In this article I analyze the Schwab Emerging Markets Equity ETF (NYSEARCA:SCHE), a thematic ETF that tracks the performance of the FTSE Emerging Index, focusing on the characteristics and metrics that, in my opinion, are worth to be considered. I also explain why I maintain a neutral stance on emerging markets outlook, despite some positive news on the matter, and I discuss why SCHE suits the diversified portfolio strategy of a long-term investor.

A summary of the most important characteristics of SCHE

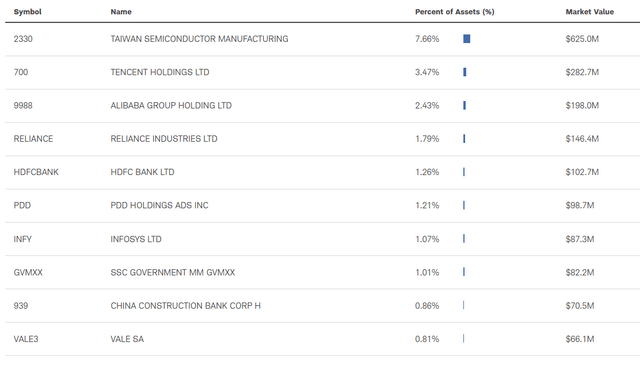

SCHE primarily invests in mid and large caps, maintaining minimal exposure to small caps. Specifically, it holds 60.8% of its investments in large-cap companies (market capitalization above $15 billion). On the other hand, for the small caps, the exposure has fluctuated over time but has consistently stayed below 5% (currently 4.69% for capitalizations between $1 and $3 billion and 0.315% for those below $1 billion).

Top 10 holdings (Charles Schwab)

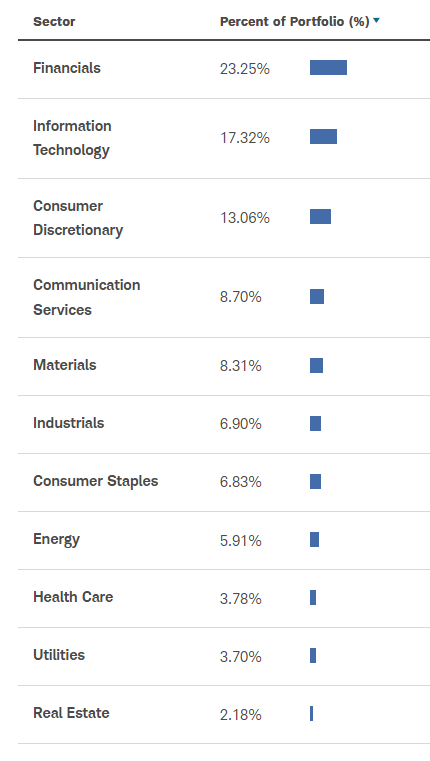

While the diversification by sector is excellent, the geographical diversification has, in my opinion, contributed to the ETF underperformance of the last few years.

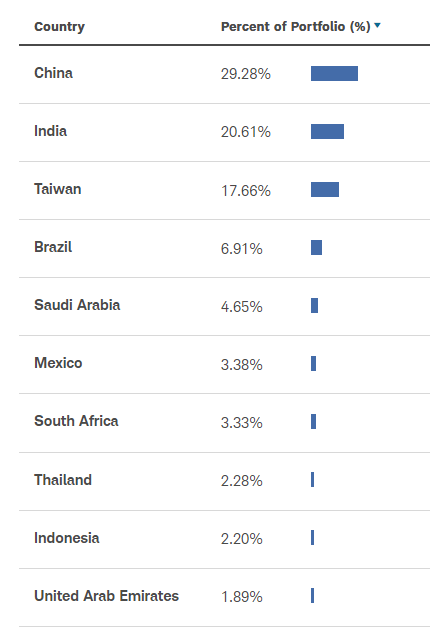

SCHE Geography (Charles Schwab)

SCHE Sectors (Charles Schwab)

Particularly, the overexposure to China in recent years has weighed down the ETF, especially when other less-exposed markets were performing better. indeed, over the last 3 years, China has experienced a -45.9% decline, whereas India and Taiwan (currently second and third in terms of exposure) have seen positive performances of +40.5% and +13.2%, respectively.

Presently, the ETF’s exposure to China has reduced due to the decline in the country’s markets, with exposure around 30%, compared to approximately 20% in India and 17% in Taiwan. It’s essential to note that this overexposure is not necessarily negative, especially if China experiences a recovery after three years of stock market decline, stimulated by positive economic news.

Additionally, the ETF has a relatively low expense ratio of 0.11%, a Weighted Average Market Capitalization exceeding $95 billion, and a Median Bid/Ask Spread of 0.04%, indicating high liquidity and reliability for long-term investors. Furthermore, the ETF offers an attractive dividend yield, currently standing at 3.83%.

Is SCHE the Best Emerging Markets ETF?

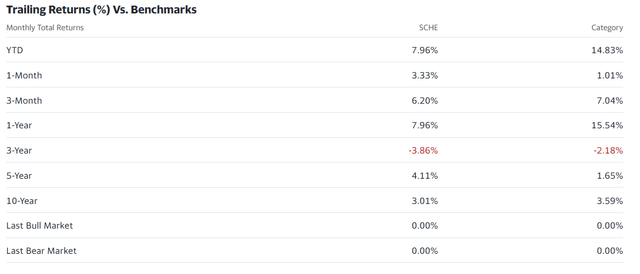

Comparing the fund with others in the same category, it is evident that SCHE possesses good characteristics. However, it falls short of being the best among its peers. Examining the 10-year performance reveals that SCHE returned 3.01%, whereas the industry average stands at 3.59% (image below).

SCHE Performance (Yahoo Finance)

Similar trends are observed in other indicators: for example the Sharpe ratio is below the category average in the last 3 years and the last 10 years, registering respectively -0.32 versus -0.06 for the category and 0.18 versus 0.24. The alpha is not better, recording -0.44 over the last 10 years compared to the category average of 2.04.

SCHE Risk Indicators (Yahoo Finance)

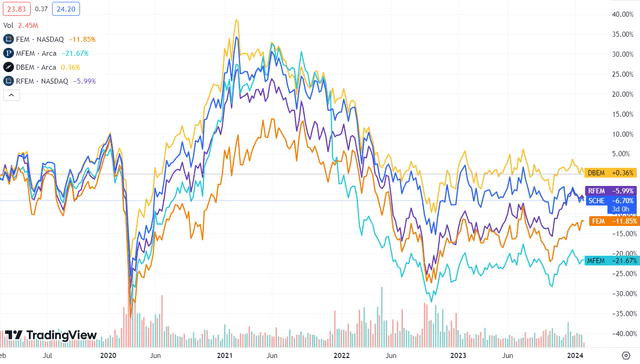

Furthermore, a comparison with similar ETFs in composition and investment theme, as listed on Seeking Alpha’s Peers Section, reveals that SCHE has returned -6.70% over the last 5 years, positioning it mid-range among the analyzed ETFs.

SCHE Performance (TradingView)

In other words, SCHE proves to be an excellent ETF, but it is not the best!

A Brief Outlook on Emerging Markets in 2024

In general, my opinion on the performance of emerging markets in 2024 is neutral since, despite several positive signals, I see many elements of uncertainty.

Looking at China, there are still many doubts, especially about growth. Furthermore, the ongoing real estate crisis, demonstrated by the recent collapse of Evergrande, does not offer good future perspectives. On the other hand, many analysts suggest that, following three years of decline in the Chinese stock market, the current scenario presents an opportunity to invest.

Looking at Taiwan, a potential reduction in rates in the United States and Europe might stimulate consumption, particularly in the technology sector, which is the island’s leading industry. However, also here there are uncertainties: recent presidential elections have left China unsatisfied, and it remains unclear if the rate reductions in Western countries will be significant enough to drive substantial demand.

On the other hand, India appears to have the most promising outlook. Despite challenging macroeconomic conditions, the country has shown resilient performance, strong growth figures and indicates a positive trajectory for 2024.

However, when considering the overall landscape of emerging markets, I see a mix of positive signals obscured by uncertainties in various countries. For these reasons, I believe that 2024 will be a year in which to be cautious, and therefore, I maintain a neutral outlook.

Bottom Line

Finally, it is crucial to underline that this type of ETF is not suitable for speculative market trends, but, in my opinion, it is more recommended for long-term investors seeking geographical diversification. In fact, the ETF performs better when combined with other ETFs in a diversified portfolio to lower overall risk, especially given the fact that I don’t expect big gains or losses for SCHE this year. Therefore, for these reasons, I assign the ETF a “Hold” rating.

Read the full article here