SITE Has Multiple Factors To Consider

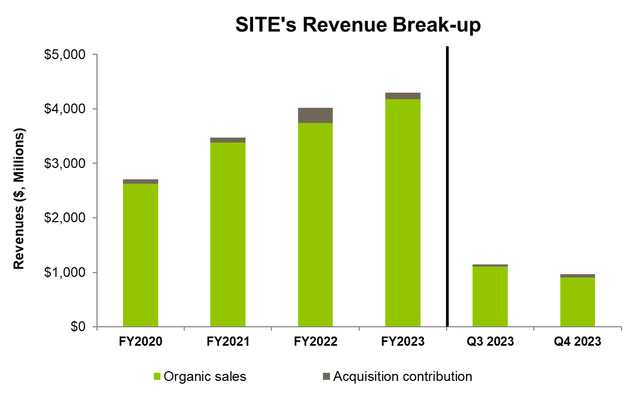

I previously discussed SiteOne Landscape (NYSE:SITE) on September 4, 2023, and you can read the latest article here. SiteOne, with its focus on small customers and private label brands, will manage costs proactively through lower inbound freight costs. The company’s customer backlogs in commercial construction led to a steady sales volume in the maintenance category. As the organic growth lacked a punch, management took the inorganic route. It acquired several small acquisitions, aggregating significant revenue additions to its top line.

However, SITE’s operating profit took a downturn in Q4, and I expect the commodity price deflation to continue to depress its financial performance in Q1 2024. The industry and economy suggest a mixed signal, but a housing market turnaround in early 2024 can lead to robust sales growth for landscaping products. Its cash flows improved handsomely while its liquidity remained robust in FY2023. The stock is reasonably valued versus its peers. I expect the effect of commodity price deflation to subside as the construction market and the economy recover by the end of 2024. Investors may consider “holding” the stock, expecting to keep returns steady in the medium term.

Why Do I Maintain My Call?

In my previous iteration in September 2023, I discussed SITE was focused on commercial initiatives and acquisitions to leverage its position to grow its small customer base. On the other hand, it faced challenges from the benign pricing and the weakness in the housing market. I wrote:

Looking at the fragmented nature of the landscaping end market, SITE aims to grow the small customer base faster than the average. To augment this strategy, it focuses on partner program members significantly. Because the end markets will either decline or see modest growth, it plans to improve margins by lowering inbound freight costs through a better transportation management system.

After Q4, the company maintained previous approaches, focusing on private label brands and complementary acquisition strategy. It acquired several companies in 2023, which added significant revenues to its portfolio. However, the decline in commodity prices will constrain its financial results in the near term. But, I expect its commercial and operating initiatives to gather the necessary momentum over the medium term. Given the slight relative overvaluation, I maintain my “hold” call.

Value Creation

SITE’s Filings

SITE has a diverse end-market mix, a broad product portfolio, and wide geographic coverage – the factors that create value for the customers and suppliers. It aims to grow small customers faster than its average because of the private label brands in the product mix and lower inbound freight costs through its transportation management system. Its commercial and operational initiatives complement the acquisition strategy. So, it creates value through organic growth, acquisition growth, and EBITDA margin expansion.

SITE estimates that 65% of its business is focused on maintenance, repair, and upgrade, 21% on new residential construction, and 14% on new commercial and recreational construction. It also estimates it has a 17% share of the wholesale landscape product distribution market. It acquired 11 companies in 2023, which added $320 million in trailing 12-month revenue. I expect much of the growth momentum in the end markets to continue.

The Recent Challenges

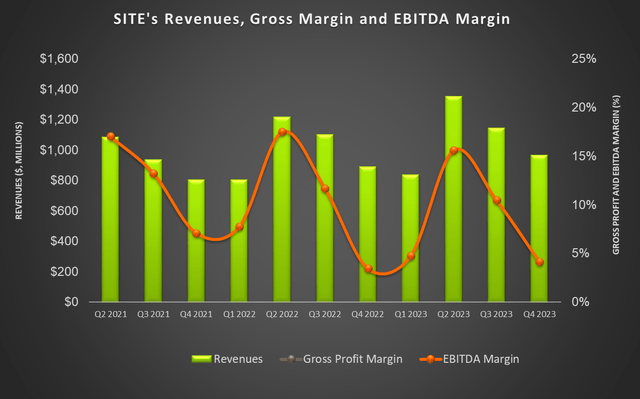

SITE’s gross margin and adjusted EBITDA margin were softer in 2023 than the previous two years when it experienced steep price benefits. In 2023, it witnessed commodity price deflation, which caused a temporary negative impact on its financial performances, including organic daily sales growth and profit margins. The company’s Q1 2024 results will remain depressed by the effects of the commodity price decline. In 2H 2024, however, the impact will subside, and the company will have opportunities to increase its margins and operating leverage through commercial and operating initiatives.

FY2024 Outlook

The company’s repair and upgrade demand will be flat in 2024, while its sales volume in the maintenance category can grow in the “low single digits,” estimates the company. Lower commodity prices can push higher demand from the customers in this business. Plus, the application rates have recovered since the 2022 downfall.

So, with the organic growth factors plus the benefit of acquisitions completed in 2023, SITE’s gross margin can improve in 2024. The company’s initiatives on productivity improvements, with the benefits of organic daily sales growth, can help expand the operating margin. The acquisitions pipeline also appears strong for the company. The synergies and contribution from Pioneer Landscaping Centers and other acquisition contributors can result in an FY2024 adjusted EBITDA of $420 million-$455 million. So, its adjusted EBITDA can increase by 6.5% in FY2024.

End Market Outlook

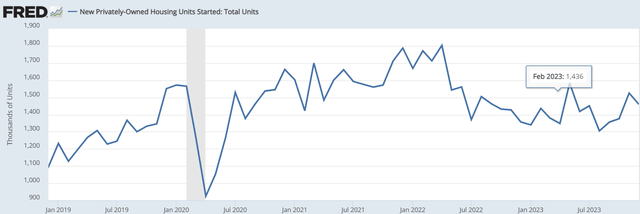

FRED Housing data

The permits for new privately owned housing units increased by 7.7% in the past six months until December. Also, in 2H 2023, the housing market has stabilized compared to 2H 2022. The company estimates its new residential construction accounts will grow modestly in 2024. Following the growth in single-family permits over the past several months, the demand for landscaping products can see momentum. However, new commercial construction, which saw relatively strong growth in 2023, can taper off in 2024.

However, the signal is mixed here as the architectural billing index shows contraction while the company’s estimates show steady project services bidding. The Architecture Billings Index was below 50 in December, indicating soft business conditions. The company’s customer backlogs in commercial construction have not shown weaknesses, suggesting stability at lower demand levels. If the housing market turns around sharply in early 2024, it can lead to robust sales growth for landscaping products.

The company’s repair and upgrade demand will be flat in 2024, while its sales volume in the maintenance category can grow in the “low single digits,” estimates the company. Lower commodity prices can push higher demand from the customers in this business. Plus, the application rates have recovered since the 2022 downfall.

Company Estimates And My Outlook

The organic growth factors plus the benefit of acquisitions completed in 2023 should benefit SITE’s gross margin in 2024. Its initiatives on productivity improvements, with the benefits of organic daily sales growth, can help expand the operating margin. The acquisitions pipeline also appears strong for the company. The company estimates that the synergies and contribution from Pioneer Landscaping Centers and other acquisition contributors can result in FY2024 adjusted EBITDA of $420 million-$455 million. This means that its adjusted EBITDA can increase by 6.5% in FY2024 compared to FY2023.

Since Q3 2021, the company’s adjusted EBITDA has grown by 40%, on average, quarter-over-quarter. During this period, the average monthly growth in the new privately owned housing units remained nearly unchanged. Because I expect the housing unit growth to remain steady in 2024, achieving an 8-12% EBITDA growth should be reasonable.

Analyzing Q4 Drivers

Seeking Alpha and Company Filings

As disclosed in SITE’s Q4 earnings announced on February 14, the company’s organic daily sales decreased by 15%. A decline in prices for commodity products (e.g., PVC pipe, grass seed, and fertilizer) triggered the sales fall. Despite the revenue additions from acquisitions amounting to an impressive 38%, the company’s total revenues decreased by 16% in Q4 compared to Q3.

From Q3 to Q4, its gross profit decreased by 16%, while its adjusted EBITDA shrank by 67%. Higher operating costs and selling, general, and administrative expenses led to a steep decline in EBITDA in Q4. But this sharp fall also reflects the absence of price realization benefit achieved in the prior year.

Cash Flows and Balance Sheet

SiteOne’s cash flow from operations improved by 37% in FY2023 compared to a year ago. Higher revenues and lower inventory led to the rise. Its free cash flow also increased by 65% in FY2023.

SITE’s leverage (debt-to-equity) (0.25x) is lower than its peers’ (BECN, POOL, MSM) average of 0.8x. As of December 31, 2023, its liquidity was $661 million. So, robust liquidity ensures little financial risks. The company aims to maintain a conservative balance sheet, to which it has devised a mechanism to return capital to shareholders. In Q4, it completed share repurchases of $11 million. Its capital allocation perspective looks to balance financial strength and flexibility.

Relative Valuation

Author Created and Seeking Alpha

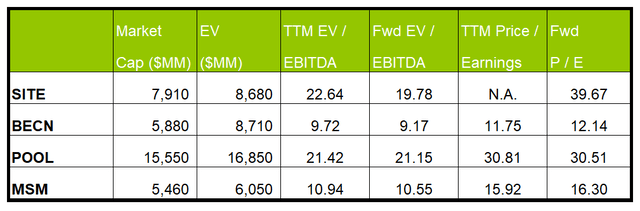

SITE’s current EV/EBITDA is expected to contract more steeply versus the forward EV/EBITDA multiple compared to its peers. This means its EBITDA should increase more sharply than its peers. This typically results in a higher EV/EBITDA multiple. The company’s EV/EBITDA multiple (22.6x) is higher than its peers’ (BECN, POOL, and MSM) average (14x). So, the stock appears reasonably valued, with a positive bias, compared to its peers.

For the past five years, SITE’s average EV/EBITDA multiple was 23.2x. If the stock trades at the past average, it can increase by 8% from the current level. The average EV/EBITDA multiple for SITE’s peers (BECN, POOL, MSM) is 14x. If the stock trades at this average, the stock price can decline by 36% from the current level. Since my last publication in September, where I suggested a “hold,” the stock has remained steady (up approximately 3%), which validates my previous call.

I think the company’s several acquisitions in 2023 will push its topline in 2024. However, the decline in commodity prices will constrain its financial results. As I discussed earlier in the article, I expect 8-12% EBITDA growth in 2024. Feeding these values in the EV calculation and assuming the sell-side forward EV/EBITDA multiple of 19.7x, I think the stock should trade between $175 and $182, implying a marginal downside.

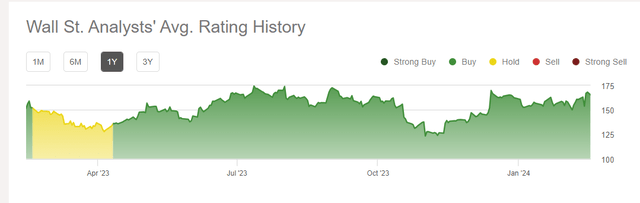

Analyst Rating

Seeking Alpha

Four sell-side analysts rated SITE a “buy” (all “Strong buys.”) Four analysts rated it a “hold,” while two rated it a “sell (including “Strong Sell.”) The consensus target price is $167.6, suggesting a 4% downside at the current price.

Given the factors I discussed in the article above and its relative valuation multiples, I think Wall Street analysts are realistic about its returns.

What’s The Take On SITE?

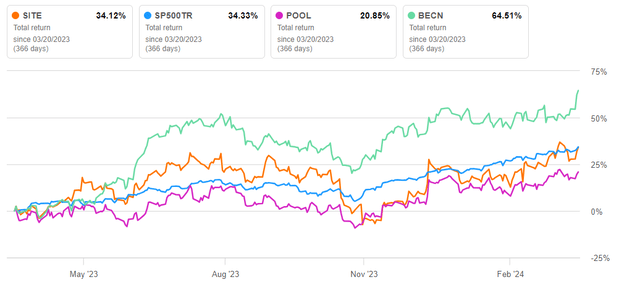

Seeking Alpha

SITE, after Q4, looks to create value through organic growth, acquisition growth, and EBITDA margin expansion. It acquired 11 companies in 2023, which boosted its revenues and gross margin. The growth in its end markets can expand the adjusted EBITDA margin. The stability in single-family permits over the past several months can also increase the demand for landscaping products. Because the end markets will either decline or see modest growth, it plans to improve margins by lowering inbound freight costs through a better transportation management system.

However, the commodity price deflation in 2023 can cause a temporary negative impact on its organic daily sales growth and profit margins. New commercial construction can taper off in 2024. So, the stock underperformed the SPDR S&P 500 ETF (SPY) in the past year. The company’s cash flows improved in FY2023, while its balance sheet remains robust. Given the rich relative valuation multiples, I think investors would want to “hold” the stock with limited near-term return.

Read the full article here