Riot Platforms, Inc. (NASDAQ:RIOT) Q1 2024 Earnings Conference Call May 1, 2024 8:30 AM ET

Company Participants

Phil McPherson – Vice President, Capital Markets & Investor Relations

Jason Les – Chief Executive Officer

Colin Yee – Executive Vice President Chief Financial Officer

Jason Chung – Executive Vice President, Corporate Development & Strategy

Conference Call Participants

Greg Lewis – BTIG

Mike Colonnese – H.C. Wainwright

Darren Aftahi – ROTH MKM

Martin Toner – ATB Capital

Regi Smith – JP Morgan

Lucas Pipes – B. Riley Securities

Owen Rickert – Northland Securities

Operator

Greetings and welcome to the Riot Platforms First Quarter 2024 Financial Results Conference Call. At this time all participants are in a listen-only mode. A brief question-and-answer session will follow the formal presentation. [Operator Instructions] As a reminder, this conference is being recorded.

It is now my pleasure to introduce your host, Phil McPherson, Vice President of Capital Markets and Investor Relations. Thank you, Phil, you may begin.

Phil McPherson

Thank you, Devin. Good morning, and welcome to Riot Platform’s first quarter 2024 earnings call. My name is Phil McPherson and joining me on today’s call are Jason Les, CEO; Colin Yee, CFO, and Jason Chung, Executive Vice President of Corporate Development & Strategy.

On the Riot Investor Relations website, you can find our first quarter 2024 earnings press release and earnings presentation, which are intended to supplement today’s prepared remarks and which include a discussion of certain non-GAAP items. Non-GAAP financial measures provided should not be considered as a substitute for or superior to the measures of financial performance prepared in accordance with GAAP and are included as additional clarifying items to aid investors in further understanding the company’s first quarter performance.

During today’s call, we will be making forward-looking statements regarding potential future events. These statements are based on management’s current expectations and assumptions and are subject to risks and uncertainties. Actual results could materially differ due to factors discussed in today’s earnings press release, in comments and responses made during today’s call, and in the risk factors section of our Form 10-K, Form 10-Q, included for the quarter ended March 31, 2024, which will be filed today after market close and other filings with the Securities and Exchange Commission.

With that, I would like to turn the call over to Jason Les, CEO of Riot Platforms.

Jason Les

Thank you, Phil, and good morning, everyone. Riot filed our first quarter 2024 press release and earnings presentation this morning, both of which are available on the investor relations section of Riot’s website.

Riot’s primary strategic focus has been on developing a leading vertically integrated Bitcoin mining company. Built on the three key pillars of developing and owning operations of significant scale; being a low cost producer of Bitcoin; and building a balance sheet of strength. By focusing on a vertically integrated strategy, we are best able to build these pillars. Over the past three years, we have been focused on developing this strategy at scale. This began with the acquisition of our Rockdale facility, its development and operations teams, and low-cost fixed-power contracts.

The strategy continued with the acquisition of the ESS Metron and the introduction of our engineering segment, which helps control the key supply bottleneck for electrical equipment and building out Bitcoin mining infrastructure. And finally, the development of our Corsicana facility has broadened our portfolio of access to power capacity and purpose-built Bitcoin mining facilities. The benefits of this strategy are on display today. And as a result, we see other miners in the space moving towards a similar strategy.

Since Riot has developed this strategy most fully and at scale we are able to build out facilities like Corsicana further, while others who have not already ordered key pieces of electrical equipment face 18 plus months of supply chain constraints. The energization of Corsicana this month means that Riot has a clear, fully funded growth plan. This landmark achievement is the result of our team’s dedication to our long-term strategy. The first phase of this facility puts us well on track to increase our self-mining Hashrate to 31 exahash by the end of 2024.

The Corsicana facility utilizes immersion cooling for all of its facilities, a technology in which Riot is the industry leader in deploying at scale. We are very excited about the incredible pipeline for growth that Corsicana facility provides for the next several years, and we look forward to further executing on this plan. Through owning and operating our own site and an unmatched portfolio of 345 megawatts of fixed price long-term power agreements, we have the unique ability to execute on our power strategy, which demonstrates the benefits of Bitcoin mining for grid stability and significantly drives down our cost of power.

Power is the primary variable input for Bitcoin mining, and that is why we have built our reputation as a leader in this key part of our business. Making large acquisitions, developing pipelines for growth, and maintaining fixed price power contracts at scale requires a strong financial and liquidity position. Our unmatched balance sheet strength makes all of this possible and is responsible for their success.

With this strong position, we are funding our near and intermediate-term growth plans to expand Corsicana and increase our Hashrate through purchasing leading-edge miners on a long-term, fixed-price basis for MicroBT.

In conclusion, we remain focused on the growth and enhancement of our self-mining business. In 2023, we terminated two remaining legacy hosting contracts at the Rockdale facility, because of both customers’ failure to perform under those agreements. As a result of the reduction in hosting revenue, we have eliminated the data center hosting business as a separate reporting segment starting in the first quarter of 2024 and are consolidating results into the Bitcoin mining business segment. Riot’s focus is maximizing Bitcoin mining results, and our strategy is enabling us to execute on this at an unprecedented scale.

With that, I would like to now turn the call over to Colin Yee, CFO of Riot Platforms.

Colin Yee

Thank you, Jason. I’m excited to present Riot’s financial results for the first quarter of 2024, during which Riot achieved a number of key milestones. For ease of reference, slide five presents a snapshot of key metrics for the first quarter of 2024.

But let’s go over some highlights on the following pages. We own and operate one of the largest Bitcoin mining operations in North America. And during this past quarter, we continued to deploy miners in Rockdale. We have also pushed ahead with development activities at our new Corsicana facility, which has since been energized and operations have begun.

At the end of the first quarter of 2024, our Bitcoin mining business segment had a total deployed hashrate of 12.4 exahash, which represents an 18% increase year-over-year. And as Jason previously mentioned, we anticipate achieving a total self-mining hashrate capacity of 31 exahash by the end of 2024.

During the first quarter of 2024, we mined 1,364 Bitcoin, which represents a decrease of 36% from the 2,115 Bitcoin we mined during the first quarter of 2023. This was primarily due to the significant increase in the Bitcoin network difficulty, which has more than doubled since January 2023. However, with the significant increase in growth in our hashrate capacity expected by the end of this year, we anticipate producing more Bitcoin per day by the end of the year than we did in the first quarter of 2024, even in spite of the recent halving that occurred a few weeks ago on April 20, 2024. Riot ended the first quarter of 2024 with 8,490 Bitcoin, up significantly relative to the 7,094 Bitcoin that we held at the end of the first quarter of 2023.

In the first quarter of 2024, Riot reported total revenue of $79.3 million, as compared to $73.2 million for the first quarter of 2023, an 18% increase year-over-year. This increase was primarily driven by a 131% increase in average bitcoin prices year-over-year offset by lower bitcoin production which decreased 36% year-over-year. Again due primarily to the significant increase in Bitcoin network difficulty, which has more than doubled since January 2023.

In footnote number one, you should note that power curtailment credits received totaled approximately $5.1 million for the quarter, as compared to $3.1 million during the first quarter of 2023. And this equates to approximately 98 Bitcoin as computed by using average daily closing Bitcoin prices on a monthly basis. If these power credits received were applied to our total cost of revenues, our non-GAAP gross profit margin would have equaled $37.3 million or a 47% margin.

Non-GAAP adjusted EBITDA for the first quarter was $245.7 million, as compared to the non-GAAP adjusted EBITDA of $81.7 million in the first quarter of 2023. Based on FASB’s final standard on crypto assets issued in December 2023, under which Riot now recognizes its Bitcoin held at fair value. And with changes in fair value now recognized in income. Riot elected to early adopt this guidance in 2023.

Net income for the quarter was $211.8 million or $0.82 per share, compared to net income of $18.5 million or $0.11 per share for the same period in 2023. As a reminder, our net income for the quarter included a change in the fair value of Bitcoin equal to $234.1 million, non-cash stock-based compensation expense of $32 million, and depreciation and amortization of $32.3 million.

Beginning in the first quarter of 2024, we adjusted our depreciation schedule for mining hardware from a two-year to a three-year schedule based on our evaluation of market practice and our own operational history. In 2023, Riot terminated its two legacy data center hosting agreements. During the first quarter of 2024, revenue from the final data center hosting agreement was no longer material from both revenue and profit. And so commencing this quarter, we will no longer report data center hosting as a separate reportable segment. We also have no plans to offer data center hosting services to new customers.

For the first quarter of 2024 Bitcoin mining revenue totaled $74.6 million, which included $32 million in hosting revenue, an increase of $26.6 million year-over-year. This increase was primarily due to higher Bitcoin prices in the first quarter of 2024, which averaged $52,343, compared to $22,706 in the first quarter of 2023.

However, this increase is partially offset by a decrease in Bitcoin mined in the first quarter of 2024, compared to the first quarter of 2023, again due to the significant increase in the Bitcoin network difficulty. Bitcoin mining cost of revenue primarily consists of direct production costs including electricity, labor and insurance and excludes depreciation and amortization.

Bitcoin mining revenue in excess of Bitcoin mining cost of revenue for the quarter was $33.5 million, which is a margin of 45%, as compared to $26.1 million, or a margin of 54% from the first quarter of 2023. This increase was primarily driven by the increase in revenues from the expansion of Bitcoin mining capacity at our Rockdale facility. If power credits were directly allocated to Bitcoin mining cost of revenue, Bitcoin mining cost of revenue would have decreased by $5.1 million, increasing our Bitcoin mining margin to $38.6 million or 52% on a non-GAAP basis. Bitcoin mining costs also included $4.5 million of power cost for the remaining hosting contracts.

Slide nine breaks down Riot’s cost to mine. The first quarter of 2024 for Riot had changes to our reporting segments. In 2023, Riot terminated the two remaining agreements under the legacy data center hosting business due to the failure of both customers to meeting their obligations under the agreements. As such, costs that had previously been captured and reported in the data center hosting segment have been absorbed by our self-mining operations and presented within the Bitcoin mining segment in our first quarter 2024 financial statements.

Direct cost to mine in the first quarter 2024 was $23,034 per Bitcoin, which power costs were $16,764 or 73% of the total. Other costs of $6,270 represents the remaining 27%. The increase in the global network hashrate and company increase in network difficulty was the primary driver behind an increase in the right average direct cost to mine Bitcoin.

Other costs include direct labor, miner insurance, miner and miner related equipment repairs, land lease and related property taxes, network costs, and other utility expenses. We have already ordered new MicroBT machines to be deployed at our Rockdale facility, of which deployment will begin in the second quarter 2024. And as additional hashrate is deployed and operational uptime is increased, we expect increased production of Bitcoin at the Rockdale facility.

So, as production increases, these fixed costs will be spread across the greater number of Bitcoin produced, thereby lowering our cost of mine each Bitcoin. Riot’s engineering business, carried on through Riot’s wholly-owned subsidiary of ESS Metron, reported revenue of $4.7 million in the first quarter of 2024, as compared to $16.1 million for the same three month period in 2023. The decrease of $11.4 million was primarily attributable to global supply chain constraints, resulting in decreased receipts of materials. This delayed the completion of certain custom products for two large projects potentially worth $13.2 million, which ended up not being delivered in the quarter, and therefore we were not able to recognize this revenue.

These supply chain shortages also impacted projects in our backlog, due to the lack of manufacturing capacity. However, we anticipate that the supply chain issues currently impacting our engineering results will be resolved towards the end of the third quarter of this year.

Engineering gross margin for the quarter was similarly impacted by these issues, resulting in a gross loss of $1.3 million, as compared to a gross profit of $0.5 million for the first quarter of 2023.

I will now turn the call back over to Jason Les.

Jason Les

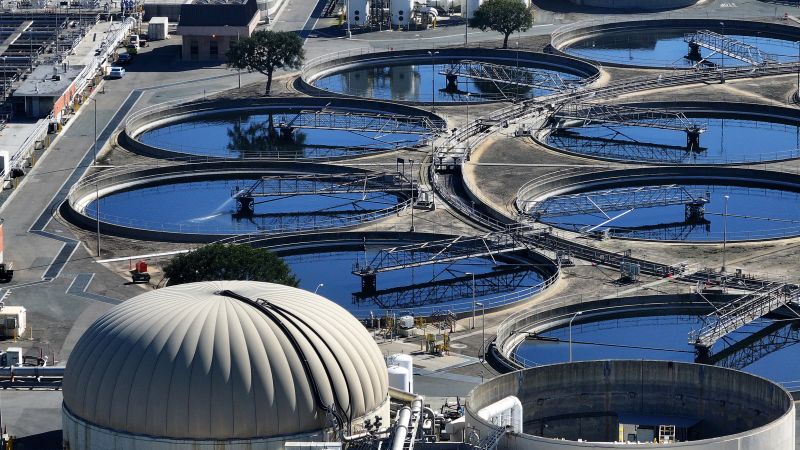

Thank you, Colin. Pictured on this slide is an aerial shot of our new Corsicana facility. We purchased the land for this facility in 2022, due to its strategic location next to the Navarro switch where 1 gigawatt of power capacity was available. Over the past two years we have worked to develop this site to support reaching 1 gigawatt in total capacity, beginning with the first phase consisting of 400 megawatts of 100% immersion cooled, Bitcoin mining infrastructure, which spans four total buildings. The 400 megawatt substation for the first phase of Corsicana’s development was energized last month, and mining operations have already commenced.

Construction remains underway to complete the rest of the first phase by the end of 2024, and in 2025, we intend to continue development of this site to eventually reach 1 gigawatt in total capacity, which would submit the Corsicana facility status as the largest dedicated Bitcoin mining facility in North America and potentially globally.

Riot’s infrastructure pipeline and long-term minor purchase agreement with MicroBT provides us with a clear and direct path to reaching 100 exahash in self-mining hashrate. Based on our current purchase agreements and development plans, Riot plans to exit 2024 with a total hashrate of 31 exahash. This includes 2.7 exahash of growth at our Rockdale Facility and 16 exahash of new growth at our Corsicana facility.

Altogether, when fully developed, this would represent a 154% increase in self-mining hashrate over 2024. Fully developing the Corsicana facility through the remaining 600 megawatts of remaining capacity following the completion of the first phase of development and executing a part of our purchase option of MicroBT M66 S-minors would allow Riot to reach nearly 60 exahash in total hashrate capacity.

In other words, Corsicana provides a substantial amount of the infrastructure needed for Riot to utilize its purchase options with MicroBT and reach our 100 exahash goal. These components give Riot the most directly visible and predictable pipeline for growth in the Bitcoin mining sector.

In order to fully utilize our pipeline of infrastructure, over the past 12 months we have entered into a series of agreements with MicroBT to a total of 32 exahash of next generation miners. The decision to enter these large-scale purchase agreements came after several months of testing various latest generation MicroBT miners in both immersion and air cooled environments and observing strong operating performance.

As a result of this investment, full deployment of our purchase orders is expected to improve our overall fleet efficiency by 21.3% to 21.8 joules per terahash. As part of our long-term agreement with MicroBT, we have purchase options for an additional 75 exahash of miners on terms substantially similar to our original order. This option provides for a fixed price ceiling of $16.50 per terahash on next generation miners in order to support Riot further growing its fleet and improving overall efficiency.

Assuming full exercise of our purchase options and deployment of those miners, our fleet efficiency would improve even further to 19.7 joules per terahash. Riot prioritizes maintaining a strong balance sheet with significant cash and Bitcoin holdings in order to drive long-term value creation for our shareholders.

As a result, we can act decisively and continuously scale our business to meet the growing opportunities in the Bitcoin mining space. Our current growth plans to reach over 40 exahash in 2025 call for $619 million in capital expenditures, which you can see broken down on this slide. We have sufficient financial resources to fund these growth plans entirely, and we expect to end 2025 with total liquidity exceeding that at the end of the first quarter of 2024.

Riot’s vision is to be the world’s leading Bitcoin-driven infrastructure platform. The strategy we have been executing on over the past several years has now begun bearing the results which position us to realize this vision. Through our vertically integrated strategy, we have created an unmatched infrastructure growth pipeline to increase our hashrate by 154% this year to 31 exahash and to ultimately lead us to our goal of reaching 100 exahash in total self-mining hashrate.

RIOT’s balance sheet strength underpins our ability to achieve these targets. And as a result, our 2024 and 2025 growth plans are fully funded. We are incredibly excited about what Riot is accomplishing this year, and we look forward to executing on our stated goals on our path to achieving 100 exahash.

Thank you all for listening to our presentation. We would now like to open the call for questions. Operator?

Question-and-Answer Session

Operator

Thank you. We will now be conducting a question-and-answer session. [Operator Instructions] Phil, the floor is now yours for the Q&A session.

Phil McPherson

Thank you, Devin. We’ll take our first call from Kevin Dede at H.C. Wainwright. Kevin? No, looks like he dropped off. We’ll move to the next one. Our next question will come from Greg Lewis at BTIG.

Greg Lewis

Yes, hi. Thank you and good morning, good afternoon. You know, Jason just watching the strategy unfold in terms of the Bitcoin inventory management, it seemed like we’ve kind of gone through ebbs and flows in terms of funding some operations with Bitcoin more recently, at least based on the monthly production guidance, it seemed like we started holding back and really trying to build that Bitcoin inventory in February, March. I don’t think we — I think maybe we saw a couple of Bitcoin.

You know, post the halving now as we look at, I guess May and beyond, how are you thinking about managing the puts and takes in terms of using Bitcoin that you’re generating to offset some costs, and then at the same time trying to build that inventory? Any kind of thoughts around that?

Jason Les

Sure. Thanks, Greg. So our strategy is to always maintain a strong balance sheet. I think by now we’ve all seen how this has played out as a key strength for Riot. This includes both in cash and in Bitcoin. We are here because we’re a Bitcoin company. We believe in the long-term value of Bitcoin. So we try to hold as much Bitcoin as possible. As you noted, at the beginning of this year, in January, we stopped selling Bitcoin. In February and March through our monthly updates we reported we have not sold any Bitcoin.

So currently we are not selling any Bitcoin. However we are continuing to always monitor our balance sheet in light of what we need for capital expenses and what we need for operational growth. By maintaining such a strong balance sheet with a task position that we’re reporting today, we have sufficient cash reserves and further access to cash through our ATM program to continue to fund all of our growth plan and our operating expenditures. So it’s a decision that we’re making on a month-by-month basis, evaluating the market, evaluating the financing options, evaluating our cost of capital, and with the parallel goal of trying to hold as much Bitcoin as possible.

Greg Lewis

Okay great and then just my other question was on the engineering business. You know realizing that it’s not a major driver of the company clearly that’s the Bitcoin mining, but there was kind of a — I guess there’s a two-part question here in terms of the engineering. With the first being is there any seasonality that we should be thinking about as we look out over the next I don’t know three, four quarters and then also I was kind of curious clearly when you bought Metron there’s an opportunity to kind of get involved on the infrastructure equipment side not realizing maybe that Riots core function as a miner isn’t going to be around AI data centers. Is that business Metron, is that position at all to benefit from kind of this ongoing AI infrastructure wave that seems like it’s — we’re in the midst of?

Jason Les

Yes, so let me tackle those starting with the last question, Craig. So first there is incredible demand for this type of electrical equipment right now. While Riot owns ESS Metron, we are one of their smallest customers. Overall, they have a ton of business and a ton of demand from all these data centers, AI data centers that are rapidly trying to build out and meet demand for this type of service. So they are really overloaded with business opportunity. And what has limited them has been manufacturing warehouse capacity and access to the input parts from the global supply chain.

So they are benefiting quite a bit from this and we are looking to increase the capacity of this business, so they can meet the demand for these data centers and AI data centers, et cetera. But as you stated, our number one reason for purchasing the ESS Metron was strategic. One, we noted in our deck here, it has reduced our CapEx expense for purchasing this electrical equipment from them by about $10 million over the two years since we’ve acquired them. But even more important than that, it has been a critical component of controlling our supply chain, while other competitors might have to rely on external parties to procure their electrical equipment and design, custom engineer and design what they need, we’re able to control this in-house. We have visibility in the supply chain. We can move around this. We can make changes. It’s been very advantageous to us as we’ve built out both Rockdale and Corsicana.

Then your first part of your question though was the seasonality of results. I think you will see a good amount of seasonality this year. Like we noted, the first quarter results were impacted by these global supply chain issues, which held back two big orders from moving forward. So not only could those orders not move forward and be recognized as revenue, they’re occupied space that stops other jobs from being completed. So we expect these to be cut up during the second-half of 2024. We have additional warehouse space we procured. They’re on top of resolving these supply chain issues. So that’ll allow these two key contracts to move forward. We can recognize those revenue, and then we can keep the backlog flowing with the other demand, which is — as you asked about, quite full of data center and AI infrastructure.

Greg Lewis

Perfect, super helpful. Thank you very much.

Jason Les

Thanks, Greg.

Phil McPherson

Our next question is from Mike Colonnese from H.C. Wainwright, Mike?

Mike Colonnese

Hi, good morning, guys, and thank you for taking my questions. First one’s really more of a high-level question for me. Just curious how you guys are thinking about the operating environment here with hash prices at all-time lows post-having, the implications for your growth trajectory at Riot? And how you expect the M&A landscape to play out as less efficient miners are forced to power down here?

Jason Les

Sure, thanks for the question, Mike. Let me answer the first part of the question, and I’ll turn it over to Jason Chung, our Head of Corporate Development to talk about M&A here.

I think the halving is always a tough time for miners. Immediately after this one, it seemed not as bad because the huge influx of transaction fees that we saw, right? There were blocks with 30 Bitcoin in transaction fees, and it scaled down from there, but that really offset the decrease in the — from the block reward having. But that has subsided, and recently the price has gone down.

I think by focusing on being a low-cost producer, Riot is very well positioned for these types of trough periods in Bitcoin mining economics. Coming into the summer here, especially with our power strategy, we are able to be very responsive with the price of power. Use that to lower our direct cost of mine. And that allows Riot to be a low cost producer when others have to fall off the network here. And when those higher cost producers fall off, as you know, difficulty adjusts that — and then that widens the margin again, as we’re mining more Bitcoin.

So we believe this is the type of environment where Riot’s strategic pillars are on full display. Obviously, we are long-term bullish on Bitcoin. We just talked about we are holding Bitcoin, because we believe in the upside of this system long-term. But to reach that long-term, to be a leading Bitcoin mining company, we have to focus on having this low cost of power and maintain a low cost of production through more difficult points in the market. But on the end of the day question, I’ll go ahead and ask [Technical Difficulty] Jason Chung.

Jason Chung

Thank you, Jason. Hey, Mike. Thanks for the question. From our perspective, historically, I think yields have really been hindered in the sector by a number of factors. We can look at volatility in the underlying public, minor stock, volatility in the underlying Bitcoin prices, differences in Bitcoin price expectations across buyers and sellers, among other factors. And all of these factors have really led to what we’ve seen as a pretty fairly wide gap between buyer expectations on valuation and seller expectations on valuation historically.

But I think our sense is that that gap has started to narrow, particularly pre-having. And now that we’re post-having, I think that trend will continue. At the same time, we’ve seen very healthy deal flow pre-halving and we think that deal flow will further increase post-halving. So when you take these two factors into consideration together, I think there’s a really interesting window of [Technical Difficulty] approaching for deals to be done in the sector. And our side, we spent a lot of time building out what we believe is the most sophisticated corporate development team in our space precisely to address this upcoming window.

Mike Colonnese

That’s great color, appreciate that. And going back to the engineering business for just a moment, how should we think about engineering revenues once these supply chain issues are resolved later this year, especially given the growing backlog you guys are experiencing? Should we expect the run rate to go back in line with what we saw last year, or should we experience more of a elevated level, especially given the growing demand for that business? Thanks.

Jason Les

Mike, I would say you can think about it just following historical performance for now. I think the main thing that we need to work on to scale this business is increasing the capacity of that engineering segment. That will really be the driver of improved financial performance there. The demand is enormous, that has not been an issue for us. It’s really expanding our manufacturing warehouse capacity. So we’re working on that, but I wouldn’t guide towards expecting a higher increase for that at that time. But it’s something I think we can touch on at our next earnings call.

Phil McPherson

Great, we’ll take our next call from Darren Aftahi from ROTH MKM. Darren?

Darren Aftahi

Yes, thanks. Two questions if I may. The machines you’re going to replace in Rockdale, I think in the release you said those are going to start in the second quarter. Could you just kind of speak to the cadence of how those are going to be added? And then secondly, on the hosting capacity, any kind of sense on resolution there, at least what you can publicly say in terms of how you can kind of shift some of that to self-mining in the future. Thanks.

Jason Les

Yes, Darren. So, for the hashrate replacement and growth at Rockdale, so this is with the M66S, latest generation MicroBT miners that we purchased. We’re receiving those this month. We’ve been preparing to deploy those miners. I would say we can probably expect this to begin at the end of May, continue through June and July. I think the bulk of the deployments will happen during June, but over about the eight weeks or so starting later this month is how we foresee those deployments going.

And that will both replace these problematic machines, which will increase the operating performance in our existing facility and then we are growing our hashrate as well so that’ll take Rockdale from the 12.4 exahash now to a little over 15 exahash when all those miners are deployed. We’re really excited about this enhancement and growth. We’ve tested these M66S miners, or M50 miners and other MicroBT miners considerably before making this decision. We were really impressed with the performance that we saw, the resilience under tougher operating conditions. So we’re really excited about the results that we did receive from those miners as we deploy them over the next couple months here.

With respect to the host team-related litigation, you know, litigation is always unpredictable. Can’t really give guidance on that. We are certainly putting a lot of effort and resources towards that litigation, and I think we’ll just have to see how it goes from there.

Darren Aftahi

Okay. Thank you.

Phil McPherson

Thanks, Darren. Our next question comes from Martin Toner at ATB Capital. Martin?

Martin Toner

Thanks very much, and congrats on some great progress here, particularly with the data center hosting. Can you talk to the drivers of sequentially higher SG&A in the quarter and maybe what we should be thinking about for a run rate going forward?

Jason Les

Sure. So, two things here. One, I just touched on, we’ve had increased level of legal litigation expense as we go through litigation process with these hosting customers. This is not a type of expense that should continue long-term, but it’s one we’re continuing right now. The other point that I would touch on is, as mentioned in the presentation, we’ve eliminated the data center hosting segment. As a result of eliminating that segment, some of the costs that were previously in cost of revenues for that segment have now gone into SG&A.

The final point I’ll leave you with on the commentary there is we’re building a large business here. We have built this business into what we now are growing into. So we have built a business for 30 exahash and beyond. And now with what we’re accomplishing, Corsicana and the results we’re seeing — we’re starting to see there, we’re growing into that newer size. So as far as what SG&A can look like going forward, I think you can expect $22 million to $25 million a quarter in cash expenses. I think that’s a good estimate that we can give right now. And legal and litigation expenses that are not ongoing continuous fall off, you know, hopefully we will be able to improve that number.

Martin Toner

Great. Thank you very much. Can you talk a little bit about the curtailment revenue in the quarter, any puts and takes that are noteworthy, and then have there been any changes to the power strategy since [Indiscernible] a few, less than a month ago?

Jason Les

So most of the power strategy results are really Q3 weighted. We see some every quarter, but most of them really come in the third quarter in the summer months. And of course, at the end of the second quarter, we get some of that in June. So the 5 — approximately $5 million do you see from the first quarter? That’s us really taking advantage of just limited opportunities that have come up in that quarter — during that quarter and the employee services revenue that we always participate in.

So how it plays out in this summer in mainly Q3 coming up here, it is hard to predict. It’s going to be based on external factors, like weather and generation performance, that we cannot control. However, because we have this 345 megawatts of fixed price power, because we have these blocks 24/7, and because of what we’ve learned from the power strategy that we’ve developed we are in a really good position to act on the opportunities when they occur here. So that 345 megawatts that is at Rockdale. So we’ll be executing our power strategy at Rockdale, selling power when that spot price of power is exceeding Bitcoin mining revenue.

And then over at Corsicana, we are beginning unhedged and we’ll just be responding to the spot prices of power as they occur there, which also gives us the benefit of capturing those very low priced or negative priced hours when they occur as well.

Martin Toner

That’s great. Thank you very much and that’s all for me.

Jason Les

All right. Thank you.

Phil McPherson

Great. Our next question comes from Regi Smith at JP Morgan. Regi?

Regi Smith

Hey, good morning, and thanks for taking the question. I appreciate the disclosure on slide nine. I’m still not all the way clear on, I guess, the drivers of the sequential increase in your cost to mine. I’m looking at the network difficulty component. And it seems rather large in relation to the 4P network. Maybe a little color on those two components, that and the other cost, and how much of that you think is kind of recurring versus one-time-ish? Any color you could provide there to just kind of bridge that increase in cost and mine would be helpful. And then I have one follow-up question. Thank you.

Jason Les

Sure, thanks, Regi. So first, as you noted, there is about a 20% increase in network difficulty quarter-over-quarter. So that accounted for about $4,400 on a cost per coin basis increase in our cost per coin. Other costs increased by about $5,000 per coin for the quarter. So what is driving that is going to be the elimination of the data center hosting business, and therefore the consolidation of some of those expenses that were previously in that segment, now in the Bitcoin mining segment.

So some examples of these costs include things like miner repair. Miner repair is slightly elevated at this time. So we hope especially when we are replacing all our problematic miners, that this cost is going to go down and not continue, at least at this quantity. So what I would say is when you look at on slide nine our cost per coin, including $6,300 per coin and other costs. I think the best we can do at this time is guide that approximately continuing. Of course, the halving has an impact on that, but that notwithstanding, other costs, which should probably continue at the same rate, but we are going to hope to decrease those by having a lot less minor repairs going forward.

Regi Smith

Got it. And you say minor repairs. You’re not repairing the equipment from your hosting partners now, are you?

Jason Les

No, sorry, let me clarify…

Regi Smith

I guess the comments were blended there. I’m trying to figure out how much of it was kind of the overhead drag from the hosting business versus some of the other things?

Jason Les

Yes, so let me clarify. Minor repair costs have always been in cost of goods for self-mining. So that is not a new expense. I would say that the minor repair costs have been elevated in both Q4 and then now in Q1 of 2024, sorry, Q4 of 2023 and Q1 of 2024. And we expect that those are going to go now going forward. And these are third-party repair costs. These are the costs that we are paying to third-party vendors for repairing our miners.

The other cost increase quarter-over-quarter by approximately $5,000 per coin, that’s largely these other expenses that were previously included in data center hosting cost of revenue that is now in Bitcoin mining cost of revenue. So some examples of this would be some direct labor expenses, some land lease and property taxes, and then network costs and other utility expenses that we incurred.

Regi Smith

Yes, that makes sense. And then I guess one big picture question for you. I appreciate the disclosure on kind of the 100 exahash. As you think about growth beyond Corsicana, does that look different in terms of the size of facility? Like is Corsicana like the last final big facility? Do you think there’ll be smaller ones going forward? And I asked that just in light of all of the AI interest and power assets and things like that? How are you thinking about that net 40 exahash of capacity beyond Corsicana? What does that look like?

Jason Les

Yes, I think that what we have at Corsicana is very valuable because it is probably the last 1 gigawatt site, probably the only 1 gigawatt site that exists and probably the last one that’ll ever be approved. Access to power is going to be a critical constraint for Bitcoin miners and these other industries scaling up going forward. So I think what you should expect to see from us is capturing smaller size opportunities. We are not opposed to doing smaller sites. We’ve merely been acting on the most frictionless growth path that’s been in front of us, which has been these two sites with a large capacity.

We’re open to new sites and new opportunities of all size. And we’re working on that quite a bit right now. So we look forward to sharing more results as those ideas become more actionable going forward.

Regi Smith

And I guess that could be outside of Texas or maybe even the United States, or are you still trying to think about staying in Texas?

Jason Les

No, we are open to operating, I would say, in the United States and North America. We operate in Texas, because that has been the easiest pathway to growth, and we really like the power market here. We’re able to really achieve this industry-leading low cost of power here, which is just so critical in Bitcoin mining. That doesn’t mean those opportunities don’t exist elsewhere though. So we look at opportunities all over the country all the time. International opportunities, I think, to be determined, we’re seeing some interesting things in South America and elsewhere. But there’s other considerations always just besides power costs. So we look at a lot of things, but I think you could expect to see our growth in North America in the foreseeable future.

Regi Smith

Perfect. Thanks, guys. It was nice talking to you.

Jason Les

All right. Thank you, Regi.

Phil McPherson

And our next call comes from Lucas Pipes at B. Riley Securities. Lucas?

Lucas Pipes

Thanks very much, Phil. Good morning, everyone. So, my first question is back on the hosting side. And if we were to be on site today, would there still be machines from your former host or customers, or have they been removed? Thank you very much.

Jason Les

Yes, Lucas. So while we terminated our last two remaining hosting agreements in towards the end of 2023, one of those customers still remains operating on site. So for the first quarter, that accounted for about $3.2 million in revenue that was included in our Bitcoin mining revenue. And then their power cost of about $4.5 million was included in our cost of revenues for Bitcoin mining. So you would see that one remaining customer there performing. I’m sorry operating while we continue through the legal process here and try to get to a resolution.

Lucas Pipes

And the other one is fully out of your facilities at this point?

Jason Les

That’s correct. That’s correct.

Lucas Pipes

Thank you. And kind of taking a step back, would you consider going back into the hosting business or is the lesson learned here never again?

Jason Les

Yes, I think that’s the lesson learned here. Maybe I’ll say it a little more strongly than I would say it. I think we have seen the best use of this infrastructure and building new infrastructure is for growing our self-mining operations. We want to get maximum exposure to Bitcoin. We want to leverage our efficient cost of production over the wider scale possible. And I think expanding the hosting business really just takes away that valuable infrastructure pipeline, which I think generates the results and better grows our business, more what our shareholders are looking for. So we are not looking to grow the hosting business any further.

Lucas Pipes

Very helpful. Thank you. And then just to round this out, when you look at M&A, you mentioned earlier you are inquisitive if you build out a sophisticated corporate development team. Would you rule out any targets that have hosting agreements today? And more generally, what would the ideal target look like? Thank you.

Jason Les

Sure. Let me turn that back to Jason Chung, our Head of Corporate Development.

Lucas Pipes

Sure.

Jason Chung

Thank you, Jason, and thanks for the question, Lucas. Look we — in the M&A world, we see a wide variety of opportunities and it’s rare to see a target that 100% encapsulates everything you’re looking for. So sometimes there are situations where there’s an opportunity to make a deal, but it might come with some amount of hosting, for example, or other factors which may not completely tie to our overall strategy. And that’s something that we have to take into account when we evaluate some of these opportunities in the market.

So I’d say that as long as an opportunity is able to check most of the financial and strategic and operational boxes, the criteria that we have, then we’ll consider it. That being said, at the same time, we are incredibly blessed at Riot to have an organic growth opportunity unlike others in the space. And so ultimately we have to evaluate all these opportunities relative to our ability to control our own destiny at Corsicana and develop our pipeline with full control over what that looks like.

Lucas Pipes

Thank you. And in terms of size, what do you think is there a sweet spot either in terms of value dollars or kind of megawatts of capacity?

Jason Chung

I wouldn’t say there’s a specific sweet spot in size. We do look at opportunities across the spectrum. Obviously as a large-scale miner we like looking at large-scale opportunities that can move the needle. But I think there are some interesting businesses that aren’t necessarily large-scale that may be a little less appreciated by the market or kind of fly under the radar. And so there are some interesting deals that can be done on there as well.

Lucas Pipes

Really appreciate all the color and comments. Continue best of luck.

Jason Les

Thank you, Lucas.

Phil McPherson

Okay we’ve got time for one more question. Our last question is going to come from Owen Rickert at Northland Securities. Owen?

Owen Rickert

Hey guys, thanks for taking my question. I’m on for Mike Grondahl all the day. So just quickly, I guess, what’s your confidence level on getting to the 31 exahash by the end of the year? And what are some of the challenges you might face or you’re currently facing to get there?

Jason Les

Thanks for the question. I think we feel pretty confident about our ability to execute on that growth target. We’re taking things step by step here. I would say a lesson that we learned from Rockdale was rushing too fast to get every minor online as quickly as possible, kind of, often times you miss some steps that you have to come back and address later. So we’re very incrementally approaching the development here. The big milestone was energizing that substation. That was huge. We’re very proud of that. And now it’s a matter of just incrementally putting up these buildings, deploying the immersion equipment, and putting the miners in and going from there.

So we’re making these deployments step by step and you can expect to just see this continue over the rest of the year. The challenges are really just kind of the small things that will come up in any large development. As you build and scale out more, you’ll incur different problems like, hey, this electrical switch needs something. This networking thing needs resolution here. Or this immersion system needs to be altered quite a bit. None of them are critical or big roadblocks. They’re just the kind of punches that you roll with in this business. And through our experience and building this infrastructure at scale, we’ve become quite good at identifying small issues, resolving them, and then just continuing to move forward. So to wrap that up, we’re very confident about our 31 exahash goal and we are just marching forward on that for the next seven months of the year.

Owen Rickert

Awesome. Thanks a ton, guys.

Jason Les

Okay. That concludes our Q&A. Thank you everyone for listening to our presentation today and for the questions from our analysts. Very excited about what we have executing on Corsicana. We’ll be providing updates as we always do on a monthly basis going forward and look forward to speaking with everyone and sharing more results after the end of Q2 and Q2 results in August.

So with that, thank you everyone. Have a good day.

Operator

This concludes today’s teleconference. You may disconnect your lines at this time. Thank you for your participation and have a wonderful day.

Read the full article here