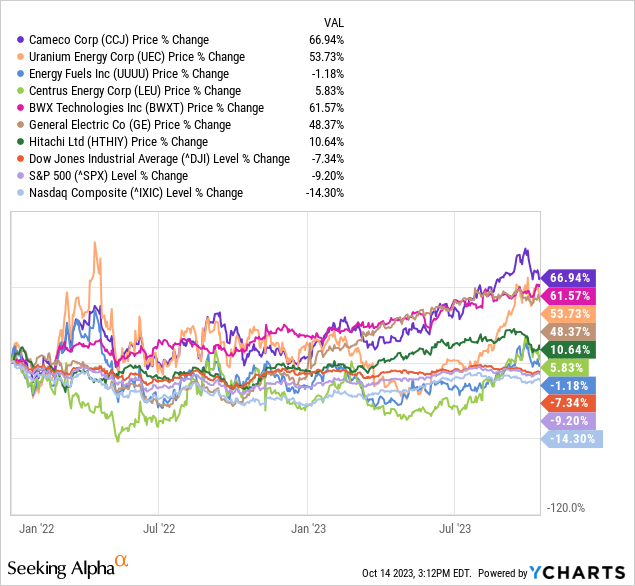

The nuclear energy investment space has been power-on. We are invested in all three subsegments: a) Miners – Cameco (CCJ), Uranium Energy Corp. (UEC), and Energy Fuels (UUUU); b) Enrichers – Centrus Energy Corp. (LEU); and c) Reactors – BWX Technologies (BWXT), and General Electric (GE) in their alliance with Hitachi (OTCPK:HTHIF) (OTCPK:HTHIY). A quick look at the charts of these seven companies shows that they all have outperformed the DOW, S&P, and NASDAQ since the beginning of 2022 when we started building our positions:

Driving the Need

Clearly, demand for carbon-free nuclear power is driving these stocks as projected and reported by various sources:

- In the high-case scenario of its new outlook, the International Atomic Energy Agency now expects world nuclear-generating capacity to double to 792 gigawatts (net electrical) by 2050.

- MarketWatch reports that “nuclear power could see its biggest expansion in decades, leading to increased demand for uranium.”

- Reuters puts it this way, “Uranium prices are likely to extend a blistering rally and end the year more than 50% higher as mounting worries over climate change accelerate a global shift to cleaner sources of energy including nuclear power.”

- For those needing more by way of tangible proof, the US’s first new nuclear project to be built from scratch in three decades, the Plant Vogtle reactor in Georgia, became commercially operational just two months ago.

Global uranium production has Kazakhstan in the lead with 46%, followed by Namibia, Canada, and Australia each at 10%+/-, with those less than that mark including Uzbekistan, Russia, Niger, China, India, and Ukraine. Notice that the United States is NOT among this list (but a few of our geopolitical adversaries are). This fact is foundational to the view that our government is vested in developing our own uranium resources. Accordingly, count me among those who believe that these stocks will continue to perform well.

Uranium Enrichment

With the rare exceptions of minority interests held by major utility companies, the process of actual uranium enrichment is controlled by state-owed or multinational atomic energy agencies – CNNC in China, Orano France, Rosatom Russia, and Urenco in the UK. Obviously, this precludes opportunities for investors.

Centrus Energy is an exception as a publicly traded company (again, LEU) that holds the only license in the US to enrich “HALEU” required by small modular reactors (SMRs). Their process is based on gas centrifuge technology that represents an advancement over gaseous diffusion used during the Manhattan Project and is now considered outdated due to its low efficiency.

Global Laser Enrichment LLC (GLE) is another outlier. A private entity, its joint venture partners are public. Cameco, Canadian, owns stock and options that could potentially give it 75% control of GLE; Silex Systems (OTCQX:SILXF) (OTCQX:SILXY), Australian, – who developed the SILEX technology licensed to the JV – currently owns 51% of GLE. Their intellectual property is in laser technology used to separate uranium isotopes (I am not a nuclear physicist). It offers the possibility of a higher degree of enrichment in a single step over traditional processes. However, engineering and scale-up have proved difficult, and NO commercial laser separation facilities are currently operating.

GLE has evolved in fits-and-starts. The joint venture was formed by GE in 2006 to be joined by Hitachi in 2007 and Cameco in 2008. GE and Hitachi later stepped back reportedly because of “…the downturn in nuclear fuel markets (coupled with a) surplus in global enrichment capacity…”. Nevertheless, after many years in the making, the R&D potential of laser-based uranium enrichment may be on the cusp of being realized. Just this past August, Silex announced:

“…successful completion of testing of the second module of full-scale laser technology required for GLE’s commercial pilot demonstration project…”, [including for High-Assay Low-Enriched Uranium, HALEU needed for SMR’s, see Centrus reference above.] Incidentally, this work is being pursued both at the company’s facility in Wilmington, North Carolina as well as in Sydney, Australia.

DOE Has it Surrounded

Against this history, the United States Department of Energy is on a tear to facilitate the development of our own uranium resources. Working with collaborating governments and agencies, the DOE has it surrounded:

- They approved the restructuring of GLE and struck, then updated, a sales agreement providing GLE access to large stockpiles of depleted UF6 tails.

- The Nuclear Regulatory Commission (NRC), closely aligned with the Department of Energy, licensed the first US-owned, US-technology uranium enrichment (centrifuge) plant since 1954 in Centrus Energy’s facility in Piketon, Ohio. The DOE itself is in a cost-sharing agreement with Centrus to demonstrate production at the facility.

- Meanwhile, the DOE awarded BWX Technologies a contract to process thousands of kilograms of government-owned scrap material containing enriched uranium to produce high-assay low enriched uranium – HALEU – feedstock as fuel for advanced nuclear reactors.

The Investment Hypothesis

The proposition here is strategic – If you believe that we need ‘dense’ non-carbon energy produced by nuclear reactors AND if you believe that some countries, the US included, are overly dependent on others for the same, then uranium mining and enrichment are of issue.

As to Silex Systems, as noted above it has evolved with on-again-off-again alliance partners in GE and Hitachi. Meanwhile, as also noted, the company appears to be registering progress with its SILEX technology in alliance with Cameco which itself appears to be moving toward a fully integrated nuclear energy company with their recent move to acquire Westinghouse Electric together with Brookfield Renewable Partners.

Laser enrichment is not there yet. Until it is, Silex shares should be considered speculative, not suitable for investors who cannot afford significant setbacks. Still, the company has staying power represented by their history, low cash drain, and small but strong balance sheet:

|

Latest Annual/June ’23 |

|

|

Total Revenues |

$6.4M |

|

Gross Profit |

-$0.5M |

|

Operating Income |

-$2.1M |

|

Net Income |

-$11.6M |

|

Operating Cash Flow |

-$1.6M |

|

Working Capital |

$96.4M |

|

Current Ratio |

52x |

|

Total Liabilities |

$2.3M |

|

Total Equity |

$99.0M |

|

Liabilities to Equity |

0.02x |

As noted at the outset, over the last 18 months or so we made the leap and, with spectacular results, now have 16% of our stock holdings invested in nuclear energy. We only recently added Silex Systems to that book believing that laser enrichment may be coming of age; we will see.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here