Investment Thesis

SoundHound AI (NASDAQ:SOUN) has seen its share price soar as it makes substantial noise about its tie-up with Nvidia (NVDA).

However, I maintain that this stock is not the best way to invest in the hottest area of the market, AI.

In fact, I know from experience that backing the hottest area of the market leads to significant capital losses more often than not.

I recommend that investors avoid this stock.

Rapid Recap

Back in January, I said,

The business has an alluring narrative, but there are pesky details that keep me bearish on this stock. For one, the business’ backlog growth rates are rapidly decelerating. Secondly, the terms of the debt on its balance sheet leave this business with no room to maneuver.

Therefore, I remain bearish on this stock.

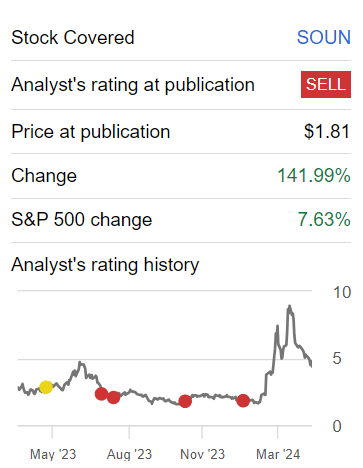

Author’s work on SOUN

In hindsight, this heavily shorted stock moved meaningfully higher once more, as investors turned feverishly bullish on AI stocks. Nevertheless, I passionately contend that backing a business with a perilous balance sheet that’s significantly unprofitable is not the way to grow one’s capital.

SoundHound AI’s Prospects

SoundHound AI specializes in providing conversational AI solutions that enable natural interactions between users and technology through voice.

With their proprietary technology, SoundHound AI aims to create value for customers by enhancing user experiences and enabling capabilities through voice interaction.

In the near term, SoundHound AI continues to capitalize on the growing demand for conversational AI solutions across various industries. SoundHound is well-positioned to penetrate the automotive sector and expand its reach in other industries such as smart TVs and the restaurant sector.

Admittedly, the narrative coming out of SoundHound AI sounds mighty compelling and futuristic. But then, when we dig a little deeper we notice that its fundamentals and narrative aren’t fully aligned.

Here’s an example from its SEC filings page 77:

For the year ended December 31, 2023, Customer A and B accounted for 49% and 13% of the revenue, respectively. For the year ended December 31, 2022, Customer A, C and D accounted for 42%, 13% and 12% of revenue, respectively. For the year ended December 31, 2021, Customer C, D and F accounted for 12%, 18% and 31% of revenue, respectively.

Two aspects are clear. Firstly, SoundHound AI is very concentrated on a few key customers and this brings significant risks.

Secondly, each year, its main customer changes. For example, in 2022 customers C and D made up 13% and 12% of its total revenues. And that in 2021, customers C and D made up 18% and 31% of its total revenues.

More specifically, customer D seemed to be responsible for a much larger source of business in 2021, but customer D has now become a much smaller revenue driver. Why? Why did customer D not increase its business with SoundHound AI? Same with Customer C?

Next, let’s delve into the bull case for SoundHound AI, before shining a light on a noteworthy bearish consideration.

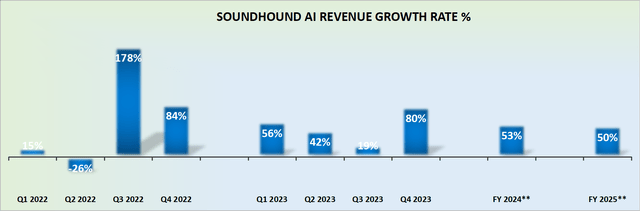

Revenue Growth Rates Guides For Strong Growth

SOUN revenue growth rates

SoundHound AI came out with early 2025 guidance that points to 50% growth rates next year. For investors, on the surface, this is music to one’s years.

After all, who wouldn’t like to invest in a rapidly growing small cap that’s growing its revenues at 50% over the next two years?

Investors pondering over this stock will have undoubtedly focused on this element already, so I don’t see much use in beleaguering this point further. Instead, let’s now turn to discuss the main bearish thesis.

SOUN Stock Valuation — 13x Forward Sales

Let’s discuss what sort of premium investors should put on the stock. But before that, let’s get some context.

Here’s another excerpt from its SEC filings.

On July 28, 2023, we entered into the Sales Agreement […] pursuant to which the Company may offer and sell up to $150.0 million of shares of our Class A common stock from time to time […]

In January and February 2024, we raised additional funds from sales of Class A common stock under this agreement, selling 34,578,019 shares of our common stock at a weighted-average price of $3.37 per share and raising $116.4 million of gross proceeds.

In short, SoundHound AI announced that it could sell up to $150 million of stock, and it swiftly moved to sell $120 million worth of equity (total amount not shown above).

Then, earlier this month, SoundHound once again made a similar announcement

On April 9, 2024 SoundHound AI, Inc. (the “Company”) entered into an Equity Distribution Agreement (the “Agreement”) with Citigroup Global Markets Inc., Barclays Capital Inc., Wedbush Securities Inc., Northland Securities, Inc. and Ladenburg Thalmann & Co. Inc., as sales managers and/or principals […], with respect to an at-the-market equity program under which the Company may offer and sell up to $150,000,000 of shares of its Class A common stock, par value $0.0001 per share (the “Shares”) from time to time through the Managers (the “ATM Offering”).

If this ATM offering goes through this year, this means that in the past 12 months, SoundHound AI will have diluted investors by approximately 20% in a year. Needless to say, that’s not a great result for shareholders.

The point of investing is when your ownership per share increases, not gets diluted down.

Why is SoundHound so determined to raise funds in a short period of time? Because its balance sheet holds about approximately $11 million of net cash (once the approximately $85 million of debt is factored in), and SoundHound is burning through about $60 million of free cash flow per year.

Looking through its SEC filings, with regard to its Term Loans it states that,

The Company used the proceeds from the Term Loan to (i) repay outstanding amounts equal to approximately $30.0 million under the Company’s existing loan facilities, […] with the remaining proceeds to be used to fund growth investments and for general corporate purposes as permitted under the Credit Agreement.

Consequently, I believe that SoundHound AI’s Term Loan may already be fully drawn. Therefore, the only avenue left to support its growth ambitions is the continued raising of capital through its ATM offering.

Put simply, this is a company, with substantial ambition, and an alluring narrative, but a business that hasn’t figured out how to successfully monetize its vision. This means that its shareholders are footing the bill of management’s bold vision.

On the other hand, it seems like SoundHound AI is hitting all the right notes with its rapid growth. And paying 13x next year’s sales might sound like music to the ears, but let’s not forget what sounds too good to be true, often is.

The Bottom Line

In conclusion, despite the buzz surrounding SoundHound AI’s recent collaboration with Nvidia and the allure of investing in the AI sector, I remain unconvinced about its long-term potential as a solid investment.

My experience has taught me that chasing hot market trends often leads to significant capital losses. While SoundHound AI presents a compelling narrative with its conversational AI solutions and anticipated revenue growth, there are concerning aspects regarding its concentration on a few key customers and its aggressive capital-raising activities, which will dilute shareholder value.

Furthermore, the company’s struggle to monetize its ambitious vision raises doubts about its ability to sustainably grow and generate profits. Thus, I advise investors to exercise caution and avoid this stock.

Read the full article here