Quantum-Si Incorporated (NASDAQ:QSI) aims to democratize next-generation protein sequencing technology for global laboratory use. Their unique approach to proteomics promises to provide thorough and impartial data. This technology is being marketed as a catalyst for expediting scientific research, identifying novel biomarkers, and supporting the creation of innovative treatments and diagnostic procedures.

Having previously analyzed Quantum-Si, it seems pertinent to reassess the company in light of recent commercial advancements in its Platinum product.

Recent developments

Quantum-Si’s recent launch of “Platinum,” a pioneering protein sequencing platform, marks a key entry into the market. Additionally, the company’s strategic move to enhance its Board of Directors by recruiting three Independent Directors, each possessing senior-level (CEO or CFO) experience in sectors such as life sciences, medical devices, diagnostics, and biotechnology, reflects a deliberate effort to infuse diverse, high-caliber expertise in the precise moment the company needs to significantly scale its sales.

In a significant operational shift, Quantum-Si has transitioned its approach to manufacturing reagents and consumables. Previously reliant on external sources, the company has now shifted towards a predominantly in-house production model. This move is designed to fortify the company’s command over the quality and cost of these essential components, a strategy anticipated to bolster gross margins as Quantum-Si scales its operations.

Commercial endeavors

Quantum-Si’s strategic focus is on the commercialization of its Platinum platform and the innovative 2M Chip, technologies known for addressing unmet needs in the market. In a significant move, Quantum-Si showcased the practical application of the Platinum platform through a webinar in October, featuring firsthand customer data. Dr. Tullman-Ercek of Northwestern University, who leads a lab specializing in protein engineering, presented this data, demonstrating how the Platinum platform was instrumental in her lab’s research on engineered proteins, including the study of secreted protein variants. The webinar highlighted specific applications such as protein barcoding and linking genotype-phenotype in proteins.

The discussion also underscored the time efficiency advantages of the Platinum workflow in laboratory settings, emphasizing one of Quantum-Si’s product’s core benefits: enhancing research efficiency. An upcoming milestone for Quantum-Si is the anticipated submission of the first customer-generated manuscript based on their technology for publication. This event is crucial, as peer-reviewed research can substantiate the technology’s effectiveness and practical utility, potentially elevating its standing and attractiveness in the market.

Quantum-Si chose a controlled commercial approach to Platinum, as it gears up for a full-scale launch in early 2024. This phased launch approach likely entails selective distribution and application of the product, allowing for comprehensive feedback collection and product refinement prior to a broader rollout.

R&D Reprioritization

In its strategic review, Quantum-Si critically assessed the Carbon program and, following an in-depth evaluation opted not to pursue the commercialization of the Carbon Instrument. This decision was informed by customer feedback, which indicated that the Carbon technology did not play a crucial role in the effective deployment of their platform.

Shifting focus, Quantum-Si has pinpointed several key areas for enhancement within their current technology suite. These enhancements target library preparation kits, sequencing reagents, and chips, with the objective of boosting sequencing output per sample, increasing coverage, and strengthening the overall workflow efficiency from library preparation to sequencing outcomes.

This strategic pivot underscores Quantum-Si’s commitment to refining and advancing existing products, rather than diverting resources into developing new technologies that may not yield significant impact in the near to medium term. In line with this approach, Quantum-Si is gearing up to introduce an advanced iteration of their kits (Version 2) in the first quarter of 2024. This updated version is designed to further refine their technology, enhancing its adaptability across diverse sample preparation methods, sample types, and specific proteins of interest to their clientele.

Financials

During the 3Q23 earnings call, Quantum-Si’s management team conveyed assurance in their financial trajectory, stating that the current capital reserves are projected to sustain operations until 2026.

Focusing on the revenue front, Quantum-Si reported a third-quarter revenue of $223,000 for 2023, attributed to two primary sources: sales of the “Platinum Instrument” and associated consumable kits. The gross profit for the same period stood at $108,000, translating to a gross margin of 48%. Given the company’s nascent stage in commercialization, fluctuations in gross margin are anticipated. Factors influencing these fluctuations include the sales mix (instruments versus consumables) and the timing of these sales.

Quantum-Si’s total operating expenses for the third quarter, calculated on a GAAP basis, were $27.3 million, a slight decrease from the $27.7 million reported in the third quarter of 2022. Notably, this marginal increase in operating expenses occurred despite an escalation in commercial operations activities, indicating efficient cost management.

For the year-to-date period ending in September 2023, the company’s adjusted total operating expenses were $72.6 million, down from $77.9 million for the same period in 2022, marking a substantial reduction of $5.3 million.

Valuation & Risks

In my prior analysis, I extended Quantum-Si’s forecast horizon to 2029, acknowledging the challenges in accelerating sales. At that time, I noted that while the company presented an intriguing risk/reward dynamic, this extended timeline significantly tempered the expected annual returns. Additionally, the path to commercial adoption is fraught with concentrated risks, with numerous factors having the potential to significantly impact the company’s trajectory.

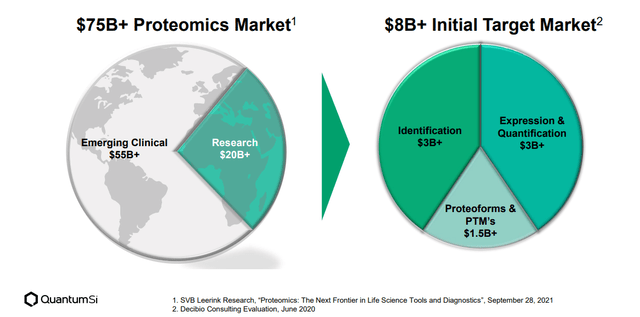

It’s crucial to recognize, however, that Quantum-Si is currently targeting an initial market estimated at around $8 billion. This target market size is substantial and should be factored into any evaluation of the company’s potential and long-term prospects.

Quantum Si

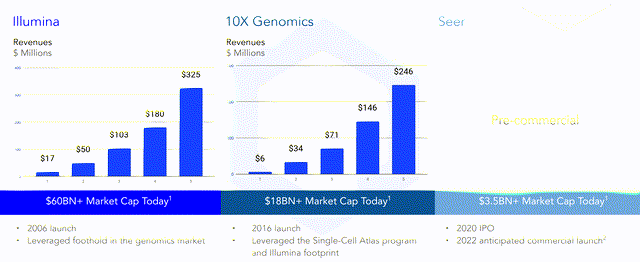

The critical uncertainty surrounding Quantum-Si’s future hinges on the extent of revenue growth achievable by 2029. In my evaluation, the prospect of the company reaching a revenue mark in the triple-digit millions, although currently appearing ambitious, remains within the realm of possibility. However, it’s important to note that product launches in the gene sequencing industry often exhibit steep growth trajectories, typically unfolding over a span of half a decade.

Historical precedents, such as Illumina’s experience, illustrate this pattern. Illumina successfully escalated from modest beginnings to a hundred million dollar revenue business within a three-year timeframe.

Quantum Si

When assessing Quantum-Si’s valuation, a key factor to consider is the evolution of shareholder dilution. To gauge this, we need to understand the company’s cash burn rate. By adjusting the current net income for depreciation and stock-based compensation, and then annualizing it, we arrive at an estimated cash burn of $85 million for 2023. Utilizing this figure, we project that Quantum-Si has sufficient cash to sustain operations until the end of 2026. The management’s slightly more conservative view suggests they are anticipating potential, though short-lived, cost increases due to the ramp-up in production.

Using the $85 million annual cash burn rate as a baseline, we can estimate that Quantum-Si will need to raise approximately $255 million between 2027 and 2029. Based on the current share price, this would translate into the issuance of roughly 136 million new shares. This is a rough estimate, omitting several variables that could influence the final figure. Notably, it doesn’t account for the possibility of the company reducing its cash burn by 2029, which seems likely if they successfully scale production and increase consumable sales.

Interestingly, this projected dilution is lower than my previous estimates. My earlier calculations were perhaps too pessimistic, and the stock price has shown some recovery since then, which also helps.

Quantum-Si’s trajectory may be at the onset of an S-curve, which could either realize or fall short of the management’s $186 million revenue target. At this juncture, it represents a high-risk, high-return investment. The outcome will largely depend on execution and the final appeal of their offerings. So far, the current product seems to be gaining traction.

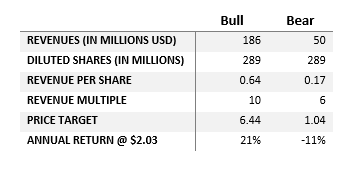

Revisiting my scenarios, the bullish projection for 2029 envisions Quantum-Si achieving $186 million in revenues with a share count close to 289 million. This scenario would yield a sales multiple close to 10, akin to companies like PacBio. The bearish scenario, on the other hand, anticipates a slower ramp-up, with the company reaching $50 million in revenue by 2029 and the same share count, but at a lower sales multiple of 6.

Author’s computations

To contextualize these scenarios, if these scenarios are well-calibrated, the implied likelihood of the bullish scenario for Quantum-Si materializing is roughly 1 in 5. This probability is considerable, given the substantial scaling the scenario entails. However, it’s important to note that if Quantum-Si demonstrates a significant revenue increase next year, similar to the rapid ascents seen in cases like Illumina, the market is likely to quickly adjust its valuation of the company. In such a scenario, a surge in the share price to around $3 would not be surprising.

Despite this potential, my current investment stance on Quantum-Si remains cautious. I already hold a small position in this stock, which is fundamentally characterized as a high-risk/high-return investment. Given this positioning and the inherent uncertainties involved, I do not plan to increase my stake at this moment. Thus, my recommendation on Quantum-Si’s stock, for now, is to maintain a ‘hold’ rating. This stance will be revised in the following quarters, as their ability to execute becomes clearer.

Read the full article here