Earnings of The First Bancorp, Inc. (NASDAQ:FNLC) will likely bottom out this year and start trending upwards by the end of 2024 as interest rate cuts will help reverse the margin’s downtrend. The bottom line will also receive support from loan growth. Overall, I’m expecting the earnings to dip by 21.0% to $2.11 per share in 2024 and then rise by 18.7% to $2.50 per share in 2025. The year-end target price suggests a small upside from the current market price. More importantly, the company is offering quite a high dividend yield of 6.1%. Based on the total expected return, I’m adopting a buy rating on The First Bancorp.

Margin Recovery Ahead

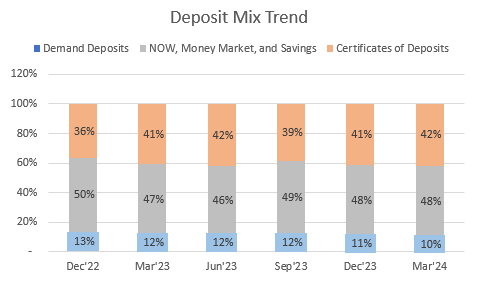

The First Bancorp’s net interest margin fell by 12 basis points in the first quarter of 2024 after plunging by 66 basis points in 2023. The margin’s contraction was mostly attributable to the cost of funds, which has shot up in the last year and a half. This surge in deposit cost was in turn attributable to a surge in certificates of deposits (“CD”).

SEC Filings

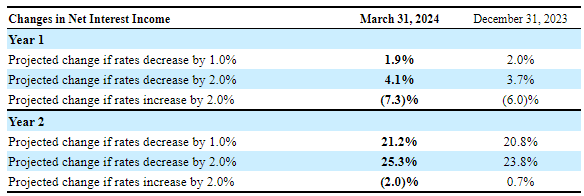

The CDs will make the average deposit cost downward sticky in a falling-rate environment. Fortunately, the asset yields are also quite sticky. In fact, it is quite likely that the re-pricing down of deposits will overtake the re-pricing down of assets. The results of management’s rate sensitivity analysis given in the 10-Q filing show that a 100-basis points rate cut could increase the net interest income by 1.9% over twelve months.

1Q 2024 10-Q Filing

I’m expecting the Fed to reduce the Fed funds rate by 25 basis points by the end of this year, and then by 100 basis points in 2025. Considering the rate sensitivity and my interest-rate outlook, I’m expecting the margin to grow by 2 basis points in the last quarter of 2024 and 8 basis points in 2025. I’m expecting the margin to have remained stable during the second quarter of this year. Further, I’m expecting the margin to continue to remain stable in the third quarter.

Due to the sharp downward trend last year and a slow expected recovery this year, the average margin will likely be much below the average for last year. I’m estimating the average margin for 2024 to be 30 basis points below the average for 2023.

Double-Digit Loan Growth Likely Again This Year

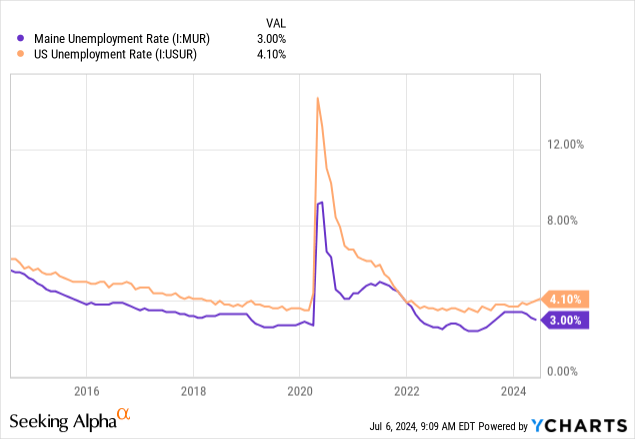

The First Bancorp’s loan portfolio grew by 2.1% in the first quarter of 2024, which is normal for the company. In my opinion, the loan portfolio can manage to grow by a double-digit rate this year, like in previous years. My opinion is based on the economic environment, which is currently as conducive to loan growth as it has been in the past few years. The First Bancorp operates mostly in Maine. As shown below, the state has continued to enjoy a low unemployment rate so far this year compared to previous years.

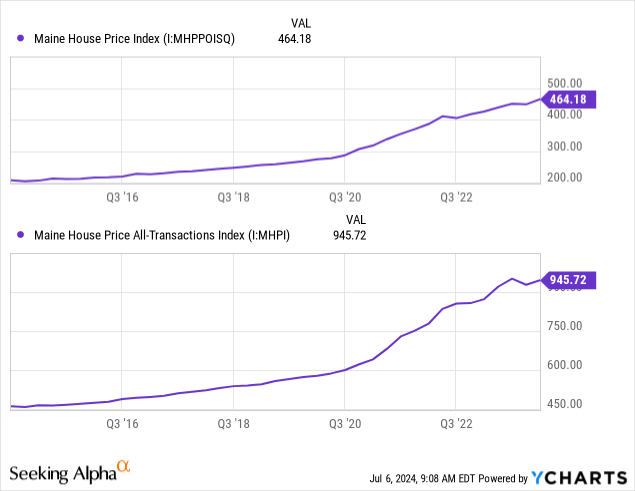

Residential and home equity loans make up 36% of total loans; therefore, home prices in Maine are also an important indicator of credit demand. As shown below, house prices were on a sharp uptrend again this year after taking a breather late last year. High house prices hurt affordability and consequently the demand for mortgages.

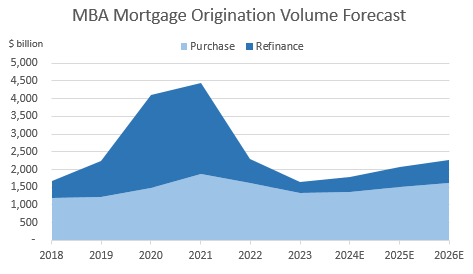

Residential mortgages are closely linked to borrowing costs as well. Therefore, the anticipated interest rate cuts will boost the demand for residential mortgages. The Mortgage Bankers Association projects mortgage purchase volume to grow by 9% next year.

Mortgage Bankers Association

Considering these factors, I’m expecting the loan portfolio to grow by 10.3% in 2024 and 10.8% in 2025. Further, I’m expecting deposits to grow in tandem with loans. The following table shows my balance sheet estimates.

| Financial Position | FY19 | FY20 | FY21 | FY22 | FY23 | FY24E | FY25E |

| Net Loans | 1,285 | 1,461 | 1,632 | 1,898 | 2,105 | 2,322 | 2,573 |

| Growth of Net Loans | 4.8% | 13.6% | 11.8% | 16.3% | 10.9% | 10.3% | 10.8% |

| Other Earning Assets | 663 | 752 | 763 | 686 | 674 | 683 | 711 |

| Deposits | 1,650 | 1,845 | 2,123 | 2,379 | 2,600 | 2,753 | 3,051 |

| Borrowings and Sub-Debt | 185 | 262 | 136 | 103 | 70 | 159 | 166 |

| Common equity | 213 | 224 | 246 | 229 | 243 | 248 | 260 |

| Book Value Per Share ($) | 19.5 | 20.5 | 22.4 | 20.8 | 21.9 | 22.3 | 23.4 |

| Tangible BVPS ($) | 16.8 | 17.7 | 19.6 | 18.0 | 19.2 | 19.6 | 20.6 |

Source: SEC Filings, Author’s Estimates (In USD million, unless otherwise specified)

Earnings to Start Recovering This Year

The upcoming interest rate cuts will likely help the earning’s downtrend reverse this year. Further, double-digit loan growth will likely help earnings recover. Based on my margin and balance sheet estimates, I’m expecting the net interest income to drop by 6.2% year-over-year in 2024 before rising by around 10.9% year-over-year in 2025. Moreover, I’m making the following assumptions.

- I’m expecting the provision-expense-to-loans ratio to return to the 2023 level after an unusual reversal in the first quarter of 2024.

- I’m expecting the non-interest income to be flattish, like the last five quarters.

- I’m expecting the non-interest expense’s growth rate to revert to the average for the last three years after an unusually high-growth rate seen for the first quarter of 2024.

Based on these assumptions, I’m expecting the company to report earnings of $2.11 per share for 2024, down 21% year-over-year, and $2.50 per share for 2025, up 19% year-over-year. The following table shows my income statement estimates.

| Income Statement | FY19 | FY20 | FY21 | FY22 | FY23 | FY24E | FY25E |

| Net interest income | 52 | 60 | 66 | 76 | 65 | 61 | 68 |

| Provision for loan losses | 1 | 6 | (0) | 2 | 1 | 1 | 2 |

| Non-interest income | 14 | 18 | 19 | 17 | 15 | 15 | 16 |

| Non-interest expense | 35 | 40 | 42 | 44 | 44 | 47 | 48 |

| Net income – Common Sh. | 26 | 27 | 36 | 39 | 30 | 23 | 28 |

| EPS – Diluted ($) | 2.34 | 2.48 | 3.30 | 3.53 | 2.66 | 2.11 | 2.50 |

Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD million, unless otherwise specified)

Risks Stem From Geographical Concentration

The biggest source of risk for The First Bancorp is the geographical concentration of its operations, as the company mostly operates in the state of Maine.

Other than the geographical risk, the company’s risk level is low. The Deposit book is currently carrying low risk as uninsured deposits made up only 16.4% of total deposits as of March 31, 2024, as mentioned in the 10-Q filing. Further, the loan portfolio has low credit risk as total past due loans were just 0.094% of total loans.

Moreover, the securities’ portfolio has a satisfactory risk level, as net unrealized losses on the Available-for-Sale securities portfolio stood at $42.8 million as of March 31, 2024, which is around 18% of the total equity balance.

Dividend Yield of 6.1%

The First Bancorp is currently offering a very attractive dividend yield of 6.1% at a quarterly dividend of $0.36 per share and the July 5 closing price of $23.40. In my opinion, the dividend payout appears safe because of the following two reasons.

- My earnings estimates suggest a payout ratio of 67.4% for 2024 and 57.6% for 2025. Both are above the five-year average of 45.4%. Nevertheless, there is barely any chance of a dividend cut because the implied payout ratios for both years are affordable. I would consider a payout ratio over 90% to be uncomfortable. Anything below 90% can be managed, especially if earnings are expected to trend upwards.

- FNLC is very well capitalized; therefore, there is no regulatory pressure on the company to build capital by cutting dividends. The total risk-based capital stood at 13.54% at the end of March, which is much higher than the minimum regulatory requirement of 10.50%.

Adopting a Buy Rating

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value The First Bancorp. The stock has traded at an average P/TB ratio of 1.48 in the past, as shown below.

| FY19 | FY20 | FY21 | FY22 | FY23 | Average | |

| T. Book Value per Share ($) | 16.8 | 17.7 | 19.6 | 18.0 | 19.2 | |

| Average Market Price ($) | 26.6 | 23.0 | 29.0 | 30.0 | 25.8 | |

| Historical P/TB | 1.58x | 1.30x | 1.48x | 1.67x | 1.35x | 1.48x |

Source: Company Financials, Yahoo Finance, Author’s Estimates

Multiplying the average P/TB multiple with the forecast tangible book value per share of $19.6 gives a target price of $28.9 for the end of 2024. This price target implies a 23.5% upside from the July 5 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.28x | 1.38x | 1.48x | 1.58x | 1.68x |

| TBVPS – Dec 2024 ($) | 19.6 | 19.6 | 19.6 | 19.6 | 19.6 |

| Target Price ($) | 25.0 | 26.9 | 28.9 | 30.9 | 32.8 |

| Market Price ($) | 23.4 | 23.4 | 23.4 | 23.4 | 23.4 |

| Upside/(Downside) | 6.8% | 15.1% | 23.5% | 31.8% | 40.2% |

Source: Author’s Estimates

The stock has traded at an average P/E ratio of around 9.5x in the past, as shown below.

| FY19 | FY20 | FY21 | FY22 | FY23 | Average | |

| Earnings per Share ($) | 2.34 | 2.48 | 3.30 | 3.53 | 2.66 | |

| Average Market Price ($) | 26.6 | 23.0 | 29.0 | 30.0 | 25.8 | |

| Historical P/E | 11.3x | 9.3x | 8.8x | 8.5x | 9.7x | 9.5x |

Source: Company Financials, Yahoo Finance, Author’s Estimates

Multiplying the average P/E multiple with the forecast earnings per share of $2.11 gives a target price of $20.00 for the end of 2024. This price target implies a 14.4% downside from the July 5 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 7.5x | 8.5x | 9.5x | 10.5x | 11.5x |

| EPS 2024 ($) | 2.11 | 2.11 | 2.11 | 2.11 | 2.11 |

| Target Price ($) | 15.8 | 17.9 | 20.0 | 22.1 | 24.3 |

| Market Price ($) | 23.4 | 23.4 | 23.4 | 23.4 | 23.4 |

| Upside/(Downside) | (32.4)% | (23.4)% | (14.4)% | (5.4)% | 3.6% |

Source: Author’s Estimates

Equally weighting the target prices from the two valuation methods gives a combined target price of $24.50, which implies a 4.6% upside from the current market price. Adding the forward dividend yield gives a total expected return of 10.6%. Hence, I’m adopting a buy rating on The First Bancorp.

Read the full article here