This article is a follow-up to my coverage of Pilbara Minerals (OTCPK:PILBF). There are two stories crisscrossing here. In the short term, the price of lithium has suffered more than I anticipated. I expect that there is further price downside in the short term and this very well may affect their share price in the next quarter or two.

However, Pilbara is investing in the future. Their many expansions are underway, and the company is positioning itself to capitalize well on the future. I believe that the underlying demand for lithium will drive a rebound in the price and Pilbara will be in a strong position when this happens.

I rate this company a hold for now, as I think that Pilbara has at least one more quarter of pain.

The Price of Lithium

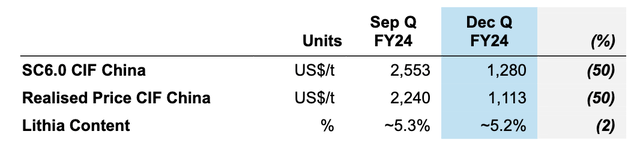

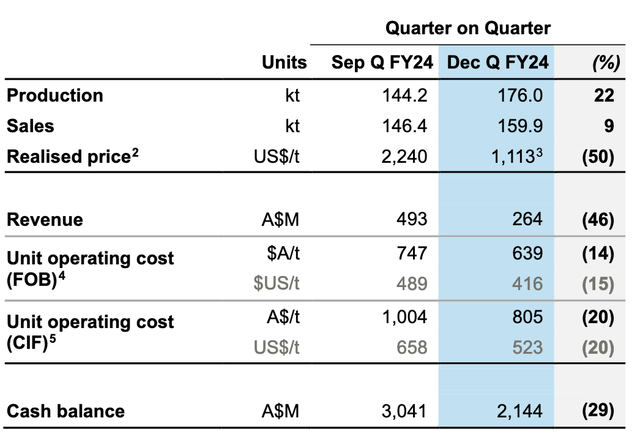

The price of lithium has fallen very fast in the past twelve months. Their realized price this quarter was $1,280 on an SC6 basis ($1,113 on their SC5.2 basis), 50% down from the last quarter. This is down 80% from a year ago when their price was $6298/t.

Pilbara Lithium Prices (Pilbara Quarterly Report)

The price of lithium has been falling for about a year now. On the call, the CEO confirmed they are selling even lower in the current quarter.

The pricing indicators at the current market, I would agree with you it’s anywhere in the range of US$800 to US$900 of what we’re seeing from the price reporting agency.

The 2023 Lithium Market

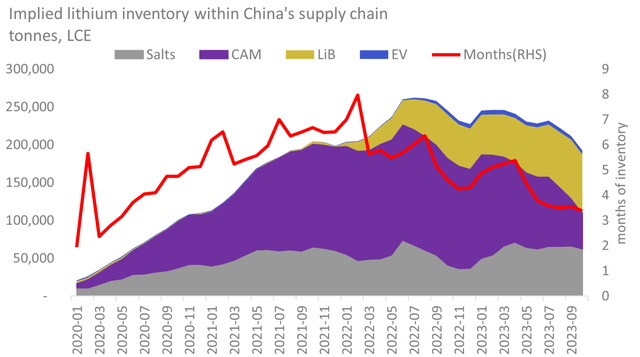

The price of lithium has fallen for some reasons. Fundamentally, I believe that two large swing factors have made the price of lithium unsustainably low. The first has been destocking. As the price of lithium has been falling, lithium producers and battery makers have opted to draw down their inventories of lithium, rather than buy more lithium in the hopes that the price will be lower tomorrow. We are probably, close to the end of the destocking cycle.

Lithium Destocking (Fastmarkets)

The second short-term reason the price came down has to do with supply. There were several sources of new supply, but not all supply was created equal. New high-quality mines, like Sigma Lithium (SGML) came online. These mines have added to the supply. However, these mines take 4–8 years to build and were not built in response to the rise in lithium price. There have also been sources of marginal supply.

The high prices of 2022–2023 incentivized low-quality supply sources, like lepidolite and DSO from Africa. These sources flooded the market with a kind of short-term supply, which is higher cost. When the price of spodumene is $3000-5000/t it is economical to ship DSO from Africa to China. When the price of spodumene is $1000/t it is not. As the price has fallen much of this marginal supply has come offline.

The 2024-25 Lithium Market

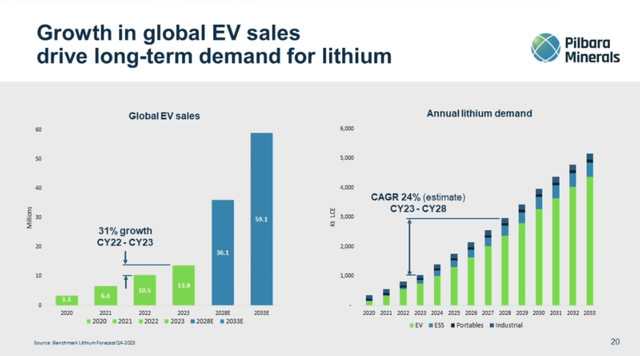

While I cannot predict the exact price moves, I have good faith that the price will turn around. The demand for lithium continues to grow, with both EVs and ESS growing. To quote Pilbara CEO Dale Henderson

At the industry level, despite the downward trend in pricing over the past year, signs of grassroots growth remain very positive. Noteworthy facts in this regard include global EV sales increased 31% on the prior year, as seen on the left-hand side of the graph. As it relates to China, the December quarter set all-time records for EV sales. In ’23, China EV sales were up 37% on the prior year. For the December quarter, China EV penetration rate was 38%, 5% year-on-year from the prior year. And as it related to the December, sales totaled 1.1 million units, giving a penetration of rate of 41%. So, very strong signs of the uptick of this important demand market for lithium.

Global EV Growth (Pilbara Quarterly Report)

He went on to speak about the global support for EVs that governments of the world are showing.

Noteworthy news here included the South Korean government on 13th of December, committing US$29 billion over 5 years for local battery companies in critical minerals. The European Commission on the 6th of December noted they’re planning on additional funding to the tune of EUR 3 billion in battery manufacturing and then the U.S. government on 15th of November, providing up to US$3.5 billion for cell manufacturing. So, big looks of cash going in to fuel the establishment of this growth industry.

So the demand should be strong and growing for the long term. In the short term, there are threats to the supply. If prices remain low then the announced supply may not come online. One example of this is the situation of Liontown Resources (OTCPK:LINRF). They have a tier-one asset in a tier-one jurisdiction, and yet the banks that were funding the construction have terminated their debt package. If this tier-one producer loses their funding, it stands to reason that potential developers like Latin Resources (OTCPK:LRSRF) or Atlantic Lithium (OTCQX:ALLIF). Even more so for expensive DLE projects like Standard Lithium (SLI) and E3 (OTCQX:EEMMF).

Further, at current prices current producers will become unprofitable and either slow down production or go into care and maintenance. Core Lithium (OTCPK:CXOXF) has gone into care and maintenance. The Greenbushes mine is slowing down production. Albemarle is also laying off employees.

All this is to say, at the current prices, the future supply and even the current supply is under threat. We are now in a pain period where only the low-cost producers will make any profit.

The question is, how long will this last? I don’t know. My best guess is that because of the fast-growing lithium demand the low price will last months rather than years. We could see the beginning of a turnaround in the fall of this year, accelerating until mid-2025.

Pilbara is Still Making Money

Though the lithium price has fallen a lot, Pilbara is still making money. Their costs came down from the last quarter, for two reasons. First, they are paying less royalties (reflected in CIF). Second, they have been ramping up P680 and this is almost done. As they increase production they should increase operational efficiencies. Though the price of lithium was $1,113, their CIF was $805, so they still had a 38% margin.

Pilbara Quarterly Results (Pilbara Quarterly Report)

They sold 159.9 kt of spodumene concentrate with a revenue of AUD 264 million. They made AUD 176 million in cash from operations, which is still a healthy margin. They also shipped 19kt of tantalite, which they had been stockpiling for a rainy day.

I guess that Pilbara will still make a profit as long as they sell spodumene above $700/t. Around that price, they might have to go into care and maintenance.

Pilbara is Solvent

The company is sitting on a lot of cash. In the last quarter, they paid a large one-off tax payment of AUD 758M. They also continued their major CAPEX projects with AUD 222 million including AUD 120 million P680 and P1000, as well as AUD 26 million for sustaining capital.

The company is sitting on AUD 2.1 billion, so it should be able to pay its quarterly CAPEX for at least ten more quarters before they are in any trouble.

The company has announced a few capital-saving measures while the price of lithium is low. They have suspended their dividend. They are deferring, “non-essential new projects and enhancements.”

Pilbara is Focused on Growth

While the price of lithium is low, the company continues all its growth projects. This focus is a vote of confidence that they believe the price of lithium will recover.

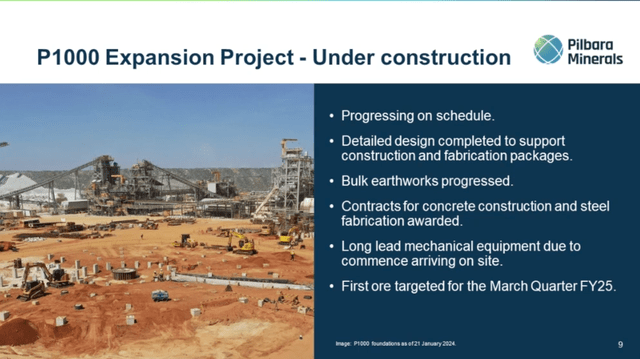

Pilbara is expanding its spodumene production with the P680 and P1000 projects. They are expanding from a run rate of around 500 kt to 1,000 kt in a few years.

P1000 (Pilbara Quarterly Presentation)

Pilbara is also expanding into midstream and downstream production. Their lithium hydroxide JV with POSCO has just finished the first train and is starting production.

In two years the company should be a spodumene giant with some real lithium chemical capacity making them an integrated producer.

Conclusion

I think this is a great company that can weather the downturn. The price cannot stay this low for too long, but it might stay low for months. Pilbara is a low-cost producer and is well-capitalized. They are at no risk of default and most likely won’t go into care and maintenance.

When the price of lithium turns, so will the shares of Pilbara, in my opinion. I believe the only question is when. The shares of PILBF are around $2.20 (USD) on the OTC. I would say that anything below $2.00 is a great price for this low-cost producer.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here