Investment Thesis

Pan American Silver (NYSE:PAAS) owns and operates gold and silver mines in the Americas. Across 9 operating facilities, PAAS produced 18.5 Moz of silver and 553 Koz of gold in 2022. With results in 2023 guiding toward almost 1 Moz of gold and 22 Moz of silver, we are expecting significant top-line growth.

However, the stock has significantly underperformed peers, with the value dilutive acquisition of Yamana, legal problems, and cost problems – all of which have driven down the sock. Now that PAAS has begun to offload non-core assets, we expect the higher margin of the gold business to put upward pressure on bottom-line results for PAAS.

Estimated Fair Value

EFV (Estimated Fair Value) = EFY24 EPS (Earnings Per Share) times PE (Price/EPS)

EFV = E25 EPS X P/E = $1.30 X 19 = $24.70

|

E2024 |

E2025 |

E2026 |

|

|

Price-to-Sales |

1.9 |

1.8 |

1.9 |

|

Price-to-Earnings |

16.1 |

11.7 |

10.2 |

Operations

For full year 2023, PAAS expects 21-23 Moz of silver and 870-970 Koz of gold. This represents an expected 19% increase year over year in silver production and a 63% increase year over year in gold production. AISC (All-in Sustaining Costs) are expected to be $14-16/oz of silver and $1,275-1425/oz of gold.

|

Silver Segment |

|||

|

Mine |

Location |

AISC (upper guidance $/oz) |

Silver Production (Moz) |

|

La Colorada |

Mexico |

$18.50 |

5.5 – 5.9 |

|

Cerro Moro |

Argentina |

$14.50 |

3.6 – 3.9 |

|

Huaron |

Peru |

$13.00 |

3.6 – 3.8 |

|

San Vicente |

Bolivia |

$17.50 |

14.1 – 15.9 |

|

Manantial Espejo |

Argentina |

$14.80 |

0.2 |

|

Gold Segment (9-month results based on the acquisition date of Yamana) |

|||

|

Mine |

Location |

AISC (upper guidance $/oz) |

Gold Production (Koz) |

|

Jacobina |

Brazil |

$1,110 |

144 – 164 |

|

El Penon |

Chile |

$985 |

600 – 770 |

|

Timmins |

Canada |

$1,800 |

130 – 141 |

|

Shahuindo |

Peru |

$1,470 |

134 – 146 |

|

La Arena |

Peru |

$1,690 |

98 – 106 |

|

Minera Florida |

Chile |

$1,850 |

62 – 74 |

|

Dolores |

Mexico |

$1,360 |

98 – 107 |

Company-wide sustaining capital is expected to be $305 – 320 million, with investment capital being around $100 million.

Development and Divestment

The development focus in the silver area is shifting to La Colorada Skarn, a primarily silver polymetallic deposit with 100% ownership adjacent to the existing mine. The existing La Colorada facility is the highest output asset PAAS has. Approval for full operation is expected to be achieved in 2H23, with expected operating guidance to be released simultaneously.

In the gold area, the most significant expansion is Phase 3 of the Jacobina mine. Currently producing around 150 Koz/year, the Phase 3 project has the potential to increase production to 270 Koz/year by 2025. Pre-acquisition, Yamana was targeting 350 Koz/year by the final phase of expansion.

To improve cost results, PAAS divested from 3 large assets deemed non-core: the MARA project in Argentina (56.25%), Morococha in Peru (92.3%), Agua De La Falda (57.74%) in Chile, and small equity shares in other assets which will yield cash proceeds of $593 million. While specific cost savings have not been released, we estimate this will save north of $25 million per year in recurring maintenance charges, and $60 million in potential reclamation charges. PAAS maintains precious metal royalty of 1.25% in Agua De La Falda and 0.75% copper royalty in MARA for the life of the mine.

In the gold area, La Arena II is an adjacent deposit to the existing mine, though the two projects would be separate. However, on the 2Q23 earnings call, management indicated that La Arena II would be a potential asset to be divested, given the development cost required for full operation and the desire for a lean balance sheet.

Dormant Mines and Risk

PAAS has two assets, which are in maintenance and non-production. Navidad in Argentina sits in an administrative district that bans open-pit mining. We feel it is unlikely that Navidad will ever escape legal challenges. With the last public legal update in late 2021, the $5 million yearly maintenance charge may not be worth the $200 million net value of the land. However, As silver prices increase due to secular tailwinds due to electrification, it may not be as politically popular as it is now to barricade development. If production were ever to start, it would nearly double PAAS’s mineral reserves, with an estimated 632 Moz contained within the deposit.

Escobal in Guatemala is undergoing an ILO 169 consultation, which has taken over a year. Escobal was previously one of the cheapest and highest-output silver mines in the world before production ceased in May of 2021. Negotiations are still ongoing as of 2Q23, and the Guatemalan Supreme Court has rejected the call for a permanent closure of the mine. While no timeframe is currently specified, the final phase of negotiations before it goes before the Guatemalan Supreme Court is underway. Previously, the mine produced 20 Moz of silver per year at $10/oz AISC.

The debt load has increased with the acquisition of Yamana, with PAAS inheriting 2 notes with an average interest of 5.52%. These notes mature within the next few years and represent some of the only long-term debt on PAAS’s balance sheet.

Outlook

Roughly 82% of global silver production comes from mining, with 18% from recycling. According to the Silver Institute, there will be a 142 Moz shortfall in silver supply in 2023. This will be exacerbated over time as global silver inventories are drawn down while demand in the industrial sector has sharply increased with electrification. Photovoltaic cell demand now represents 11% of global silver demand, with electronics representing 19%. All of these factors grew silver demand by 11% 3-year CAGR since 2020.

2Q23 was the final dividend under the old policy based on net cash on hand. The new policy details have not been announced yet. Still, the incremental reduction in maintenance cost with divestitures should ensure that the dividend is at least maintained at its current $0.40/year level, 2.64% yield. However, since the transaction for Yamana was value dilutive for PAAS, we expect that the new policy would carve out capital for share buybacks. PAAS will likely step away from growth for a time as it streamlines its portfolio and invests in expansion and efficiency in its existing assets.

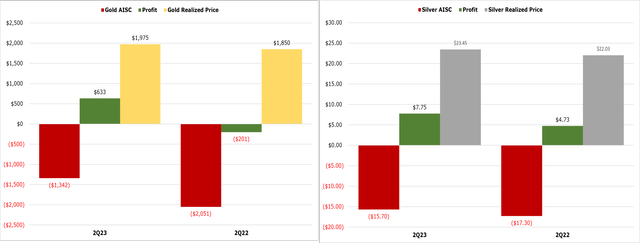

AISC costs year over year (PAAS, BuildingBenjamins)

Overall, operating results have significantly improved in 2Q23, including a significant reduction in AISC year over year. PAAS has been plagued with increased AISC in the wake of high levels of inflation globally and work stoppages in critical assets. We expect acceleration on AISC reduction with the shedding of non-core assets on the table and the potential reopening of Escobal.

While the company has faced challenges, it is moving toward a leaner portfolio with large increases in production expected for 2023. With global demand for precious metals increasing, PAAS represents a company with exposure to the broad precious metals market.

Read the full article here