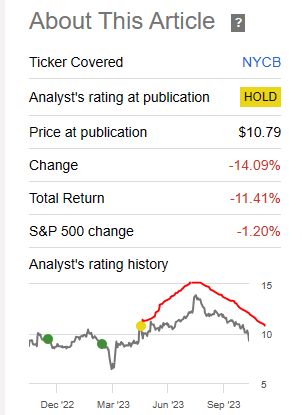

You can only make decisions on valuation for the long haul. It seldom works out in the short run. The same was the case for New York Community Bancorp, Inc. (NYSE:NYCB) where we left a lot of money on the table as we exited. Our rationale was as follows.

So while we think the Fed is close to getting done, don’t expect the rate cut cycle to start until equity markets really get blown to smithereens. Circling back to NYCB, we don’t think they will be immune. Their losses will rise and possibly quite substantially.

NYCB outperformed regional banks by a mile in 2007-2009 and we expect something similar here. While we are sure they will outperform the banking index, investing is not a beauty contest. We don’t believe being prudent on reducing financial sector exposure with the most inverted yield curve is a bad bet.

Source: I’ll Leave Manhattan

But the stock has completed its mountain climb and descent and we are now down 14% from that article.

Seeking Alpha

Are we set up for the reentry?

Q3-2023

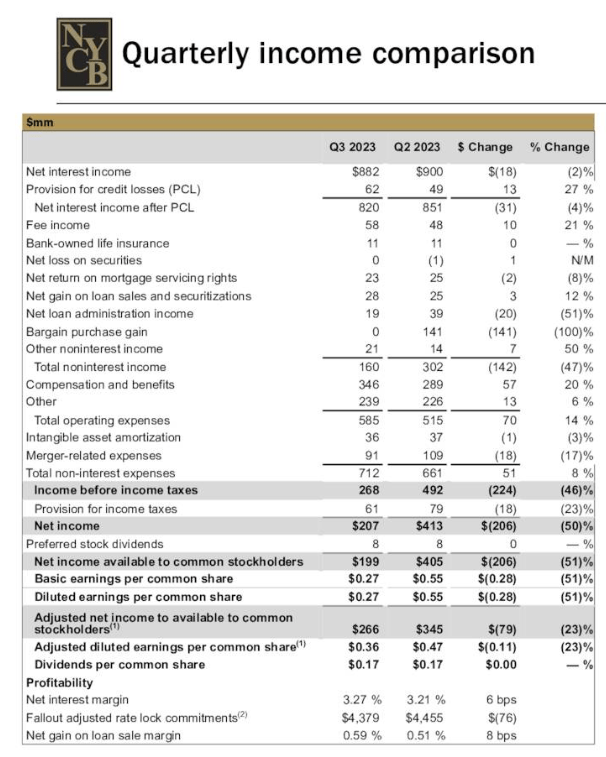

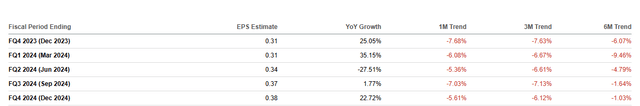

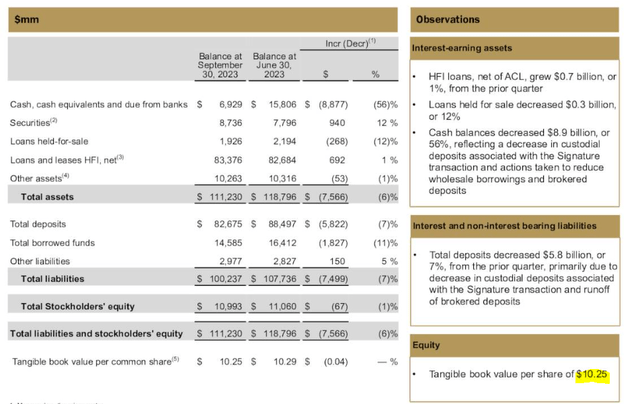

NYCB has been on a downtrend for some time, but it really took a beating as it released its Q3-2023 results. At the surface, there was nothing really wrong with the report. Both the earnings per share and revenue numbers were slightly ahead of consensus. We can see below the quarter-over-quarter changes.

NYCB Q3-2023 Presentation

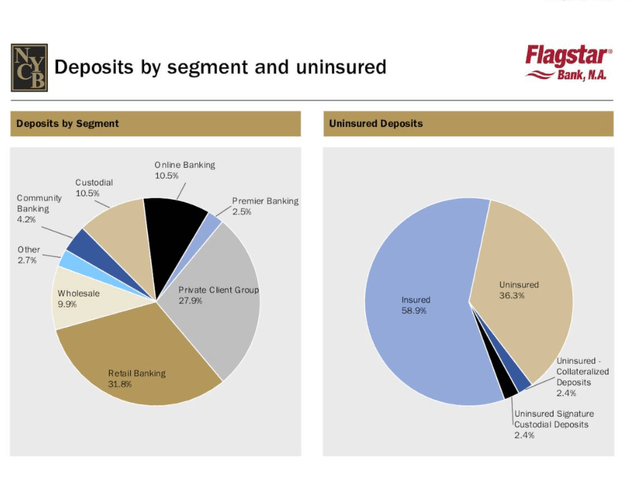

There is a small contraction in the net interest income and that comes from the deposit run-off. NYCB called this “normalization of cash balances”. Adjusted earnings were substantially lower quarter over quarter but that again is reflecting the one-time gain booked from the Signature transaction. What was impressive in this quarter was that the net interest margin or NIM, expanded by 6 basis points. Most of its deposit base remains in the insured category and its loans-to-deposit ratio remains the best among peers.

NYCB Q3-2023 Presentation

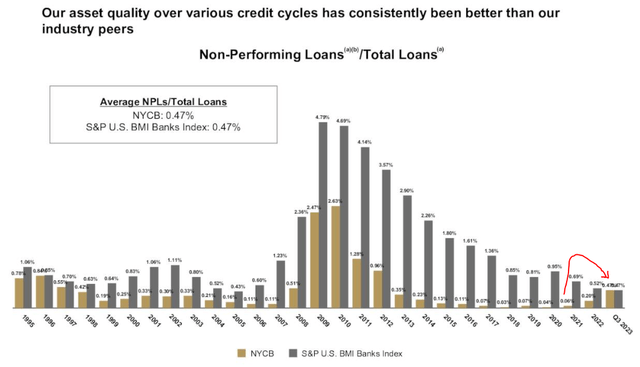

What perhaps was concerning for investors though, was the first massive spike in non-performing loans in this cycle. You have seen this over the last two quarters as NYCB went from being way below the regional bank average to being right in line with it.

NYCB Q3-2023 Presentation

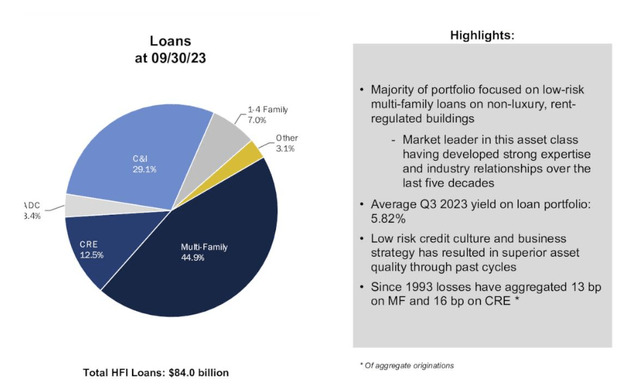

NYCB has historically focused on its bread and butter segment, the low-risk multi-family loans. The current composition is no different with that segment making up almost 45% of the total.

NYCB Q3-2023 Presentation

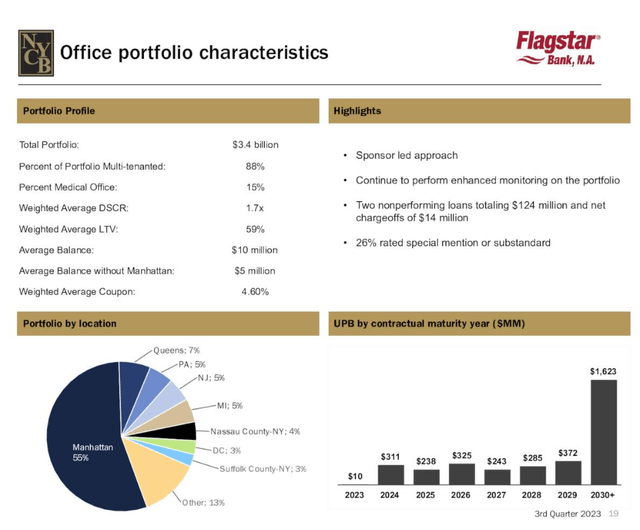

But there is 12.5% of the total in CRE and a good deal of that (32.5%) is in office loans. While this gets to fractions of fractions in relation to the total portfolio, banking is a highly levered industry, and small percentage write-offs in loans result in big equity losses. This quarter, we saw two large loans total $124 million, being added to the non-performing list.

NYCB Q3-2023 Presentation

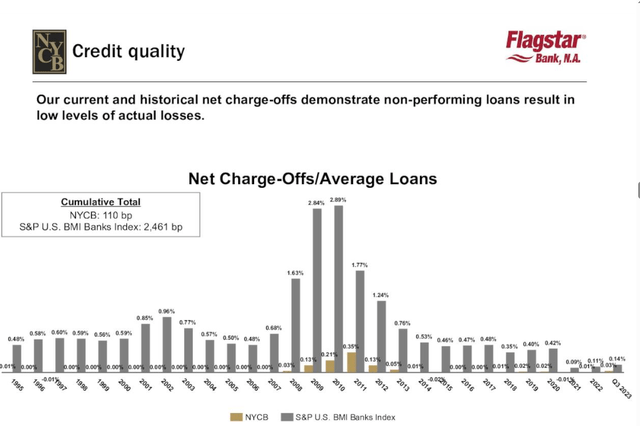

Now, even adding it to a non-performing set does not mean there will be large charge-offs. In fact, NYCB has shown the opposite to be true and most regional banks are in the same conservative category. Hence charge-offs to average loans tend to be way lower than non-performing loans.

NYCB Q3-2023 Presentation

If you go by the “this time is different” and mark the office values of the entire loan portfolio down 60%, the losses should be modest. After all, the loan-to-value was about 59% to begin with. So if the original office property value was $100, NYCB loaned out $59 and if you value the property at $40, NYCB’s loss is $19. So your losses to total loans should be modest even in that scenario, but we would still be talking about $1.0 billion of total losses. That is a big number in relation to total tangible equity of about $7.4 billion. As to how this actually plays out, remains to be seen. But this space deserves watching for fallout and while we think NYCB will land up being fine, there will be more turbulence here.

Guidance

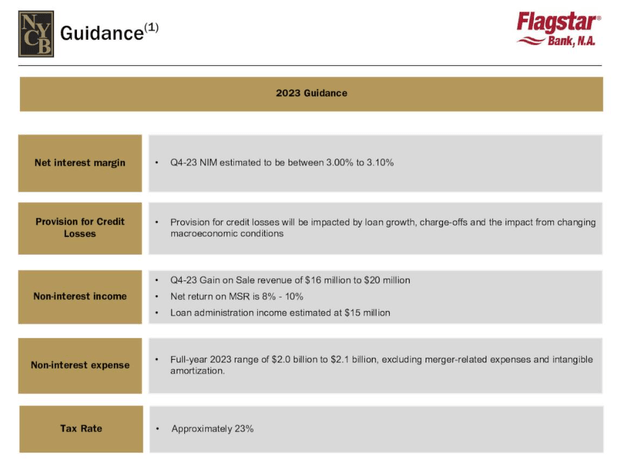

NYCB expects NIM to contract sharply in Q4-2023.

NYCB Q3-2023 Presentation

This is a bit of a surprise here and analysts have cut estimates right as this was disclosed.

Seeking Alpha

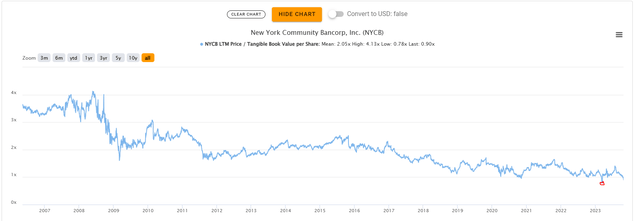

The same picture shows the perpetual optimism in the analyst community. Earnings will suddenly go vertically right as deposits will start demanding more and we likely step into a recession. None of that is likely, so you have to use your own numbers to weigh in. What we can say here is that the stock has never been this cheap relative to tangible equity.

NYCB Q3-2023 Presentation

Ok, that is not entirely accurate as the stock’s plunge in March of this year (circled in red) had it trading even cheaper briefly.

TIKR

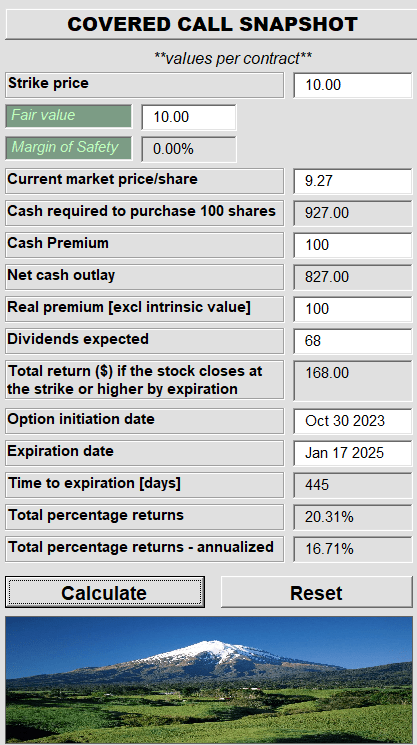

But valuation is not too far off from that despite the stock being way higher. That is because the Signature deal basically gave NYCB a large amount of free equity. So we have an appealing valuation alongside a hostile macro environment. How do we play it? Well, if you are heavily underweight financial stocks, then this is one of the best you can add. If you are patient, the odds of you making 10% annualized returns from this point are quite high. But it’s likely to be a volatile next 12-24 months in our opinion and you don’t want to assume that those earnings estimates cannot go way lower.

Two Ways To Play

The first way to consider playing NYCB would be via a covered call. This is a good risk-adjusted play and one we might put on.

Author’s App

The second one would be the junior subordinated debt trading on the stock exchange as New York Community Capital Trust V UNIT 05/07/51 (NYCB.PR.U). These trust units are rated one notch higher than the preferred shares New York Community Bancorp, Inc. DEP SHS REPSTG A (NYSE:NYCB.PR.A) by Fitch. The current yield on the price is about 8.8% though the yield to its long-dated maturity is way higher. These are best held in tax deferred accounts as they throw off interest payments and not qualified dividends.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Read the full article here