I started coverage of Moog (NYSE:MOG.A) (NYSE:MOG.B) last year and so far, my buy ratings for the stock have performed rather well. On the 26th of April, Moog reported Q2 2024 earnings, beating estimates on top and bottom lines. In this report, I will be discussing the stock price performance, the most recent earnings, updated guidance and discuss whether the reported and projected performance trigger any changes in my buy rating.

Moog Stock Price Performs Extremely Well

Seeking Alpha

In March 2023, I initiated coverage for Moog stock with a buy rating. I noted that the track record of Moog in translating revenue growth into profits, free cash flow and shareholder returns has been far from attractive, but this could change with a new CEO taking the lead. Since my buy rating, the stock price appreciated by 63% compared to 23% appreciation for the S&P 500. It shows quite well that historical performance does not provide a guarantee for future performance in either direction. My second report on Moog was also one with a Buy rating, as I pointed the opportunity for margin expansion. That call preceded the outperformance against the market, with the stock price increasing 15% compared to 9% for the S&P 500.

Moog Q2 2024 Revenues and Margins Grow

Moog Inc.

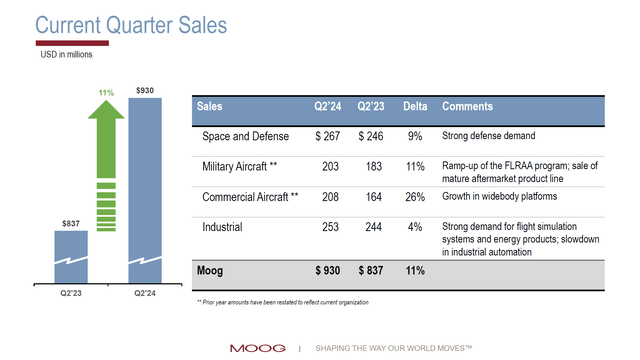

For the second quarter, we saw demand strength in the end markets translate into solid revenue growth. The current geopolitical landscape is driving up sales in the defense markets; Space and Defense revenues grew 9% and 11% growth in Military aircraft, driven by the ramp up of the FLRAA program revenues. I noted earlier that the primary contractor on the FLRAA program, namely Textron (TXT), saw its revenues grow as well, driven by the FLRAA. So, we are seeing how the top-line value of the FLRAA program is flowing through the entire supply chain.

Commercial Aircraft revenues grew by 26% driven by high growth in wide body platforms. These platforms primarily are the Boeing 787 and the Airbus A350. There seems to be significant growth opportunities ahead there, as Airbus recently announced plans to increase Airbus A350 production to 12 airplanes per month by 2028. The Boeing 787, however, is a watch item, I would say. Boeing recently announced it would temporarily dial back production on the Dreamliner program due to supply chain constraints. Moog is currently producing at a rate of 5 airplanes per month and is sticking to the master schedule that provides for an increase to 8 per month later this year. However, as the production rate at Boeing has been reduced and production rate increases have been pushed to the right, I do think that eventually Moog could also see some impact.

Industrial sales grew 4% driven by strength in flight simulation and energy products, but as anticipated we are now seeing the expected slowdown in demand for industrial automation.

Overall, revenues of $930 million provided 11% year-on-year growth, beating analyst estimates by $56.4 million.

Moog Margin Expansion Is Materializing

Moog Inc.

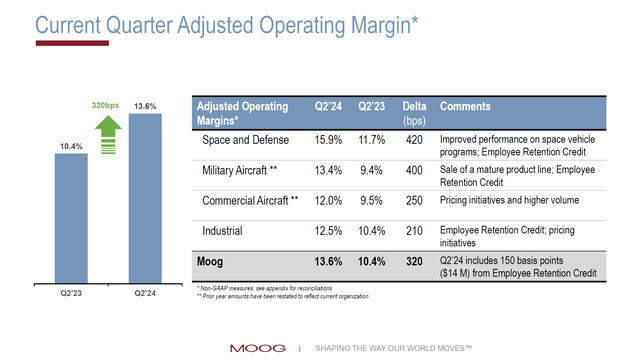

In December 2023, I maintained my buy rating on Moog, citing the opportunities for margin expansion, and the second quarter earnings did show the margin expansion rather well. Margins climbed in all segments driven by improved volume, pricing, performance and Employee Retention Credit. Margins improved by 320 basis points to 13.6%. This included Employee Retention Credit benefits of that drove almost half of the margin expansion. Even if we strip the Employee Retention Credit from the margins, we would still see Moog margins expand from 10.4% to 12.1%.

Moog earnings of $2.19 per share beat analyst estimates by $0.46. That looks like a strong beat, but it should be pointed out that the margins in Military Aircraft were partially driven by the sale of a mature product line, driving an impairment of $0.16 per share, while the Employee Retention Credit drove $0.33 in earnings. Excluding these items, there would be a modest miss. However, what remains intact is the margin expansion story. If we look at the unadjusted margins, meaning including restructuring charges and impairments, the reported margins grew from 5.1% to 6%. The translation from adjusted to unadjusted margins is quite significant as Moog is going through some restructuring and shaping its portfolios that are leading to headcount reductions, severance costs and asset impairments. It should be taken into consideration that these restructuring plans have some margin impact through 2027, but fully fit in the longer-term objective to improve operating margins.

Moog Inc. Increases Guidance for 2024 Sales and Earnings

Moog Inc.

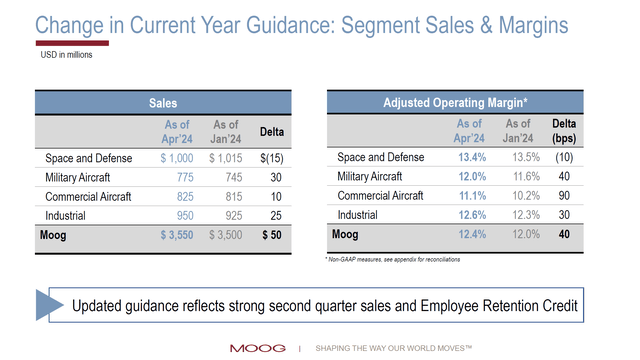

For the full year, Moog has increased its revenue and margin guidance. The company expects $3.55 billion in revenues, indicating 7% growth year-on-year. The Space and Defense sales are expected to be $15 million lower than initially anticipated, but this is more than offset by $30 million in higher revenues for Military Aircraft, $10 million in Commercial Aircraft sales and $25 million in the Industrial segment. While the guidance is up by $50 million, what will be a watch item for me is the Commercial Aircraft segment given the pressures on the Boeing 787 production rate which might eventually impact the Commercial Aircraft segment at Moog if their guidance does not provide sufficient padding and deliveries to Boeing for the Dreamliner program indeed do decrease. The margins expectations have increased from 12% to 12.4%. Applying those margins against the revenue estimates, we see a bump to segment operating earnings of $18 million, of which $14 million is driven by the Employee Retention Credit. Excluding the Employee Retention Credit tailwind, the margins would be stable at 12% and the $4 million in higher profits is driven by an increase in the top-line estimates.

On free cash flow, the company has guided for modest free cash flow, but it noted that the free cash flow is under more pressure than initially anticipated, driven by end market dynamics but primarily driven by timing of receipts.

Is Moog Inc. Stock A Good Buy?

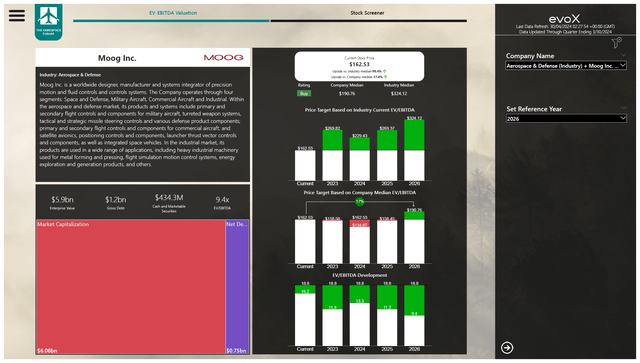

The Aerospace Forum

I believe that Moog Inc. stock still has upside. However, that upside is no longer driven by factoring in FY25 earnings. The longer-term target would be $191 per share, representing 17% and is based on factoring in FY26 earnings. The alternative valuation would be to value the stock between its median EV/EBITDA and that of its peer group, which would provide a $182.15 price target, representing 12% upside. As a result, I am maintaining my buy rating but also note that the downside risk did somewhat increase as the stock price now exceeds its FY24 and FY25 valuations.

What Are The Risks Factors For Moog Inc.?

I believe that Moog is on a good trajectory. The industrial business is seeing some pressures, primarily in the automation business. However, defense and commercial aerospace are performing well. Obviously, the general risk is a softness in demand for wide body jets to which Moog has exposure. More directly, I believe that the Boeing 787 could provide a risk as Boeing has dialed back production and Moog is still producing and assuming production at the previous production rates of 5 airplanes per month currently and 8 per month in the near future, while Boeing is likely producing at a rate closer to 3 airplanes per month.

Furthermore, the company needs to deliver on its cash conversion targets. In FY2028, the company has around $835 million in debt maturing. To pay this debt from the cash pile, the company needs to see continued end market strength and deliver on its cash conversion targeted at 75% to 100% by FY25 and FY26. Refinancing and utilizing revolvers are alternatives to eventually cover this debt. By FY26, the company is set to have around $435 million in cash giving it another one to two years to get the remaining $400 million in which could be achieved by leveraging end market strength, expanding margins further and executing planned sales of some factories. So, I don’t doubt that Moog will be able to repay this debt or handle it any way or form, but the cash generation needs to remain strong.

Conclusion: Moog Inc. Is Executing Well

I believe that Moog Inc. is executing well. We see sales growth as well as margin expansion, whereas the company saw significant challenges in the past years to translate sales to profits on higher margins. I believe the company is on a strong trajectory to book higher profits at higher margins and revenues, but do note that free cash flow for the year is under pressure and the step-up for FY25 and FY26 in cash conversion is going to be significant. So, the execution on that cash conversion is going to be a watch item while I maintain my buy rating and increase the price target to $182.15.

Read the full article here