Stacks of U.S. $100 banknotes.

Given that my dividend growth stock portfolio consists of over 100 individual stocks, it’s safe to say that I’m a major believer in the concept of diversification. But with my top 10 holdings contributing to 21.5% of my net annual forward dividend income, I do have some especially high conviction picks in my portfolio.

Comprising 2.6% of my total dividend income, Philip Morris International (NYSE:PM) is my third largest holding by dividend income. Perhaps it’s not surprising then to learn that PMI was also one of my five top picks in my first month at Dividend Kings.

For the first time since March 2021, let’s dig into PMI’s recent operating results, balance sheet, and valuation to understand why I’m so bullish on the stock.

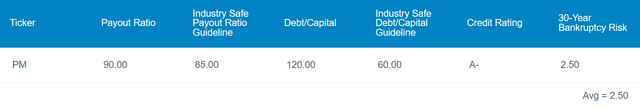

DK Zen Research Terminal

Even with the risk-free rate near 5%, PMI’s 5.9% dividend yield is attractive in this environment. The company’s 90% EPS payout ratio is a bit higher than the 85% that rating agencies prefer from tobacco companies. However, I’ll show why that isn’t a big problem as the article progresses.

At double the rating agency preference of 0.6, PMI’s debt-to-capital ratio is elevated. But thanks to its immense profitability and robust growth prospects, S&P is confident enough to award an A- credit rating to the company. That suggests the 30-year bankruptcy risk for PMI is just 2.5%.

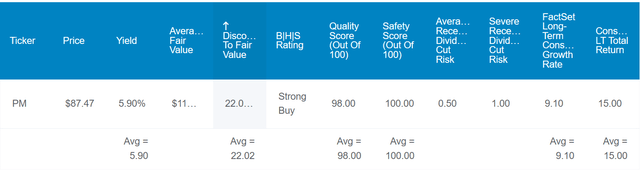

DK Zen Research Terminal

The company’s intrigue doesn’t end there, either. PMI is trading well below fair value. By virtue of historical fair values using metrics like dividend yield and P/E ratio, Dividend Kings assigns a fair value of $112 a share to PMI. For context, from the $92 share price (as of November 3, 2023), that implies PMI is trading at an 18% discount to fair value.

I come out to a similar fair value with my inputs into the dividend discount model. Based on its current $5.20 annualized dividend per share, a 10% discount rate, and a 5.25% long-term annual dividend growth rate assumption, I compute a fair value of approximately $109 a share.

Averaging out these two fair values, I get a fair value of $111 a share. That suggests PMI’s shares are 17% discounted relative to fair value. If the company grows as anticipated and reverts to this fair value, here is what its annual total returns could look like over the next 10 years:

- 5.7% yield + 9.1% FactSet Research annual growth consensus + a 1.9% annual valuation multiple boost = 16.7% annual total returns or a cumulative 368% total return versus the 10.1% annual total return potential of the S&P 500 (SP500) or a cumulative 162% total return

The Future Belongs To Philip Morris International

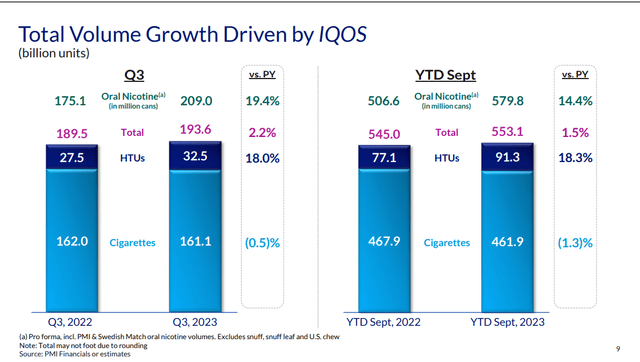

PMI Q3 2023 Earnings Presentation

Led by the heated tobacco IQOS brand, Marlboro cigarette brand, and Zyn nicotine pouches brand, PMI and its remarkable brand portfolio delivered a respectable third quarter.

The company’s total shipment volume for cigarettes and heated tobacco units edged 2.2% higher year-over-year to 193.6 billion for the third quarter. As one would expect from the global cigarette industry, PMI’s total cigarette volume fell. Though, this 0.5% drop in volume to 161.1 billion units during the quarter was rather marginal.

That was easily offset by an 18% growth rate over the year-ago period in HTU volume to 32.5 billion units in the third quarter. This double-digit volume growth rate in HTUs largely coincides with the 15.6% year-over-year growth rate in total IQOS users to 27.4 million for the quarter.

Zyn’s global shipment volumes surged 19.4% higher over the year-ago period to 209 million cans during the third quarter. This was mostly driven by a staggering 66% growth rate in the U.S. to 105.4 million cans. Along with the more favorable pricing on its smoke-free products, that explains how total net revenue grew at a solid 9.3% rate to $9.1 billion during the third quarter.

As more cigarette smokers shift to smoke-free products, PMI’s share of smoke-free revenue should only climb from its 36.2% rate as of the third quarter. This is why the company has set the goal of deriving at least 2/3 of its 2030 net revenue from higher margin smoke-free products by 2030.

PMI’s currency-neutral adjusted diluted EPS roared 20% higher to a record quarterly high of $1.67. In light of higher volume and the more favorable margins of its smoke-free products, this huge earnings growth shouldn’t be a surprise. After this blowout quarter, it also shouldn’t be a shock to learn that the company upped its currency-neutral adjusted diluted EPS guidance from the previous outlook of 8% to 9.5% to 10% to 10.5% for 2023 (all details in this section according to PMI Q3 2023 Earnings Press Release and PMI Q3 2023 Earnings Presentation).

PMI can also cover its financial obligations well from earnings. This is supported by the company’s interest coverage ratio of 11 through the first nine months of 2023 ($8.6 billion in EBITDA/$788 million in net interest expenses per page 4 of 128 of PMI’s 10-Q filing).

Dividend Growth Should Accelerate Soon

PMI’s most recent 2.4% dividend increase doesn’t jump out if you’re a dividend growth investor. But the company’s dividend growth looks set to meaningfully accelerate shortly.

This is because PMI generated $9.7 billion in free cash flow in 2022. Compared to the $7.8 billion in dividends paid during that time, this equates to a manageable 80.3% payout ratio (details sourced from pages 78-79 of 241 of PMI’s 10-K filing).

Now that the company is significantly bearing the fruits of its smoke-free investments in recent years, earnings growth is accelerating. This will also trickle down to PMI’s free cash flows, which is why I would be stunned if dividend growth didn’t start coming in at around 5% annually in another year or two.

Risks To Consider

PMI is a world-class business, but it has risks that it must properly manage just like everybody else.

Of particular concern for PMI and its industry peers, regulatory risk is perhaps the most meaningful. This is while the company has received more favorable taxation of its reduced-risk products around the world, it could change at any time. That could weigh on profit margins for RRPs.

As a highly profitable business, PMI is also naturally the target of quite a few lawsuits. In Brazil, Canada, and Nigeria, these lawsuits are seeking damages in the billions of U.S. dollars. If the company receives an unfavorable outcome in these lawsuits, earnings and free cash flow could be adversely impacted temporarily.

Finally, PMI operates in a highly competitive industry. Although the company has been very successful in meeting the adapting preferences of consumers so far, this may not be the case indefinitely. If PMI doesn’t keep up with consumer preferences, the company could lose market share. That could hurt its growth prospects.

Summary: Philip Morris International Offers High Income And Growth Potential At A Cheap Valuation

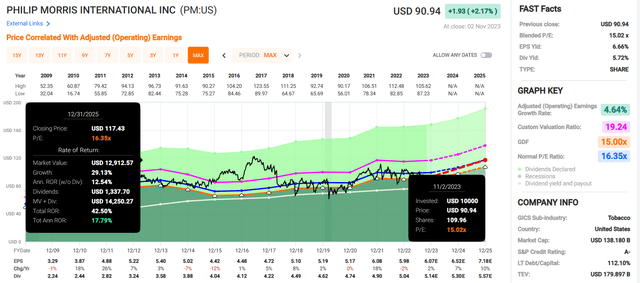

FAST Graphs

At first glance, PMI’s current blended P/E ratio of 15 versus its 16.4 historical blended P/E ratio would make you think it’s not a bargain. But considering that the company’s fundamentals have arguably never been stronger than they are now, I don’t think a slight premium to its historical valuation is out of the question.

Regardless, even just assuming a reversion to its historical valuation, PMI could generate 18% annual total returns for shareholders at the current share price through 2025.

This makes the stock an interesting pick for both the near term and the long term. That’s why I am very bullish on PMI and would be buying even more right now if I wasn’t building up my liquidity to strengthen my balance sheet.

Read the full article here