RH (NYSE:RH) retails furnishings under RH Galleries and RH brands. In addition, the company operates showrooms under the Waterworks name. The company has international operations, as it operates in the United States, the Middle East, Australia, the United Kingdom, and other parts of Europe, among other places. RH focuses on the luxury segment in the furnishings industry, selling high price-point items.

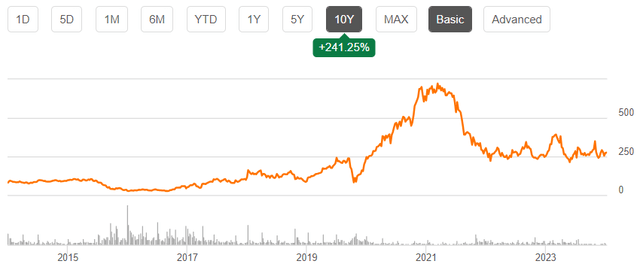

The stock has had a good return in the past decade, compounding at a CAGR of 13.1% aided by aggressive share buybacks shrinking outstanding shares considerably. Still, the stock’s more recent return has been negative, as the Covid pandemic-boosted financials have turned into earnings pressured by a tougher economic climate.

Ten Year Stock Chart (Seeking Alpha)

Financial Profile: Long-Term Growth, Short-Term Pressure

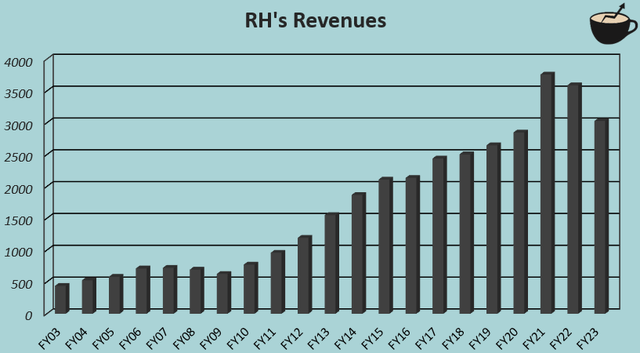

Over the long term, RH has achieved impressive growth. The company’s revenues have compounded at a CAGR of 10.1% from FY2003 to FY2023, with predominantly organic growth.

Author’s Calculation Using TIKR Data

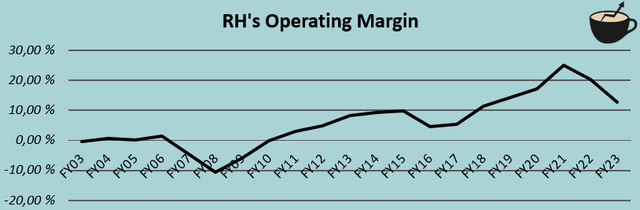

Along with the expansion of RH’s operations, the company has experienced significant margin expansion, driven by great gross margin growth and some operating leverage. The company’s operating margin is currently below previous years’ level, but still at a healthy figure of 12.7% in FY2023.

Author’s Calculation Using TIKR Data

As can be seen in revenues and the operating margin in the past couple of years, RH has experienced a good amount of financial turbulence after a mostly stable earnings history. The Covid pandemic first boosted RH’s sales rapidly, boosting revenue growth into 32.0% in FY2021 as the housing market was booming and as customers spent more time indoors. Due to higher sales, significant operating leverage also boosted the operating margin from 14.4% in FY2019 prior to the pandemic into 24.9% in FY2021.

Since, the boost has subsided, and revenues in FY2023 are -19.4% below FY2021 revenues. Revenues have now grown at a CAGR of only 3.4% from FY2019 despite high inflation in the period, below RH’s long-term growth rate, making current revenues weak as the real estate market has cooled down. The slowdown in sales has pressured the operating margin into the current FY2023 figure of just 12.7%, even below the margins achieved prior to the pandemic.

When & How High Will Earnings Bounce?

An eventual recovery in RH’s sales seems inevitable. The FY2023 weakness is clearly related to an incredibly slow housing market, as is communicated in the Q4 shareholder letter. The company already anticipates gradual improvements throughout FY2024 with a housing market recovery and decreasing interest rates – with the real estate market correlating strongly with interest rates, the FED’s decisions have a clear impact on the timing of the recovery in the furnishings industry in the United States. In Europe, 12-month Euribor rates have stayed quite near the peak for the time being, but lowered interest rates are expected in the back half of 2024.

RH’s financial outlook of an 8% to 10% growth in FY2024 seems to expect quite a dramatic recovery in upcoming quarters as Q1 sales are still guided down slightly – I believe that there’s a significant chance that the financial outlook will not be achieved, and investors shouldn’t yet expect such a timely recovery. Competitors’ revenues are estimated to continue at a weak level, with revenue growth of 1.1% expected for Wayfair (W), 5.4% for aggressively expanding Arhaus (ARHS), and a negative -9.2% for Haverty Furniture (HVT).

The size of the financial rebound is also still up for debate. Investors shouldn’t reflect back on earnings achieved during the Covid pandemic’s heightened demand, but should in my opinion, rather extrapolate pre-pandemic trends. RH has continued to invest in growth during recent years with a record $269.4 million in capital expenditures in FY2023, and operations have grown well from FY2019 despite quite similar revenues – at the revenue CAGR of 7.2% from FY2014 to FY2019, revenues would have ended up at $3496 million in FY2023 instead of the achieved $3029 million, representing a better estimate of current sustainable sales in normalized conditions.

Margins should also see a significant boost from the operating margin achieved in FY2023. The FY2019 operating margin of 14.4% seems to be lower than should be currently expected in light of RH’s historically great operating leverage, but very significantly higher margins shouldn’t be expected in my opinion.

Upcoming Q1 Results

While no specific date for the Q1/FY2024 results has been announced at the time of writing, RH is expected to announce the earnings quite soon. Analysts are expecting revenues of $725.2 million and a normalized EPS of -$0.10 in the typically low seasonal sales quarter. The estimates represent a year-over-year revenue decline of -1.9% and a dramatic normalized EPS decrease of -$2.31, and follow RH’s given first quarter guidance of low single-digit revenue declines and an adjusted operating margin between 6% and 7%. The quarter comes after a Q4/FY2023 revenue decline of -4.4%.

Peak Earnings Are Priced In

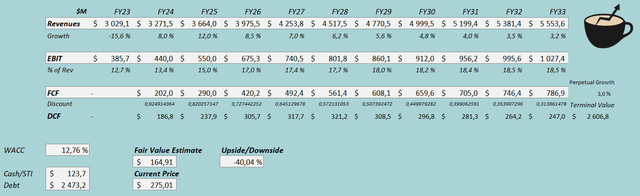

I constructed a discounted cash flow model (DCF model) to estimate a fair value for the stock. In the model, I estimate RH’s revenues to grow by 8% in FY2024, followed by an improving housing market causing a 12% growth in FY2025. Afterwards, I estimate a gradual growth slowdown in steps into a perpetual growth of 3%, representing a CAGR of 6.2% from FY2023 to FY2033.

For the EBIT margin, I estimate gradual improvements from 12.7% in FY2023 into 17.0% in FY2026, leveraged further afterwards into an eventual level of 18.5% through operating leverage and slight gross margin expansion. The company’s capital expenditures and working capital increases chip away at cash flows, making the conversion rate quite modest, but I estimate a gradual improvement as the growth slows down.

With the mentioned estimates, the DCF model estimates RH’s fair value at $164.91, around 40% below the stock price at the time of writing – although the stock price has fallen significantly from 2021 highs, the stock still seems to price in too high earnings anticipations. A more aggressive growth runway could make the stock worth the current price, but with RH’s five-year return on capital of 14.0%, more aggressive growth would require more intensive investments than I currently anticipate too.

DCF Model (Author’s Calculation)

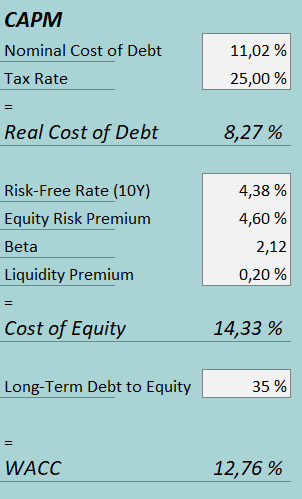

A weighted average cost of capital of 12.76% is used in the DCF model. The used WACC is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

In Q4, RH had $68.1 million in interest expenses. With the company’s current amount of interest-bearing debt, RH’s annualized interest rate comes up to 11.02%. The interest rate seems to be extremely high and reflects RH’s high debt and volatile operative earnings. Despite turbulent earnings, RH leverages quite a high amount of debt, and I estimate a long-term debt-to-equity ratio of 40%.

For the risk-free rate on the cost of equity side, I use the United States’ 10-year bond yield of 4.38%. The equity risk premium of 4.60% is Professor Aswath Damodaran’s latest estimate for the United States, updated on the 5th of January. Seeking Alpha estimates RH’s beta at a figure of 2.12. Finally, I add a small liquidity premium of 0.2%, creating a cost of equity of 14.33% and a WACC of 12.76%.

Takeaway

RH’s earnings have fallen from pandemic highs to currently depressed earnings caused by a slow housing market. The company anticipates a gradual demand recovery during FY2024, but I believe that caution around the timing of the recovery is needed as competitors are estimated to have quite a weak 2024. The current stock price seems to anticipate an aggressive earnings recovery into pandemic highs, which I don’t see likely to happen in the medium term. While RH should be able to continue the long-term growth story and recover earnings into a better normalized level, the current valuation seems to price in too much. As such, I have a sell rating for the time being.

Read the full article here