SoFi Technologies (NASDAQ:SOFI) delivered one impressive earnings sheet for the third-quarter which saw the largest amount of customer additions ever, a re-acceleration of account growth, for the first time since Q2’21, as well as an upward revised guidance for FY 2023. SoFi also sailed past earnings expectations and the personal finance company is now solidly on track to report its first-ever GAAP profit in Q4’23. The student loan origination business is also seeing strong momentum after the student loan moratorium expired. However, the market’s reaction to SoFi’s earnings report was truly confounding — shares were up only 1% — and I believe that, given that the firm’s metrics all point to the upside, SoFi represents a strong buying opportunity!

Previous rating

I rated SoFi as a hold in August despite the looming resumption of student loan repayments because I considered shares to be highly valued at the time. Investors also seemed to have gotten carried away a bit with soaring bullish sentiment, so I adopted a position of caution at the time: SoFi: Why I Am Down-Grading To Hold Despite Record.

Given the strength in customer growth on the SoFi platform, I believe the FinTech is on track to deliver outstanding results in the next several years, regarding top line, account, and adjusted EBITDA growth. The re-acceleration of account growth in the third quarter was unexpected and attests to the strength of SoFi’s ecosystem. I believe shares are now also much more reasonably valued for long-term investors.

Strong earnings sheet for Q3’23

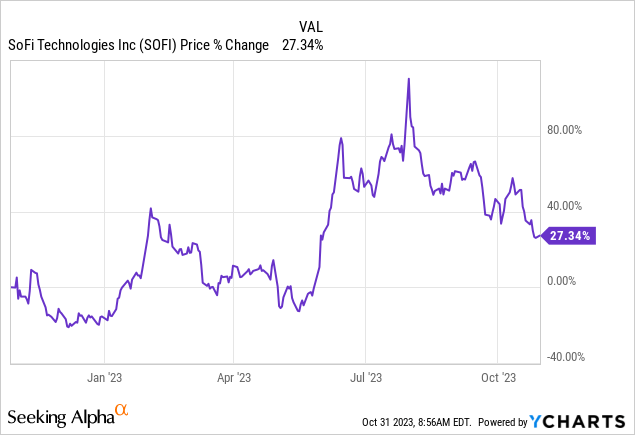

SoFi reported earnings for the third quarter on Thursday that, on an adjusted basis, totaled $(0.03) per share. Although still a loss, the $0.03 per share loss was drastically lower than the expected one of $0.09 per share. GAAP earnings totaled $(0.29) per share in Q3’23, but management confirmed its belief that the FinTech will achieve GAAP profitability in the fourth quarter.

Source: Seeking Alpha

Truly impressive customer growth

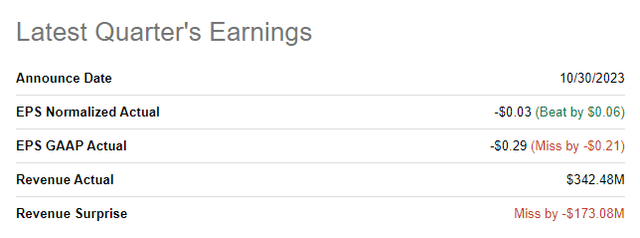

SoFi’s customer growth in the third quarter absolutely and totally crushed it: the FinTech added a massive 717 thousand new customers to its SoFi personal finance platform in the September quarter, which was the largest absolute number of account additions in a single quarter ever.

Just as impressive was the fact that SoFi saw a re-acceleration of growth in the third quarter, the first such acceleration since the second quarter of FY 2021: the growth rate in new accounts soared 47% year over year in Q3’23 and was 3 PP higher than in the previous quarter. Because of the massive growth in accounts I am upgrading my end-of-year customer total estimate from around 7M (which was already reached as of the end of September) to 7.5-7.6M.

Source: SoFi

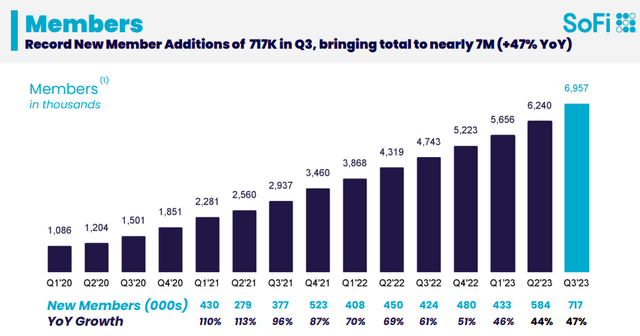

Reboot of the student loan origination business

The student loan segment is set for continual growth and earnings tailwinds for SoFi: in the third quarter, within SoFi’s origination business, student loan originations soared 101% compared to the year-earlier period as payments resumed and the student loan business is back to normal. Student loans were by far the fastest-growing origination category for SoFi in Q3’23… and grew even faster than personal loans which previously helped compensate for declining origination growth in the student loan segment. Going forward, I expect student loan originations to continue to grow as demand is set to increase after the student loan moratorium expired last month.

Source: SoFi

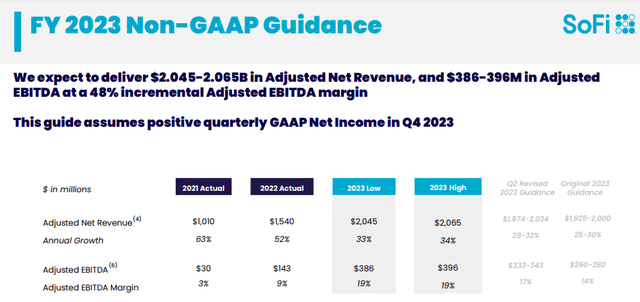

SoFi pushed up its guidance yet again, EBITDA margin keeps growing

For the third time, thanks to a restart of student loan repayments on October 1, 2023, SoFi raised its guidance for the full year. SoFi projects total adjusted net revenue of $2.045-2.065B, reflecting a $51M raise (2.5%) at the mid-point of guidance. Compared to the first guidance submitted at the beginning of the year, SoFi’s adjusted net revenue mid-point has gone up by $93M or about 4.7%.

Source: SoFi

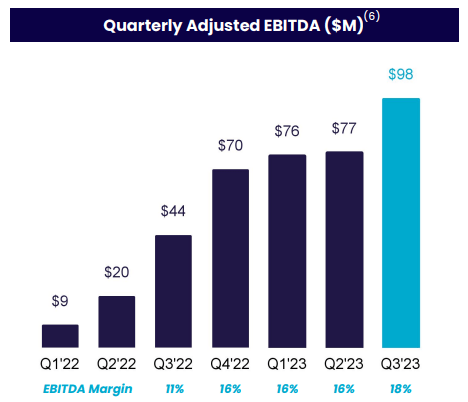

The real takeaway from SoFi’s Q3’23 earnings release was that the FinTech’s growth in accounts is translating to incremental growth in adjusted EBITDA… which has surged in the third quarter as well. SoFi generated $98M in adjusted EBITDA on $513M in revenues… which calculates to an EBITDA margin of 18%, showing a 2 PP increase compared to the prior quarter. Based off of SoFi’s new full-year outlook, Fintech expects 1 PP expansion in its EBITDA margin in the near term.

Source: SoFi

SoFi’s valuation relative to other FinTechs

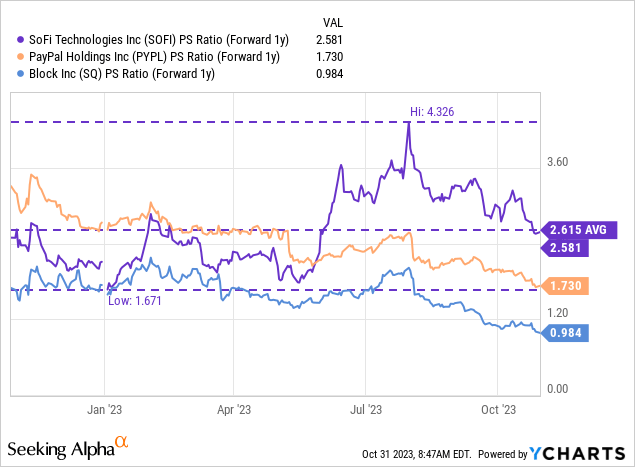

SoFi is expected to generate 34% top line growth in FY 2023 and 24% in the following year which makes it one of the fastest-growing FinTech companies in the space. Therefore, SoFi has a higher price-to-revenue ratio than other FinTechs, but the multiplier has compressed significantly since August and shares are now trading below the 1-year average P/S ratio of 2.6X.

Additionally, SoFi has a catalyst that PayPal, as an example, doesn’t have: the firm is set to report its first-ever GAAP profit in Q4’23… which could be a major inflection point in addition to being a catalyst. SoFi’s shares are currently valued at 2.6X PS and I don’t see why shares couldn’t revalue to 4X forward revenues. I use a 4X multiplier because of SoFi’s exceptional growth curve and potential for higher EBITDA margins as the student loan origination business gets a reboot as justification for such a multiplier. SoFi has traded at a much higher than 4X revenue multiplier in the past. Assuming a 4X revenue multiplier, shares of SoFi could be fairly valued around $11, which implies 59% revaluation potential.

Risks with SoFi

The biggest commercial risks for SoFi, as I see them, relate to the student loan origination business and GAAP income trajectory. SoFi confirmed that it expects its first-ever GAAP profit in the fourth quarter and investors have been waiting for this moment for years. Naturally, SoFi will be expected to generate sequential GAAP income growth in the quarters after that as well. If either student loan originations or GAAP income growth rates decline going forward, maybe during a recession, then SoFi may face a deterioration of operating fundamentals (contracting EBITDA margins) and see a lower valuation factor as well.

Final thoughts

What an impressive earnings sheet SoFi presented for its third quarter… earnings were much better than expected in a myriad of ways, but especially in terms of account growth: so far the FinTech added its largest number of quarterly account additions ever (717 thousand) and it saw a re-acceleration of account growth for the first time since the second quarter of FY 2021. SoFi’s shares failed, unfortunately, to respond positively to the significant achievements of the FinTech in the third quarter, which is one more reason for me to buy more. With student loan originations also booming again, I believe SoFi is on a very encouraging business trajectory!

Read the full article here