Investment Thesis

Spotify (NYSE:SPOT) is upping its game in the music streaming industry as it prepares to compete with some of its formidable foes in this industry. The company has been busy ramping up their product feature rollouts with a focus on winning over users overseas as its core markets show signs of maturing. In addition, Spotify has scored some legal wins in its fight against the deplatforming of major app stores like Apple’s (AAPL) App Store, but the direct implications of that in the immediate term may be unclear.

Still, Spotify’s management is demonstrating efforts to scale adoption of their streaming platform. Recent commentary from their full-year FY23 earnings call and earnings report also points towards the direction that management plans to take the company. In addition, Spotify’s management is also showing resolve to grow the company in a way that is sustainable for the business.

I am encouraged by recent developments, and I see catalysts that could propel Spotify forward, but after a monster rally of ~35% in this year alone, I believe the stock needs to rest, and I will rate the stock as a Hold.

Updates on Spotify so far

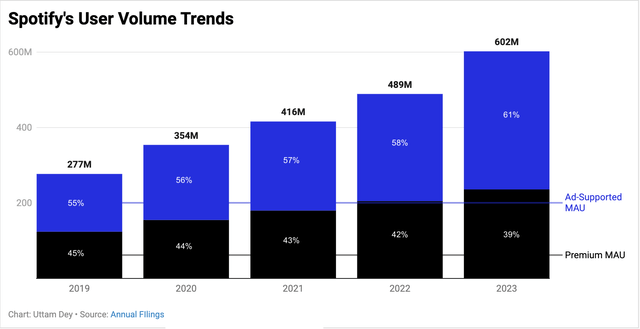

Spotify is the world’s largest music streaming platform, with more than 602 million monthly active users, including 236 million users who pay monthly subscriptions for Spotify’s Premium Subscription plans per its 20-F annual filing. The company operates in more than 180 markets worldwide and accounts for 32% of the market share of the music streaming industry, based on a subscriber study from Statista. Subscriptions form a major revenue source for the company, while it also earns some revenue from ads, which, in my opinion, is not relatively as meaningful as its reliance on subscription revenue.

The company recently scored a huge legal win against its direct competitor, Apple, but the implications of this win are still unclear, as even the company itself suggests. Some commentary from Spotify’s CEO, Daniel Ek, does point to a direction where the company may lean on promotions and discounts to win over customers, suggesting that this win may allow them to now move in that direction as well.

Last week, Spotify launched a feature to add the feature of streaming music videos directly on the platform without leaving the platform. This is currently being tested in 11 markets, as per the report. I think this is a pivotal feature that, in the mid- to long-term, will put the streaming giant directly in the path of another streaming giant, Google’s YouTube. I will discuss the implications of this below.

Spotify’s product roadmap and pace of innovation is encouraging

I will admit that I find Spotify’s latest feature to view music videos in the app intriguing. As a user myself, I’m not sure about how I feel about watching videos in the app since I typically use the app to play music in the background. Personally, the app would need to provide a strong, compelling reason for me to switch from watching videos on other video streaming platforms such as Alphabet’s (GOOG) YouTube to watching them on Spotify.

But I believe a key motivation for the company to launch this feature is to increase engagement on the platform with the hope of monetizing the engagement down the road. One of the key reasons I suspect this may play out is because I see Spotify’s core markets getting saturated which can be seen on Slide 15 of the Q4 FY23 earnings presentation. Per the chart below, growth from their overall monthly actives (MAU) is growing faster than their premium subscriptions.

Spotify’s share in ad-supported users is outpacing the growth in premium subscribers (Company Sources)

Per earnings presentations for FY23 and FY22, the company is seeing strength in emerging markets such as Latin America and Rest of World regions such as India and Indonesia. I suspect the company’s long-term plan is to use the music video streaming platform to place ads and increase ad revenue while reducing reliance on its premium subscription revenue, similar to Netflix (NFLX). This puts the company in the path of collision with YouTube, which also includes a huge inventory of music videos. These are early days since Spotify’s feature is still in beta mode.

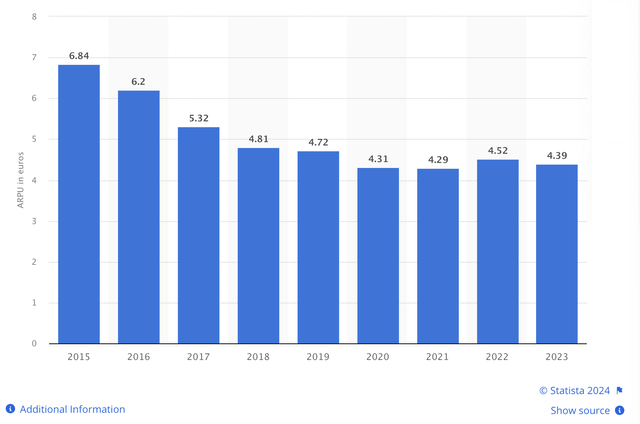

In fact, the company did something similar with its podcast business, per my observation. Spotify was a first mover with podcasts, signing deals with top podcasters, and is now positioned to beat Apple Music as per projections into 2025. Taking advantage of their leadership position in podcasts last year, the company launched its ad marketplace in some markets in November last year. All these product and feature rollouts should help the company revive their ARPU (Average Revenue Per User), which is flatlining, especially the premium ARPU, which can be seen below.

Spotify’s Average Revenue Per User (in Euro) has been flatlining since the pandemic (Statista)

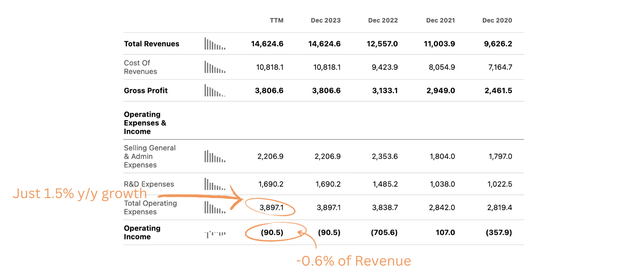

In terms of operations, the company is demonstrating resolve in managing the company responsibly. Whether this is because of activist investor stakes can be debated, but I am encouraged by the observation that the company grew revenue by 16.5% y/y in FY23 while its expenses grew by just 1.5% y/y in the same period. At the same time, gross margins expanded by one percent to 26%, the company almost became profitable on an operating profit basis in FY23, as pointed out below.

Spotify grew its revenue 16.5% y/y while expenses grew just 1.5% y/y in FY23. (SA)

These are all great developments but I believe the stock may have run its course for now.

Spotify’s Outlook and Valuation

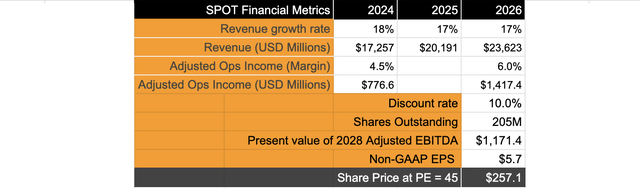

As I mentioned before, Spotify management has impressively steered the ship towards sustainable growth. Given the strong performance, I have assumed revenue and non-GAAP operating income projections slightly higher than the midpoint of consensus estimates. With these assumptions, Spotify will grow its revenue at a compounded growth rate of 17%, while its adjusted operating income should grow at twice the pace of its revenue, growing at a CAGR of 35% over the same period of time.

Author’s valuation model of Spotify (Author)

These growth rates would imply a forward premium of 45, in my opinion, suggesting that the company is fully priced in. Therefore, I believe the company’s stock is fully valued, leaving no room for upside for long-term investors. Remember that I have used assumptions that were slightly above consensus estimates to arrive at my projection.

Risks and other factors to look for

Competition is a huge factor that would threaten Spotify’s dominant position here. While Spotify has managed to secure its leadership over Apple Music over all these years by innovating rapidly and moving to market faster, there is always the threat of Apple, Google, Amazon (AMZN), and other local rivals in other markets competing for Spotify’s leadership. So far, Spotify has shown to work on features on the app while also striking significant content management deals with media companies and personalities to maintain an edge over the content library as well. But if Spotify slows its pace of innovation and execution, the threat can pose significant headwinds. Moreover, if Spotify’s users do not feel compelled to stay engaged on the platform when the music video streaming feature rolls out, it may pose more threats to Spotify’s advances in this market.

I had also pointed out the platform risks that threaten Spotify’s market share in continuing its fight against Apple’s App Store policies. So far, regulation has sided with app companies such as Spotify, but the direct implications of the EU DMA Act are still mostly unknown.

Finally, on a positive note, investors should bear in mind that Spotify may become profitable on a GAAP basis this year, which may add further fuel to investor optimism.

Takeaway

Spotify has emerged as a strong performer this year after firing on all fronts. The company’s journey to profitability is especially encouraging to investors, and the company is poised to become profitable this year. There are some risks, as I have outlined, but I think Spotify should have shown great resolve to grow sustainably. However, with the massive run-up this year, I believe the stock needs to rest on a short-term to mid-term basis, and I rate the company as a Hold for now.

Read the full article here