Real estate investment trusts (“REITs”) had a tough 2023 right until October. It was around there that some larger cap quality names were being thrown away like they were about to go out of business. Our preference was to stay defensive in most of them, as there were no bonus points for catching falling knives. If you keep saying every opportunity is the best you have ever seen, well, eventually you will be right. But that is not how we can add value.

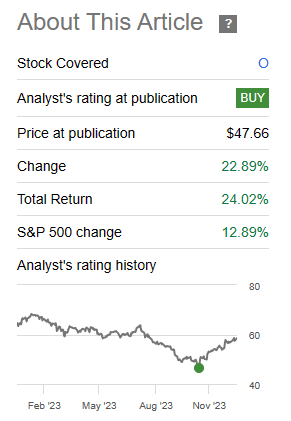

That said, late September and October provided some extremes that the market had not previously seen, and we gave a Buy rating to both Realty Income Corporation (NYSE:O) and Spirit Realty Capital, Inc. (NYSE:SRC). It was our first recent buy rating on Realty Income and our second on Spirit (the first recent one being just 4 weeks prior to that).

Seeking Alpha

We go over the rationale as to why we liked them then, but are downgrading both to a neutral stance.

The Consensus Story

The overall bull thesis for REITs in general and Realty Income, in particular, differs a bit depending on who you speak to. But generally, it comprises the following three legs:

- Attractive relative valuations.

- Fading interest rate headwinds.

- Moderately strong macro environment.

The problem for us is that we disagree on all three.

1) Valuations

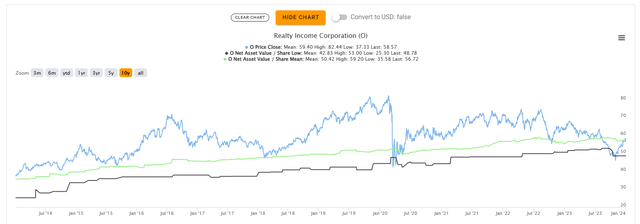

At 14X funds from operations (“FFO”), you really cannot argue that Realty Income is expensive. On a consensus NAV estimate (green line below), Realty Income is trading right in line. We have also shown the low NAV estimate (black line below), which is what the most pessimistic analyst thinks, and that estimate is at $48.78.

TIKR

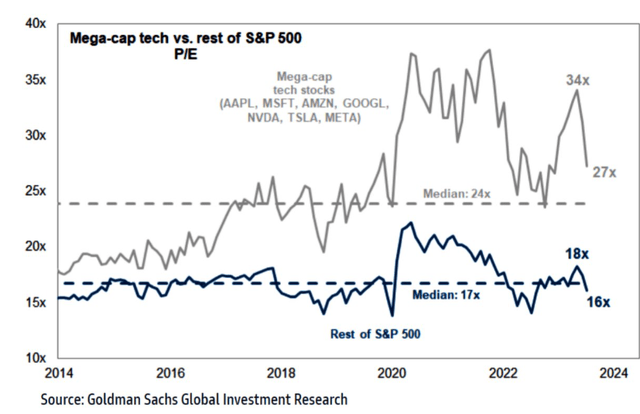

Spirit Realty is about to be bought out by Realty Income so its valuation is tied to the hip to Realty Income’s. Valuations look ok, but we don’t believe they are necessarily compelling, if a recession hits. The bull counterargument is that REITs are cheap relative to the S&P 500 (SP500). Well, you don’t have to buy the S&P 500, or SPDR® S&P 500 ETF Trust (SPY). There is a lot of value if you look outside the Maleficent 7.

Goldman Sachs

Valuations look middling to us here, and considering that we think Realty Income will grow FFO at about 2% a year, they certainly are not something to get excited about. Yes, at near the mid $40s, things did look a bit attractive, and we were compelled to issue a buy rating, but here it is a “meh.”

2) Interest Rates

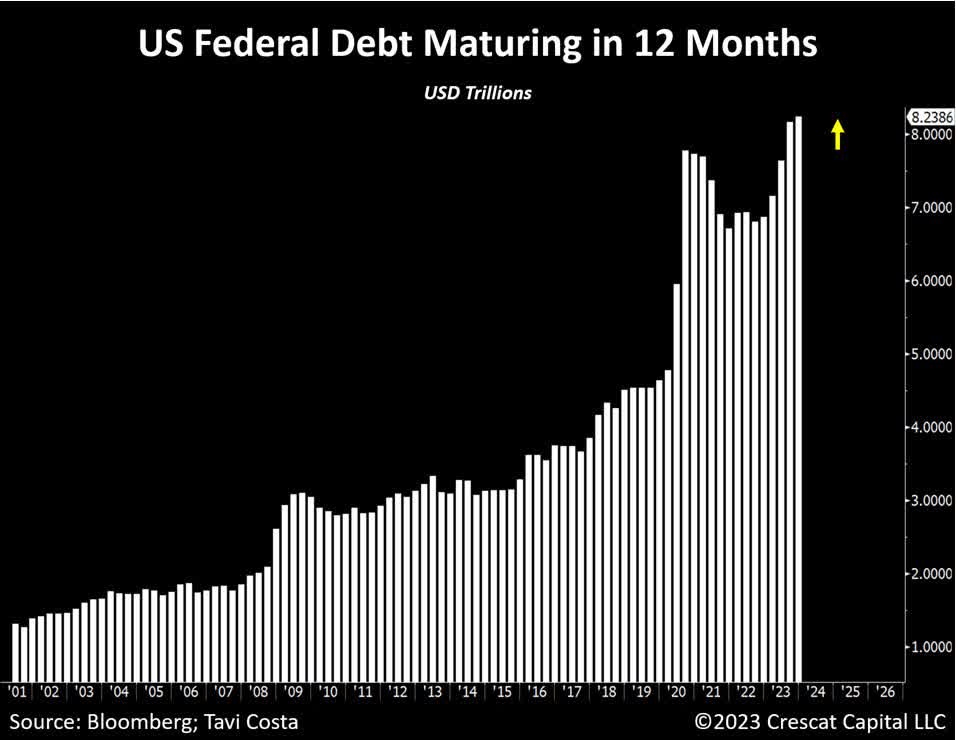

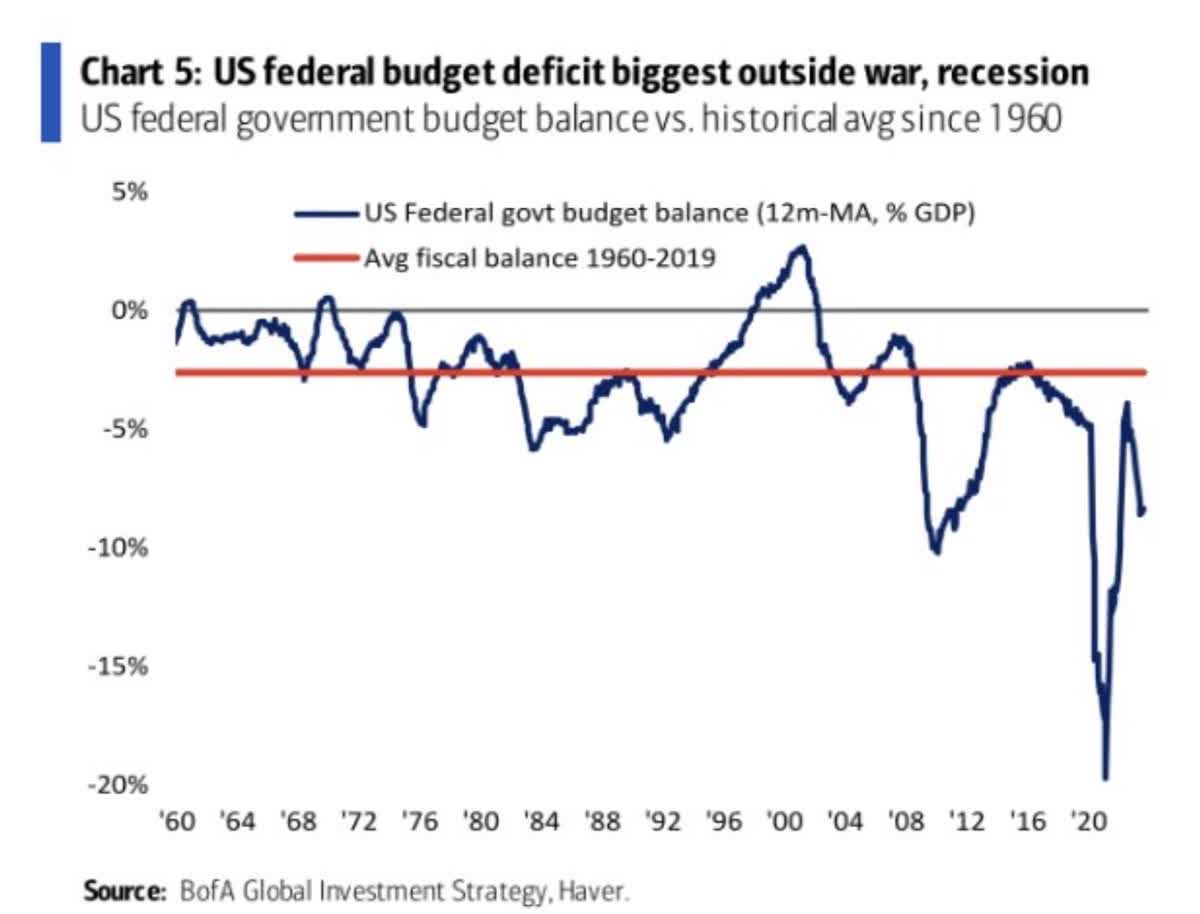

The other part of the bull case has been that U.S. debt cannot tolerate these levels of interest rates and interest rates must go down. Imagine you went to a doctor with high blood pressure and the doctor told you that your blood pressure has to drop because your body cannot handle it. No medications, no exercise, no diet. It just will self-correct because you cannot handle it. That is what these interest rate arguments sound like to us. We continue to run unbelievably large deficits and have to finance or refinance almost $10 trillion in 2024. That is the sum of maturing debt and the expected deficit.

Crescat Capital, Shared On X

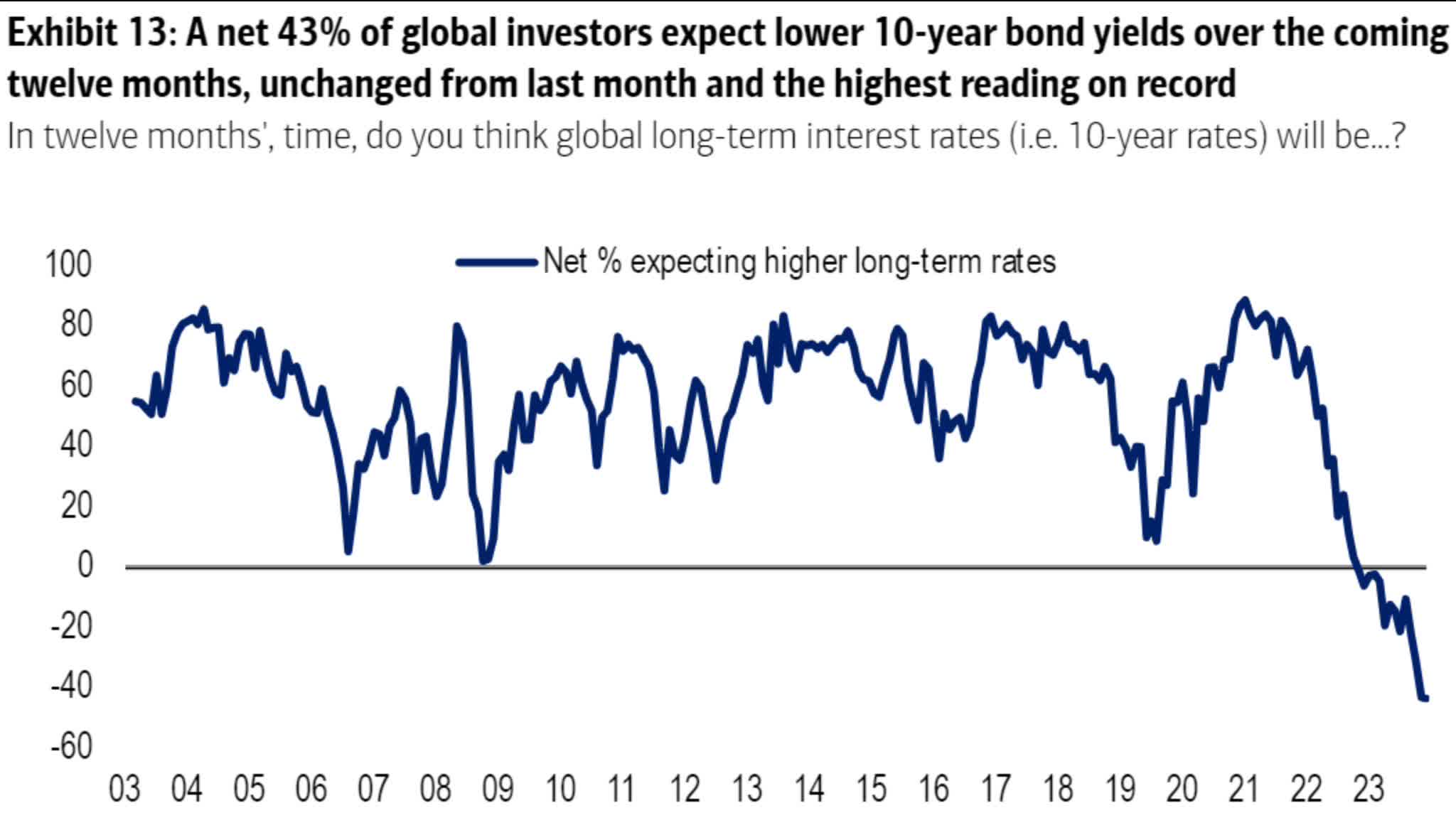

We have decided, though, that since we cannot tolerate high rates, they must go down. In fact, we have the biggest consensus lined up on that side of the boat since the dawn of time (well, at least since the dawn of this survey).

Bank Of America

Count us on the other side of this argument. Interest rates are likely to make fresh highs on the long end in 2024 in our view.

3) The Macro

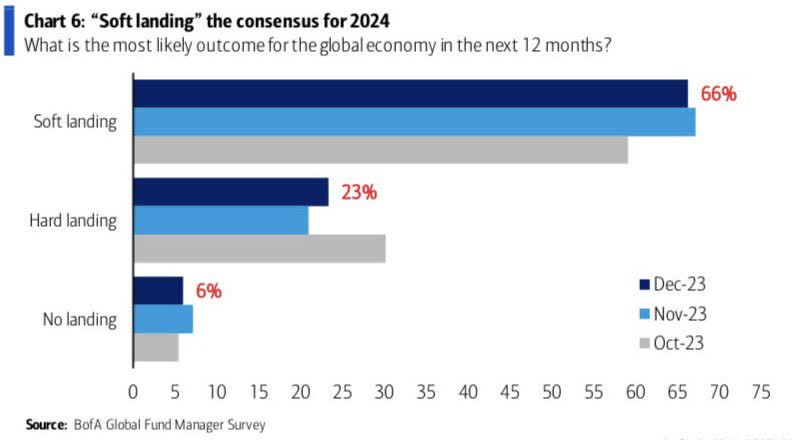

The chart below gives you where everyone stands today. If we do get what 66% expect, Realty Income likely makes it to $66. We will give the bulls that, at least.

Bank Of America

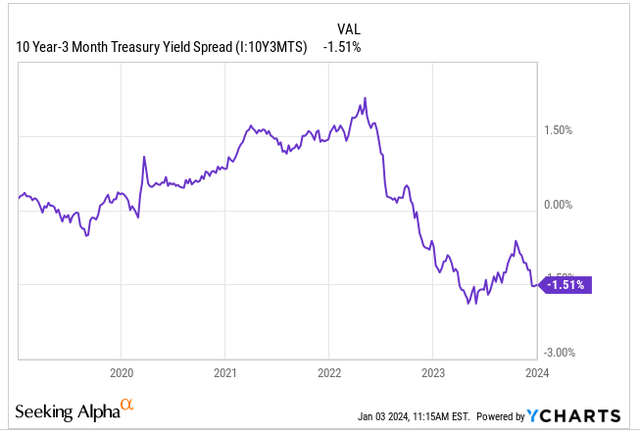

The case for a hard landing comes from the heavily inverted yield curve.

Y-Charts

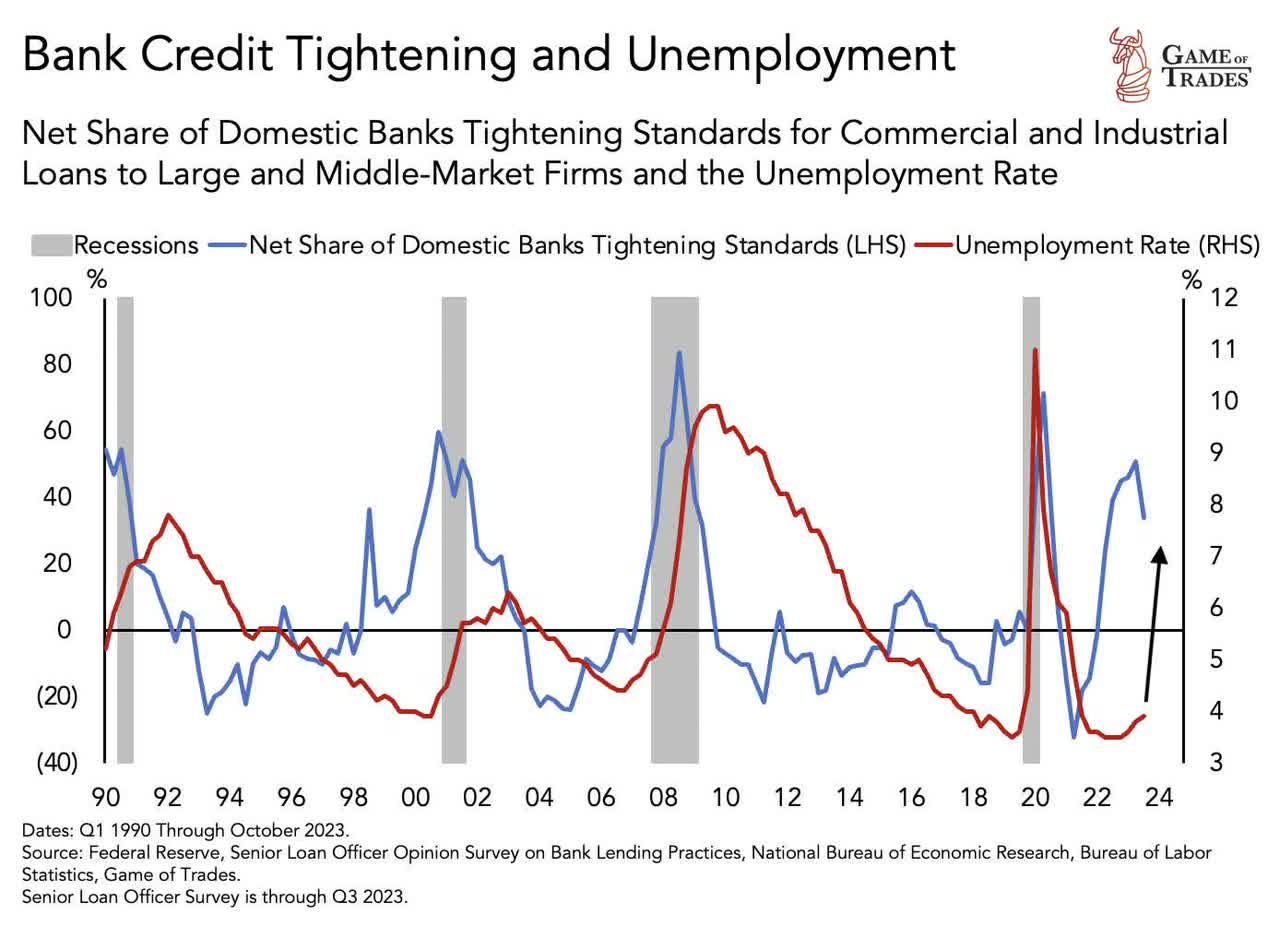

It also comes from the lead we see in banks tightening credit.

Game Of Trades On X

The case for “no-landing” comes the Government spending.

Bank Of America

In both the other cases, we think a trip to the October lows is highly probable.

Verdict

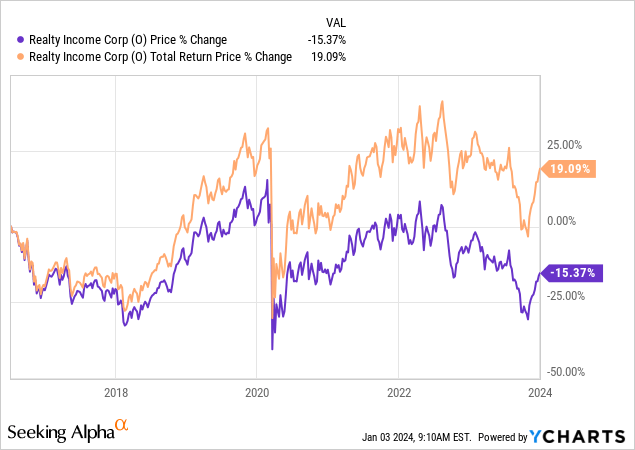

The monthly dividend company O has had a big bounce off the October lows. But entry prices do matter. For example, if you chased it at a “Bubblicious” 24X FFO in 2016, your total return, including dividends, would have been 19.09% after 7.5 years.

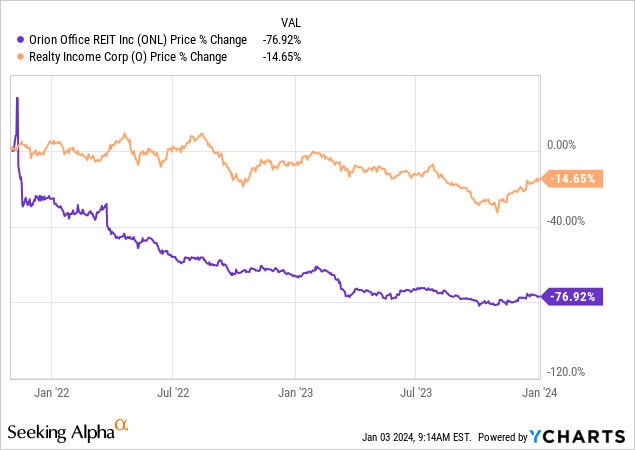

The current setup is nowhere near as extreme as that, but there are some big risks including a wider fallout from Commercial Real Estate. So far, the pain seems confined to the office sector only, and you can see that by examining just how Realty Income’s office spinoff, Orion Office REIT Inc. (ONL), is doing.

If the office remains the only distressed sector, Realty Income likely can continue a steady performance in 2024. We think some spillage from office distress here is not just possible, but highly probable. Work from home has hit office values in key downtown areas, but retail in the same locations is facing similar pressures as foot traffic has not recovered. 2024 should prove to be challenging to most REITs, and we think Realty Income won’t be immune. We are downgrading both Spirit Realty Capital, Inc. and Realty Income Corporation stock to a “Hold.”

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Read the full article here