TC Energy Corporation (NYSE:TRP) is one of the largest midstream operators, with a market cap of circa $39 billion. The current structure of TRP’s business is rather similar to most of its peers that also operate in the midstream segment. For example, there is a decent distribution of EBITDA generation across natural gas pipeline and storage, liquid pipeline and storage as well as power generation segments. The only notable difference in terms of fundamental aspects of how the TRP business is structured is related to the fact that a notable chunk of TRP’s EBITDA stems from Canadian assets. However, the geographical diversification between the U.S. and Canadian markets is not a unique aspect as there are several midstream businesses out there that also have this structure in place (e.g., Enbridge Inc. (ENB)).

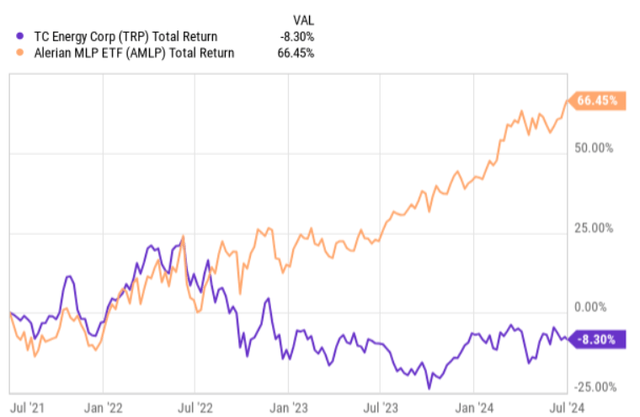

Having said that, if we take a look at the chart below, we will easily conclude that there are some TRP-specific nuances that have caused such a significant divergence from the rest of midstream players.

YCharts

From the chart above, we can see that starting from mid-2022, TRP has lagged the midstream market and even delivered negative total returns despite the surging index.

With this in mind, let’s now assess TRP’s situation closer to determine whether there is an enticing investment case now after experiencing such a pronounced underperformance of the relevant index.

Thesis

All in all, looking at the prevailing multiples and dividend yield that is offered by TRP, the immediate conclusion is that the overall investment case is not the best one here and certainly has to embody some clear advantages.

What I mean by that is that currently TRP trades at EV/EBITDA of 12.8x, which is on the expensive side compared to such strong investment grade peers as Enterprise Products Partners (EPD) and Western Midstream Partners, LP (WES). Similarly, the dividend yield of 7.5% is below what investors can find in other large cap and investment grade names. Although the dividend yield angle is not that far off from the sector average, the fact that TRP trades at a premium and does not offer more juicy yield introduces a pressure for the business (fundamental metrics) to justify such situation -especially against the backdrop of the aforementioned underperformance.

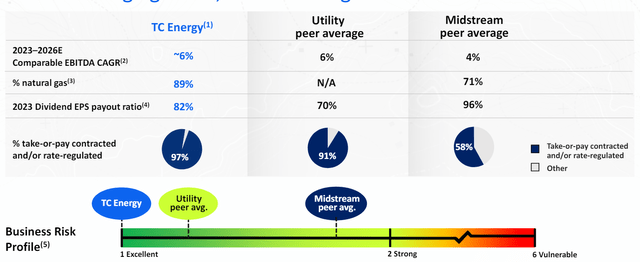

Now, there are indeed some positives that should contribute to a premium in the multiple. The graph below captures the most important advantage of TRP.

TRP Corporate Profile Presentation

The key advantage here is the combination of a heavier bias towards the natural gas segment and almost the entire EBITDA generation being lined to take-or-pay or rate-regulated contracts. Moreover, if we dig deeper, we will notice that of the total EBITDA, more than 80% is attributable to contracts that are truly regulated and have a CPI escalator component attached. Plus, a large chunk of the Canadian asset base is subject to regulated tariff mechanisms, which allows TRP to pass over the interest rate (cost of debt) risk to the customers, thereby further de-risking the overall cash flow profile.

All of this adds a meaningful layer of safety that helps TRP achieve a greater cash flow predictability and stability.

Additional advantages that are worth underscoring and which could theoretically stimulate higher multiples are the following:

- TRP has communicated that starting from 2025 it will lower its CapEx spend to ~ $6 billion per year, which is materially below the 2023 level, where it incurred ~ $12 billion in CapEx. This should relax the pressure from the balance sheet and help TRP deleverage.

- This year, TRP expects to divest roughly $3 billion of assets to use this liquidity in financing the relatively ambitious CapEx plan this year.

- In mid-2025, TRP expects to put Southeast Gateway on-line, which is projected to generate incremental EBITDA of ~ $800 million per year.

However, my key concern of TRP is related to its balance sheet. Currently, TRP carries a leverage of 4.75x, which is arguably one of the highest levels in the sector. In fact, we could observe such debt levels several years ago before the outbreak of COVID-19, which triggered midstream players to initiate a system-wide deleveraging process. For example, WES, EPD, Energy Transfer (ET) and Plains All American Pipeline (PAA) have all put a heavy emphasis in bringing down their debt loads to 2x – 3x territory. Needless to say, this has allowed these companies to shield their cash flows from the spiking interest rates.

The situation with TRP’s leverage is that the Management has established a more focused capital allocation strategy to de-risk the financial profile. For example, the commentary in the recent earnings call by Bevin Wirzba – EVP & Group President, Liquids Pipelines and Coastal – suggests that on a go forward basis we will see significant efforts being put at reducing the debt load at TRP’s books, which includes making the necessary adjustments in the organic CapEx and project types.

With respect to our capital allocation priorities and your comment around the interest rates, our capital allocation priorities first are deleveraging, the way we can — because we believe that deleveraging is accretive to the equity investor, the way we can achieve that on an accelerated basis compared to what we highlighted at Investor Day is allocating capital to Blackrod. That project is a very short cycle project. It will be on in early 2026. Cash flows can be created off that asset at the low end of our EBITDA build multiple range at the 6 times level. That allows us to really accelerate our de-levering in the face of that interest rate environment that you point out.

Here, one could argue that the combination of lowered CapEx spend, divestitures and relatively stable cash flows should warrant an easy path for TRP in optimizing its capital structure. While this might be true, in that case, I just do not see a reasonable justification of why TRP should trade at a premium and offer average yield, especially given that the focus on de-risking the balance sheet inherently reduces the growth prospects.

The bottom line

At its core, TRP is a resilient cash flow machine, where the underlying cash flows are supported by favorable and predictable contracts.

Yet, the leverage of 4.75x is excessive, introducing a more elevated financial risk and putting downward pressure on TRP’s ability to accommodate solid EBITDA growth going forward. This is especially an issue in the context of TRP’s unfavorable valuation multiples.

As a result of this, in my opinion, there is no solid basis for going long TC Energy, while there are many peers out there with already strong balance sheets and similar cash generation profiles.

Read the full article here