Investment Thesis

Parker-Hannifin Corporation (NYSE:PH) is well-positioned to benefit from the strong demand in its aerospace as well as industrial business. The company’s Aerospace Systems segment is benefiting from a recovery in commercial aviation post reopening and increased defense spending due to rising geopolitical tension. Further, the Diversified Industrial segment should benefit from inventory destocking coming to an end and the upcoming reversal in the interest rate cycle next year in the North American business, and easier Y/Y comparisons in the international business. Moreover, the company has been strategically shifting its portfolio towards longer-cycle, secular growth markets targeting the recent reshoring trend, electrification, clean energy etc. which bodes well for its medium to long term revenue growth.

On the margin front, the company should see benefits from operating leverage on higher revenues, cost-cutting initiatives, and productivity gains resulting from investments in automation, robotics, etc. The stock is trading at a discount compared to its peers with aerospace and industrial exposure like Honeywell International Inc. (HON) and Eaton Corporation plc (ETN). Given the company’s good execution in terms of positioning its portfolio for longer-term growth and improving margins, I believe the company’s P/E multiple can continue to re-rate and drive the stock higher. So, I have a buy rating on the company.

Revenue Analysis and Outlook

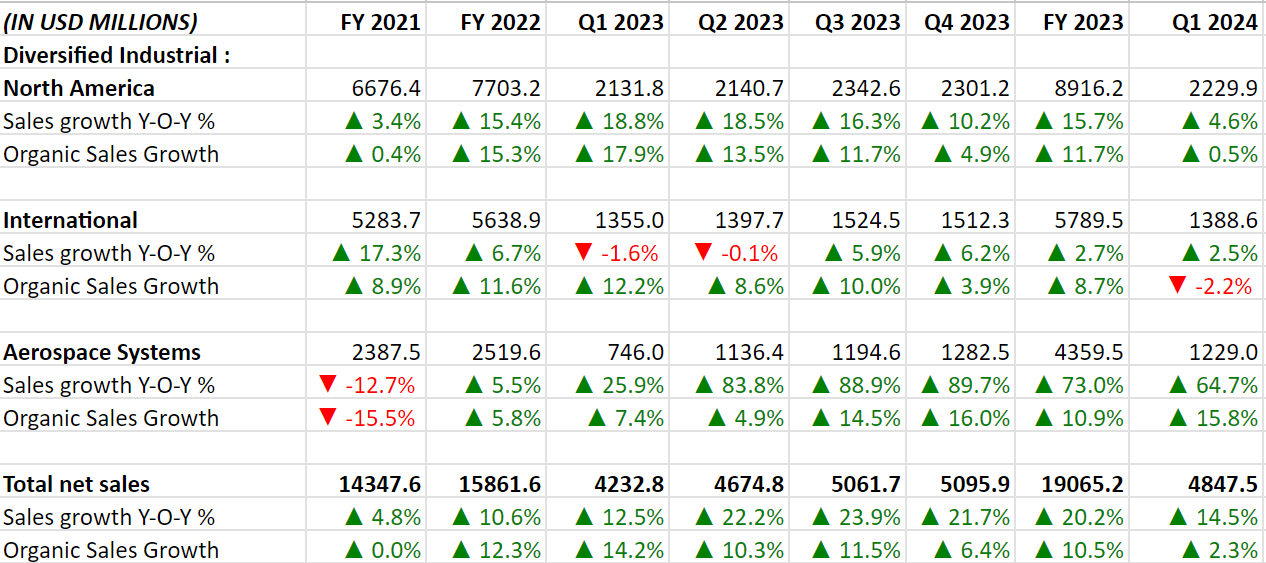

Over the last couple of years, PH’s sales growth benefitted from solid momentum across its Diversified Industrial and Aerospace Systems segments driven by good end-market demand and accretive acquisitions. The growth continued in the first quarter of 2024 and the company posted a 14.5% increase in net sales to $4.847 billion. This increase was attributed to a 2.3% Y/Y increase in organic sales, an 11.8% contribution from acquisitions, and a 1% favorable impact of FX translation which more than offset a 0.6% negative impact of divestiture of the MicroStrain sensing systems business and aircraft wheel and brake business.

The Diversified Industrial North America segment’s sales grew 4.6% Y/Y or 0.5% Y/Y organically driven by increased demand from distributors and end users across the oil and gas, material handling, cars and light trucks, and farm and agriculture markets which effectively offset the lower end-user demand in the refrigeration, engines, construction equipment, and life sciences markets.

On the International side, sales increased by 2.5% Y/Y. Excluding a 2.8% benefit from acquisitions and a 1.9% favorable impact of FX translation, sales declined 2.2% Y/Y on an organic basis as a result of lower sales in the Asia Pacific region more than offsetting higher sales in Europe and Latin America regions.

In the Aerospace Systems segment, sales surged by 64.7% Y/Y mainly due to a $386 million contribution from the Meggitt acquisition. On an organic basis, sales increased by 15.8% Y/Y aided by higher volume across all businesses, particularly the commercial and military aftermarket businesses.

PH’s Historical Revenue Growth (Company Data, GS Analytics Research)

Looking forward, the company’s revenue growth prospects look attractive. The company’s backlog was up 5.5% Y/Y at the end of the last quarter primarily driven by strength in the Aerospace Systems segment which saw its backlog up 17.3% Y/Y with 24% Y/Y growth in orders. The aerospace end-market is seeing strength across the board, including commercial and military, original equipment manufacturing, and MRO. The recovery in air travel after the reopening continues to take hold driving the need for both new planes as well as maintenance, and repair of existing planes. The backlog at Boeing (BA) and Airbus (OTCPK:EADSF) (OTCPK:EADSY) continues to remain healthy and they are ramping up production as the supply chain constraints ease. On the military side, the recent geopolitical developments like the Russia-Ukraine war and the conflict in Israel have resulted in increased focus on defense spending which is helping this market as well.

On the Industrial side, North American business is well-placed to benefit from recent reshoring trends and the government stimulus in the form of the CHIPS and Science Act and the Inflation Reduction Act encouraging this trend. While this business has been seeing some destocking in recent quarters which is impacting the company’s sales, the good news is the destocking headwind can’t continue forever and its impact should reduce as 2024 progresses. So, looking forward, inventory destocking ending, benefit from reshoring trend and government stimulus, and eventual reversal in the interest rate cycle should help accelerate the company’s growth in North America Industrial business.

On the International side, things are mixed with China continuing to be challenging while India, Southeast Asia, and Latin America are showing strength. Even if we don’t assume much recovery in China, I believe comparisons getting easier should benefit the segment Y/Y performance as the year progresses.

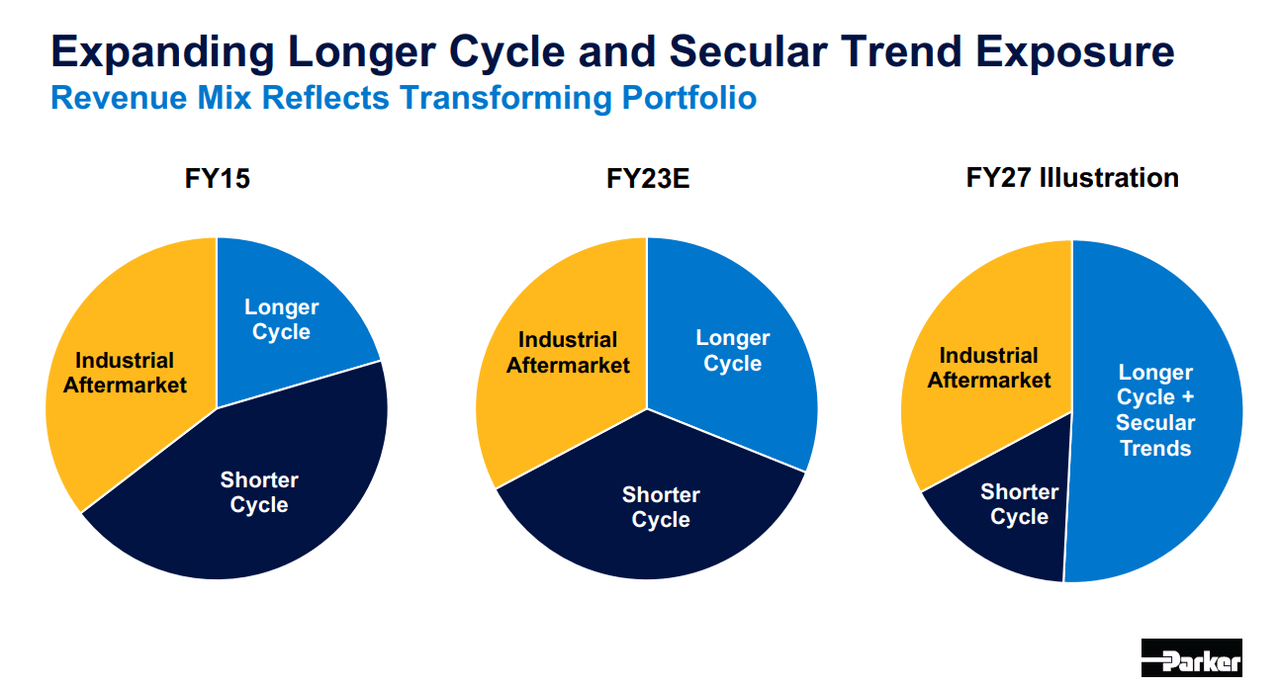

The company has also done a good job in terms of portfolio transformation and has steadily increased the longer-cycle sales mix over the last several years. The company continues to position its portfolio toward longer cycle markets benefiting from secular growth trends like electrification, clean energy, digitization, etc., which should help its growth in the medium to long term.

Parker-Hannifin’s Portfolio Transformation (Company’s Investor Presentation)

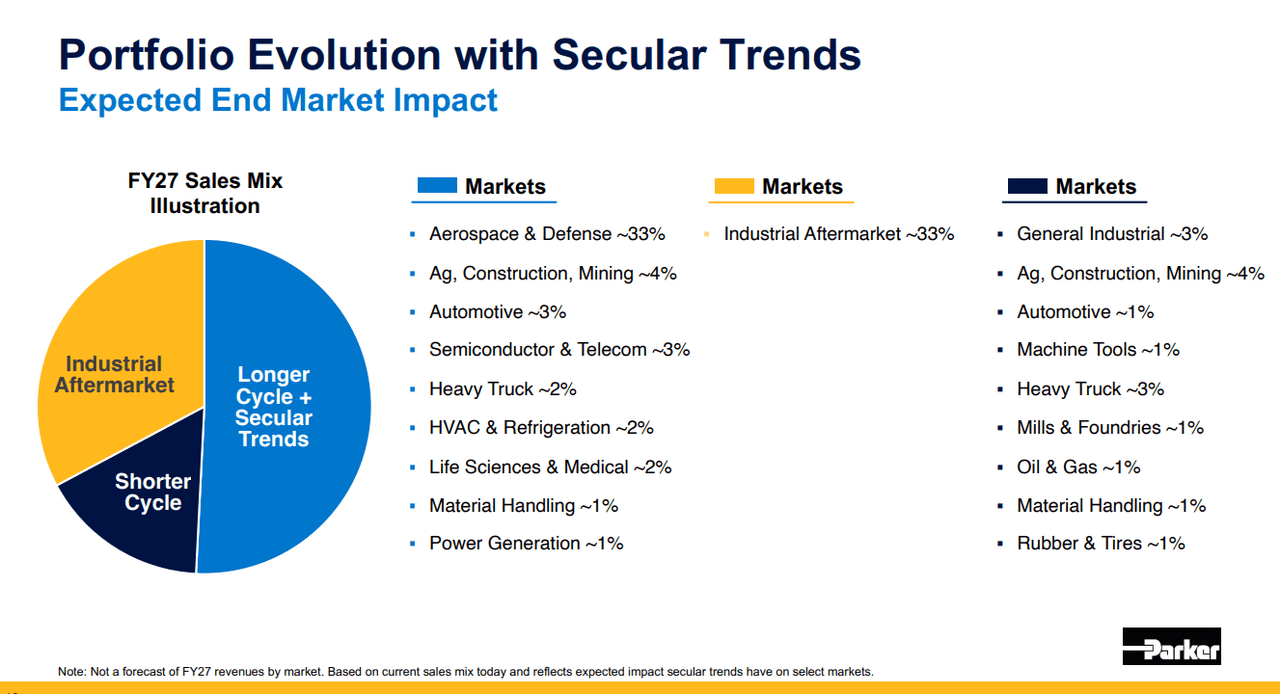

PH’s FY27 Sales Mix Illustration (Company’s Investor Presentation)

So, overall, I remain optimistic about the company’s near as well as long-term prospects.

Margin Analysis and Outlook

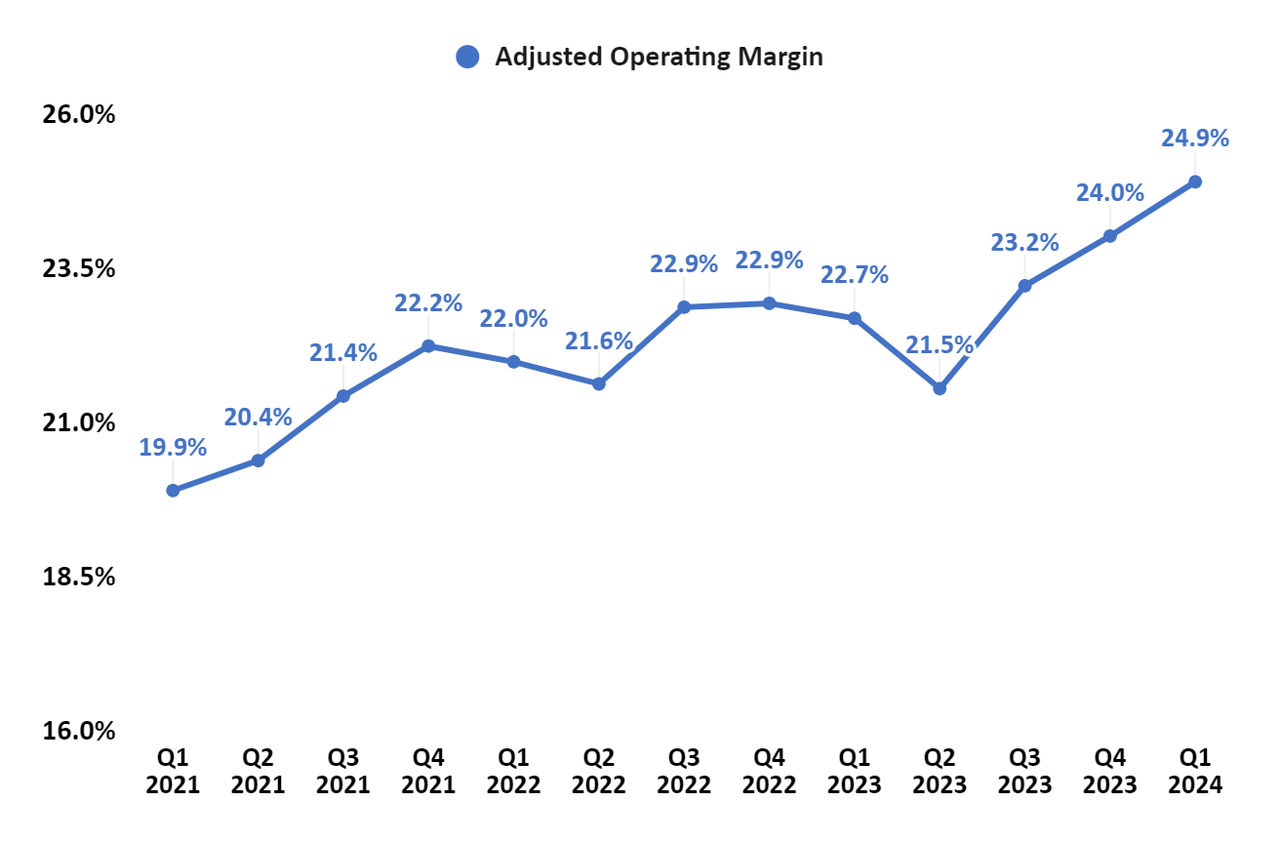

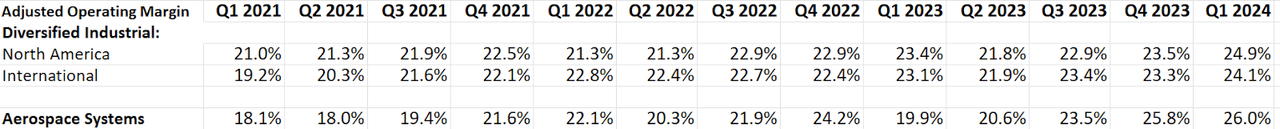

In Q1 2024, the company’s adjusted operating margin expanded by 220 bps Y/Y to 24.9% thanks to the benefits of cost containment initiatives under the Win Strategy, price increases, and favorable product mix.

Segment-Wise, the Diversified Industrial North America segment’s adjusted operating margin increased by 150 bps Y/Y while the Diversified Industrial International segment’s adjusted operating margin increased by 100 bps Y/Y. The Aerospace Systems segment witnesses an impressive 610 bps Y/Y expansion in its adjusted operating margin.

PH’s Adjusted Operating Margin (Company Data, GS Analytics Research)

PH’s Segment-Wise Adjusted Operating Margin (Company Data, GS Analytics Research)

Looking forward, the company’s margin outlook is positive. The company posted ~40% incremental margins last quarter and, with the positive revenue growth outlook, it should continue to benefit from operating leverage.

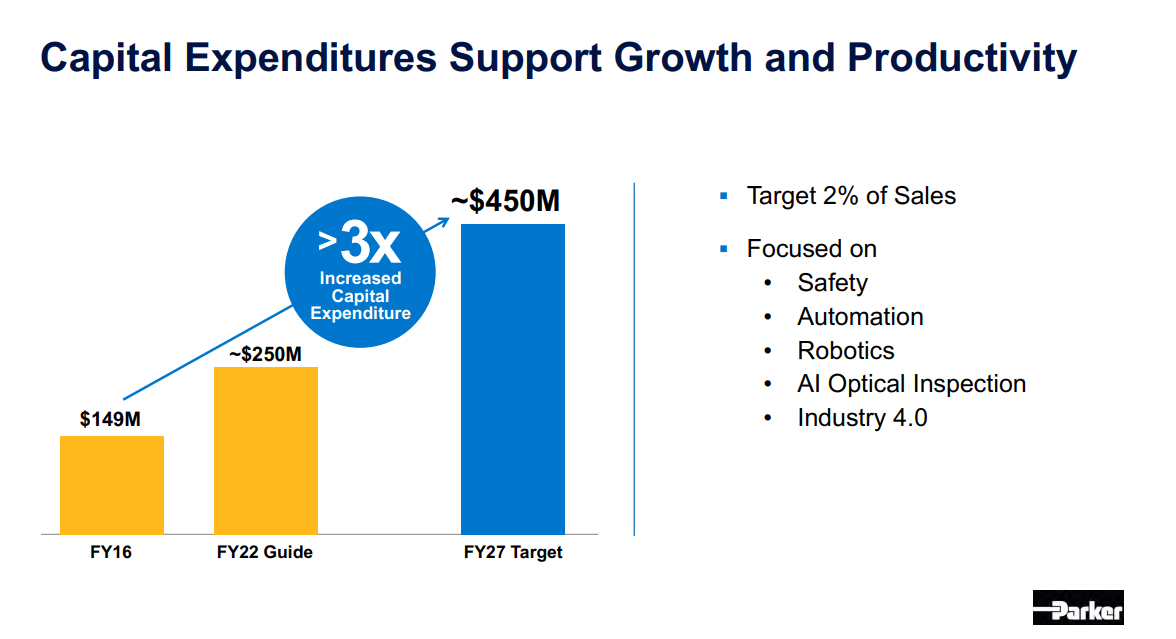

The company has also done a good job in terms of productivity and cost-cutting initiatives like implementing the 80/20 strategy and achieving synergy benefits from Meggitt PLC’s integration. Management is further investing in driving productivity and is focusing on automation, robotics, and AI which should further help drive margin expansion.

PH’s FY27 Capex target (Company’s Investor Presentation)

At its last Investor Day, management shared a ~25% adjusted EBITDA margin target for FY27. Given we are already very close to this target, I see a good potential for an upward revision in this target.

Overall, I remain optimistic about the company’s margin growth prospects.

Valuation and Conclusion

PH is currently trading at 19.92x FY24 (ending June) consensus EPS estimates and 18.29x FY25 consensus EPS estimates. While this is higher compared to the company’s average forward P/E of 17.30x over the last five years, the company’s portfolio positioning and margins have also meaningfully improved compared to what it was earlier. So, I believe this higher multiple is justified. I see a further potential for re-rating as its peer companies with aerospace and industrial exposure like Honeywell and Eaton are trading at a P/E multiple in the low to mid 20s.

I like the company’s near-term and long-term revenue growth potential fueled by healthy backlog levels, strength in its Aerospace Systems segment, inventory destocking ending in the North America Industrial Business, the upcoming reversal in the interest rate cycle, easier comps in the international industrial business, secular demand trends including recent reshoring trend, electrification, etc., and government stimulus programs like the CHIPS and Science Act and IRA. The margins should also expand with the help of operating leverage on higher revenues, cost-cutting initiatives, and increased productivity-related capex. Moreover, the company has done a good job in terms of positioning its portfolio for longer-term growth and improving margins. Hence, I believe the PH’s stock is a good buy at the current levels.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here