I cautioned investors about Marvell Technology (NASDAQ:MRVL) stock’s unsustainable surge in May and August 2023. As such, I’m not surprised that sellers took the opportunity to hammer late MRVL buyers, causing it to plunge toward its October lows. As such, over the past four months, the momentary outperformance against its semiconductor peers represented in the iShares Semiconductor ETF (SOXX) turned into underperformance.

Accordingly, MRVL has collapsed nearly 32% from its early June 2023 highs through this week’s lows. As a result, sellers also digested most of its May 2023 surge, spooking investors who chased its momentum spike after Marvell’s fiscal first-quarter or FQ1’24 earnings scorecard. Keen investors should recall that the company upgraded its guidance significantly, as management telegraphed a 100% CAGR in AI revenue from FY23-25, reaching $800M.

Marvell followed up with another solid release for its FQ2 scorecard in August 2023. However, it only attracted more sellers to return, taking advantage of another momentary spike to digest buyer optimism.

With MRVL being battered over the past few months, I believe it’s opportune to update whether the company’s structural drivers have altered.

Management provided keen insights on its well-diversified business model in two conferences (here and here) in early September 2023. In both cases, management highlighted the confidence in its AI business, although weakness in the storage and enterprise business remains uncertain. However, the company didn’t think these headwinds were structural, suggesting its confidence to continue improving its earnings growth through FY25.

Given its expertise in its data center interconnect segment, Marvell is a vital player in AI infrastructure. Coupled with the recovery of its networking business, I’m confident that the more than 30% battering MRVL received over the past few months isn’t linked to its structural growth drivers. Then what could it be?

Could it be the recent tightening of export restrictions by the Biden Administration that could have spooked investors? While alluding to a single factor is challenging, Nvidia has not reduced its orders with TSMC (TSM) based on a recent Digitimes supply chain update. Also, TSMC remains on track to double its CoWoS advanced packaging capacity, which remains constrained. As such, I believe it’s credible that the robust underlying secular demand could mitigate the export headwinds in the AI business.

In other words, while the AI hype is undeniable, it is likely sustainable and expected to grow as data centers retool their infrastructure for AI solutions. Given Marvell’s diversified segments, it is well-positioned to offer customers a holistic solution to lower their TCO.

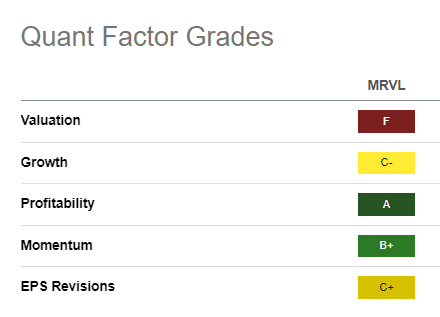

MRVL Quant Grades (Seeking Alpha)

However, keen investors should know that the market is forward-looking. As such, I believe market participants priced in MRVL’s near-term opportunities rapidly in its May surge.

Notwithstanding its recent plunge, MRVL remains priced at a premium, as seen in its “F” valuation grade. As such, management needs to improve its execution (“C+” earnings revisions grade), notwithstanding its best-in-class “A” profitability grade.

In other words, the market is justified to reflect significant caution over the past few months as semi-stocks came under pressure. With MRVL’s growth premium, investors shouldn’t be surprised that it underperformed.

The question facing investors now is whether MRVL could bottom out soon.

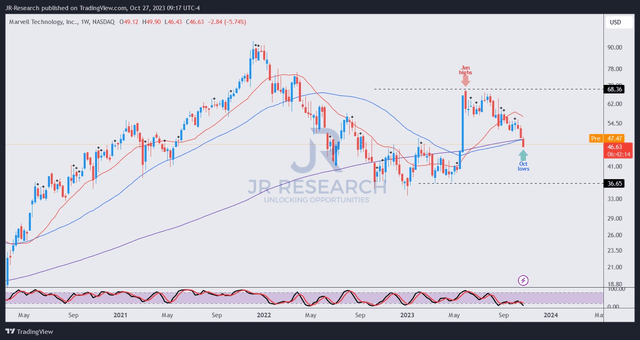

MRVL price chart (weekly) (TradingView)

As seen above, MRVL collapsed toward its 50-week moving average or MA (blue line) this week, a pivotal development that looked “nearly impossible” at the height of its overoptimism in May 2023.

Astute investors who assessed its unsustainable upward surge are unlikely to have been stunned by its decline. I also cautioned investors that its momentum could “reverse quickly as earlier dip buyers take profit/cut exposure.”

As such, I believe my thesis has panned out accordingly. I have yet to glean a constructive bottoming process. However, the risk/reward profile has improved markedly relative to the opportunities in May and August 2023. With that in mind, I’m ready to upgrade MRVL.

Buyers are urged to consider allocating their purchases in phases, as I have not gleaned a consolidation phase yet.

Rating: Upgraded to Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here