Marvell Technology (NASDAQ:MRVL) is a key supplier of data center infrastructure semiconductor solutions for data center core and network edge. Marvell’s data center business represented more than 70% of total revenues in the most recent quarter. Marvell anticipates its AI revenues from optics and custom ASIC reaching more than $1.5 billion by FY25. Additionally, the company is well positioned to grow its data center switching portfolio (Active Electrical Cables) in the near future. I am initiating with a ‘Buy’ rating with a one-year price target of $80 per share.

Growth in AI Optics and Custom Silicon

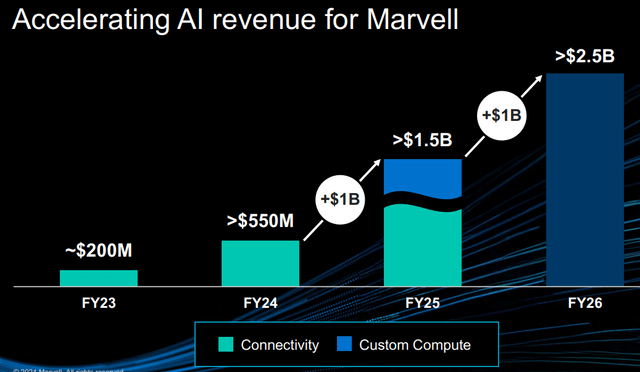

Marvell’s AI exposure lies in its data center optics and custom silicon (“ASIC”) business. As shown in the chart below, the company is expected to deliver >1.5 billion in revenue from AI by FY25.

Marvell Investor Presentation

- AI Optics: Marvell’s optics portfolio includes pulse amplitude modulation, digital signal processors, laser drivers, trans-impedance amplifiers, and data center interconnect solutions. Data centers require interconnect solutions to connect massive GPU, routers and switches. Marvell is well poised to capture the rapid growth in data center interconnectivity market.

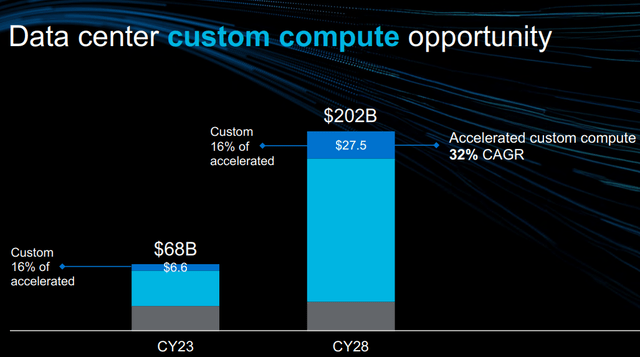

- Custom ASIC: The company develops system-on-a-chip solutions tailored to individual customers. For instance, hyperscalers, such as Microsoft (MSFT), Amazon (AMZN) and Alphabet (GOOGL), can either purchase standard GPU products from Nvidia (NVDA), AMD (AMD), or Intel (INTC), or design their own chips with Marvell’s ASIC technology. According to the management, Marvell has been working with all the hyperscalers to design their own chips. As reported by Business Insider, Marvell holds around 15% of market share in custom ASIC market. Marvell has collaborated on the production of Amazon’s 5nm Tranium chip and Google’s 5nm Axion ARM CPU chip. Additionally, Marvell has been advancing its 3nm technology with these hyperscalers. As shown in the slide below, the total addressable market for custom ASIC is anticipated to grow at a CAGR of 32% from FY23 to FY28, primarily driven by rapid AI and data center growth.

Marvell Investor Presentation

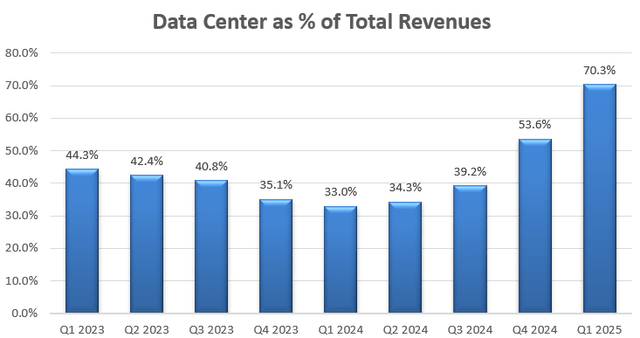

As AI is growing rapidly currently, I anticipate Marvell’s optics and custom ASIC businesses will grow at a fast pace in the coming years. As depicted in the chart below, Marvell has growing its data center business significantly over the past few quarters, contributing more than 70% of total revenues in Q1 FY25.

Marvell Quarterly Earnings

Weakness in Other Cyclical Business

Marvell has 30% of revenue exposure in some cyclical businesses including enterprise networking, carrier infrastructure, consumer electronics, and automotive markets. In Q1 FY25, enterprise networking declined by 58% in revenue year-over-year, carrier infrastructure declined by 75%, consumer by 70%, and automotive/industrial markets by 13% in revenue.

Amid the high interest rates macro environment, enterprise and telco companies are tightening their IT budgets. Additionally, CIOs have to prioritize AI spendings within their constrained IT budgets. These macro headwinds are causing temporary softness in enterprise/telco/automotive/industrial markets.

Over the long term, I continue to expect these cyclical businesses to grow, albeit at a slower pace than the data center business. In October 2022, Marvell announced its 100G/lane active electrical cables (“AECs”), enabling 400G, 800G and 1.6T server-to-switch and switch-to-switch solutions. Marvell’s ethernet controllers and network adapters could continue to grow alongside enterprise ethernet market. Having said that, these cyclical businesses are likely to continue causing near-term headwinds.

Recent Result and FY25 Outlook

Marvel released its Q1 FY25 earnings on May 30, reporting 12.2% decline in revenue and 21.8% decline in net income, primarily caused by notable declines in 5G, auto/industrial, enterprise networking and carriers businesses, as discussed earlier.

My biggest takeaway from the quarter is its strong growth in data center business, which grew by 87% year-over-year and 7% sequentially. During the earnings call, the management expressed optimism about the growing demand for AI applications. The company has begun the initial ramp of custom AI compute silicon with hyperscalers. I anticipate the revenue contribution from custom ASIC will begin in FY25.

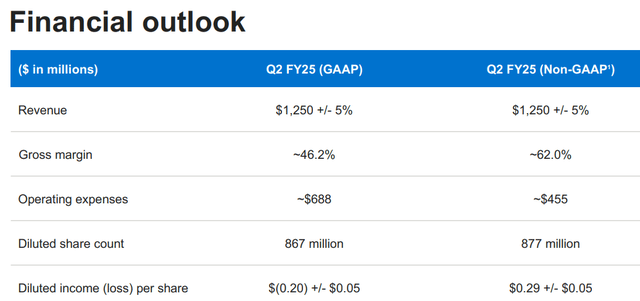

For Q2, the company anticipates its revenue to grow by 8% on a sequential basis, primarily driven by the strong growth in data center.

Marvell Investor Presentation

I am considering the following factors for FY25:

- Data Center: Considering Marvell’s strong growth in Q1, I anticipate the data center business will grow by 70% in FY25, driven by both interconnectivity and custom ASIC businesses. It’s worth noting that Marvell only generated $2.2 billion revenue in data center in FY24; therefore, they have a small base to grow rapidly for their interconnectivity and custom ASIC businesses.

- Enterprise Networking and Carrier Infrastructure: The end-markets are experiencing inventory destocking currently, and it is possible that the market will start to normalize and recover in the second half of FY25. To be conservative, I forecast Marvell’s revenue will decline by 40% in FY25.

- Automotive semiconductor market is normalizing in the post-pandemic period. S&P Global forecasts that global new light vehicle sales in 2024 will see a 2.8% increase year-over-year. Automotive is a small portion of Marvell’s business, representing less than 7% of total revenue. I anticipate its revenue will grow by 3% in FY25.

Putting these pieces together, I anticipate Marvell will grow its revenue by 7.3% in FY25.

Valuation

To estimate the normalized revenue growth beyond FY25, I am considering the followings:

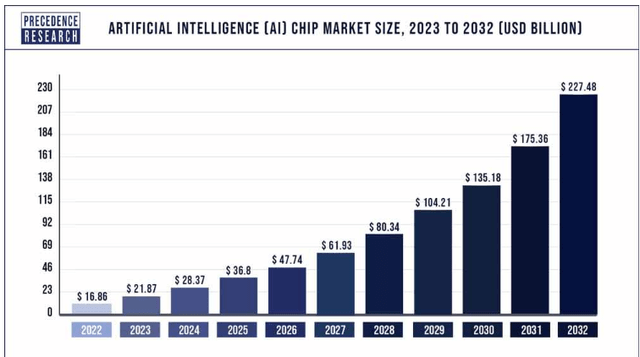

- Data Center: I am optimistic about Marvell’s custom silicon and AI optical business. Precedence Research predicts that AI chip market will grow at a CAGR of 29.72% from 2023 to 2032. Considering the rapid AI adoption by enterprise customers and Hyperscalers, I anticipate Marvell’s data center will grow at a rate of 30%+ beyond FY25.

Precedence Research

- Enterprise Networking and 5G: the market has been growing at around mid-single digit in the past. Enterprise customers need to invest in edge-networking in the future to deploy AI training and inference workloads. I anticipate Marvell will grow the business by 5% annually.

- Auto chips: according to several auto chip companies, such as ON Semiconductor (ON) and NXP Semiconductors (NXPI), the automotive semiconductor market is more likely to grow at a rate of 12%+ in the future. As such, I assume Marvell can grow in line with the market growth in the near future.

As such, I assume Marvell will grow its revenue by 16% annually beyond FY25.

In April 2021, Marvell completed the acquisition of Inphi for $10 billion, a leading high-speed data interconnect platform for data center market. With hindsight, it was a great acquisition that has significantly contributed to Marvell’s current technology advancements in the data center market.

In addition, Marvell acquired Innovium in August 2021 to accelerate its networking solutions for cloud and edge data centers. These acquisitions have resulted in huge amortization costs for Marvell over the past few years, incurring more than $1 billion in annual amortization. In FY23, Marvell still had $4 billion in intangible assets on its balance sheet, and I calculate that its acquisition amortization costs will start to decline gradually in the near future, contributing to margin expansion opportunities for the company.

I estimate that Marvell will increase its operating expenses by 13.5% annually, leading to a 360bps annual margin expansion.

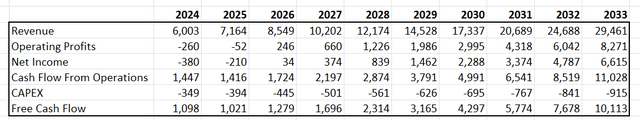

In addition, I assume the company will allocate 10% of total revenue towards M&A, contributing 3.3% growth to the topline. The summary of the DCF model is:

Marvell DCF – Author’s Calculations

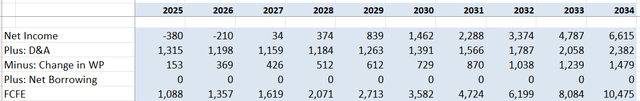

I calculate the free cash flow from equity as follows:

Marvell FCFE- Author’s Calculations

The cost of equity is calculated to be 17% assuming: risk free rate 4.2%; beta 1.88; equity risk premium 7%. Discounting all the future FCFE, the one-year price target is calculated to be $80 per share.

Key Risks

Cyclical Businesses: Marvell is a semiconductor company, operates in a highly cyclical industry. In the near term, its 5G, enterprise networking, automotive and industrial businesses are in the down cycle. Over the long term, I anticipate Marvell’s revenue growth continues to be volatile, and investors need to be prepared for the volatility each quarter.

China Exposure: China represents 43% of total revenue, and Marvell is exposed to the risk of any potential regulatory activities such as tariffs, export controls and sanctions. The outcome of the US presidential election could also impact Marvell’s exposure to export restrictions.

Growing Stock-Based Compensations: Marvell spent 11.1% of total revenue in stock-based compensation (“SBC”) in FY24, an acceleration from 9.3% in FY23. As a semiconductor company, Marvell’s SBC spendings are quite high. The management needs to properly manage its spending in SBC going forward.

Conclusion

I like Marvell’s leading position in AI optics and custom ASIC markets, and their business is quite relevant , especially with the growing demands for data center and AI computing. I am initiating with a ‘Buy’ rating with a one-year price target of $80 per share.

Read the full article here