The oil market is among the few that offers a general hedge against the most significant risks impacting stocks and bonds. In 2021, the sharp rise in oil and gas prices was a major contributing factor to inflation, hampering the profitability of some stocks and contributing significantly to the rise in interest rates. This change can be seen clearly in the correlations of stocks, bonds, and oil-producing stocks. In the past, the S&P 500 was highly correlated to the oil-producer equity ETF (XOP) at a 0.8X correlation in 2021 (36-month rolling), but is down to 0.5X today. At the same time, the correlation between the S&P 500 (SPY) and long-term bonds (TLT) has risen from -0.5X to +0.5X, while XOP and TLT have become uncorrelated.

In my view, although this point may appear technical, it is one of the most important developments impacting financial markets today. Stocks and bonds, almost always negatively correlated, now move together due to their shared negative exposure to inflation. Conversely, oil stocks diverge from most other equities because they’re among the few that benefit most directly from inflation. Of course, that will only remain the case as long as oil market tightness remains a major inflationary factor.

Key oil producers like Marathon Oil (NYSE:MRO) are an excellent hedge investment against this risk factor. Marathon’s position as a significant US-based oil producer gives it a key advantage in the geopolitically turbulent oil market. Further, the company trades at a very low valuation and now returns tremendous capital to shareholders. Depending on changes to oil prices, Marathon Oil may have significant upside potential over the coming quarters.

Marathon Stands to Benefit From Oil Volatility

On Wednesday, Marathon published its Q3 earnings report, beating slightly on both EPS and sales. Most significantly, it generated $718M in free cash flow, up 35% sequentially. Like many shale-oriented US producers, Marathon is in the midst of a transition from growth to maturity. Over most of the past fifteen years, it has aggressively expanded its position in shale oil, investing tremendous capital, resulting in a significant glut in global oil production. Resulting in low oil prices harmed profits and increased Marathon’s debt risks.

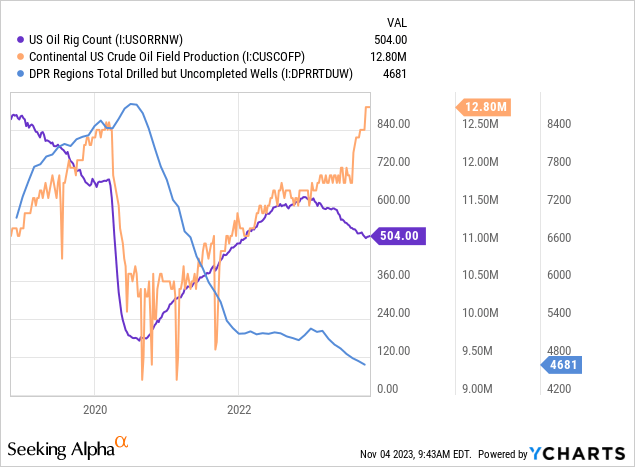

However, since 2020, US oil shale production has slowed. For most of this year, there has been increased debate regarding “peak shale,” with many executives seeing shale oil production topping out soon or in the coming year or two. Although US oil production is now back at pre-COVID levels, a falling rig count indicates that output should not rise much further as drillers focus on quality over quantity. See below:

Substantial drilling reductions in 2020 led to an energy market crisis of low supplies and higher fuel prices. As a result, producers such as Marathon aggressively increased drilling and utilized many “drilled but uncompleted” wells, which are a cheaper but limited way to increase production. The significant decline in oil prices over the past year has caused most producers to reduce their drilling rates, usually resulting in lower oil production. That said, total US production has continued to rise over recent months despite intense drilling due to renewed use of “drilled but uncompleted” wells. This trend can continue for some time, but not for more than another year at the current pace of “DUC” declines, which will also limit production growth further out.

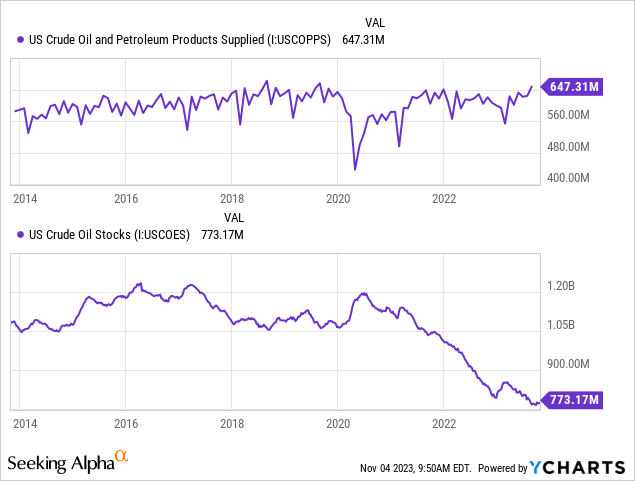

Overall, it is not entirely accurate to say that oil production has peaked, but drilling almost certainly has. Today, gains in oil production are due to the cost-effective completion of previously drilled wells. One year from now, this will result in lower production without an increase in drilling. However, it costs around $50-$70 to produce a barrel of oil in a new well, so drilling is not too profitable with oil around $80. Naturally, higher production should result in lower oil prices. That said, the market is also supported by record-high demand, as seen in the latest “products supplied” figure. Additionally, total US oil inventories are historically extremely low today, meaning an external market shock would have a more bullish impact than usual. See below:

For most of this year, oil has been weighed down by the prospects of lower oil demand due to slowing economic growth. On the one hand, there is a considerable slowdown in household/consumer credit and spending stability levels, as well as small business stability. Conversely, GDP growth is robust today due to increased US government spending and high fixed investments. Thus, as opposed to the 2020-2022 “low demand, low supply” market, we’re now seeing a “high demand, high supply” market, which can have ambiguous impacts on oil prices.

As things stand, there is not necessarily a clear bullish or bearish bias on the oil market. As I’ve stated in previous oil markets, deterioration in “drilled but uncompleted” oil well inventories, as well as oil inventories, are significant long-term bullish factors; however, those factors must be catalyzed by a rapid supply and demand imbalance. Russia and OPEC may pursue more oil cuts, as discussed, but there is also some evidence suggesting that Russia is distancing itself from OPEC.

To me, the most likely bullish catalyst for oil would be an enforcement of the US embargo on Iranian oil exports. Although the US has long since enacted sanctions to try to stop Iranian oil exports, there has been no effective enforcement, causing Iran’s oil exports to rise by around 7X in recent years. In fact, Iran has been one of the fastest-growing major global economies over the past year. Unsurprisingly, the sharp increase in Middle Eastern instability over the past month and Iran’s support for Hamas has led to both an increase in calls for enforcement of the Iran embargo and Iran calling for a counteracting OPEC+ embargo. However, OPEC+ does not currently support that. Still, enforcement of Iranian oil exports appears somewhat likely, potentially blocking a significant source of global oil and possibly resulting in a broader increase in tensions among oil exporters. However, because China imports almost all of Iran’s output, the US faces difficulties blocking Iran.

Changes in oil prices primarily drive Marathon Oil’s performance. In my view, it is unlikely we will see a sharp decline in oil prices because that is already resulting in drilling cuts. However, although it is not necessarily a “high probability” scenario, I believe we may see a “domino effect” of oil-impacting events in the Middle East, mainly if the US looks to stop Iran’s primary source of income. For the most part, oil has lost its “war premium.” To me, some premium is reasonable, considering a blockade of key oil export shipping lanes could easily result in a vast (~$50-$100) oil price increase because the market is so supply-sensitive and global oil inventories are so low. Again, even if this is not a “high probability” outcome, investors should hedge against it because it will be bearish for almost all stocks and bonds besides oil producers like Marathon.

Marathon Oil vs. Other Oil Producers

The macroeconomic situation is relatively bullish for all US oil producers because declines in Iranian oil exports would naturally increase profits for US exporters toward Asia. To me, in a “no change” scenario, we can expect Marathon to continue to earn the EPS and free cash flow that it did in Q3. According to the company’s metrics, its FCF breakeven oil price should be around $45 per barrel in 2024, the lowest among the larger oil producers. However, its natural gas and liquid segments are not profitable due to low prices in those markets, so it only earned around $12 in FCF per barrel of oil equivalent last quarter, which is still better than most of its peers ($10 average).

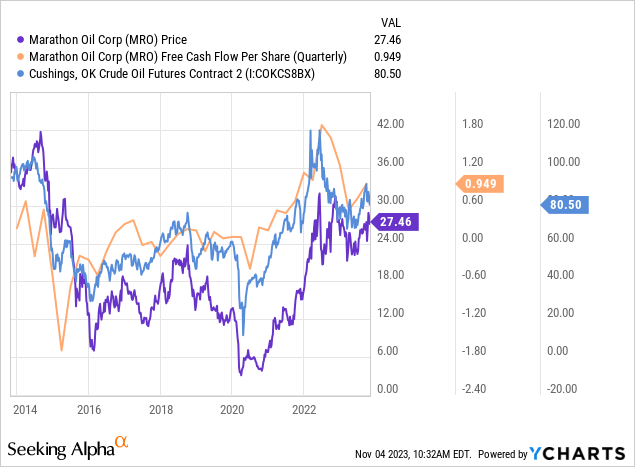

Around 82% of the company’s revenue comes from oil, with the rest mixed between natural gas and liquids. To a great extent, MRO’s price and its free cash flow per share are a direct function of crude oil prices. See below:

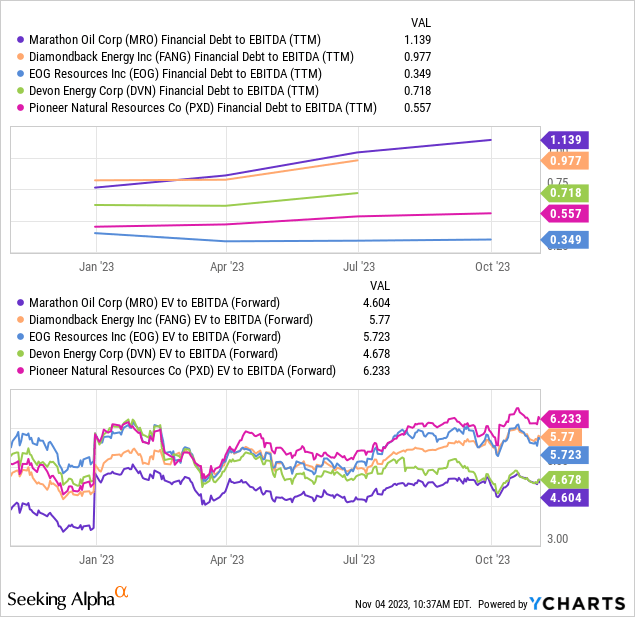

If we assume the oil market remains relatively stagnant around the $75-$85 range it has held over the past year, then Marathon should continue to earn around $0.95 in FCF per share per quarter. Thus, it has a price-to-FCF of about 7.2X. Marathon also has the lowest forward “EV/EBITDA” of its peer group but also has the highest debt-to-EBITDA. See below:

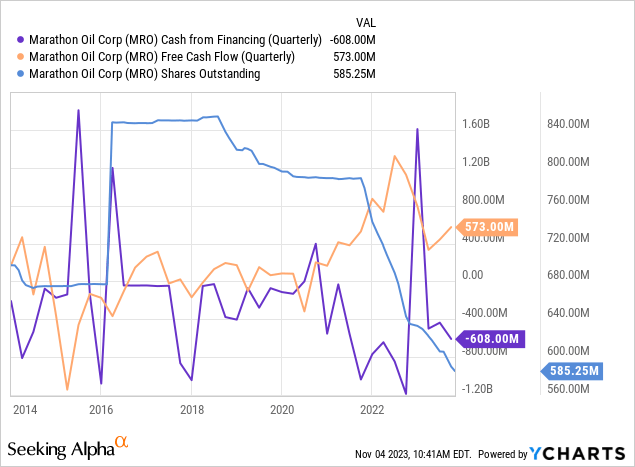

Notably, “EV-to-EBITDA” accounts for leverage levels, so although MRO is the most leveraged amongst its peers, that alone does not justify its valuation discount. Further, although its high-leverage position was an issue years ago when it was losing money, it is a benefit today because it can now pay off that debt quite quickly, and its cash flows are restored. Many investors would prefer if MRO’s dividend were higher, but it still returns an immense amount of capital to investors through share buybacks. See below:

Last quarter, MRO returned $608M to stakeholders through dividends, share buybacks, and changes in debt (essentially zero). In my view, dividend yields are not particularly important for long-term investment performance because some companies pay dividends while raising debt or selling equity, giving no actual benefit to investors. Conversely, in Marathon’s case, its valuation is so low that it is most reasonable to use high FCF to buy its stock because of its discounted value.

From my view, a company’s true “yield” is its FCF-to-EV, or the amount of cash generated after CapEx compared to its combined equity and debt value, which is about 10% for MRO today. Of course, if oil rises to $150 in a black swan event, its FCF (pre-tax) from oil should increase by roughly 230% based on its breakeven. I conservatively estimate that would increase its quarterly FCF to around $1.5B per quarter after taxes, giving it a 25%+ FCF-to-EV. Of course, oil reached about $150 fifteen years ago, so I would personally not be surprised to see even higher oil prices in a global conflict situation, particularly given abysmally low emergency inventory levels.

The Bottom Line

Overall, I believe MRO is a good investment today, given no change in geopolitical and macroeconomic circumstances. Its efficiency is stellar, and it is cheaper than its peer group. Like most, it is focusing away from growth toward the return of capital to stakeholders. It trades at a much lower valuation than most equities but is likely more stable given the situation in the oil market. Thus, despite increased geopolitical turbulence, I am slightly bullish on MRO. Of course, should the US look to block Iran’s oil supply, or Iran look to block Saudi oil exports to Israel (or the US), or, least likely, Saudi Arabia shift against the US and Israel (as it did in the 1970s), then oil could rise meteorically higher.

In that scenario, all American oil producers (north and south) would benefit tremendously by being exporters who can produce away from turbulent markets. Marathon is my favorite large US oil producer in this situation. That said, smaller US producers and South American companies probably have more upside potential, albeit with more immediate risks. In my view, although I do not believe the probability of more significant escalation occurring is too high, the associated risk for all other stocks is great enough that MRO (or others) would be a great way to hedge against it.

Read the full article here