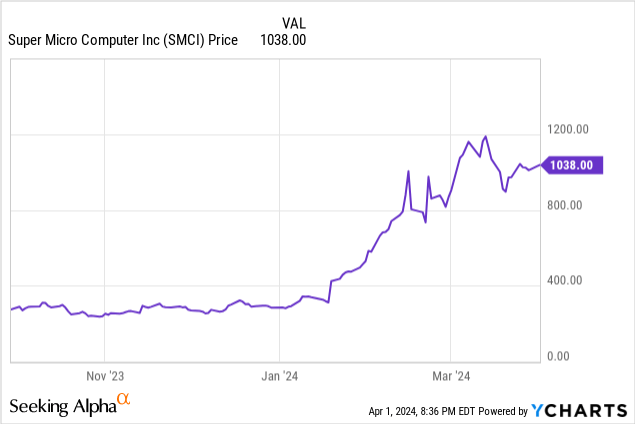

Since my last article recommending a buy for Super Micro Computer (NASDAQ:SMCI) on November 15, 2023, the stock price has soared around 251%. Several things have occurred since my recommendation last year. For instance, last month, on March 18, the company joined the S&P 500. Additionally, the company raised capital multiple times over the previous four months. So, it was time to share my opinion on these moves and explain why I still think Super Micro (also spelled Supermicro) is a buy.

This article will discuss a few aspects of the company’s business, its competitive advantages, its still attractive valuation, the competitive landscape, and why aggressive growth investors can still buy Supermicro at its current price.

What the company does

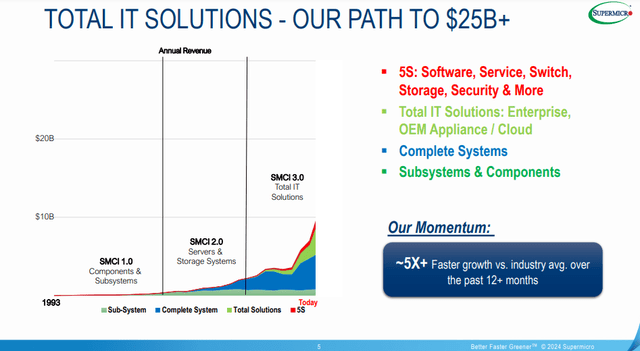

Supermicro began around 30 years ago as an expert in designing motherboards, the main circuit board connecting all components inside a computer. Its first customer, Citigroup’s (C) Citibank, used its motherboard to power Automated Teller Machines (ATMs). Today, the company does so much more. The following image from its second quarter fiscal year (“FY”) 2024 presentation shows how the company has evolved since the 1990s from only selling components like motherboards to building servers and storage systems to becoming a Total Information Technology (“IT”) Solution provider selling AI clusters in its SMCI 3.0 phase. In other words, it provides virtually everything to build a modern data center, from all the necessary hardware components to the software and security systems to manage everything from individual hard disk drives (HDDs) to an individual server to the whole data center.

Supermicro second quarter fiscal year (“FY”) 2024 presentation

In its 2023 Annual report, management describes Supermicro as a “Silicon Valley-based provider of accelerated compute platforms that are application-optimized high-performance and high-efficiency server and storage systems for a variety of markets, including enterprise data centers, cloud computing, artificial intelligence (“AI”), 5G, and edge computing.” In other words, it makes the hardware and software systems that power some of the highest upside secular trends over the last several years. At the time of the above presentation, Supermicro was closing in on $10 billion in annual revenue. The following section will review the company’s competitive advantages that led to it growing five times faster than the industry average over the last year.

The company’s competitive advantages

One of the biggest reasons Supermicro has gained an edge over many competitors is that it gives its customers what they want: a server or storage system customized to their specific needs. That is easier said than done in the time frames that customers require. The complexity of putting together many different components in a configuration for a specific application under time constraints is high enough to limit competition.

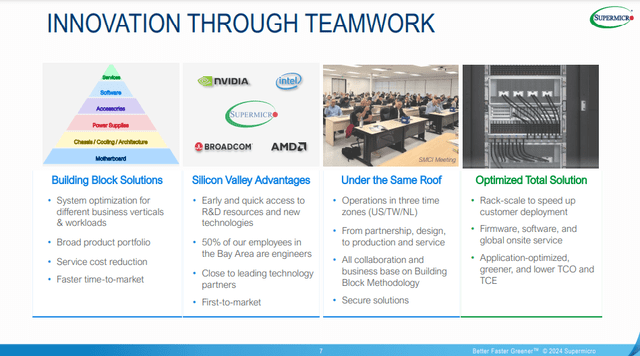

Supermicro second quarter FY 2024 presentation

The not-so-secret sauce that allows Supermicro to accomplish customization in the low-margin server industry is its modular approach, pre-designed, compatible components that can be easily mixed and matched to create custom configurations using the latest technology. One huge advantage of this approach is rapid turnaround times from first receiving the order to delivering the final product. Between its well-established relationships with some of the most significant Silicon Valley component manufacturers, allowing it to access the newest technology coming down the pike, and its modular approach, Supermicro launches servers approximately the day component manufacturers officially launch a product. For example, Supermicro has a close relationship with NVIDIA (NVDA). In November 2023, NVIDIA announced that it planned to start shipping its newest, most powerful chip, the NVIDIA HGX H200 GPU, in the second quarter of 2024. On March 18, 2024, Supermicro issued a press release that said (emphasis added):

“In the era of AI, the unit of compute is now measured by clusters, not just the number of servers, and with our expanded global manufacturing capacity of 5,000 racks/month, we can deliver complete generative AI clusters to our customers faster than ever before,” said Charles Liang, president and CEO of Supermicro. “A 64-node cluster enables 512 NVIDIA HGX H200 GPUs with 72TB of HBM3e through a couple of our scalable cluster building blocks with 400Gb/s NVIDIA Quantum-2 InfiniBand and Spectrum-X Ethernet networking. Supermicro’s SuperCluster solutions combined with NVIDIA AI Enterprise software are ideal for enterprise and cloud infrastructures to train today’s LLMs with up to trillions of parameters. The interconnected GPUs, CPUs, memory, storage, and networking, when deployed across multiple nodes in racks, construct the foundation of today’s AI. Supermicro’s SuperCluster solutions provide foundational building blocks for rapidly evolving generative AI and LLMs.”

In another Supermicro press release, the company said that NVIDIA’s next-generation Blackwell architecture NVIDIA HGX B100 8-GPU would be “drop-in ready” to Supermicro’s servers and “enhanced to support the B200.” This speed to market with the latest technology applies to all components, whether it’s Advanced Micro Devices’ (AMD) latest GPU or Intel’s (INTC) latest CPU, or the latest memory chips from Micron Technology (MU). Supermicro can charge premium pricing and increase its margins by being among the first companies to bring high-demand solutions to market. Additionally, because the company has a reputation for constructing servers with the newest technology, it can grab market share from manufacturers that are laggards in providing customers with the latest innovations. Chief Financial Officer (“CFO”) David Weigand said about the modular design during the Barclays Global Technology Conference on December 7, 2023:

So there’s a lot of emerging technologies. And this is really playing into Super Micro’s model, which is our building block [modular] solutions. And our building — what we call building block solutions is that we architected the server technology from the ground up. And that is we designed our own chassis, we designed our own motherboards. So we built all of the pieces of the server designed those in-house. And that gives us the ability to quickly incorporate new technologies. It also gives us the ability to customize solutions, which is our — really our forte, customizing solutions for companies, specific applications. And this differentiates us from both the ODMs [Original Design Manufacturers] as well as the other Tier 1 server manufacturers who try to offer a select number of SKUs to address all of — a broader part of the market.

When David Weigand talks about Supermicro designing its chassis and motherboards, he means that the company designs the case that houses the server components and the main circuit board to accept third-party GPUs, CPUs, memory, network interface cards, and other elements in the form of plug and play modules. This modular design allows it to customize solutions with the latest technologies instead of ODMs that use off-the-shelf generic parts to construct servers. ODMs often lack the ability to customize servers or use the latest components. Although tier-one server manufacturers may have a more comprehensive array of server options, they often lack the ability to customize on the same level as Supermicro or provide the latest technology. CFO Weigand later discussed at the same conference how the company customizes its solutions for specific applications (emphasis added):

So, we try to bring the very best technologies together in our solutions. And so we don’t use any one technology exclusively. We are going to bring about, number one, what we think are the highest performing solutions for a particular workload. Now if a customer has a preference for one vendor over another one, we’re going to follow that preference. But we largely will recommend to a customer the very best top performing solution for their particular application, whether it’s online gaming, online payment processing. We have zero base — zero trust based cyber security providers, that we have companies that are doing online — cloud based storage solutions. So whatever the application is we’re going to bring the best — the very best technology.

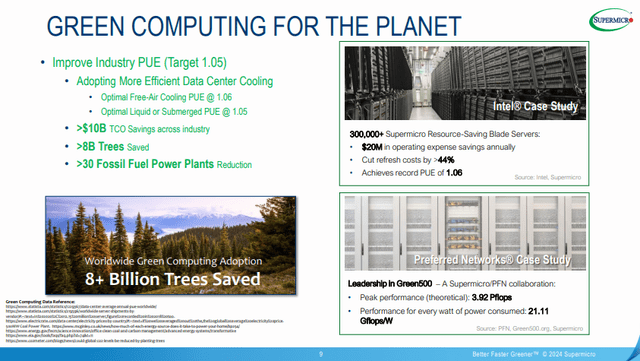

Recreating Supermicro’s modular approach appears to be no easy feat for potential competitors. It requires a lot of investment and technical expertise, which this company has plenty of. Approximately 50% of Supermicro’s employees are engineers, including its Chief Executive Officer (“CEO”) Charles Liang. Supermicro’s engineers not only equip their customers with the latest available technology but also design systems to help customers reduce capital expenditures (“CapEX”) and operational expenses (“OpEx”). For instance, it was one of the first companies to use liquid cooling in servers, which it promotes as a green computing initiative. However, liquid cooling has benefits beyond saving trees. For the same computing power, liquid-cooling servers take up less space than air-cooled servers, reducing the real estate footprint of the servers and thus reducing CapEx if the customer owns the land containing the data center facility. The image below shows an Intel case study highlighting $20 million in OpEx savings for 300,000 Supermicro blade servers with liquid cooling.

Supermicro second quarter FY 2024 presentation

Let’s examine how Supermicro’s competitive advantages have resulted in above-average industry growth and excellent fundamentals.

The company outperforms the industry

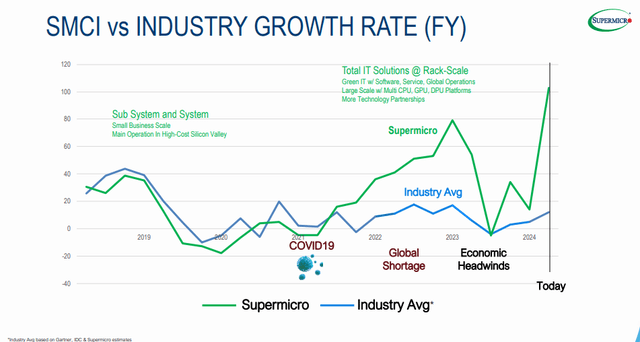

A combination of Supermicro’s move toward emphasizing total IT solutions, its manufacturing of computing systems up to the cluster level, and companies adopting generative AI, driving them toward the types of premium servers that Supermicro manufactures, has aided the company in achieving above-market revenue growth. The chart below shows that revenue growth exceeded 100% year-over-year when the company reported its second-quarter FY 2024 results on January 29, 2024, vastly outperforming industry growth.

Supermicro second quarter FY 2024 presentation

The following table shows some key figures from the company’s target growth model for 2024, which management presented at an analyst event in March 2021. Supermicro is within the range or has exceeded those targets. The chart uses the trailing 12-month (“TTM”) revenue figure for the second quarter of FY 2024 results below.

| Non-GAAP | Target Growth Model 2024 | Second Quarter FY 2024 |

| Annual Revenue Growth Rate | 17%-23% | 39.3% TTM |

| Gross Margin | 14%-17% | 15.5% |

| Operating Margin | 5%-8% | 10.14% |

Although Supermicro’s gross margins are within its targeted growth range, they compare unfavorably to some of its largest competitors, as shown in the table below.

| Annual Revenue growth | Gross margin | OpEx as a % of revenue | Operating margin | |

| Supermicro | 39.03% | 15.50% | 5.26% | 10.14% |

| Hewlett Packard Enterprise (HPE) | 2.24% | 36.37% | 27.67% | 8.70% |

| Dell Technologies (DELL) | -13.56 | 23.82% | 17.14% | 6.68% |

| Lenovo (OTCPK:LNVGF) | -13.50 | 16.55% | 12.65% | 3.90% |

CFO David Weigand said about the company’s gross margins on the company’s second-quarter earnings call:

At this time we are we are growing really quickly. And in order to do that and in order to take market share, we will take opportunities by being more competitive on pricing.

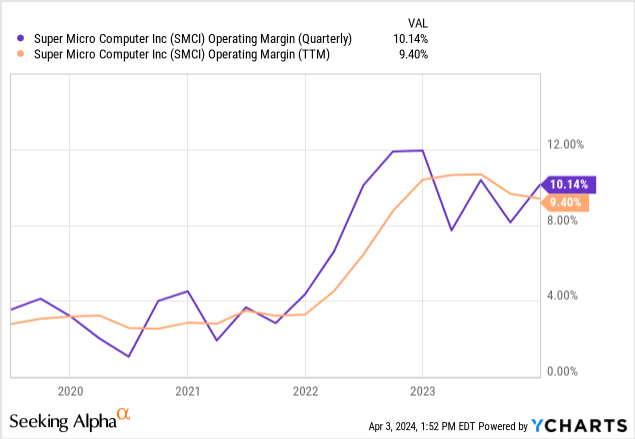

Generally, lower pricing leads to lower gross margins. Additionally, until Supermicro scales its business, it may not match its competitor’s gross margins. The good news is that the company has one of the lowest OpEx rates in the industry, helping it achieve one of the highest operating margins in the server manufacturing sector. CEO added to Weigand’s statements, saying, “The good thing is that when we continue to grow our economies of scale, our operation margin indeed will be still able to keep in healthy position.” It achieved operating margins of 10.14% in the second quarter, 144 basis points ahead of second place Hewlett Packard Enterprise. The chart below shows the company’s significant margin expansion over the last two years.

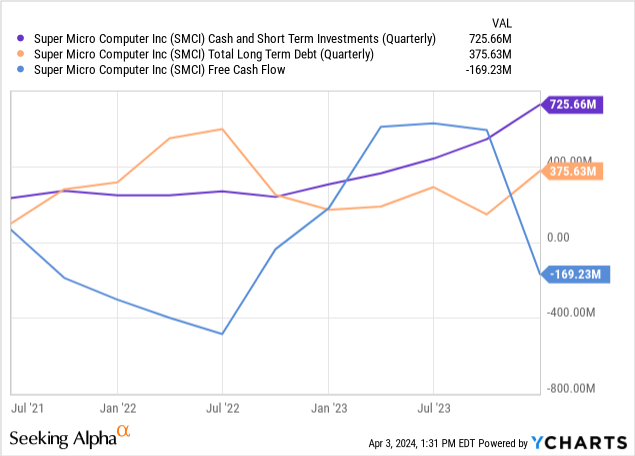

Supermicro ended the second quarter with $725.66 million in cash and short-term investments, compared to $375.63 million in long-term debt. The bad news is that it produced $169.23 million in negative free cash flow (“FCF”). If negative FCF persists and the financial markets worsen, Supermicro may be unable to raise capital. In that case, investors may become concerned about its ability to maintain growth or its financial health.

Supermicro’s low debt-to-EBITDA ratio of 0.26 is a good sign that the company can currently manage its debt. Its quick ratio of 1.19 means the company can pay its short-term obligations. Let’s examine why TTM FCF turned negative when it reported its FY second quarter.

Why the company’s negative FCF is not an issue currently

If you are wondering why the company’s FCF sharply turned negative, it is a function of the company pushing the pedal to the medal to capture market share and produce high revenue growth. The issue the company has run into is that the cash it pays out to buy inventory to manufacture the servers (accounts payable) comes ahead of when the company gets paid for the finished product by its customers (accounts receivable), leading to a shortage of working capital and negative FCF. If Supermicro continues to grow at the same rate, it might burn through its cash and short-term investments. The company has two choices: either slow down its growth rate or raise capital to cover the shortage of working capital. However, management has high growth goals. Seeking Alpha posted an article on March 19, 2024, that stated, “[CEO] Liang told The Journal his goal is to produce 5,000 racks of servers a month by the middle of the calendar year, up from its present ability to produce 4,000 racks per month.” Considering the company’s previously stated revenue growth and margin goals, investors should expect management to keep its foot pressed on the accelerator. Supermicro’s CFO Weigand explained why the company would need to raise capital in the following way during the Barclays Global Technology Conference:

So with our high growth, we needed additional capital really to purchase inventory. As a manufacturing company, we have to carry — we have to purchase inventory, carry it as we build it, carry it as it’s in accounts receivable until it converts to cash. So just with rapid growth, we need additional working capital.

As long as Supermicro can access the capital markets to compensate for the shortfall in working capital, its negative FCF should not be a significant issue at this time. The company raised capital three times over the last four months. The first capital raise was a $524 million equity offering on December 1, 2023. Next, on February 23, 2024, the company announced a private offering of $1.5 billion in convertible senior notes. The company’s most recent capital raise occurred on March 19, 2024, when the company announced a public offering of 2 million shares of common stock, diluting investors by around 4%. Investors didn’t take the news well. The stock dropped approximately 9% on the day of the announcement. The capital raises have likely produced a sluggish stock price since the middle of March.

Risks

Supermicro may need to raise more capital in the future to finance inventory and support growth. Investors should remember that if the company further dilutes shareholders, the dilution could make valuations based on the company’s earnings inaccurate. As a result, the risk of further shareholder dilution may cap stock returns in the short term. In addition, the long-term success of this growth strategy depends on its ability to maintain high revenue growth and profitability.

A second risk you should be aware of because it could considerably impact the company’s results is the geographic location of some of its manufacturing capacity. Supermicro has built significant capacity in Taiwan, and if China invades or places a naval blockade around Taiwan, it could negatively impact Supermicro’s manufacturing capacity, resulting in decreased sales.

Third, as the company moves up the value chain and sells to larger customers, it may run into customer concentration risks. Supermicro acknowledged this risk in its 2023 10-K:

While no single customer accounted for 10% or more of net sales in any of fiscal years 2023, 2022 or 2021, we may have customers account for 10% or more of net sales in the future. If customers buy our products in greater volumes and their business becomes a larger percentage of our net sales, we may grow increasingly dependent on those customers to maintain our growth.

The upside of selling to companies with significant cloud or data center operations is that they can produce a massive jump in sales. However, there are several downsides to selling to large enterprises, such as potentially lumpy sales, meaning sales from quarter to quarter could vary widely. Supermicro may produce massive revenue growth in one quarter, and in a different quarter, sales may go into the doldrums, causing disappointed investors to sell the stock. Another downside of relying on a small group of customers is that it could significantly drop revenue if one of those customers defects to a competitor’s solution. Next, the larger the customer, the more the competitive environment for those sales increases, possibly squeezing Supermicro’s gross and operating margins.

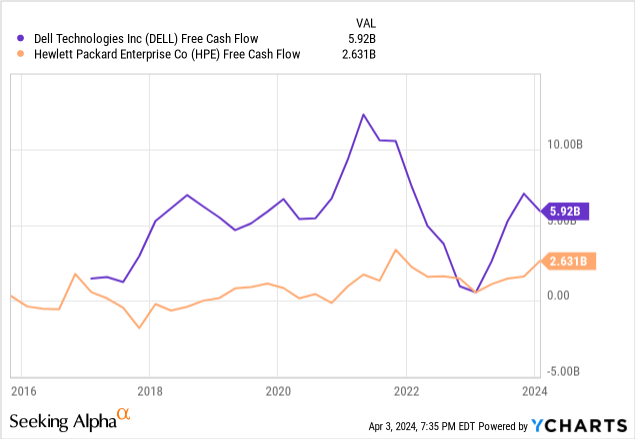

Last, although Supermicro has solid competitive advantages, those advantages may not be insurmountable in an intensely competitive market. Management, for instance, considers its closeness with Silicon Valley companies like NVIDIA to be an advantage. However, this advantage may only hold for smaller competitors. One of the company’s most significant competitors, Dell, also has a close relationship with NVIDIA and significantly greater resources. Compared to Supermicro’s negative FCF and need to raise cash, the following chart shows Dell produced nearly $6 billion in TTM FCF in its latest quarter. Another significant competitor, Hewlett Packard, made $2.63 billion in TTM FCF.

Supermicro’s other competitive advantages may be overwhelmed over time by legacy server companies or new entrants to the market. Investors should monitor the company’s revenue and gross and operating margins for signs that its competitive advantages are deteriorating.

Valuation

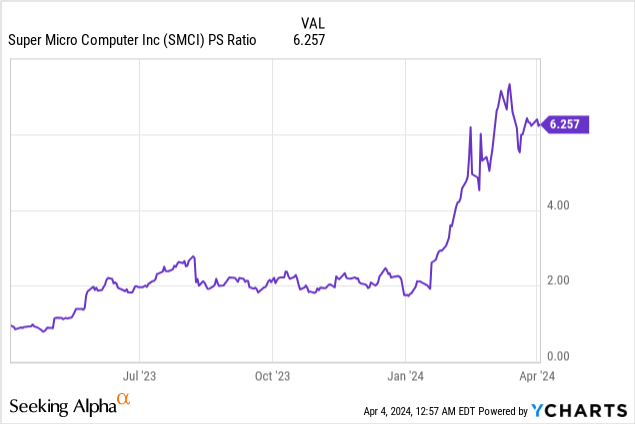

The following chart shows Supermicro’s price-to-sales (P/S) TTM ratio soaring from slightly below 2.00 at the beginning of 2024 to its current 6.26. Currently, its sector median P/S ratio is 2.99. Judging the stock’s valuation from a P/S ratio perspective, some might consider it wildly overvalued.

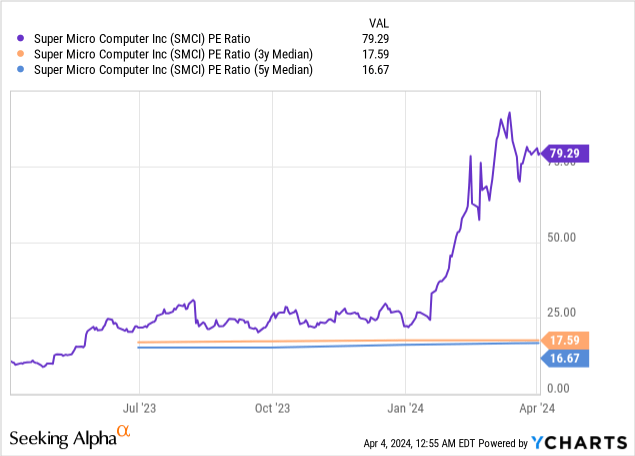

The chart below shows Supermicro’s price-to-earnings (P/E) TTM ratio of 79.29, which is substantially above its three- and five-year median P/E — a sign that the market may significantly overvalue this stock.

However, the above valuations consider things from a backward-looking perspective. Let’s consider things from a forward-looking perspective.

| Fiscal period ending | Estimated year-over-year growth | Forward P/E ratio |

| June 2024 | 86.02% | 46.23 |

| June 2025 | 39.02% | 33.21 |

Data Source: Seeking Alpha

Generally, the market may undervalue a stock when the forward P/E ratio sells below the estimated growth rate. Using that standard, if Supermicro’s forward P/E sold at its 2024 estimated growth rate of 86.02%, its stock price would be $1,889.86, which is 86% above the closing stock price on April 3, 2024. If Supermicro’s one-year forward P/E sold at its FY 2025 estimated growth rate of 39.02%, its stock price would be 1,193.23, 17.5% above the closing stock price on April 3, 2024.

I still consider the stock a buy

Some of the hottest secular trends in the tech industry today, such as the adoption of cloud computing, increased usage of high-performance computing, and the proliferation of generative AI, drive Supermicro’s revenue growth. If you believe those trends will persist over the next several years, this company should be on your list of stocks to investigate for a possible investment. The company’s innovative engineer-focused culture has helped it vastly outperform its competitors over the last several years despite some competitors having more financial resources than Supermicro.

What about Supermicro’s recent inclusion in the S&P 500? Research conducted by McKinsey & Company shows that index inclusion may provide a short-term boost in stock price but doesn’t factor into how investors value a stock in the long term. Supermicro may have already seen a short-term increase in stock price. So, there is little use in investing in Supermicro today based on its index inclusion, which happened a few weeks ago. If you decide to invest in Supermicro, it’s advisable to do so for longer-term reasons besides its inclusion in the S&P 500 index.

One valid reason for investing in Supermicro is that the market may undervalue its potential earnings growth over the next several years. Although its valuation is less enticing than when I first recommended it, the company still has solid potential upside. I maintain my buy rating on Supermicro.

Read the full article here