It is not an easy time for RBB Bancorp (NASDAQ:RBB), in fact for the third consecutive month the price per share continues to plummet. The $9 per share reached at the peak of the banking crisis at the beginning of the year is still distant, but the downward trend may not be over yet.

Last week Q3 2023 was released, and although estimates were beaten, the price per share slumped further:

- Normalized EPS was $0.62, beating analysts’ estimates by $0.13.

- Revenues were $35.13 million, beating analysts’ estimates by $2.70 million.

There are several issues of concern to investors and in particular the unexpected sharp compression of NIM.

NIM compression and doubts about the cost of deposits

Over the past few quarters, RBB Bancorp has gone through a process of de-leveraging, reducing its exposure to all those loan categories that might experience difficulties in an environment of high interest rates for longer. In fact, this resulted in a major reduction in the loan-to-deposit ratio: from 110.7% at the end of 2022 to 97.6% today.

This approach helped the bank protect it against future loan losses; however, it negatively impacted its profitability. In fact, not having replaced maturing loans with others at current market rates resulted in a reduction of the net interest margin by as much as 50 basis points compared to the previous quarter. Also impacting, among other things, was the rising cost of deposits.

In other words, having strengthened the balance sheet had a major cost in terms of earnings.

RBB Bancorp (RBB) Q3 2023 Earnings

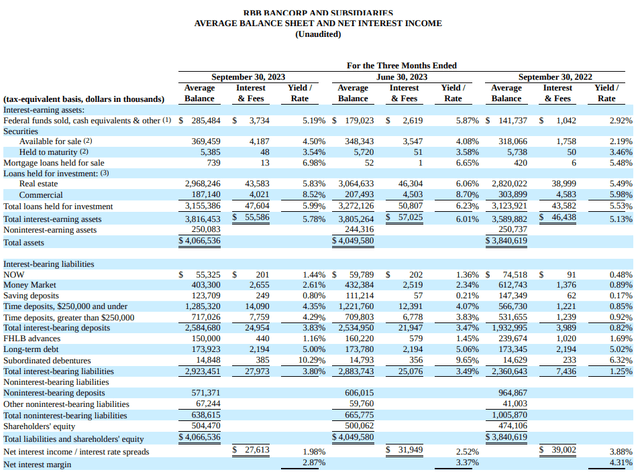

As we can see from this image showing the average values of the balance sheet, the net interest margin has decreased from 3.37% in Q2 2023 to the current 2.87%. This is a negative result since the average NIM of peers is 3.15%.

It is rather paradoxical to note that the average yield of total loans went from 6.01% in Q2 2023 to the current 5.99%. Typically, in a rising interest rate scenario, the average loan yield tends to increase, yet in this case it did not because of the de-leveraging strategy discussed above. At the same time, total interest-bearing deposits did not stop their growth and increased by 36 basis points.

Overall, compared to last year, the net interest margin has plummeted by 144 basis points, and this is probably not the end of the story. According to CFO Alex Ko’s expectations, there is room for another drop in Q4 2023:

Our net interest margin actually compressed this quarter actually more than what we expected in the second quarter, and the reason for the larger compression was due to our de-risking strategy, as David mentioned. There was a large amount of payoff and paydown, especially payoff for the second quarter, but the level of the payoff came down in the third quarter. As an example, $165 million paid off in Q2. Now we’re still at $36 million payoff in the third quarter, and I would expect there is one large loan that will be paid off in the fourth quarter that will have a higher interest rate. It will maybe impact a little bit negatively to further compress loan yield and net interest margin, but that’s the only one that I think will have a negative impact on the loan yield and margin.

Regardless, a 50-basis point compression is not expected as in this quarter. The bottom may be near, but doubts remain about the cost of deposits.

RBB Bancorp (RBB) Q3 2023 Earnings

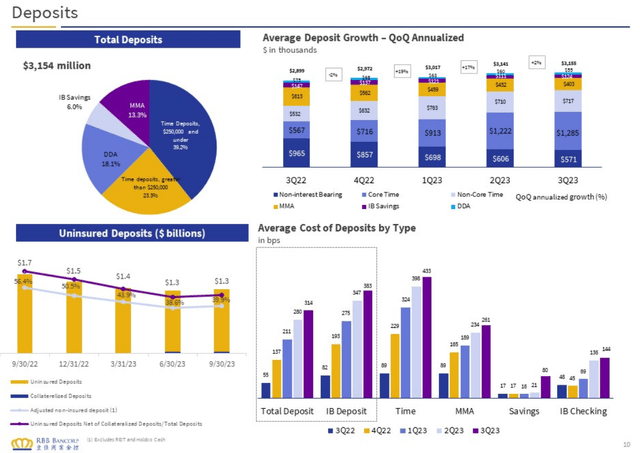

As we can see from this image, non-interest-bearing deposits continue to decline quarter by quarter. Compared to last year there was a decrease of $394 million.

In a sense this is an improvement over the previous quarter since this decrease is slowing down, however, we do not know when it will cease. Some peers have already seen a slight improvement in non-interest-bearing deposits, so RBB Bancorp seems to be falling behind the competition. Moreover, the reduction in non-interest-bearing deposits has been offset by far more expensive core time deposits. The latter have an average cost of 4.33 percent and their cost may continue to rise in the months ahead. In just one year their weight in total deposits increased from 20% to 41%.

Capital ratios and shareholder remuneration

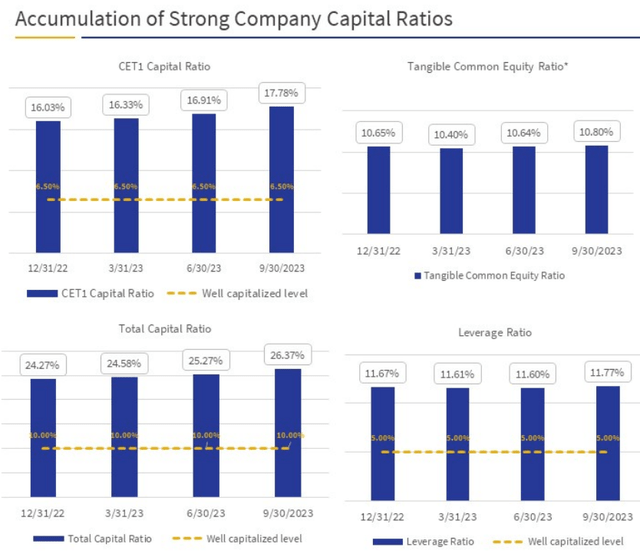

In terms of capital ratios, RBB Bancorp presents quite positive results.

RBB Bancorp (RBB) Q3 2023 Earnings

In fact, the CET1 capital ratio is 17.78%, among the highest compared to peer banks. From this point of view, the de-leveraging process has brought the expected benefits.

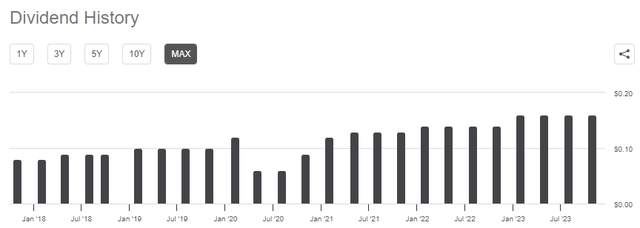

Finally, in terms of shareholder remuneration, this bank used to issue dividends and do buybacks.

The current dividend yield is 5.63%, significantly higher than the average of the past five years of 2.52%. This significant difference could be a sign of undervaluation. In any case, I think it is important to highlight that the dividend is not always guaranteed.

Seeking Alpha

In times of trouble, RBB Bancorp could drastically cut the dividend, which has already happened during the pandemic. Thus, that 5.63% dividend yield could drop dramatically in the event of a recession.

As for share buyback, since December 2019 RBB Bancorp has purchased 5% of its outstanding shares. In Q3 2023 the buyback program has been suspended but could restart from mid-November. There are still 433,000 left to be purchased.

Conclusion

RBB Bancorp is experiencing a difficult time in terms of profitability since the net interest margin continues to decline rather rapidly. The de-leveraging plan has improved capital ratios and the loan-to-deposit ratio has reached 97.6%. The financial structure remains quite tight, and from the next quarter we may observe a greater willingness by management to make new loans at high interest rates. All this, however, must be supported by growth in deposits, otherwise the loan-to-deposit ratio will return to above the 100% threshold.

For the time being, the dividend remains sustainable, and buybacks could begin from mid-November, taking advantage of this time when RBB Bancorp’s price per share seems quite low. After all, the tangible book value per share increased further and reached $22.71 per share.

Read the full article here