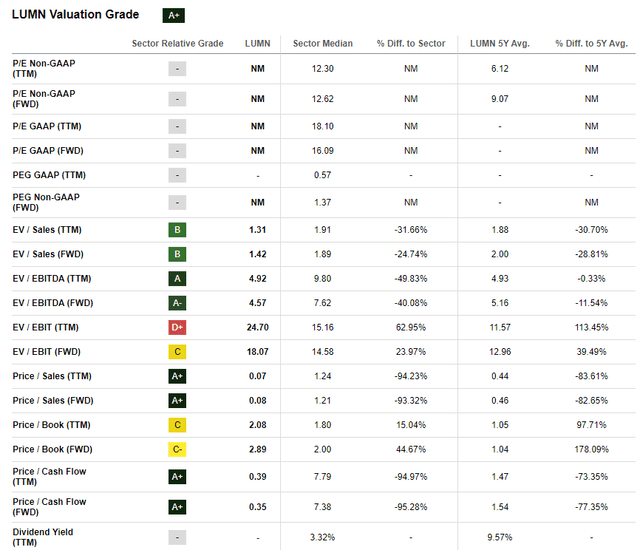

Valuation multiples are equally favorable with key Sales ratios and cash flow ratios at A and B, depressed well below the sector and the 5-year average. Tying this back to the valuation discussion above, the value of a telecom is heavily in assets, so from this angle seeing valuation multiples so low signals notable upside potential.

LUMN Valuation (Seeking Alpha)

Downside Risk

The largest downside risk is a lack of buyers for key assets, although that risk is well mitigated as the big three continue to acquire wireless and wireline players to expand their networks.

The second downside risk to call out is a guidance miss for 2024. Part of the game now is an investor confidence game and as the stock nears $1 a shock like a guidance miss could push Lumen over the threshold. Now, the risk of delisting is limited, especially as insiders load up on stock. A reverse stock split is more likely. Still, it is something to pay attention to.

Verdict

Lumen Technologies is struggling, and I don’t intend to undermine that reality. However, there is still a core value to the business, especially in assets, and I believe the market has overreacted to recent performance.

My DCF analysis on the low end of management guidance presents a compelling price target with 17% upside. In addition, the asset portfolio, net of debt, is worth nearly double the current market cap of the business even at a conservative valuation. Furthermore, insiders are scooping up stock with major purchases and valuation multiples are compelling.

Even if the turnaround doesn’t pan out, there is enough value here to support a rise in share price with a comfortable margin of safety. With all of the above in mind, I raise my rating on Lumen Technologies, Inc. shares to buy.

Read the full article here