Dear readers/followers,

Banco Santander, S.A. (NYSE:SAN) is a company that I remain invested in at a mid-level. Since my last few articles on the company, this bank has posted a very solid performance that also has seen its valuation climb quite a bit – and, since my last article, the company has outperformed by growing 7% above the S&P500 return of around 6.5%. Not a large outperformance by any means or measurement, but a respectable performance for this bank nonetheless.

Above all, I remain high in my conviction that this company’s trajectory going forward is going to be a positive one, and that the results presented by Santander over the past few months are going to support this somewhat higher valuation.

Is this bank the most fundamentally safe financial play on earth? No, certainly not. That’s why this bank investment is about half the size of my other financial investments, and why I’m typically pretty slow adding to it – but I still say that this is a good overall investment.

So, in this article, I’ll update on Banco Santander, S.A. (SAN) and we’ll see where we have this bank going forward. You can find my latest article from August 2023 with the previous thesis for the bank here.

I’ve been covering this bank for over a year at this point and have remained high in my conviction despite the volatility in the stock due to what I believe to be operational outperformance potential, making sure this operational outperformance remains likely as the company reports its latest results. My key update will therefore be to make certain that this investment still has the upside that I’m looking for.

Banco Santander – An upside of double-digits remains here

Santander has been a bank that pretty much since the GFC has not performed all that well. 2011 and 2012, it dropped. 2013 til 2019, it pretty much went nowhere, and in 2020, the earnings crashed again. However, following the COVID-19 crisis, which is when I started investing in Santander, the bank seems to have turned over a new leaf.

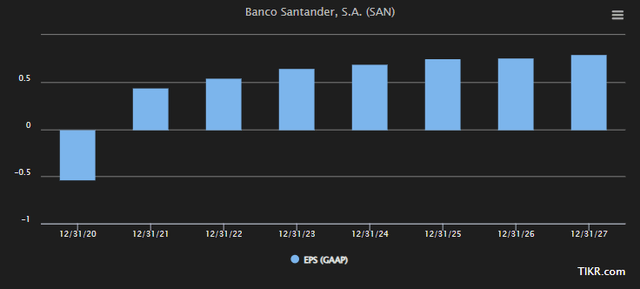

The company’s fundamentals are improved. It’s now A+ rated. The company’s earnings trajectory has been a never-ending solid story since essentially late 2020, with 2021 seeing an 80% EPS improvement and the current expectation for close to double-digit earnings improvement annually.

This bank has over €60B worth of market cap, a total equity value of over €500B, and could, despite the low dividend of around 3%, have a total return potential with a very high eventual valuation, once the market normalizes to levels of 12-13x P/E where this bank has been before.

It currently trades at around 6-7x.

Why do I believe in this degree, or level of normalization relative to today’s valuation? In my work, I put a non-trivial weight to historical averages, especially over a longer period, meaning 10-20 years. This is how I’ve managed to outperform the market – by investing when valuations for a company have been well below historical averages for that company and the market – preferably both. This is the case for Santander as it stands today – a 6-7x normalized P/E is around half the multiple the company has commanded during a 20-year average. This might be justified if the company was in some sort of longer-term earnings slump, or a fundamental deterioration – but the case is the actual opposite, which we’ll see from quarterly results.

3Q23 is the latest set of results we have (You can find those here) reported in October, and it’s a clear and concise continuation of the positive trajectory we’ve seen for Santander.

In what way?

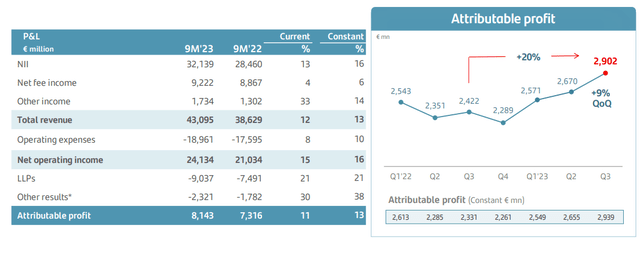

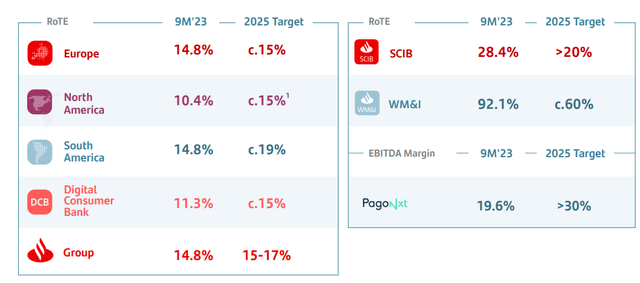

The company saw a YoY 20% improvement in profit, 11% on the 9M period. So that double-digit improvement, that’s confirmed. The company’s RoTE improved by over 125 points, with a straight, bottom-line EPS improvement of 17%.

The company still isn’t a market leader in CET1, but nonetheless has seen a good improvement in this as well.

Santander IR (Santander IR)

What is this coming from, aside from the obvious interest rate trends? The company is growing in terms of overall customer revenues, but also improving in efficiency. It’s now fully on track to deliver the 2023E financial targets of double-digit revenue growth at 13%, and a 44-45% efficiency ratio, with a CET-1 of over 12%.

Most of this is organic growth. The company also improved the dividend, but at these levels, that is an absolute given, with the low dividend payment we have today. The company also combines this dividend return with buybacks and announced that since 2021 and going with the full authorization, Santander will have bought back close to 10% of shares outstanding, which of course goes a long way to support the current valuation as well.

A beaten-down bank stock like this needs to provide consistent and unerring proof that it does manage to grow its earnings and other KPIs, and the company is still only somewhere at the beginning of that trend, as I see it.

But the signals, for those who want to look, are all there.

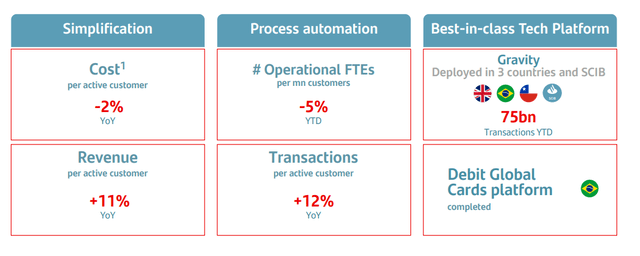

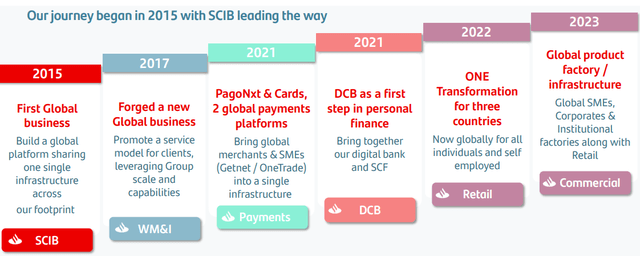

The bank is seeing underlying efficiency improvements with its so-called “one transformation” (much of what I see in terms of improvements), which is the core method of the company driving down costs and driving up other indicators. And this is working wonders on a global scale. This program is what most other banks are doing to improve their operational efficiency, and it involves a combination of streamlining inefficient bureaucratic processes, increasing digital adoption for certain parts of the operations, and as we can see below, overall making sure that less are doing more, adding to the bank’s bottom line. That’s the essence of its “One Transformation”, another name for what many companies have been doing for years at this point.

Santander IR (Santander IR)

As long as these improvements continue along this sort of trajectory, and there are no risk additions for the company, I don’t see any reason why this company should see a massive drop in its valuation – and even if it did, I wouldn’t see it as justified here.

The pace of revenue growth in many of these segments that the company is targeting, such as the global and network businesses, is growing faster than the group overall.

While still very small compared to a segment like Auto leases, where the company has over €179B and which is slightly falling, the growth in something like WM&I is still 22%, growing to €52B.

South America remains one of the company’s core targets for profitability, with a 19% target in 2025E, the highest in the entire group, and carrying a large part of that group’s 15-17% target for the 2025E.

Santander IR (Santander IR)

Overall, I do not see a lot of risk in this company’s most recent results. With both NII and NIM up YoY supported by both volumes and rate increases, South American trends moving to the positive sector, positive jaws from the transformation program (this means that the company’s revenues are growing faster than its costs), and a continued improving overall credit quality for the company’s loans and portfolios, there are a lot of things to like here.

Yes, compared to other European, and especially Scandinavian banks, this company’s NPLs and CoR ratios are at shockingly high levels. NPL for September 2023 was 3.13%, with over €35B at stage 3 and over €1,000B at stage 1. Compare this to something like Swedish banks, which rarely, if ever, rise above 0.5%.

However, coverage ratios remain robust at over 65%, and this is still something to expect in this particular credit environment. Unemployment remains very low in the company’s target geographies, and most of the group’s provisions are related to retail. Chiefly among its impacted geographies are Poland, with Brazil improving, Mexico actually at good levels, and the US in line with overall expectations.

As I said, this has been a long journey for Santander going back at least 5 years – and a difficult one. Santander coming out of the GFC was in bad shape, with 2011 earnings going down 31% and at absolute lows. The bank then went through essentially from 2013/2014 to 2020, almost 6 years without any sort of earnings improvement, which saw the share price collapse to the bottom of COVID-19 lows, and once again low EPS. Since then, the company has recovered – but the share price, while we’ve seen the beginning of a journey here, is not reflecting these improvements yet.

Santander IR (Santander IR)

I became comfortable investing in that journey a few years back when the price justified it. I haven’t regretted it since that first investment.

It’s important to contextualize these latest set of results in the bigger and longer picture. What I want to see here, every quarter, is no signs of worry in the underlying fundamentals or growth prospects. I don’t want to see any of what I consider the most important KPIs “fizzle”. If that was the case, I would revisit my fundamental thesis and expectations for this bank. Let’s say we were to see, suddenly, a decline in profitability in some of the company’s major markets, such as South America or the home market Spain. Given the importance of these markets, this would warrant a far deeper survey of what’s driving this deterioration, and if we should expect this to continue. But to put this quarter in the context of the bigger picture, it was yet another confirmation for me that Santander is indeed moving in the right direction, and to my thesis that the upside isn’t materialized enough in the valuation.

My expectations for FY23, and for 4Q23, which is going to be reported in about 2 weeks, is a strong finish to the fiscal. I expect further Net fee income and improved profitability numbers not only in the European but in the South American markets as well. I believe the company will deliver on the 2023E targets – as it has communicated that it is on a good trajectory to do so. I believe, furthermore, that we’re only at the beginning of a material EPS improvement for this bank – and I’m far from the only analyst seeing the signs of underlying improvements, as most forecasts call for a ~€0.4/share native EPS or thereabout, but one that’s likely to improve as much as to double that within 4 fiscal years, as the improvements the company is currently executing on mature (Source: S&P Global).

Let’s look at the risks and upsides for this particular bank.

Risks & Upside for Santander

The company’s long-term trends are far inferior to the shorter-term ones. In fact, my investment in Santander is up more than 24% in a single year. I would categorize the primary risks to Santander as follows.

The obvious risk to the company is the heavy LATAM and South America exposure. No matter how even someone positive on the region such as me wants to slice it, it’s one of the most politically volatile regions in the entire world, perhaps except for certain regions in Africa and the Middle East. Another point in that region negative is that these regions are no strangers to large-scale banking collapses – and while Santander remains somewhat insulated due to its European domicile, it nonetheless has its feet and hands deep in those geographies. If you don’t like LATAM and Southern-American risk, you probably should reconsider Santander.

Santander reports its results and presents mostly in Euro – but the fact that around 70% come not from the eurozone but from foreign currency is another risk. The company remains, despite improvements, very exposed to emerging market currency risk. Another reason I remain only a comparatively smaller position in the company.

However, on the upside, if you’re like me, then this company operates in high-prospect areas and manages impressive profitability compared to almost all European peers. Its diversification and focus on retail banking also give it an incredible amount of risk spreading, which is a necessity for a player such as this one, and when this company’s portfolio is fully unlocked, then this bank could certainly go places. What I mean by this is that Santander has the potential to essentially 1.5-2x its earnings on a GAAP/IFRS basis if it were to be as efficient a bank in terms of C/I, credit quality, and operations as some of its European peers. Take a look at RoTE, Efficiency, and combined operating ratios of the insurance operations, also part of Santander. There’s no doubt to me that this is still years off, but it’s a potential – and it’s in this potential improvement that I am investing.

That’s how I see this company’s risks and upsides.

Santander Valuation

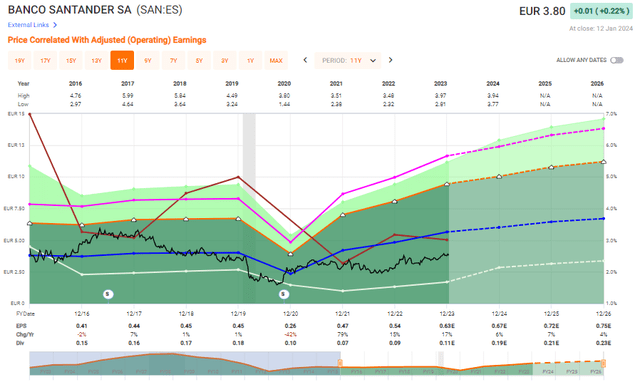

The valuation is of course a somewhat different story – because it remains very attractive here. Let’s say that we forecast the bank at the lower end of its recent 5-year average, which would come to around 8x P/E, which I believe to be the lowest we should allow here. That’s even with the relatively high miss ratio that the bank does have under its belt.

Such an estimate goes to 21% per year, or 76% until 2026, which remains a very solid and market-beating sort of potential RoR. Again, this is the lower short-term estimate.

If we were to use 20-year averages, which I would consider as actually being more accurate, then we could see an upside to an 11.2x P/E of 33% per year, or 137% total RoR. And this is not a strange or outlandish expectation in any way, given that the company traded well above this during worse growth prospects in the past.

The reason why I consider historical averages relevant here, as long as they’re in the longer term, is that the longer-term 20-year averages include both policy periods with low, and high interest rate periods. While I view it as dangerous to look at only a 5-year or even a 10-year average for a bank (for instance, Sweden has not seen interest rates this high in more than 10 years), a 20-year average takes into account a wider range of interest rate environments, which makes it more relevant.

Santander is volatile, and it has the potential to go both up and down in relatively significant ways. No doubt about that. However, as things stand right now, I view the trends for the bullish view as extremely favorable.

Banco Santander FAST Graphs (FAST Graphs)

That is why, even with the relatively low yield that Santander still offers here of 3.66%, I would not view it as the best investment possible in terms of safety – but certainly safe enough with its combination of fundamentals to weigh up for the risks from the geographies wherein the company is active.

S&P Global analysts give the company a set of targets starting at $3.6 and going up to $5.8 with an average of $5.2. The company currently trades at $4.12. I give the company a price of $4.2, at least in my last article. Unpacking this price target, when it comes to banks, I’m looking at a few multiples. Book value multiples are more useful than with other companies, especially given the insurance operations because it helps us determine how much we’re paying for the bank’s assets relative to history and relative to the sector. EBITDA multiples are useless – P/E still has some value, but book multiples are higher on the list here (though, preferably, we use a combination of them). Santander, for the native, trades at a 15-year P/B average of 1.6x, with a high of 6x, and a low of 0.4x. It’s currently at around 0.8x. Even if you limit the comparison to the post-GFC era, the bank is still undervalued compared to a 1.25x – especially given the bank’s vastly improved credit quality since that time, as well as the operational safety. But the unpacking of the book value also explains why, while I say the bank can double in P/E, my price target does not imply a “doubling”, but rather a more modest upside – because I work more with P/B when it comes to these companies.

While I do see further upside to this bank and could increase my target given the latest set of positives, I’m not doing that until I see the 4Q results – so for now, I’m keeping my target “steady” here, with a solid “BUY” but with a low upside to my current PT. I’m prepared to bump my target here if I see further upside, but for the time being, I give the company around 1-1.1x P/B in the target range, and upwards of at least 8-9x P/E, compared to the current native P/E of around 6x. This takes into consideration as well, what I consider to be a vast outperformance potential based on earnings – take a look at what S&P Global analysts are expecting over the next few years, which is part of what I base my upside on.

Santader EPS Estimates (S&P Global/TIKR.com)

Here is my updated thesis for 2024.

Thesis

- Santander is one of the better banks found in the Southern European area and geography. It has significant emerging market exposure, which gives it a heightened risk profile in context to other banks – but it’s also immensely qualitative, as evidenced by how it has survived previous downturns.

- I consider Santander a “Buy” at cheap valuations, and I believe this bank can deliver significant upside over time – and now is one of those times.

- I believe the company’s thesis and potential have improved since my last article, and I continue to add shares, albeit at a lower rate than some other banks.

- I remain for Santander at a PT of $4.2/share, a share price upgrade, and give it a “Buy”.

- This thesis has been updated for 2024, and I remain positive here.

Remember, I’m all about:

-

Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

-

If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

-

If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

-

I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansions/reversions.

Despite a 7% RoR since my last article, I consider the company fulfilling all of my criteria – it’s attractive here.

Read the full article here