Letter from the Managing Director

Our Performance

For the three months ending September 30, 2023, the Mayar Responsible Global Equity Fund (Class A) was down -5.26% net of all expenses and fees, while the MSCI World Index decreased by -4.31% in the same period. Since its inception in May 2011, the Fund has seen a 168.57% increase versus a 169.34% increase for the MSCI World. This corresponds to a 8.31% annualized rate of return for the Fund, compared to 8.34% for the MSCI World.

General Commentary

We all know how it ends. Not what will be said exactly, but when the great Hercule Poirot asks everyone to join him in the big room, we know that all will be revealed. We’ll finally discover who the murderer is …

When Poirot gives us the answer to the mystery in that final scene, it will suddenly seem so obvious, we’ll wonder why we didn’t see it. We encounter similar situations in Investing. It’s all so obvious – after the fact!

Reading was one of my favorite pastimes as a kid, especially crime fiction novels. I used to look forward to the weekend when my father would take me to a bookstore in Dammam and let me buy as many books as I could carry, thanks to his open-budget policy when it came to books. I’m following in his footsteps with my own kids today. I also regularly visited the Aramco library to borrow crime fiction novels. I simply couldn’t get enough of them.

I must admit I’ve never stopped loving crime fiction, though as free time has become more scarce in recent years, I struggle to get through more than half a dozen crime fiction novels a year.

I didn’t know it at the time, but reading crime fiction was the best preparation for becoming an investor. Attempting to solve crimes taught me to think critically, identify deep patterns, and try to understand human nature, as well as to assess risks. It also taught me to test and discard theories several times and not to stick with my first guess of who the murderer is.

More broadly, I believe that reading fiction helps build creativity, which is one of the most underrated skills in investing. It’s a skill we look for when recruiting at Mayar.

When I first got interested in investing it was the puzzle-solving aspect of it that drew me in. That remains by far my favorite part of the job. My inner (aspirational) Hercule Poirot gets giddy with excitement when looking at a new investment opportunity.

The fundamental challenge of investing is that all the facts and data are in the past but all the investment returns depend on the future. No matter how much information we gather and analyze, we cannot be certain of how things will unfold. Even after digging up the last scrap of information, then conducting a flawless analysis, unpredictable events in the future will nonetheless have an impact on our returns, either positively or negatively.

Successful investors must imagine many versions of the future and try and figure out how well an investment will do in each of them. This is where the creative thinking comes in.

Creativity is not only important for investment upside, however. It’s perhaps even more important for risk management. Studies of long-tenured fund managers show that great managers make the correct call on an investment roughly 55% of the time. Yes, they’re wrong a whopping 45% of the time!

The key to their success, however, is they tend to make a lot of money when they’re right and don’t lose too much when they’re wrong, so they’re remembered for their successes, not their failures. That’s what successful risk management is all about.

There are two fundamental mistakes that many fund managers make when it comes to risk management. The first is outsourcing it to a risk officer or a risk management department when it is in fact one of the most important parts of the fund manager’s job.

The other mistake is trying to make the process purely quantitative – in a misguided obsession of the investment industry. This error has caused many to focus exclusively on the past – because that’s where the data is! But the truth is that many bad outcomes come as a total surprise with no real historical precedents (Covid?). This is why a more creative perspective is so valuable.

A subjective assessment of the risks is just as important, if not more important, than looking at the numbers. No, it won’t be as exacting as a purely data-driven approach but reality is messy, and markets and the economy reflect the chaotic behavior of billions of people around the world. Seeking precision is futile and we must learn to work with that. As the great John Maynard Keynes said, “it is better to be roughly right than precisely wrong.”

Our recent performance…

There’s no doubt that our performance over the past 24 months has been extremely disappointing, frustrating, and quite honestly humbling. Aubrey and I have recently spent significant amounts of time analyzing our decisions during that period to try and understand the reasons for this outcome and draw lessons from it.

This is a crucial practice we regularly perform—even when things are going well—because we fundamentally believe that successful investors must continuously learn, grow, and adapt. The world and the markets never stand still, and neither should we.

We’ve learned several lessons from this experience, and I’m confident that what we’ve gleaned will improve our investment process going forward. We also identified a couple of specific decisions during this period we could have made differently that would have helped our performance.

The bigger conclusion we reached, however, was that the bulk of the underperformance seems to be is attributable to factors that are fundamental to our investment process. A redo wouldn’t change that.

And that’s one of the biggest challenges of active investing. Consistency is required for the successful application of any investment strategy, but no investment strategy works all the time.

Outperformance over the long term can only come from doing things differently from the crowd. And we’ve always prided ourselves on having a very high active share in our portfolio (i.e., our portfolios are very different from the index). But this comes at a cost. Sometimes the crowd will do something that’s really dumb and by sheer luck make money doing it.

The first nine months of this year are a perfect example. The stocks of a handful of big technology companies, now known as the “Magnificent Seven,” have increased to levels that we believe are completely disconnected from business fundamentals. During the same period the average stock is down slightly.

This level of divergence in performance has not happened since the days of the technology bubble in the late 1990s – when the high-flying stocks of technology and internet companies rocketed while the stocks of profitable but boring old companies went nowhere. It did not end well for the investors in technology stocks then, and I predict that today’s high-flying tech investors will face a similar bursting bubble fate.

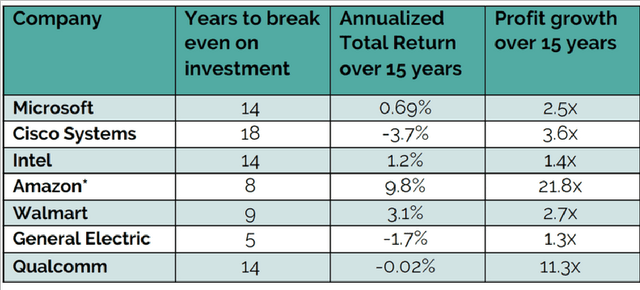

The “OG” Seven (2000 vintage)

And how they fared over the subsequent 15 years:

| *Amazon recorded a loss in 2000, so I’ve used its operating income in 2002 for the profit calculation. |

This table highlights a very important point: investing in great businesses is not enough. Even with a long-term horizon, investors must pay sensible prices to generate good returns. The dismal performance of this basket of stocks occured over a period where the underlying businesses had generally done well when measured in terms of profit growth.

Admittedly, knowing that occasional underperformance is an inevitable part of the job doesn’t make it any less painful for us as investors. But I don’t think this temporary pain is just an inevitable part of any successful investment process. It’s unavoidable. It’s a feature, not a bug.

The market is generally efficient and full of smart and competitive people. Any simple and painless way to outperform will be easily copied and competed away. There must be a reason for any advantage to persist over time. There must be a price to pay.

In the case of value investing, I think we’ve been paying that price in periods like the past 24 months. It’s been so painful to be conservative and sit on the sidelines while watching others party like it’s 1999.

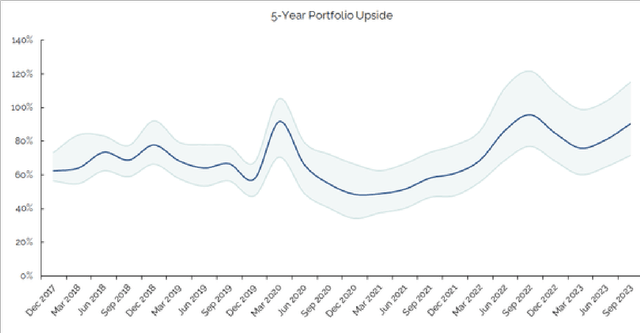

The good news is that we believe the portfolio we hold today is one of the most attractive we’ve ever owned. We’re confident that our patience will be rewarded.

Source: Mayar Capital, Factset. 30 September 2023

I also believe the next few years will be great for the types of businesses we like to invest in. In a world of higher interest rates, capital will be more costly to obtain. Mediocre businesses will struggle in this environment and higher quality businesses will shine.

Let’s take the hypothetical example of two companies.

Commoditized Corporation (CC) sells a commoditized product and earns an 8% return on capital. Specialty Incorporated (SI) is a highquality business that sells a differentiated product and earns a 15% return on capital. Both companies finance half their business with debt and half with equity.

In a time like the past decade when interest rates were near zero, the weighted-average cost of capital for a business could be as low as 5 or 6%. So even CC earned a lot more than its cost of capital and rewarded its shareholders with higher dividends. It probably commanded a higher multiple from the market and its management was celebrated for turning around the business. But fast forward to today’s environment where this company’s cost of capital is now closer to closer to 8%, and there’ll be no money left to reward CC shareholders. SI, on the other hand, with its higher return on capital, will still have plenty of excess cash to keep its shareholders happy, to invest in its future, and continue to grow.

Many companies in CC’s position have locked in lower financing costs in the past few years, so I believe the effects from higher interest rates will come with a lag. Once it does, we’ll see a lot more distress from companies that borrowed extensively when rates were near zero but can no longer survive that level of indebtedness at today’s higher rates.

Our Portfolio

During the quarter, we initiated a new investment in the shares of Capgemini SE. Founded in 1967, the company is one of the world’s largest IT consultants and outsourced engineering, and research & development providers.

Deriving about sixty percent of its EUR 22bn revenue from Europe, Capgemini amongst its peers, thus has one of the highest revenue exposures to a region with a notable labor shortage in digital services.

Sales, well diversified across sectors, combined with multi-year strategic contracts and a large backlog, all help dampen economic volatility. Utilization and profitability across the business cycle should also be supported by Capgemini’s higher offshore workforce ratio, which at over 50% is more than doubled since 2007, and offers the company more headcount flexibility.

The industry in which Capgemini operates has comparatively low barriers to entry, but significant barriers to scale. Large players will benefit from classic operating leverage and brand awareness, but also from having a global client servicing infrastructure, which multi-nationals count on to avoid having to develop global sales and engineering capabilities themselves.

Their service delivery networks also allow companies like Capgemini to pay for capability enhancing acquisitions, as revenues can easily be scaled across existing clients. Additionally, larger, diversified streams of revenue enable long-term investments in employee training programs and delivery centers based in low-cost locations.

Lastly, institutional knowledge and intellectual property accumulate with every completed project, which allows for cheap incremental revenues within industries and specific customer accounts.

Overall, we believe that technology remains the key driver of productivity improvements across industries and, as a technology enabler, Capgemini stands to benefit from the increasing adoption and complexity of technology.

Kenvue, Inc. (KVUE)

We also initiated a new investment in the shares of Kevnue, Inc. In August, Johnson & Johnson completed the split-off from Kenvue in which J&J shareholders could tender their shares in exchange for Kenvue shares at a 7% discount. Kenvue is formerly the J&J

Consumer Health business. The transaction makes sense – the Consumer division was always small for J&J and this separation gives investors two distinct options, one pure-play FMCG company, and one pure-play healthcare company. We like Kenvue’s strong brand portfolio across its OTC medication business as well as its beauty and other healthcare brands (such as Listerine and Johnson’s), and the company has some very strong positions in its niches. While this isn’t a fast-grower, the manufacturing scale, IP and distribution network of this business provide a deep enough moat to give reasonable assurances about the company’s quality. And the current valuation looks attractive.

We also added to our existing investment in Helical, Ain, Brenntag (OTCPK:BNTGF) and UPS, and trimmed our holdings in Dropbox (DBX) and Visa (V).

The Fund and The Company

After 12 years of service, we’ve reviewed and updated our partnership principles to reflect our company’s growth and evolution, and to guide us through the next stage of our journey.

Our Guiding Principles

- Be honest and always do the right thing

- Be curious and keep learning

- Be humble and kind

- Be exceptional at everything you do

- Be cautious but take calculated risks

- Be patient and persistent

- Be mindful and don’t waste

These updated principles, which embody our team’s values, will help in piloting our company in the future. We believe our partnership with you is built on trust, respect, and mutual benefit.

By adhering to these principles, we can perpetuate a partnership that is strong, productive, and long-lasting.

Our team grew during the quarter with Daniel Benton joining us in

July as an Operations Associate. Dan previously worked as an Operations Analyst at Hosking Partners for 7 years. He began his career at Pershing in 2013 and holds the Investment Operations Certificate, which he earned in 2015. Dan attended Queen’s University in Belfast where he obtained a BSc in Economics.

Mayar Capital ended the quarter with $446m in Assets Under Management (AUM).

As always, if you have any questions, please don’t hesitate to reach out to us.

Best regards,

Abdulaziz A. Alnaim, CFA, Managing Director

Read the full article here