As part of our ongoing series of articles on bank stability, and at the request of many of our clients, we wanted to address the major risks we foresee for bank stability in the coming years.

But before we begin, I want to take this opportunity to remind you that we have reviewed many larger banks in our public articles. But I must warn you: The substance of that analysis is not looking too good for the future of the larger banks in the United States, details for which are here.

Moreover, if you believe that the banking issues have been addressed, I’m sorry to inform you that you likely only saw the tip of the iceberg. We were able to identify the exact reasons in our public article which caused SVB to fail well before anyone even considered these issues. And I can assure you that they have not been resolved. It’s now only a matter of time.

In one of our recent articles, Our Banks Are Sick And We Are Watching A Slow-Motion Train Wreck, we discussed the recent report from Moody’s on U.S. banks, which came out with a significant time lag relative to our analysis.

If you have been following our work on banks, you would know that we have been discussing the issues to which Moody’s was recently referring for the past 18 months. We also noted that Moody’s, as well as other rating agencies and research departments of investment banks, have mostly ignored several major issues that were revealed by the U.S. banks’ 1H23 results. In our view, each of these issues is a major risk for bank stability, and each of them is worth a separate article.

In our first article, we discussed consumer lending and its potentially significant negative impact on the stability of the banking sector. The trends we’re currently seeing have suggested even further deterioration since that article. For example, this week, the NY Fed published a report saying that the average perceived probability of missing a minimum debt payment over the next three months is 12.5%, which is the highest reading since May 2020. Moreover, we expect that the Q3 earnings season is very likely to reveal major issues among consumer lenders.

In our second article, we discussed CRE (commercial real estate) lending, which also is a major threat to the stability of the banking system, in our view. We also expect Q3 earnings to show that the situation in this lending segment continues to worsen.

In this article, we would like to discuss commercial & industrial (C&I) lending.

It may come as a surprise to some, but C&I lending has been among the fastest-growing segments of the U.S. banking system since the Great Recession.

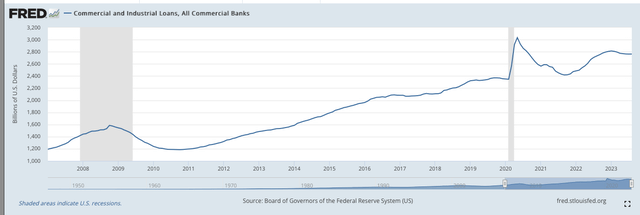

St.LouisFed

As the chart above shows, C&I loans grew from $1,190B in June 2010 to $2,763B in August 2023. The zero-interest rate environment boosted demand for C&I lending, and it was attractive for banks from both growth and profitability perspectives. Even banks that were lacking the necessary expertise in underwriting entered this space.

When the policy rates were zero, even borrowers with weak credit profiles continued to repay their C&I loans, especially given that it was so easy to approve a refinancing procedure. However, when the Fed started its tightening cycle, the situation began to change, especially for those banks that were lacking underwriting expertise during the period of high growth in the C&I space.

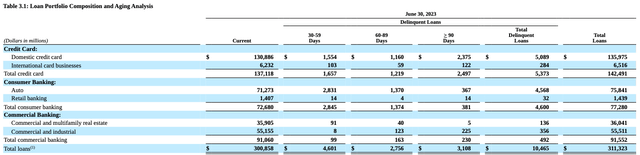

For example, while Capital One (COF) is viewed by many as a monoliner with a focus on consumer lending, it has significant exposure to C&I lending. In fact, it accounted for 18% of the bank’s total credit portfolio. If we add CRE lending, this figure goes to almost 30%. As such, COF’s total commercial banking loans are even larger than its auto book based on total outstanding loans.

Company Data

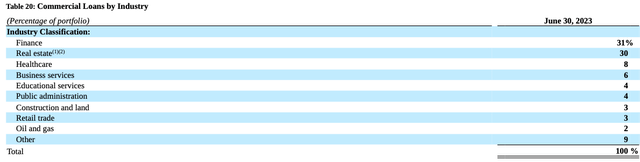

If we look at a breakdown of COF’s commercial loans by industry, it looks very risky, as 61% of loans were granted to finance companies and real estate companies.

Company Data

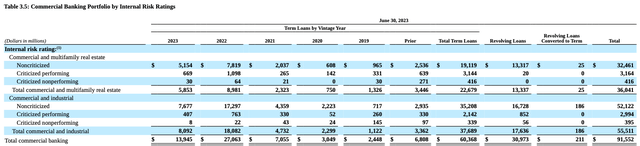

Most importantly, even in this relatively benign environment, COF’s commercial book already is showing initial signs of major asset quality issues. According to the bank’s internal risk ratings, the share of criticized loans in the total C&I book is 6.1%, and for term loans, this share is even higher at 6.6%. The share of criticized loans in the CRE book is 10%, which is very high. We assume that such weak credit quality ratios in the commercial banking segment are due to the fact that COF was likely lacking the necessary underwriting expertise when commercial loans were booming.

Company Data

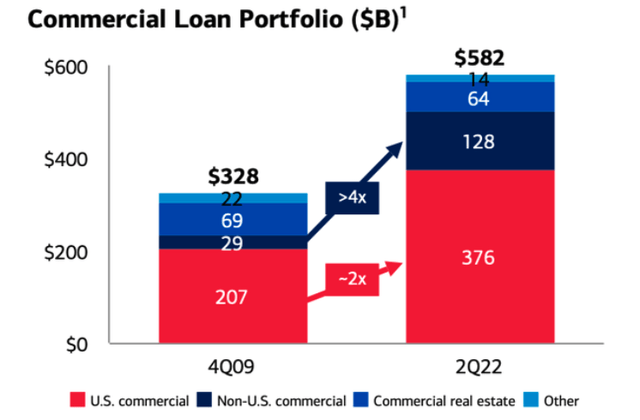

Another issue with the C&I segment is that U.S. banks have significantly increased lending to non-U.S. companies. In our article on Bank of America (BAC), we showed the following chart:

Company Data

As the chart shows, there was indeed quite a large increase in commercial lending. Notably, non-U.S. commercial lending grew 4x times, from $29B as of YE2009 to $128 as of 1H22.

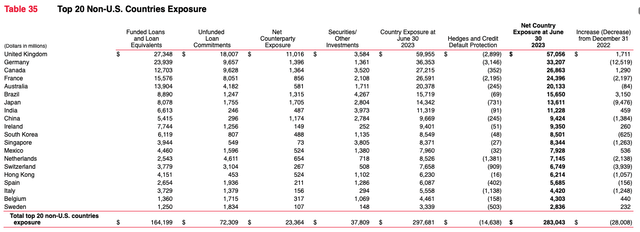

The table below shows BAC’s Top-20 countries exposure.

Company Data

As we can see, non-U.S. loan exposure is $164B (28% of BAC’s total commercial loan book), while total net exposure, which includes unfunded commitments and securities, is $283B. Needless to say, non-U.S. loans are subject not only to credit risks but to FX risks as well. It’s very likely that the dollar would significantly appreciate against other global currencies in a systemic crisis scenario.

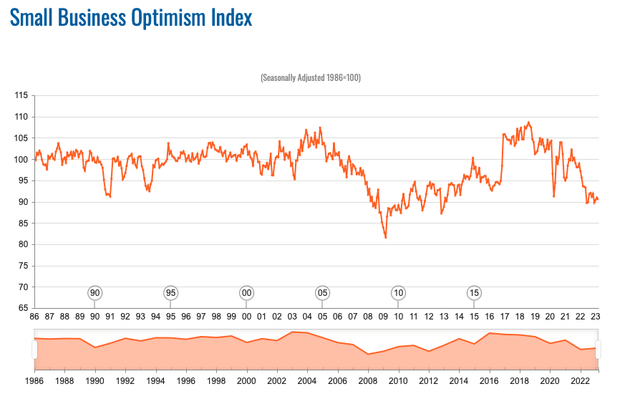

Finally, we also would like to highlight a recent survey by the National Federation of Independent Business. According to the survey, the so-called Small Business Optimism Index has recently reached its lowest level since 2013. There are clearly problems in the small business lending space, and the main one, in our view, is a continuous rise in interest rates. That’s very likely to result in asset quality issues for the banks soon.

NFIB

Bottom line

We expect these three topics that we have discussed in our recent articles to be in the spotlight when banks start reporting their 3Q numbers. As a reminder, the top-15 banks that we have recommended to our clients are much more resilient to these issues as they have very low exposure to consumer lending, CRE lending, and commercial loans.

At the end of the day, we’re speaking of protecting your hard-earned money. Therefore, it behooves you to engage in due diligence regarding the banks which currently house your money.

You have a responsibility to yourself and your family to make sure your money resides in only the safest of institutions. And if you’re relying on the FDIC, I suggest you read our prior articles which outline why such reliance will not be as prudent as you may believe in the coming years.

It’s time for you to do a deep dive on the banks that house your hard-earned money in order to determine whether your bank is truly solid or not. Feel free to use our due diligence methodology, outlined here.

Housekeeping matters

This article, as well as Saferbankingresearch.com, is a combination of efforts between Avi Gilburt and Renaissance Research, which has been covering U.S., European, LatAm, and CEEMEA banking stocks for more than 15 years.

If you would like notifications as to when my new articles are published, please hit the button at the bottom of the page to “Follow” me.

Also, for those that are questioning why all comments (including mine) go through moderation, you can read here: Haters Are Gonna Hate – Until They Learn.

Lastly, I have asked the editors to close the comments section, as I will be out through the weekend. The comments section will re-open when I return next week.

Read the full article here