In our last update, we emphasized how Compagnie Générale des Établissements Michelin (OTCPK:MGDDF) (OTCPK:MGDDY) was trading at a 20% discount compared to its historical average in EV on sales, EV on EBITDA, and P/E. Aside from an attractive entry price, our buy rating was backed by the company’s ability to offset raw material price cost pressure, a strong balance sheet supported by M&A optionality beyond tire, and Nokian’s Russian exit implications. After eight months, the company is up by >20% and exceeds our target price set at €33 per share (and $17.6 in ADR).

Mare Past Analysis

Earnings Results

Before looking ahead, it is vital to report the company’s recent Q4 and FY results and the management’s comments.

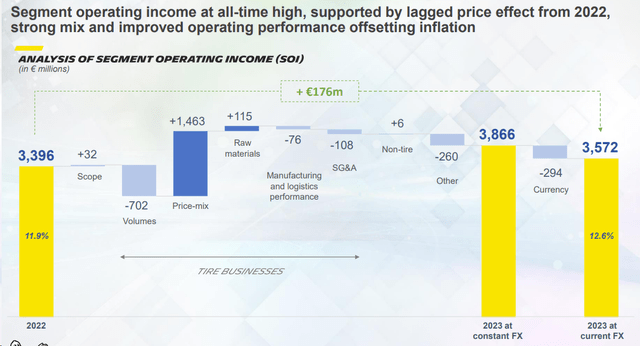

Considering a weak volume environment (Q4 tire was down by 7.4% compared to Q4 2022), Michelin 2023 sales reached €28.3 billion with a segment operating income of €3.57 billion (Fig 1). This was also ahead of Wall Street’s expectations. Our primary investment thesis mainly supported this. Indeed, the company recorded manufacturing and raw material cost tailwinds for approximately €600 million. This was also supported by price/mix gains for a total contribution of €286 million. Lower costs and price MIX offset lower volume and negative currency development. At a segment EBIT level, Michelin’s beat was driven by Passenger consumers and Light Trucks, followed by Trucks, while the Specialties division lagged expectations.

Michelin’s operating income evolution

Fig 1

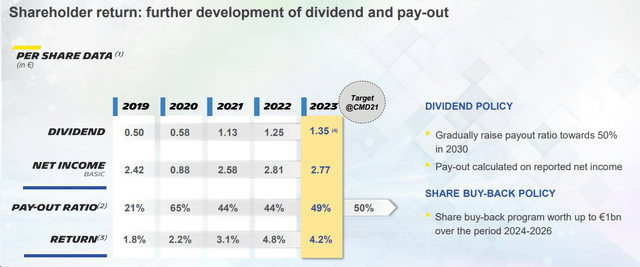

Michelin reported a free cash flow of €3 billion. Looking at the details, this was driven by a higher-than-expected reduction in inventories, which accounted for a total cash inflow of €775 million. On shareholder remuneration, the company’s dividend per share was set at €1.35 (slightly lower than our expectation of €1.36 per share). However, Michelin announced a surprise share repurchase program of €1 billion over the next three years (Fig 2).

Michelin shareholders remuneration

Fig 2

Why Are We Now Neutral?

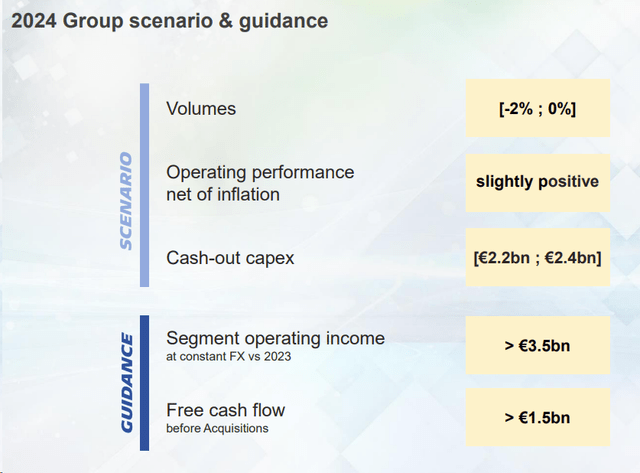

- The company now targets a soft 2024 segment operating income with a floor at €3.5 billion in constant FX. This is slightly below the Wall Street Visible Alpha consensus of €3.68 billion. Indeed, this might provide near-term stock price volatility. In addition, looking at our numbers, Michelin’s free cash flow outlook is below our estimates (€1.5 billion versus €2 billion – Fig 4). This is probably due to reflect working capital unwind achieved in 2023;

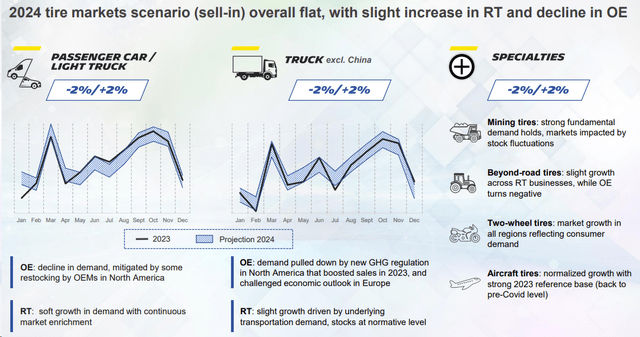

- Having listened to the Q4 analyst call, I see that there are keynotes to report. This includes a cautious view of volume recovery. Michelin management sees no reason for the market to rebound (Fig 4). However, aligned with our thesis, price should support the company’s operating leverage. This is supported by Michelin technology and performance. We still believe raw materials provide a cost tailwind but are not incorporated into pricing. In addition, the company expected total savings of €200 million, mainly visible in 2026. Price MIX coupled with product MIX should again be Michelin’s main earnings driver;

- On the volume side, our 2024 assumptions are set at -1% in volume against a market assumption between -2% and +2% (Fig 3). In 2023, Michelin’s volume was -4.7%. Despite that, we should highlight that Michelin’s share of >18-inch tires reached 61% in 2023 (compared to a 56% market share in 2022). This well contributed to a favorable mix effect. We reiterate that the company will likely continue underperforming tire market development. Beyond its value-focus strategy, the ongoing Red Sea crisis could temporarily penalize Michelin’s raw material sourcing with a focus on natural rubber. In addition, the company has a highly profitable industrial plan in APAC. This current crisis might also decrease volume shipments in Q1;

- Following the volume decline and continuing to be positive on price MIX, we estimate sales of €28.9 billion in 2024 with a segment operating income of €3.58 billion (we arrive at a margin of 12.4%). In our estimates, excluding M&A activities, Michelin FCF reached €1.8 billion with a deleverage of approximately €1 billion;

- Here at the Lab, our cautious view also applies to the company’s current valuation. Michelin is a quality business supported by a leading product and strong management. Despite that, the valuation is not cheap. On a one-year forward estimate, Michelin trades at a 10% premium versus its historical price-earnings (9.5x compared to 8.5x). For this reason, we decided to move our rating to neutral.

Michelin tire market view

Fig 3

Michelin 2024 Outlook

Fig 4

Valuation And Risks

Our eyes are now shifting to Michelin’s upcoming Capital Market Day on 28 May. Here at the Lab, we expect the company to focus on presenting an update on 2024-26 mid-term financial targets. The company’s valuation seems rich even if we believe Michelin’s 2024 outlook is conservative with a favorable mix. We have already reported the P/E premium compared to Michelin’s historical average, so we should also note that the company has a premium valuation on EV/EBIT and EV/Sales. In detail, Michelin trades at an EV/EBIT of 7.5x and EV/Sales of 1x compared to a historical average of 6.9x and 0.9x, respectively. We are slightly above the company’s 2024 outlook. Considering a segment operating income of €3.58 billion, we arrived at an EPS of €3.7, and valuing Michelin with a target P/E of 9x, we increased our target price from €33 to €34 per share, moving our rating to neutral. Michelin’s stock price is above €35 at the time of writing.

Downside risks include pricing pressures from competition, lower-than-estimated volume, a disruptive non-tires diversification strategy, raw materials volatility, and disruption of supply chains.

Conclusion

Here at the Lab, we like Michelin and its quality business. However, according to our estimates, the company’s valuation is full. To support our cautious view, we report the CEO’s words: “We believe that the overall market should be selling market somewhere flat.” He also adds: “The pattern of the market will not massively change versus 2023.” A full valuation and a cautious management view support our rating change to an equal weight status.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here