I am starting to feel bullish as we might be sailing past the “Ides of March”

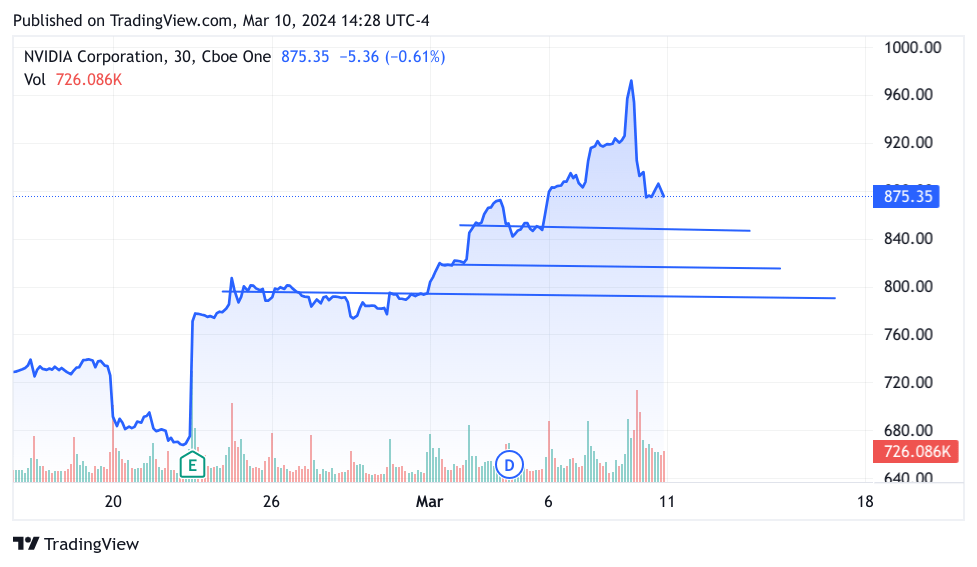

On the surface, the price action of NVIDIA (NVDA) could be a concern, especially as we once again see key economic data – the CPI revealed on March 12, and the PPI revealed on the 14th. So the question is, is the sell-off starting on Friday out of expectations of bad news next week, or was it a discrete action? Here’s what I mean. Early Friday morning, Bloomberg published an article that NVIDIA will split the stock and the stock shot up to 950. The original article was published March 8, 2024, at 7:16 AM EST, here is the link to the article Bloomberg If someone else would use this as an explanation for the price action, I would be the first to say that correlation is not causation. However, there was no other news that I could find that would propel NVDA to break above 950 at 7 am. Then, once the market opened, traders leapt up on the stock and pushed it up to 974 before it tumbled and closed 100 points lower at 975 a full 100 points lower. Market technicians call this price action a “Key Reversal.” This is when a stock reaches an all-time high and falls below the previous trading day’s low. This is not a positive development for the stock price, generally. I can also say that in the long run, it is good for the stock and our market in general. The stock was headed to an unsustainable parabolic formation. This reversal could serve to moderate the unsustainably sharp rise and perhaps maintain the overall market rally. Of course, the big trend that in my opinion has already been establishing itself is the wider participation of stocks from various sectors, which we will look at later. The point I want to summarize here is that there is a good chance that most of the selling on Friday is not the fear of the CPI, but more about the reversal of NVDA. Below is the about 3 weeks of trading. The first thing I want to illustrate is the sharp reversal and settling precariously at 875. I suspect that the next support level of 850 will be tested on Monday, the next level is 820. Perhaps the price gets as low. I think buyers will come in again.

TradingView

So what are the indicators that I am watching? No one should be surprised when I say watch interest rates and the VIX. The VIX has been the most reliable indicator, but when paired with the 10-year it tells an interesting story, The first is the 3-month chart of the VIX. I drew a line outlining the rising lows since the start of the year.

CNBC

Market participants have been raising their hedging, and we see from the low at the beginning of March we are now approaching 15. I often say it is not the actual number of the VIX that is as important as the speed of the rise (or drop). A leap of 2% is a concern, What is really interesting is when you pair the spike in the VIX with the direction of the 10-Y below

CNBC

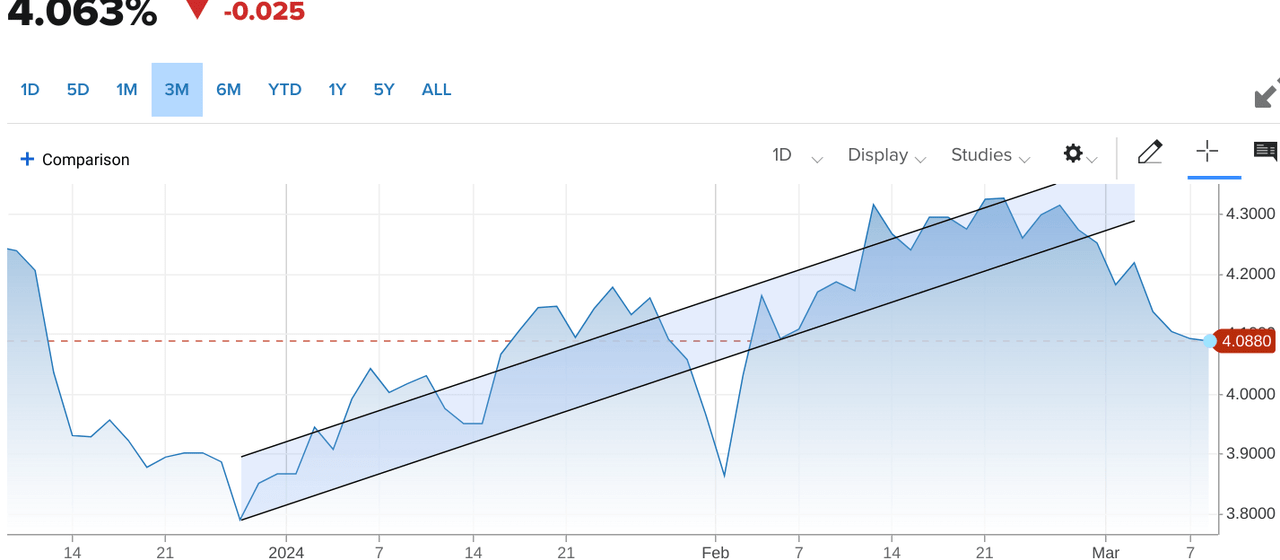

The above is the 3-month chart of the 10-Y. By now, loyal readers should remember how I was harping on the consistent rise of the 10-Y and how I thought that I could pressure stock prices if it was an indicator of higher inflation. Surprisingly, the 10-Y has now broken down in nearly the exact inverse of the VIX. Leading me to believe that market participants are piling into the 10-Y as a safe haven.

I know it sounds repetitive, but this CPI does count.

We had a strong CPI for January, which was explained away by seasonal factors. Logically, it makes sense, a lot of business contracts begin in January, so prices naturally move higher. But this CPI is now for February, and the seasonable argument is not going to work. You recall that I made a big deal out of the prices paid index of the manufacturing PMI the Friday before, and it came in benign, so I think that we should get a good result on Tuesday. If I am wrong, then NVDA might not hold 850, or even 820. We could even have that 7% sell-off I have been gabbing about for the last several months. The thing is, if everyone is expecting it, it is likely not to happen.

So reaching back to NVDA, I think that if the CPI comes in line we could have a nice week. I think buyers move back into NVDA and the rest of tech follows. Let’s recall how sure Powell was that inflation was moving in the right direction. Also, perhaps a little bad news is good news, the unemployment percentage gapped up to 3.9%. That should have some amelioration in inflation, also productivity is still quite strong. No, I think the market is going to be pleasantly surprised that the CPI breaks our way. Should you be jumping in with both feet on Monday? I won’t make such blanket statements, I have been calling for a big sell-off right about now and here I am doing an about-face, it would serve me right if the market goes ahead and does sell off hard.

Why make a prediction and then abandon it?

I make predictions because it helps my trading decision-making. I set up a plausible thesis and I test the data coming through against that thesis. Right now, with the 10-Y cooling off, the inflation data generally behaving itself, and Powell in no hurry to adjust the dials, there is nothing on the macroeconomic front that is going to unsettle stocks unless the CPI flies skyward. Yes, I think Powell would be wise to talk about cutting rates and not do them. Cutting rates is a fraught endeavor right now. On top of that, earnings reports have been green, though some high-flying stocks have pulled back on forward guidance. Finally, let me sum up by reiterating that this rally has been expanding, perhaps not as parabolic as the AI stocks, but a number of sectors are doing fine. For example, Industrials, Materials, and the Russell Index (small caps) are higher, and so are the homebuilders. This is a very healthy stock market, as March turns to April, I will return to my usual bullish self.

So what will I do with this newfound bullishness, I will wait a day and see how the CPI turns out. I will continue to monitor the VIX, if I am correct, the VIX might give us a hint tomorrow by staying at the level it closed at 14.74 or about there. If the VIX moves higher, I will be concerned about Tuesday, especially if the 10-Y breaks under 4%.

My trades:

I did the absolute amateurish wrong thing and got long MongoDB (MDB) too quickly. I read the earnings teleconference transcript and was (still am) convinced that all the items that made them pull back on guidance were truly one-time items. I also think that MDB could grow fast enough that they beat expectations (now lower) on the next earnings report. So instead of waiting, I bought right away. I even chased it, against all my discipline and rules, and the stock fell further. I should have waited until Monday at least, or even for the stock to test the low of the day first. I have all these mental exercises to try and stay disciplined, but I let external distractions take me off my game. On the other hand, I did close out my hedge of Puts on the Nasdaq-100 3X ETF (TQQQ), and also my 15 strike calls on the VIX futures and built some cash. I am still long SentinelOne (S), UiPath (PATH), and Palantir (PLTR) all are in the money calls out to June. I also have these stocks as long-term investments. Most of the stocks I trade in options, I also have long-term investments in, just so you know. Also, I keep my investments in a separate account segregated from my trading, which is in another account.

Read the full article here