In no real surprise, Macy’s, Inc. (NYSE:M) terminated discussions with investment firms constantly lowballing the company with offers to acquire the business. The department store retailer has a valuable retail business and real estate assets worth billions, yet the firms continued to make offers far below the true value of just the real estate assets. My investment thesis is ultra-Bullish on the stock, dipping here due to a broken stock market.

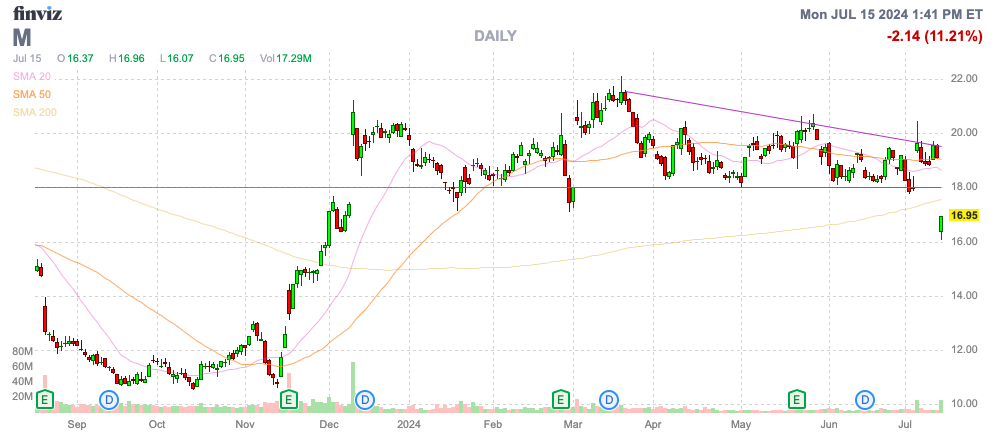

Source: Finviz

Terminated Discussions

Macy’s announced the company was no longer working with Arkhouse Management Co. LP and Brigade Capital Management, LP on finalizing a deal. The department store retailer made the following statement to shareholders before the market opened:

…has unanimously determined to terminate discussions with Arkhouse and Brigade that have failed to lead to an actionable proposal with certainty of financing at a compelling value.

The investment firms initially made an offer to pay $21.00 per share to acquire Macy’s with the intent of making a higher bid based on due diligence. The move is odd, considering the best way to get management and shareholder attention is to make a best offer. Instead, the investment firms appear interested in making Macy’s BoD dance to obtain a higher bid, when the company has no incentive to play such games.

Arkhouse Management and Brigade Capital came back with a 3rd offer of $24.80 per share, amounting to a valuation of ~$7 billion. The last bid was only $0.80 above the 2nd bid of $24.00, probably the last straw for management.

In essence, the management team has already wasted hundreds of hours on this due diligence process, which Macy’s should’ve never engaged in the first place. The investment firms need to bring a larger offer to the table with credible financing before management ever wastes time again on a potential offer.

As long discussed, Macy’s has real estate with estimated valuations from $5 to $14 billion. The recent analysis by CoStar analyst Bandon Svec valued the real estate assets alone at $10.5 billion based on CoStar Market Pricing.

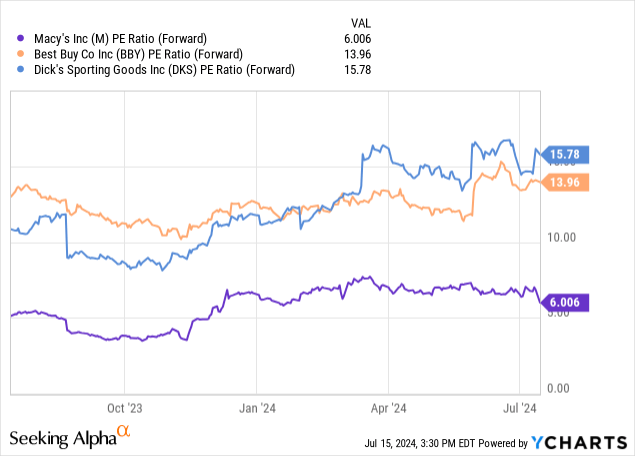

From the beginning, a price above $30 is likely what’s needed to entice management to agree to a deal, yet the last offer suggested a giant rift in the value of Macy’s. Other leading retailers in Best Buy (BBY) and Dick’s Sporting Goods (DKS) without the same level of valuable real estate traded at an average forward P/E multiple of 15x.

Cycle Bottom

The apparel retail sector has faced a tough few years, which has always made a buyout deal now less than compelling. An investment group was always going to attempt to lowball Macy’s based on the current stock price, not a legitimate price during a normal cycle.

Following Q1 results, Macy’s guided up to an EPS of $2.55 to $2.90 for 2024. The company forecasts relatively flat comp sales as apparel retail remains in a horrible slump with consumers squeezed by inflation and higher interest rates.

The Fed appears poised to cut interest rates in the 2H, with Goldman Sachs now forecasting a 25 basis point rate cut in July. The Fed cutting interest rates a few times this year should help consumer spending in the apparel segment.

The department store retailer earned a $3.50 EPS in a more normal 2023. Investors should have some level of confidence in Macy’s returning to those earnings levels.

Either way, the stock trades at only 6x EPS targets despite the additional massive real estate assets. The company will move forward with A Bold New Chapter strategy and a return to the 2023 EPS estimates along with a 15x multiple pushes Macy’s up to $52.

Takeaway

The key investor takeaway is that Macy’s never appeared set to accept the Arkhouse Management and Brigade Capital deal based on value alone. The company is wisely moving on from this distraction until a more legitimate deal is offered up to Macy’s. The stock falling today back to $16 is a sign of how the stock market is broken when valuing such stocks.

Investors should load up on Macy’s, Inc. stock trading at only 6x EPS targets while the real estate assets ultimately provide a catalyst for a buyout offer, including a higher bid from Arkhouse Management and Brigade Capital.

Read the full article here