Investment Thesis

Back in July, we initiated a Buy rating on Meta Platforms (NASDAQ:META) stock. We saw the potential for generative AI to significantly improve productivity for small businesses and content creators. Platforms like Facebook and Instagram that have grown thanks to mutual benefit with these groups are well-positioned to capitalize on this trend.

We believed that as generative AI enhances creators’ ability to produce content, Meta platforms would benefit. The stock price has increased 20% since our initial Buy rating.

Our original investment thesis focused on the impact generative AI could have on Meta’s ecosystem of users and content creators. In this report, we will explore recent advancements in AI technology and how they could affect areas like advertising, subsequently impacting Meta’s revenues and expenses. We believe generative AI’s potential to aid advertisement production will provide tangible benefits for Meta in 2024.

Given the valuation still does not fully reflect its long-term growth prospects, Meta remains competitively positioned, and we maintain our Buy rating.

AI in Advertising

Investors are having lively debates about who will come out ahead and behind as artificial intelligence continues advancing in 2024. They are also discussing which industries are likely to see breakthroughs stemming from AI progress.

One area that seems poised to keep benefiting is advertising. AI has already started transforming parts of the ad world, conferring early advantages on some industry players. Major internet companies especially are actively exploring how to harness generative AI, integrating it into multiple facets of marketing campaigns and digital advertising. We’re seeing signs it could reshape swaths of the space. For instance, if we look at the latest developments from the big tech firms, Google (NASDAQ:GOOG) (GOOGL) can now use generative AI to help produce content for video ads. Meta’s AI Sandbox has further expanded the scale of early testing capabilities, while also introducing more leading advertisers to test out the technology. Microsoft (MSFT) and Snap (SNAP) have also incorporated chatbot advertising in messaging apps, and are continuously exploring more exposure formats.

Complexities in Modern Advertising

At its core, advertising is about getting your marketing message in front of your target audience. On the surface, this seems like a simple “matchmaking” task. But in reality, the whole process is super complex.

Targeting the right users with the right ads online involves intricate steps that inevitably create friction. First, you analyze people’s past behavior to identify interests. Then from various traffic pools, you find your best user match to show ads to. And after all that, you collect user feedback data to further refine your understanding of people’s interests.

With so many complex, interlocking steps – governed by elaborate rules and restrictions while external parties try interfering – there are bound to be countless little pain points. That’s why “optimization” is constantly top of mind in advertising. How can we eke out a little more efficiency at each phase? A little better relevance? A fraction more response? It all adds up when billions of ad impressions are at stake.

The Potential of Generative AI in Streamlining Ad Processes

This explains why Baidu’s (BIDU) new “Yangyi” product, which uses AI to automate much of this cumbersome ad process, is so groundbreaking.

For instance, Yangyi uses AI to directly match marketing goals with suitable user impressions, avoiding inefficient filtering funnel steps. Early gains of over 20% in recall efficiency highlight the immense optimization potential, given Meta’s even larger trove of user data.

Similarly, Yangyi instantly generates customized ad templates tailored to shifting user preferences – a stark contrast to expensive manual methods that quickly become outdated. With dynamic creatives already demonstrating over 10% higher click rates and 9% better conversions, the expense savings could stack up quickly for ad-reliant firms like Meta.

By seamlessly matching campaign goals with optimal users and instantly generating personalized creatives, Conversion rates have already improved. Just imagine the expense optimization potential for ad platforms like Meta. AI promises to finally smooth the intricate friction that has always underlaid online advertising.

AI’s Role in Expense Optimization

Spotify announced 17% staff layoffs on Dec 4th, and Google also announced layoffs on Dec 20th.

Interestingly, both companies’ stock prices surged after the layoffs – Spotify was up 10% on the day of the announcement. We published an article strongly recommending investors buy in because we believe artificial intelligence played a key role in optimizing Spotify’s internal human resources. Although the CEO did not explicitly state the reason for the layoffs, when Google revealed optimizations in its ads division on December 20th, it further validated our view that the advertising industry will see significant cost reductions from AI’s impact on large companies’ workforce optimization in 2024.

The reason we recommended investing in Meta rather than Google is that while we are also bullish on Google benefitting, we are still evaluating the rising risks to Google from intense cloud competition with Microsoft, Amazon, and Nvidia in 2024. Meta does not face this risk because it has no cloud business.

Also, clues can be seen in Meta’s 2024 financial projections – for example, they expect only 11% expense growth in 2024, but 20% growth in capex. This signals optimized expense allocation, with more investments in infrastructure over headcount to drive future growth.

Valuation

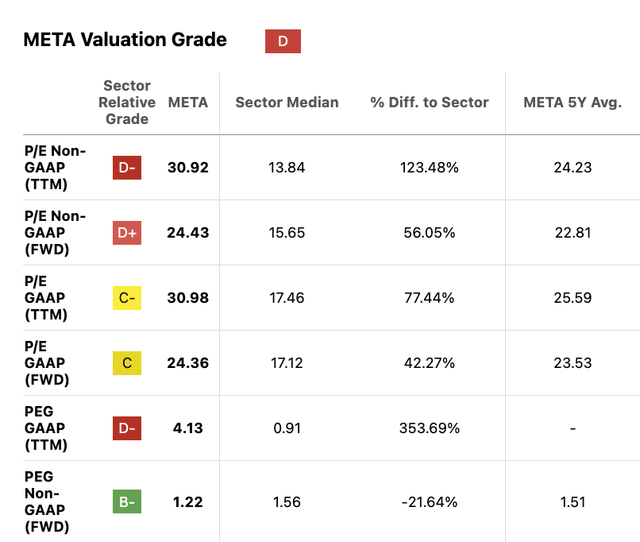

Meta’s stock valuation has come down to a forward P/E of around 25x.

Seeking Alpha

Seeking Alpha

On a comparable basis, Meta’s stock price has been trading at levels comparable to its US peer, Google. This makes sense to us, as the two tech giants share similar growth prospects and enjoy the benefit of AI in their ads business.

Meta’s higher multiple than Chinese tech peers stems from stronger expected earnings growth in 2024 amid economic uncertainty in China.

As discussed, AI advancements can optimize ad expenses at Meta and Google. So Meta may see substantial bottom-line boosts from AI-driven cost savings. Meta can also leverage generative AI to improve content quality on Facebook and Instagram.

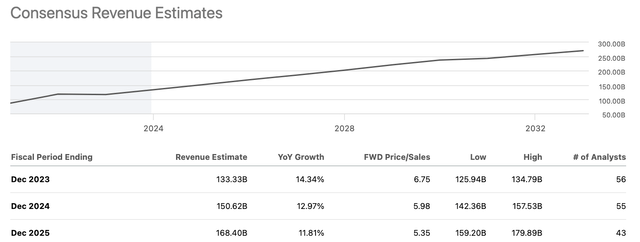

While Meta’s 10-15% revenue CAGR forecast seems modest, it supports our thesis – AI can expand Meta’s ecosystem.

Seeking Alpha

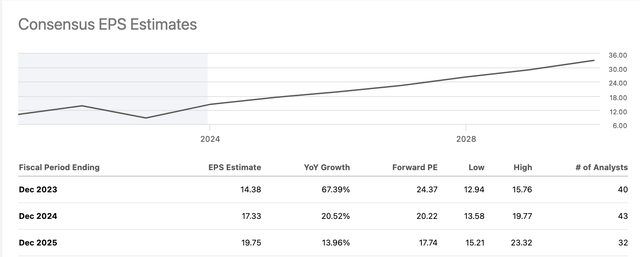

More importantly, 2024 EPS is projected to grow 20%, consistent with our AI cost reduction thesis. We believe current expense reduction estimates remain conservative.

In essence, Meta deserves a valuation premium based on AI’s potential to simultaneously drive top and bottom-line gains. Margin expansion from better ad targeting and creation should affirm Meta as a long-term winner.

Seeking Alpha

Risks

ByteDance’s TikTok is forecast to generate over $110 billion in revenue in 2023, a 30% jump that would surpass rival Tencent. This shows TikTok strengthening as parent ByteDance expands, posing a threat to Meta in the US.

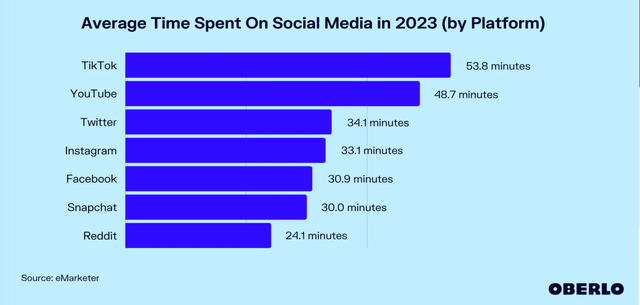

We see TikTok as a formidable rival since short video apps can disrupt social media’s “moat.” TikTok topped 1 billion monthly active users and 850 million daily active users in just 4 years, also leading in time spent. As Meta earns from ads, network effects don’t prevent such competition – advertisers care more about reach.

Oberlo

Cooperation between Amazon (NASDAQ:AMZN) and Meta for in-app shopping highlights this threat. Letting Instagram and Facebook users link to Amazon accounts can make Meta more attractive to advertisers while expanding Amazon’s shopper reach. Alongside partnerships with Pinterest and Snapchat, the titans aim to withstand rising competition from TikTok’s commerce plans. We will continue to monitor the competition landscape.

Conclusion

We are optimistic about Meta’s prospects in 2024 because we expect advancements in artificial intelligence to help make online advertising more cost-efficient. This should allow Meta to lower expenses and increase earnings. While Meta’s stock price rose 204% in 2023, we still think valuations look reasonable when looking at price-to-earnings growth metrics. Also, since Meta does not have a cloud computing business, it avoids potential price war risks that other US tech firms could face next year. However, we will keep monitoring competitive threats from TikTok. Overall, we believe Meta stands to benefit greatly from innovations in AI. Therefore, we are maintaining our buy rating on the stock.

Read the full article here