Investment Thesis

Mister Car Wash (NYSE:MCW) has been unable to sustain profitability and warrants a sell for investors. The company reached its highest level of debt in Q3 2023 in over 3 years and has been unable to achieve cash flow growth. Furthermore, its attempts to achieve greater profitability through its latest Titanium 360 car wash features are inadequate in the face of encroaching competition with lower price points.

Fundamental Red Flags

Mister Car Wash is one of the largest car wash chains in the United States with over 450 locations in 21 states. The company has seen strong growth since its IPO in 2019 by providing high-quality, conveyorized car washes. However, the company’s quick expansion between 2019 and 2023 has also led to current troubles. The company’s latest increase in expenses has been predominantly due to interest and taxes, resulting in its highest annual cost of revenue. While still achieving strong revenues, MCW has seen an increase in liabilities for 9 straight quarters and stands at a total debt-to-equity of nearly 200%.

Mister Car Wash Annual Growth of Land, Buildings, and Machinery

|

MCW Assets |

2019 |

2020 |

2021 |

2022 |

2023 |

|

Land |

18.0M |

28.3M |

81.9M |

94.5M |

95.1M |

|

Total Buildings |

33.3M |

55.3M |

171.5 |

190.0M |

184.2M |

|

Total Machinery |

168.0M |

204.8M |

261.3M |

316.1M |

338.9M |

Source: SEC filings

While higher interest rates have impacted most businesses, MCW has had a challenging time reducing costs and, as I will cover later, has little room to increase prices. Consequently, the company hit a total debt of $1.75B in Q2 2023, its highest in at least the last three years. The company touted a 7.7% YoY revenue growth in its Q3 2023 earnings release. However, the real story lies in its net income, which for Q3 was $19.5M, down from $27.1M in Q2.

Mister Car Wash 2023 Quarterly Cash Flow vs. Debt

|

Q1 2023 |

Q2 2023 |

Q3 2023 |

|

|

Operating Cash Flow |

$67.0M |

$50.1M |

$43.6M |

|

Operating Cash Flow Growth |

-17.81% |

-5.59% |

-14.23% |

|

Total Debt |

$1.71B |

$1.75B |

$1.76B |

Source: SEC filings

Also troubling is MCWs’ return on total capital at 4.39%, 28% lower than the sector median of 6.16%. After the company saw negative free cash flow for four straight quarters prior to Q3 ’23, share price plummeted. YTD share price for MCW is down 36%. Its 5-year total return is -60%. While MCW saw an increase in share price when it announced its Q3 results, I believe this is short-lived and the fundamental red flags remain.

Attempts to Improve Profitability

Mister Car Wash was able to achieve unlevered free cash flow in Q2 this year. However, this was achieved primarily through its largest sale of property, plant, and equipment (PP&E) of $73.7M. As previously indicated in MCW’s annual growth of land, building, and machinery, there is a decline in total buildings for 2023. It is concerning that the company is still attempting to expand, given that its best effort to achieve FCF is through the sale of property. While the company proudly announced multiple new locations in its Q3 earnings call, it did not mention its highest level of debt with decreasing net income.

Sale of PP&E as a Factor of Net Income and Unlevered FCF

|

Q4 2022 |

Q1 2023 |

Q2 2023 |

Q3 2023 |

|

|

Sale of PP&E |

$24.4M |

$8.9M |

$73.7M |

$14.3M |

|

Net Income |

$17.8M |

$21.1M |

$27.1M |

$19.5M |

|

Unlevered FCF |

($5.3M) |

($15.9M) |

$18.1M |

($49.9) |

Source: SEC filings

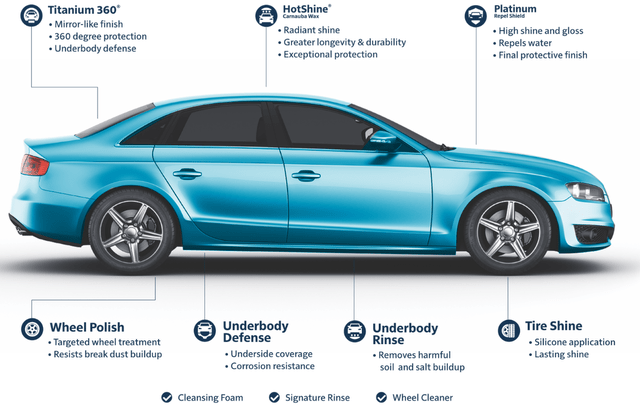

A key concept around Mister Car Wash’s marketing and allure for customers is its premium, high-quality car washes. MCW recently added a new Titanium 360 wash with unique chemicals, giving customers an “ultimate immersive car wash experience”. In the company’s own advertisement, the Titanium 360 wash proclaims phrases like “radiant” or “lasting” shine. However, one might argue that even the most basic car washes should leave your car with a shine.

Advertised Features of Titanium 360 Car Wash (mistercarwash.com)

With prices between $26 to $32, Mister Car Wash may have would-be customers questioning whether the elevated price is worth the value. While gas station chain car washes are admittedly the most “basic” wash, prices are half or even lower than the cost range for Mister Car Wash. Given the below price range comparison, MCW’s price range presents a clear vulnerability to future earnings, particularly in the event of an economic recession.

Price Range Comparison: Mister Car Wash vs. Basic Car Wash Competitors

|

Car Wash Provider |

Mister Car Wash |

Exxon |

Kwik Trip |

Shell |

7-Eleven |

|

Price range |

$26-$32 |

$13-$18 |

$8-$13 |

$4-$11 |

$7 |

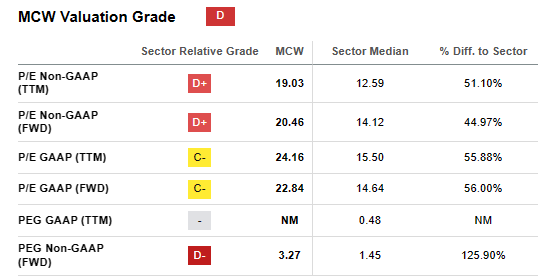

Valuation

MCW saw a 13.7% jump in share price following its Q3 earnings announcement last week, predominantly due to its 7.7% increase in YoY net revenues. However, the fundamental red flags of the company’s debt and inability to achieve sustainable cash flow indicate that this increase is unwarranted. Furthermore, MCW holds a P/E GAAP (FWD) of 22.8, 56% higher than its sector. By comparison, primary competitor Driven Brands Holdings Inc. (DRVN) holds a P/E of 12.69, lower than the sector median. Given stubbornly high inflation as well as elevated interest rates, MCW’s debt and challenges to cash flow will linger. Therefore, MCW warrants a sell due to its likelihood of underperformance and high price point that competitors will continue to challenge.

MCW Valuation (Seeking Alpha)

Looking Forward: Risks versus Reward

Looking forward, there are likely two scenarios. Scenario one is that Mister Car Wash is able to reduce costs to account for increased expenses due to interest rates, taxes, and other costs of revenue. If MCW achieves an increased net profit margin, it may present a greatly undervalued opportunity. However, even at its current share price, MCW has a P/E ratio higher than the sector median. MCW’s latest outlook for ending 2023 is an adjusted net income of $94-$103M, lower than its 2022 net income of $113M.

With interest rates at elevated levels, stubborn inflation, and increasing competition, a second scenario appears more likely. This second scenario is that Mister Cash Wash will maintain elevated debt levels and high costs of revenue. It could sell land, property, or equipment, but its fundamental red flags will remain. Primary competitors like DRVN will encroach on MCW’s revenues and undercut its high price point. As a recent data point, DRVN reported in its Q3 ’23 earnings a 12% revenue growth YoY, higher than MCW as well as higher total revenue ($581M for DRVN, $234 for MCW). Finally, “economy” car washes like Exxon, Kwik Trip, and Shell will present substantially lower prices further squeezing Mister Car Wash’s ability to raise prices to account for its costs.

Even if scenario two plays out, Mister Car Wash will still likely sustain strong revenues. This is due to its substantial amount of Unlimited Wash Club members, who the company states are its “most loyal and steadfast customer base.” As of late September, MCW has approximately 2 million Unlimited Wash Club members who will likely maintain a steady revenue stream for the company, despite any challenges with its bottom line.

Concluding Summary

While MCW’s 36% drop in share price YTD presents a temptation to buy, Mister Car Wash is a sell for me due to its inability to achieve sustainable cash flow growth and increasing debt. Its recent efforts to turn the tide against increased costs have shown to be fundamentally ineffective. Furthermore, its high price point is difficult to justify despite the “premium” quality features advertised. While MCW maintains a loyal base of unlimited wash club members, the company has little room to increase prices considering competitor pricing.

Mister Car Wash’s attempts to achieve profitability are endangered with competitors like Driven Brands Holdings Inc. also seeking increasing market share. If MCW is able to reduce costs and further expand its club membership, it will likely demonstrate strong cash flow growth. This scenario appears unlikely, and the company will rely on a loyal existing customer base, willing to pay a higher price for the immersive car wash experience.

Read the full article here