Bitcoin (BTC-USD) has garnered recent widespread investor attention after the decision by the SEC not to challenge the ruling, paving the way for a Bitcoin Spot ETF to enter the marketplace. The significance of the initial ruling and the subsequent decision by the SEC to not tempt fate again cannot be understated. A Spot ETF will allow Bitcoin to become a mainstream asset class, with the most accessible vehicle for participation by the retail investor, the ETF wrapper. The article below will discuss my favorite currently traded ETF to capitalize on this unique opportunity.

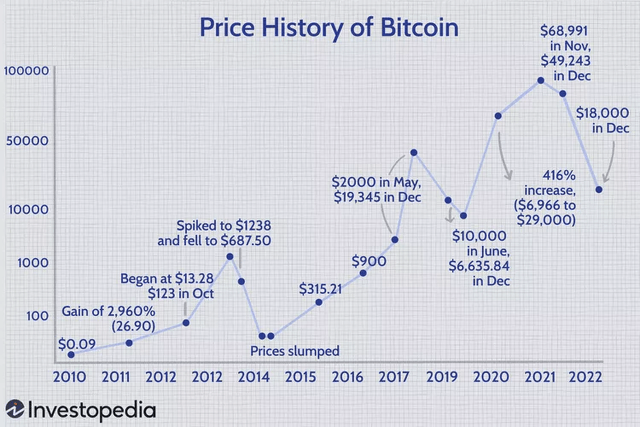

Bitcoin Historical Price Chart (Investopedia)

Photo Source: Investopedia

Bitcoin is a Commodity

To better understand the opportunity ahead, a quick primer on Bitcoin is in order. I firmly believe BTC is a commodity as it has exhibited the classic boom-bust characteristics over its brief lifetime. The unique aspect of the BTC cycle is how neatly it thus far follows the 4-year halving cycle, with a series of higher highs and higher lows. The halving cycle is programmed into Bitcoin’s code to reduce the block reward size by half every 210,000 mined blocks. BTC code is designed to generate a new block every ten minutes with difficulty adjustments made to keep the flow of blocks in a ten-minute interval. For example, if the network becomes congested and it takes 12 minutes to produce a block, a difficulty adjustment will occur, thus reducing the hash power required to mine a block. The reciprocal also applies if block generation is occurring at a more robust rate than 10 minutes per block. The halving date is anticipated to occur in late April 2024, thus putting us roughly six months away.

The Importance of Bitcoin Mining

The Bitcoin network is highly dependent on miners providing hash power, thus the incentive of the block reward. Miners incur actual costs to provide this service, ranging from the cost of the machines to the energy required to power them. When the price of BTC is elevated, such as in late 2022, the miners are posting stellar revenue growth numbers. In my view, BTC shares similar characteristics with another commodity-Gold. Let’s examine the performance of the gold miners during a bull run in gold.

Chart of recent move in Gold vs Gold Miners ETF (Tradingview)

Source: TradingView

The above chart compares the move in the VanEck Gold Miners ETF (GDX) juxtaposed with the move in the S&P Gold ETF (GLD). The ramp in 2020 led to a 2x outperformance of the GDX versus the corresponding return of GLD. GLD has traded sideways over the past few years, but the outperformance has dissipated, with GLD slightly higher than GDX. If my thesis is correct that a BTC Spot ETF is coming before the halving cycle, then the miners should outperform the move.

Valkyrie Bitcoin Miners ETF

For a directional move in an asset class, I prefer to use an ETF, thus avoiding single equity risk. I view a jump in the underlying commodity as a rising tide lifts all boats scenario ideally suited to ride an ETF. I am currently long the Valkyrie Bitcoin ETF (NASDAQ:WGMI).

Top 10 Holdings of WGMI (Seeking Alpha)

Source: Seeking Alpha

The top nine holdings are as expected, with a heavy concentration in BTC miners and Nvidia (NVDA). I do believe the sponsor is stretching a bit by including both NVDA and Advanced Micro Devices (AMD). Yes, their products are used to design the miners-the same products are used wherever computing power is required. I prefer their exclusion, but this type of style drift occurs in smaller ETFs, especially in less liquid names such as most BTC miners. YTD, the ETF has doubled, neatly tracking the late 2023 trough in the BTC price.

My Target Price

I am looking for a quick move up into the $15ish range, which marked a recent peak in August 2022 and is in the midpoint range of the recent ramp-up into the $19 range. Interestingly, WGMI has severely underperformed the underlying move in BTC, an anomaly that should begin to close if recent history holds proper.

Risk Factors

Some notable risk factors need to be addressed to give a more balanced approach to the thesis. For the trade to work, the price of BTC will need to continue its ascent-not a given. BTC price collapsed in 2022 in the face of the Terra Luna collapse on the subsequent implosion of the FTX exchange. While the current period in the historic cyclical nature seems favorable, there are no guarantees the cycle will repeat.

There is a school of thought that the actual announcement of a Spot ETF will lead to a buy-the-rumor sell-the-news event, leading to a quick rush to the exit. Either of the two mentioned scenarios above would hurt WGMI. For WGMI to work, BTC will need to continue to push higher into the $40k range and maintain for an extended time. Such a scenario would signal the supply-demand balance for BTC is stable, thus giving the Street confidence higher prices are here to stay. BTC above $40k should ignite the miners, thus setting up a favorable trading environment and potential outsized gains. In my account, I am long WGMI and plan on holding through the halving to give optimal time for the drop in block reward to create a shortage of available BTC, thus driving the price higher in line with historical precedence.

Good luck to all!

Read the full article here