In December last year, I wrote an article on Monroe Capital (NASDAQ:MRCC) outlining three specific reasons why investors should, in my opinion, avoid investing in this BDC.

These reasons were the following:

- Low margin of safety in the dividend coverage.

- One of the highest leverage profiles in the BDC space.

- Clear signs of deteriorating portfolio quality.

Back then, in light of expectations on falling interest rates and an increased distress in the corporate segment, investing in a BDC, which embodies an abnormal risk profile did not seem reasonable.

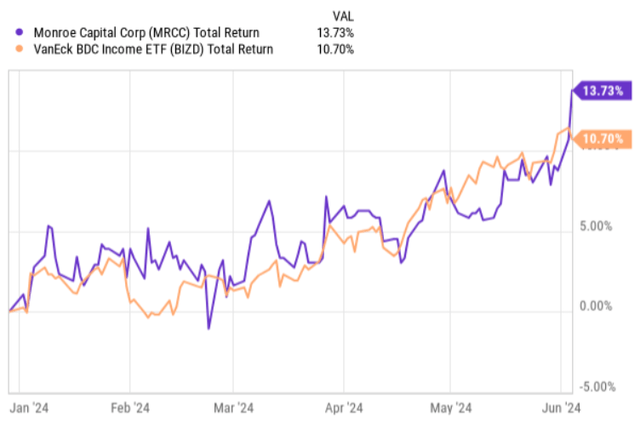

However, since the publication of my bearish article, MRCC has actually outperformed the BDC market.

Ycharts

A major driver behind this dynamic has been the positive systematic or beta movement in the overall BDC space, where such aspects as strengthening of higher for longer scenario and lower corporate distress levels have introduced tailwinds for almost all BDCs. In such “risk on” market conditions, riskier companies with high leverage tend to outperform the more defensive players.

Another factor that we have to take into account when assessing MRCC’s performance and its current attractiveness is the Q1 2024 earnings results, which reveal some interesting data points.

Let’s now review the Q1 report in detail to determine whether there have been any major changes in MRCC’s fundamentals that would now justify assuming a more bullish stance on this BDC.

Thesis review

All in all, the Q1 2024 quarter brought suboptimal results, leaving the question of MRCC’s dividend sustainability open.

In Q1, MRCC registered a decrease in the underlying NAV of $0.10 per share, or roughly 1% compared to the prior quarter. The 1.1% decline was mostly driven by the fact that MRCC distributed all of its adjusted net investment income in dividends and had to record an unrealized loss of certain portfolio companies due to struggling credit performance.

The key metric, which measures MRCC’s ability to accommodate the dividends and leave some cash at the BDC to cover incremental growth (or maintain a cash flow buffer) – the adjusted net investment income – came in lower by $0.01 per share than in Q4 2023. This decrease was attributable to a reduction in average investment and average invested asset size over the period, coupled with the build-up of non-accrual positions.

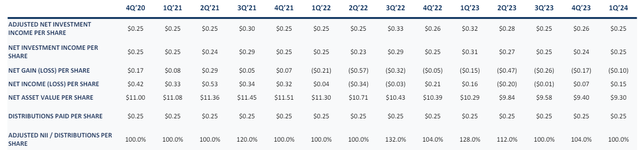

As we can see in the table below, MRCC’s dividend coverage has fallen back to 100% level, which implies that there is no margin of safety left.

MRCC Q1, 2024 earnings presentation

Interestingly, while the cash flows have decreased, MRCC’s leverage has continued to tick higher. During the quarter, MRCC’s debt to equity increased from 1.49x (which was already excessively high) to 1.6x. This now makes MRCC the fourth most leveraged BDC out there (with the sector average being 1.15x).

Speaking of leverage, it is also important to underscore that from the currently outstanding borrowings of ~$322 million, $130 million are based on a fixed rate, where the cost of financing level is materially below the market level rate (i.e., the fixed rate is 4.75%). The maturity date for this fixed rate financing is 2026, which at the time of refinancing will most likely expand MRCC’s interest cost component (unless interest rates/SOFR drop to below 2% territory).

On top of deteriorating cash flow profile and increasing leverage, MRCC was forced to put incremental positions under the non-accruals, representing circa 1.1% of the total portfolio value. With this, the total non-accrual position for MRCC has reached 2.1% of the portfolio value, which is more or less in line with what is typically observed across the BDC landscape.

With that being said, in the most recent earnings call Mick Solimene – CFO & Chief Investment Officer, Corporate Secretary – still painted a positive picture around MRCC’s ability to cover the dividend on a forward basis:

When considering current leverage levels, the interest rate environment in the favorable percentage of our at a fixed rate, we believe that on a run rate basis, our adjusted net investment income will continue to cover our current $0.25 per share quarterly dividend, all other things being equal.

The bottom line

In a nutshell, after dissecting Q1 2024 earnings report it is clear that the recent run-up in MRCC’s share price has not been so much driven by the fundamentals as by the general beta factor that has lifted the overall BDC market higher (e.g., strengthening of higher for longer scenario and lower corporate distress levels).

There are four specific factors at the fundamental end, which together fully justify a decision to still avoid investing in MRCC:

- Adjusted net investment income is on a decline.

- The leverage profile has gone from bad to worse.

- The dynamics at the non-accrual front are not encouraging.

- There is no margin of safety for MRCC’s ability to cover the dividends in a sustainable manner.

Finally, in the context of the embedded margin of safety (or rather lack of it), we have to also keep in mind that the presence of so abnormal leverage imposes an additional layer of risk in terms of magnifying any slightest struggle (or cash flow drop) in the underlying business operations.

So, the combination of excessive leverage, no safety buffer, and negative portfolio dynamics, in my opinion, makes Monroe Capital a suboptimal investment choice.

Read the full article here