By Andrew Prochnow

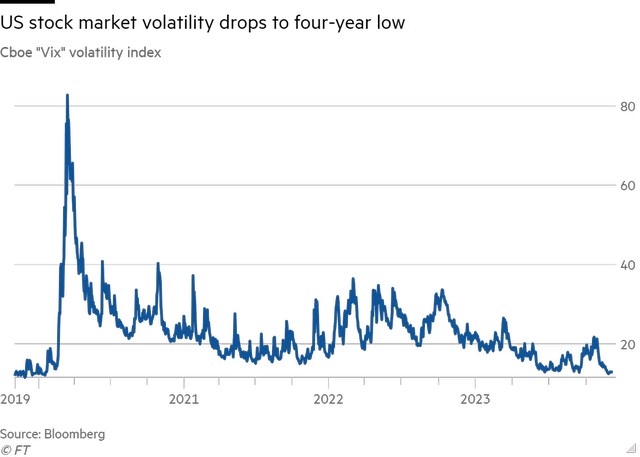

The VIX hasn’t surpassed 40 since April 2020, nearly four years ago. Prior to that, it hadn’t exceeded 40 since September 2011, and even then, it only barely surpassed that threshold. The last significant surge in the VIX, akin to the onset of the COVID-19 pandemic, occurred during the 2008-2009 Financial Crisis.

This pattern indicates that the VIX tends to breach the 40 mark only during times of extreme market distress. Under normal trading conditions, a VIX of 40 serves as a sort of ceiling for the index, as observed since April 2020.

Considering recent history, what could potentially drive the VIX above 40 in the near future? Contrary to expectations, it’s unlikely to be a military conflict. Despite two major military conflicts occurring since the COVID pandemic, neither has resulted in the VIX surpassing 40

Bloomberg

It’s probable that another financial crisis will be the catalyst for pushing the VIX above 40, similar to what occurred during the 2008-2009 period. Sixteen years ago, the banking crisis, fueled by the real estate market, cascaded into a full-fledged financial meltdown.

During that time, financial institutions had overextended themselves in the real estate sector. Consequently, as real estate prices plummeted, the value of these investments also declined. The severity of the real estate downturn led to the collapse of the balance sheets of numerous financial institutions, forcing many into bankruptcy.

Stress test

Currently, there doesn’t appear to be the same degree of risk in the financial system as there was in 2008. Federal regulators routinely conduct “stress tests” to ensure that the country’s largest financial institutions are sound. Moreover, rules have been implemented to help ensure that banks don’t take on too much risk.

On top of that, the U.S. banking sector appears to have adopted a defensive posture in the wake of last year’s regional banking shakeup. At present, many of the country’s banks are sitting on historically high levels of cash/liquidity. According to recent data collected by bank regulators, U.S. commercial banks have squirreled away 15% of their total assets in the form of cash. Back in 2019, that figure was closer to 10%.

The decision to hoard cash was undoubtedly driven by the turbulence observed in the financial system in early 2023, when several regional banks went belly up. This was due, in part, to the swift uptick in interest rates, which devalued the long-term bond holdings of many financial institutions.

Amidst the turmoil, regulators stepped in to guarantee the deposits of troubled institutions. And that decisive action arguably helped avert a broader run on the country’s banks, which would have triggered further destabilization in the financial system. After the stock markets’ strong bull run to close 2023, the banking crisis was largely forgotten.

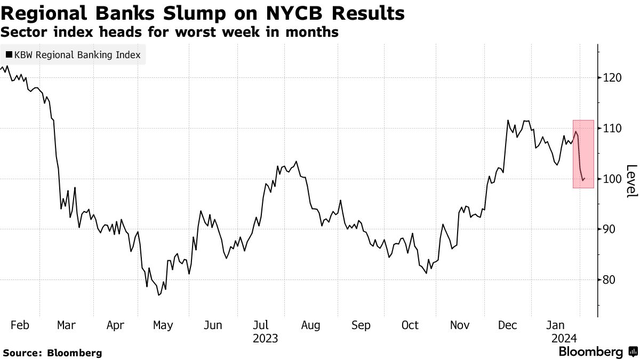

That all changed on Jan. 31, 2024, when the investment world was served with a harsh reminder that significant risks remain in the system. On that day, New York Community Bancorp (NYCB) reported quarterly earnings, and the results weren’t pretty. Unexpectedly, the bank swung to a quarterly loss of $0.36/share, as compared to the pre-earnings expectation of a $0.27/share profit.

As many readers likely recall, New York Community Bancorp acquired the remnants of Signature Bank when the latter failed last year. And in the wake of the recent earnings report, one of the big concerns for New York Community Bancorp-as well as the broader sector-is a surge in loan-related losses, particularly those linked to the embattled commercial real estate sector. Net charge-offs, which are basically loans that a bank deems uncollectible, surged from only $1 million in Q4 2022 all the way to $185 million in Q4 2023 at New York Community Bancorp.

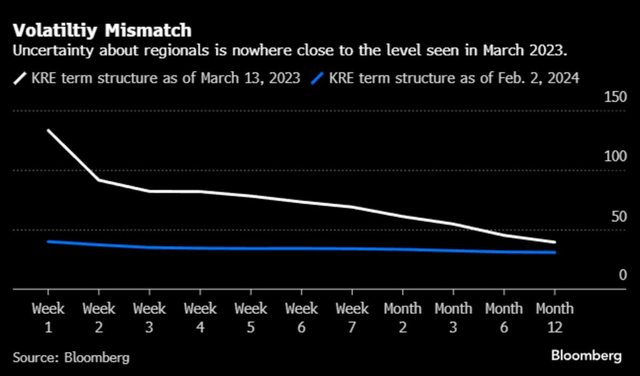

As a result of those surprisingly poor earnings figures, the bank was forced to cut its quarterly dividend from $0.17/share all the way down to $0.05/share. Shares of NYCB have dropped by about 48% so far this year. And the SPDR S&P Regional Banking ETF (KRE) has also fallen in sympathy with NYCB, declining by about 10% over the same period. But as of yet, that fear hasn’t crept into the implied volatility of KRE options, as highlighted below.

Bloomberg

Broader Impact on the Regional Banking Sector

From a glass half-full perspective, some of the New York Community Bancorp’s Q4 losses were attributable to increased regulatory expenses. After its acquisition of Signature Bank, New York Community Bancorp now has more than $100 billion in assets, which means the bank faces more stringent compliance standards.

The big concern, however, is that loan losses associated with the commercial real estate sector will continue to grow. Not just for New York Community Bancorp, but for the broader regional banking sector. Research indicates that small and medium regional banks hold roughly 70% of the loans linked to the commercial real estate sector.

So, if loan losses continue to grow, some of the country’s regional banks will undoubtedly experience further erosion in their earnings, as well as their overall financial positions. Under that scenario, it’s virtually assured that more regional banks will fail.

New York Community Bancorp wasn’t the only financial institution to report worse than expected earnings in Q4. Earlier in January, regional banks such as Citizens Financial Group (CFG), Comerica (CMA), KeyCorp (KEY), PNC Financial (PNC) and Zions Bancorporation (ZION) all reported disappointing earnings as compared to the same quarter last year. And much like New York Community Bancorp, Truist Financial (TFC) actually swung to a quarterly loss.

Bloomberg

Aozora Bank’s loses

Aozora Bank-headquartered in Japan-also announced recently that it expected to book unexpected losses from loans tied to the U.S. commercial real estate sector. Year-to-date, shares in the Tokyo-listed Aozora bank are down over 30%.

Commenting on the current situation, the chief investment officer of Guggenheim Partners Investment Management-Anne Walsh-said in mid-January that “the commercial real-estate pain in the office sector is just starting.” Considering the unexpectedly poor earnings quarter for the regional banking sector, those sentiments now seem even more ominous.

One thing the regional banks have going for them is that the U.S. economy has held up better than expected, despite record-high interest rates. On Feb. 2, the U.S. Labor Department announced that 353,000 new jobs were created during the month of January, which was well ahead of expectations. That level of hiring suggests the economy remains robust, and that the potential for an imminent recession remains low.

That means regional banks could continue to face headwinds from the commercial real estate sector but aren’t facing the same level of pressure in other areas of their operations. As long as the economy keeps growing, robust revenues from the corporate and consumer banking sectors could help offset credit losses from the commercial real estate sector.

On the other hand, this situation also illustrates how regional banks are currently walking a tenuous path. If another leg of the stool wobbles-corporate or consumer banking, for example-then the regional banks could come under intense pressure. And if a crisis develops in the regional banks, there’s no guarantee it won’t domino into other parts of the financial system.

Banking crises and black swans

Unfortunately, banking crises and black swans are birds of the same feather. Black swans, by definition, are sudden, unexpected events that catalyze severe, jagged corrections across the universe of investable assets. While black swans can creep up in an unanticipated manner, that isn’t always the case. There were some experts that correctly predicted the onset of the 2008-2009 Financial Crisis, which was undoubtedly a black swan.

During 2008-2009, complications in the banking sector eventually spiraled into a full-blown financial crisis, triggering corrections in many parts of the financial markets. The result was much the same in 1929, when an over-extended banking system ultimately pushed the U.S. economy into a deep depression.

Certainly, that doesn’t look likely today, with the major market indices trading at fresh all-time highs, and the VIX trading in the low teens. But back in 2007, the VIX was also trading in the low teens, and the S&P 500 was cresting toward a fresh all-time high. The Great Recession arrived not long after that.

Taken all together, it’s an important reminder that significant risks remain in the system. And as Warren Buffett famously said, “be fearful when others are greedy and to be greedy only when others are fearful.”

Read the full article here