Investment Thesis: I take the view that Marriott International has the capacity to see further upside from here, based on encouraging growth in RevPAR and EBITDA.

In a previous article back in August, I made the argument that Marriott International (NASDAQ:MAR) can continue to see upside over the longer-term, based on strong growth from China as well as healthy RevPAR growth for the Marriott Hotels brand.

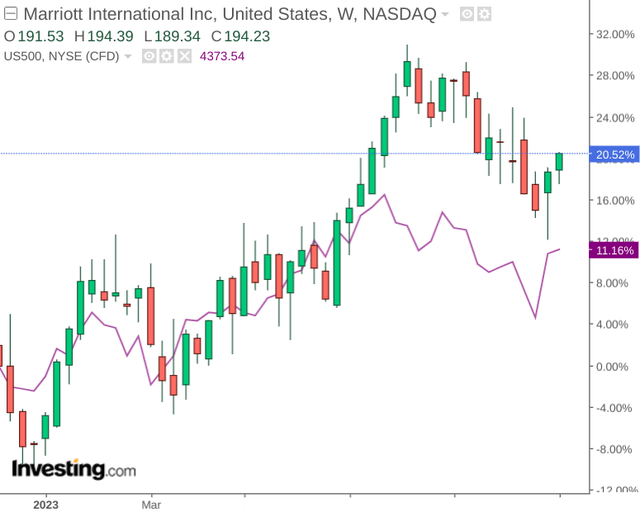

Since then, the stock has descended to a price of $191.16 at the time of writing:

TradingView.com

The purpose of this article is to assess whether Marriott International has the ability to see continued growth from here taking recent performance into consideration.

Performance

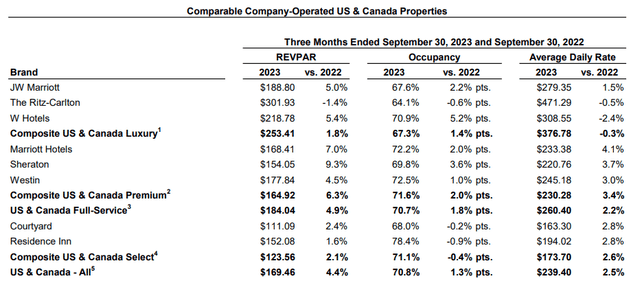

When looking at third quarter 2023 results for Marriott International (as released on November 2), we can see that with the exception of the Ritz-Carlton (which is the highest priced brand by ADR – or average daily rate), RevPAR (or revenue per available room) has seen growth across all brands.

Marriott International: Third Quarter 2023 Results

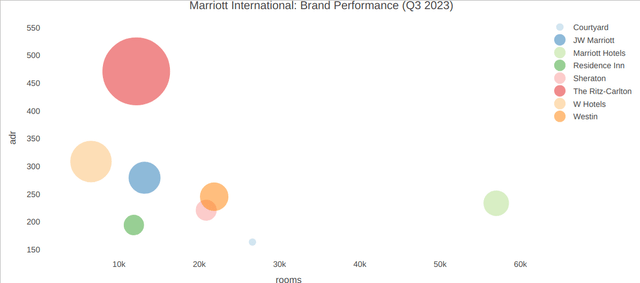

When we visualise brand by RevPAR on a bubble chart (with a larger bubble indicating higher RevPAR), we can see that while the Ritz-Carlton shows the largest RevPAR (and also the highest ADR), the Marriott Hotels is by far the largest brand in terms of room size.

Graph generated by author using the plotly visualization library in R using figures sourced from Marriott International Q3 2023 Earnings Release.

An interactive, web-based version of the above plot is available here with more details on ADR and room metrics across brands.

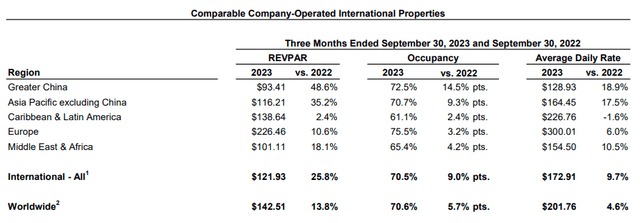

Additionally, when looking at revenue by geography, we can see that while RevPAR across Greater China is lower than that of other geographies – this region has seen the highest growth rate YoY.

Marriott International: Third Quarter 2023 Results

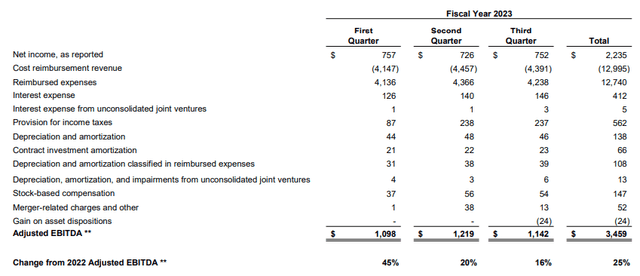

Additionally, when looking at a breakdown of adjusted EBITDA, we can see that the third quarter showed a 16% growth in EBITDA from that of last year. However, it is also notable that we have also seen a slowdown in adjusted EBITDA growth from that of Q1 and Q2 at 45% and 20% respectively.

Marriott International: Third Quarter 2023 Results

We have seen that growth in adjusted EBITDA has slowed through the quarters in part due to the fact that we have seen higher cost reimbursement revenue in the second and third quarters (which are not included in adjusted EBITDA). This has also coincided with a plateau in net income growth across the three quarters.

Cost reimbursement revenue relates to reimbursements for costs that Marriott incurs in operating property-level and centralized programs and services for the benefit of hotel owners. With the same having seen an increase in Q2 and Q3 – this signifies that the cost of operating properties has seen an increase.

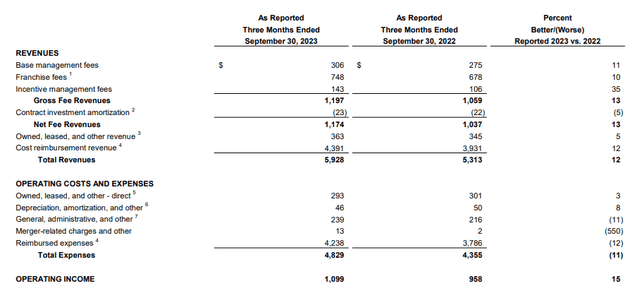

Marriott International: Third Quarter 2023 Results

We can see from the above that reimbursed expenses saw a 12% increase from that of the previous year – which led to an increase of 11% in total expenses, which was almost the same rate of growth as that of 12% for total revenues.

My Perspective

As regards my take on the above results and the implications for the growth trajectory of the stock going forward, my prior case for upside was founded on the basis that strong RevPAR growth in China as well as healthy RevPAR growth for the Marriott Hotels brand would continue – both have proven to be the case in Q3.

We can see that for this year, Marriott International has outperformed the S&P 500:

investing.com

In this regard, I take the view that investors continue to be enthusiastic about the performance of the stock as a whole. In my opinion, should we see property-related expenses start to moderate once inflation starts to slow – then Marriott International is in a good position to further bolster revenue across its brands and in turn boost adjusted EBITDA.

From this standpoint, I take the view that the decline in the stock that we have seen over the last three months may be market-related, or due to concerns among investors that rising expenses is hindering net income growth.

However, I take the view that the stock has the capacity to rebound to the prior high of just under $210 that we saw earlier this year.

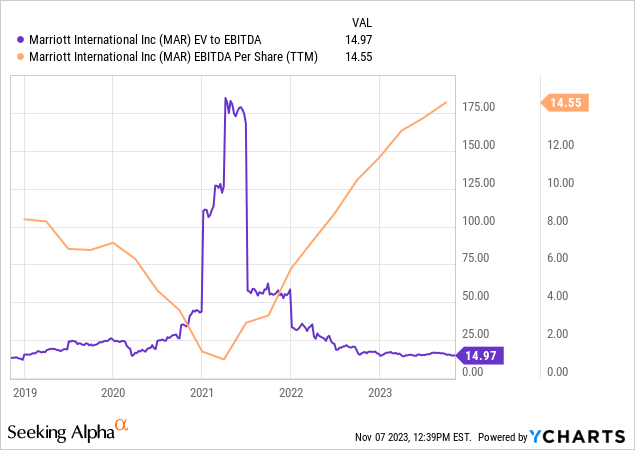

ycharts.com

Additionally, when we look at Marriott International from an EV/EBITDA standpoint, we can see that the EV/EBITDA ratio is trading at 2019 levels once again, while EBITDA per share is trading at a much higher level as compared to 2019. In this regard, I take the view that the current price of $191 is justified by the earnings growth that we have seen to date – and fair value more likely lies near the $210 mark where we previously saw the stock trading.

Risks

In terms of the potential risks to Marriott International at this time, the main one in my opinion is higher expenses potentially placing a slowdown on EBITDA growth.

We have seen that higher property-related expenses have somewhat diluted the effects of strong revenue gains in the last quarter, and if this continues to place pressure on earnings growth, then we could see investor apprehension lead the stock lower.

Heading into the winter months, hotel booking demand is also expected to be lower due to seasonality. In this regard, while we have seen encouraging growth in RevPAR across the company’s brands and geographies – a lull in growth during the winter months could lead to short-term downside in the stock.

Conclusion

To conclude, Marriott International has seen encouraging growth in RevPAR across China and its Marriott Hotels brand, and growth in EBITDA has continued in spite of challenges.

In this regard, notwithstanding the short-term risks – I take a bullish view on Marriott International stock.

Read the full article here