Microsoft has closed its $69 billion acquisition of video game publisher Activision Blizzard, according to a regulatory filing by the company on Friday. It’s Microsoft’s largest deal in its 48-year history and comes after the company quelled concerns about competition from U.K. and European regulators and gained a favorable ruling from a U.S. district judge.

The U.K.’s Competition and Markets Authority gave its nod to the deal earlier on Friday, clearing the way for the close.

The deal gives Microsoft a hefty portfolio of video game franchises, including Call of Duty, Crash Bandicoot, Diablo, Overwatch, StarCraft, Tony Hawk Pro Skater and Warcraft. The game developer generated $7.5 billion in revenue in its latest fiscal year, a small fraction of the $212 billion in sales reeled in by Microsoft.

“Today we start the work to bring beloved Activision, Blizzard, and King franchises to Game Pass and other platforms,” Microsoft Gaming CEO Phil Spencer said in a blog post. “We’ll share more about when you can expect to play in the coming months.”

Activision Blizzard CEO Bobby Kotick will stay on as CEO through the end of the year.

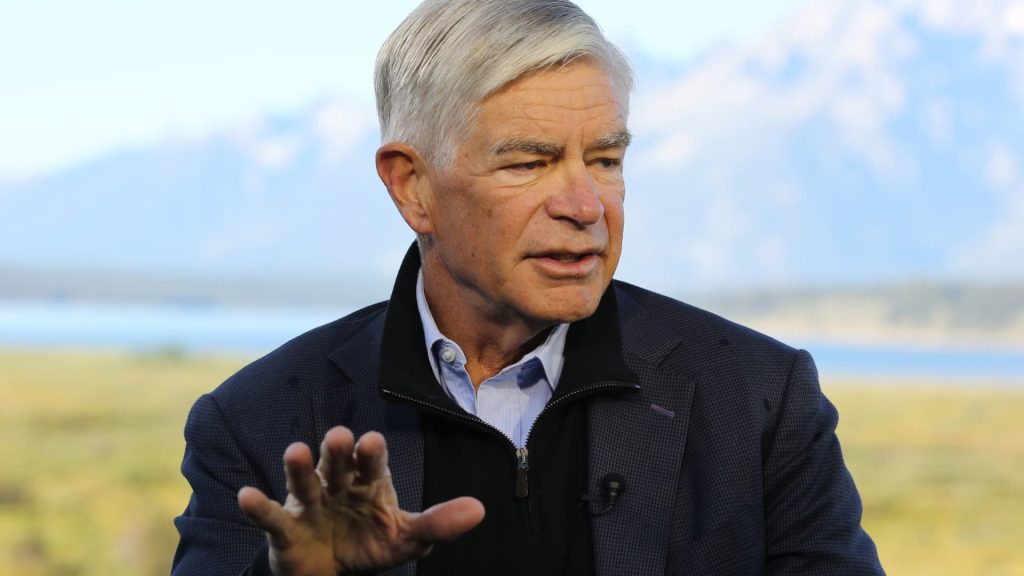

Microsoft CEO Satya Nadella, who took the helm in 2014, is aiming to diversify the company’s business beyond its core areas such as operating systems and productivity software. Activision has been both a partner to Microsoft and a competitor. It’s one of the few large companies that releases popular games that can cost hundreds of millions of dollars to produce.

Regulatory pushback delayed the acquisition. When it announced the deal in January 2022, Microsoft said it expected to close the transaction by the end of June 2023. In July, the two companies agreed to extend the deadline to Oct. 18.

The Federal Trade Commission in the U.S., the European Commission and the U.K.’s Competition and Markets Authority (CMA) all raised objections to the transaction.

Microsoft made concessions that placated Europe regulators. The company agreed to give consumers in the European Economic Area free licenses to stream their Activision Blizzard games, along with free licenses to streaming providers so European gamers can play the games through the cloud.

Microsoft signed agreements with console rivals Nintendo and Sony, promising them access to Call of Duty games for 10 years. And Microsoft made similar arrangements with cloud-gaming providers, including Boosteroid, Nvidia, Nware and Ubitus.

The FTC In July asked the San Francisco federal district court for a preliminary injunction to stop Microsoft and Activision from closing their deal before receiving full approval. But after five days of hearings, a judge sided with the two companies. The agency took the case to the U.S. Appeals Court for the 9th Circuit, which denied a motion to temporarily stop the consummation of the deal.

Satisfying UK officials was more complicated. In August, Microsoft said that, assuming the deal closed, game publisher Ubisoft would receive cloud streaming rights for Activision’s games for 15 years. That change to the proposal should resolve lingering concerns about the deal, the CMA said on Sept. 22.

The FTC said Friday it still has concerns.

“We remain focused on the federal appeal process despite Microsoft and Activision closing their deal in advance of a scheduled December appeals court hearing,” FTC spokesperson Victoria Graham said. “Microsoft and Activision’s new agreement with Ubisoft presents a whole new facet to the merger that will affect American consumers, which the FTC will assess as part of its ongoing administrative proceeding. The FTC continues to believe this deal is a threat to competition.”

Activision ended the second quarter with $587 million in net income on $2.2 billion in revenue, which was up 34% year over year.

WATCH: Microsoft deal with Activision Blizzard set to clear final hurdle

Read the full article here