Overview

Note that I previously rated a hold rating for O’Reilly Automotive, Inc. (NASDAQ:ORLY) due to a lack of margin of safety. In this post, I am reiterating my hold rating again for the same exact reason, which is a lack of margin of safety. My model implies an upside of only 6%, which, in my opinion, is too risky. However, I want to point out that ORLY is a top-quality business that consistently reports strong results, and there is no exception for the third quarter of 2023. When compared with peers, it dominates them across all metrics, such as profitability and growth.

Recent results & updates

ORLY reported a 17% increase in diluted EPS and an 8.7% increase in comparable store sales for the third quarter of 2023. Important components of the ORLY value proposition are service and product availability. By maintaining a laser-like focus on these principles, the company has been able to grow both its professional and do-it-yourself businesses. The comparisons to ORLY’s previous year become increasingly difficult as the company progresses through the second half of the year. This dynamic was evident in the third quarter’s comparable store sales cadence, which was strongest in July and August. On a two-year stacked basis, on the other hand, its performance was much more stable throughout the quarter, with September’s performance only marginally less than the overall performance because of a moderating effect of the favorable weather it experienced earlier in the quarter.

Although I observe that ORLY outperformed during the quarter in heat-related categories like HVAC and cooling, it also saw success in hard part categories with a broad application as well as maintenance categories like filters and oil. These dynamics show that, although the weather did help ORLY, it was not the main factor in the company’s performance, and the sales it is making in the failure and maintenance categories point to a strong degree of demand from a wide range of customers. The more notable outperformer is still the professional business, and ORLY was able to produce third quarter comparable store sales growth in the mid-teens. Despite increasingly difficult comparisons to the previous year, this remarkable growth was consistent with the professional sales increase it achieved in the second quarter.

Despite my expectations that the benefit from inflation would moderate, the DIY business produced strong comparable store sales growth and top-line growth consistent with the first half of the year. Positive DIY ticket count comps in the third quarter and higher average ticket values have been the main drivers of the growth in DIY comparable store sales. In my opinion, I believe the high inflationary environment has been benefiting ORLY instead of putting pressure on its revenue. This reasoning stems from the fact that instead of taking on the payment for a more expensive, newer vehicle, customers have remained resolute and are still giving their current vehicles’ maintenance top priority.

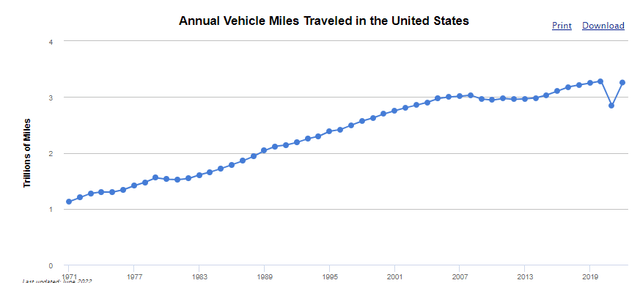

Moving forward, I anticipate that ORLY will keep up its current growth rate in the future. My optimistic outlook for ORLY is driven by management’s confidence that the primary factors driving aftermarket demand are in place to support steady growth going forward, including a steady recovery and miles driven and very favorable U.S. vehicle fleet dynamics. Additionally, consumers have shown resilience and are still placing a high priority on maintaining their current cars rather than taking out a loan for a more expensive newer model. I believe the persistent inflation is creating opportunities for ORLY to grow in the markets.

AFDC

Source

Valuation and risk

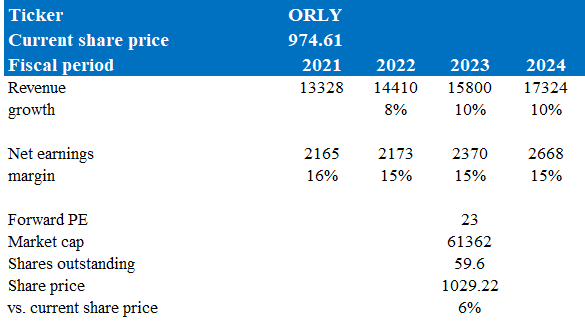

According to my model, ORLY’s target price is $1029 in FY24, representing a 6% increase. This target price is based on my growth forecast of 10% over the next two years, and these assumptions are in line with management’s FY23 revenue guidance provided during the earnings call. I believe ORLY is able to achieve this target because its third quarter result shows its resilience to macroeconomic challenges. In the face of high inflation and interest rates, ORLY still manages to grow its sales and EPS. The reason ORLY manages to achieve this is because of its business model, which focuses on DIY and repair. In a high inflation and interest rate environment, new cars are expensive, and the financing on them is also hefty. Instead of taking on the payment for a more expensive, newer vehicle, customers have remained resolute and are still giving their current vehicles’ maintenance and repair top priority. As of today, inflation is still above the Fed’s target rate of 2%, which resulted in a 22-year high interest rate of 5.5%. With no clear view of Fed’s lowering stance in sight, I expect this to continue to drive ORLY’s growth in the next 2 years.

Author’s valuation model

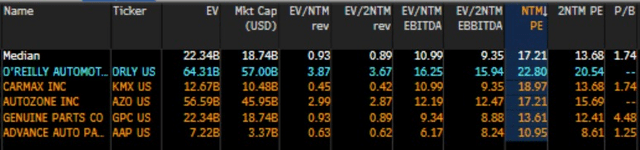

As of now, ORLY’s forward P/E stands at ~23x, surpassing its peer median of 17.21x. This higher multiple can be attributed to ORLY’s higher margins in comparison to its peers. ORLY boasts a net margin of 15%, higher than the peer median of 5%. Moreover, the ORLY EBITDA margin of 25% is also higher than the peer’s 14%. Lastly, in terms of growth outlook, ORLY dominates its peers with a growth rate of 10% vs. its peers’ 4%. Using ORLY’s present forward P/E, my target price for ORLY’s indicates a potential gain of 6%. Due to ORLY’s far better business financials than its peers, it seems like the market has already priced its strength in by giving it a higher forward P/E. To be conservative, I believe its 35% P/E premium is quite generous, and I am sticking to it. With a lack of margin of safety, I continue to maintain my hold rating for ORLY, despite it being a good-quality company that is able to ride the wave of inflation.

Bloomberg

One upside risk to my hold rating could be that inflation-induced demand for ORLY’s product far exceeds management guidance. Given that ORLY’s margins are surpassing those of its peers, if its upcoming results exceed expectations, it will cause its already high P/E to expand even further away from its peers. This is because higher revenue translates to even higher EPS, and its margins are far superior to those of its peers, which allows ORLY to generate higher EPS. In that scenario, there is potential to see the share price increase even higher.

Summary

In summary, ORLY reported strong third quarter 2023 results where both revenue and EPS grew. This is on top of a tough comparison in 2022. Although the hot weather has contributed to ORLY’s growth, it also saw growth in hard parts categories as well as maintenance categories. This is because instead of taking on the payment for a more expensive new vehicle, customers are giving their current vehicles’ maintenance top priority. Therefore, inflation, which is a headwind for most of the companies in the world, is actually benefiting ORLY. Currently, inflation and interest rates are still high, and there are uncertainties surrounding their future trajectory. I believe that the persistent inflation will continue to create opportunities for ORLY to grow in the markets.

Read the full article here