Last April, I placed a “Buy” rating on MPLX (NYSE:MPLX) saying it was deserving of a position in the portfolios of income-oriented investors. The stock has generated a return of about 25% since then, slightly outpacing the S&P 500. More recently in August I wrote I expected the company to meaningfully increase its distribution, which it did. With the company reporting its Q4 results at the end of January, let’s catch up on the name.

Company Profile

As a quick reminder, MPLX is a midstream company that operates in two segments: Logistics & Storage and Gathering & Processing. The former accounts for about two-thirds of its EBITDA and is supported by long-term fee-based arrangements with minimum volume commitments. Its Gathering & Processing segment, meanwhile, is a mix of fee-based, percent-of-proceeds, and keep-whole agreements, making it a bit more volatile.

Refiner Marathon Petroleum (MPC) owns about 65% of the company and accounted for just under 50% of its revenue last year.

Q4 Results

For Q4, MPLX put up a very strong showing, with its adjusted EBITDA up 12% year over year to $1.62 billion, while its distributable cash flow was up 10% year over year to $1.36 billion.

MPLX’s Logistics & Storage Segment tends to be very predictable given its ties to MPC and its fee-based contracts. It saw its EBITDA climb 11% in Q4 to $1.089 billion. Volumes increased 3%, with crude pipeline throughput up 4% and terminal throughput flat. Tariffs increased 9% to 97 cents a barrel.

MPLX’s smaller G&P segment can be more volatile as it has some NGL price exposure. However, its Q4 results were very strong, with adjusted EBITDA climbing over 12% to $534 million.

Gathering volumes rose 1% and processing volumes climbed 9%. The Marcellus, its largest basin, saw gathering volumes rise 10% and processing volumes climb 9%, along with a 1% increase in fractionation volumes.

Discussing the current environment on its Q4 earnings call, CEO Michael Hennigan said:

“In our largest base in the Marcellus, the cost to develop is at the low end of the cost curve and below current commodity prices. In the fourth quarter, process utilization reached 96%, and we expect producer drilling activity to support continued volume growth in the Marcellus. We’ve seen similar growth rates in the Utica, where processing utilization increased 10% year-over-year. Both basins are seeing wells with longer laterals, which are resulting in higher volumes, highlighting the strength and opportunities we see in our Northeast footprint. In the Permian Basin, crude prices remain attractive and associated gas production continues to grow as producers execute drilling and completion activities.”

Looking ahead, MPLX expects to spend $1.1 billion million in capex in 2024, including $950 million on growth projects. In its L&S segment, its Whistler Agua Dulce to Corpus Christi (“ADCC”) natural gas pipeline is projected to go into service in Q3. Meanwhile, its BANGL NGL pipeline is set to be completed in the first half of 2025.

On the G&P side, the company continues to focus on the Permian and Marcellus basins. Its Harmon Creek II gas processing plant in the Marcellus is projected to be in service at the end of Q1, while in the Permian, its Preakness II facility is expected to come online early in Q1. It also is adding a seventh gas processing plant, Secretariat, in the Delaware Permian, which is expected to come online in the second half of 2025.

In December, meanwhile, the company completed the purchase of the remaining 40% interest in a Permian gathering and processing joint venture for about $270 million.

The company ended the quarter with leverage at 3.3x. Its distribution coverage ratio, meanwhile, was 1.6x. It also had $1.0 billion million of cash on its balance sheet.

This was just another great quarter from MPLX, with both its segments performing well. Its Logistics & Storage segment continues to be a steady, predictable performer, while its Gathering & Processing segment grew nicely, highlighted by strong volume growth in the Marcellus. The company has also gotten a nice boost from increased rates as well.

Notably, very low natural gas prices did not impact its gathering throughput or natural gas processed volumes in the Marcellus, which is a natural gas basin. Production in the basin has largely been flat, but MPLX has been gaining market share, while the basin could see some uptick in volumes as the MVP Pipeline is set to finally come online after many years of delays, although it was delayed recently until June. This performance in such a difficult natural gas price market is a testament to how solid MPLX’s business is, the importance of its assets in the Marcellus basin, and the basin’s ability to withstand low natural gas prices given its low cost of production.

Meanwhile, MPLX has continued to lower its leverage, while also having one of the best growth project backlogs in the midstream space. That’s a unique combination.

Valuation

Looking at valuation, MPLX trades at 9.3x the 2024 EBITDA consensus of $6.51 billion. For 2025, it trades at 9.2x the EBITDA consensus of $6.61 billion.

It has a free cash flow yield of about 10.4% based on 2023 FCF of $4.1 billion. The stock has a yield of nearly 8.7%.

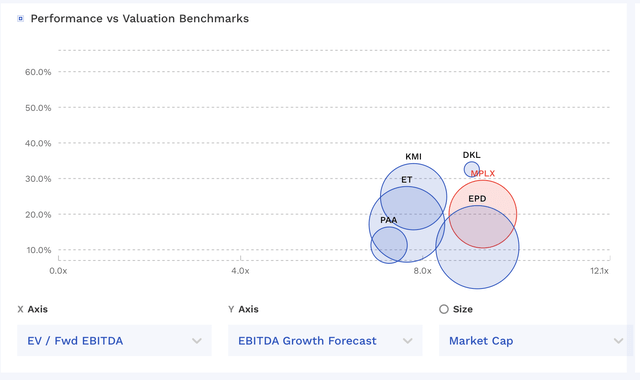

The stock trades in the higher end of the range of valuation compared to its midstream peers.

MPLX Valuation Vs Peers (FinBox)

Overall, I think MPLX deserves to trade at a premium given its growth project backlog, balance sheet, and strong recent performance. As such, I’d value the company between 9-11x 2025 EBITDA. That would value the stock between $38-$51, with a midpoint of $45.

Conclusion

MPLX has been a strong performer, and it once again reported another excellent quarter. It has a strong track record of growing its distribution, and it delivered on the expected 10% increase in distribution I predicted in my prior write-up. Given its leverage, growth projects, and coverage ratio, I’d expect another nice distribution increase later this year.

As such, I continue to rate the stock a “Buy” given its combination of growth and defensive nature. I will set a target of $45. I previously did not have a target price on the stock.

The biggest risks to the stock would be decreased throughput through its facilities. However, the biggest cause would most likely be low natural gas prices, and MPLX has been able to grow through a very weak natural gas price environment. The company can also be impacted by NGL prices, as a 5-cent per gallon change in NGL prices has an about a $20 million annual impact on its results.

Read the full article here