The Gap, Inc. (NYSE:GPS) reported Q1 results, blowing Wall Street analysts’ and my estimates out of the water. This made the shares rally by 29% following the results, as all of Gap’s brands showed signs of clearly improving demand.

I previously published an article on the company, published with a Sell rating on the 13th of May with the title “The Gap: Recent Margin Leverage Doesn’t Seem Sustainable.” In the article, I outlined Gap’s brands to be still performing weakly, making the company’s greater gross margins a short-term solution to a more persisting underlying problem.

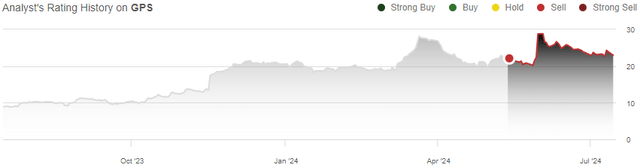

While the article aged very poorly at first as the stock rallied to Gap’s Q1 results, the stock has now performed below the S&P 500’s (SP500) return. The SP5o0 has returned about 8%, while GPS has had a total return of just 3% from the article’s publishing, with the stock now starting to fall back. With the stock retreating, I believe that a revisit to the thesis is due as the Q1 results showed such a strong performance.

My Rating History on GPS (Seeking Alpha)

The Q1 Results Exceeded Expectations

Gap’s reported Q1 results exceeded expectations by a wide margin. The reported revenues of $3.39 billion, up 3.4% year-over-year, exceeded Wall Street analysts’ estimates by $100.6 million, and the normalized EPS of $0.42 beat expectations by a highly impressive margin of $0.27.

Behind the financials, all of Gap’s brands showed an improving performance – Old Navy’s comparable sales grew 3%, Gap’s 3%, Banana Republic’s 1%, and Athleta’s 5%. Meanwhile, only the Gap brand managed to have a positive growth (1%) in FY2023. The reported growth is especially strong considering the apparel industry’s current headwinds regarding consumer spending – Gap also communicated to have gained market share with all of its brands in the quarter.

With the Q1 report, Gap also raised its FY2024 guidance. Previously, the company anticipated roughly flat comparable sales, but raised the outlook into “up slightly.” With the greater sales anticipation, Gap also expects gross margin leverage to continue incredibly well with 150 basis points compared to the previous 50 basis point outlook. Ultimately, the improved performance outlook improved the earnings outlook incredibly well through operating leverage, raising the operating income growth outlook from up in the low-to-mid teens into up in the mid-40% range from a $606 million adjusted operating income in FY2023.

While the operating income outlook was raised dramatically, the quite low sales growth outlook still expects weak growth going forward, expecting the consumer spending to stay lower than usual throughout FY2024.

Gap’s Turnaround Likelihood Looks Good Going Forward

The Q1 earnings call also clearly suggests Gap’s management’s confidence in continued turnaround momentum looking ahead. Old Navy’s more relevant product lines and the Gap brand’s successful Linen Moves marketing campaign have pushed the two largest brands’ demand considerably. The company is planning to build more upon the successfully created momentum, especially with a better brand expression at Old Navy, focusing on the brand’s core strengths. Banana Republic and Athleta also follow in the footsteps of the larger brands, showing an incredibly upbeat performance from operational improvements and marketing.

Looking at Old Navy’s and Gap’s Google Trends charts, Old Navy’s performance still isn’t strong, with quite a stagnant year-over-year view, although the brand has started to see some stabilization in very recent times after the historical declines. On the other hand, Gap even shows a well-improving performance – to me, it appears that the sales turnaround is now more likely to stick around considering the shown results, although the Old Navy performance still needs to be followed closely.

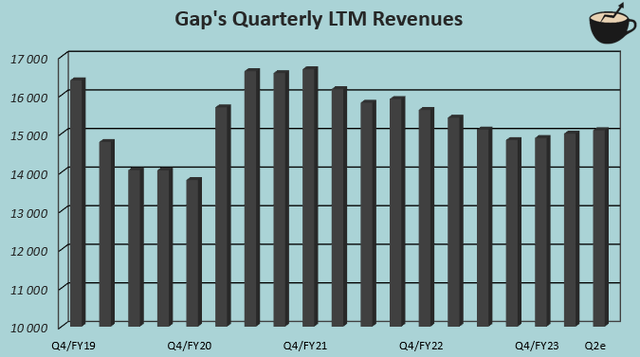

Author’s Calculation Using TIKR Data

With the stronger brand performance, Gap’s gross margin expansion also looks more likely to be sustained. In addition, the growing sales look to bring additional operating leverage. The Gap’s CFO, Katrina O’Connell, even communicated in the recent earnings call that the organization will still have SG&A optimization left after achieving $550 million in cost reductions up to date. I believe that the Q1 results very significantly raised Gap’s long-term earnings outlook, with a more likely sales turnaround.

Gap should report the company’s Q2 results in August, giving more insights into the turnaround’s success.

Updated Valuation

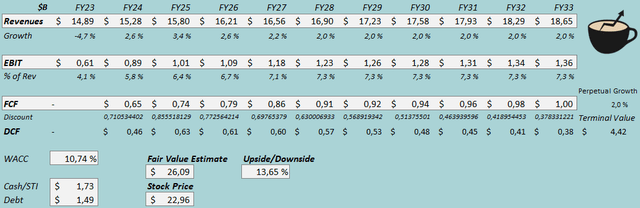

I updated my discounted cash flow [DCF] model considerably from the prior estimates. I now estimate the turnaround to be way more successful – after previously estimating a -0.5% FY2024 revenue decline, I now estimate a 2.6% growth. Afterward, I estimate a better 3.4% growth from an improved macroeconomic outlook, gradually slowing down into 2.0% perpetual growth. I previously estimated the growth to only gradually improve to the 2.0% perpetual growth.

Due to the better demand outlook, I also estimate elevated margins with a midterm gradual improvement into a 7.3% EBIT margin, up 1.5 percentage points from my updated 5.8% FY2024 estimate. I previously estimated a sustained 5.5% EBIT margin level.

Gap’s cash flow conversion outlook remains fairly good with the given growth estimates.

DCF Model (Author’s Calculation)

The estimates put Gap’s fair value estimate at $26.09, 14% above the stock price at the time of writing. The stock now even represents a potentially attractive investment if the sales turnaround progresses as it currently does. With more long-term showcasing still needed, though, I believe that investors need to keep some caution in estimating too high improvements as a base scenario going forward.

The fair value estimate is up from $17.28 previously due to the dramatically better earnings outlook given the successful turnaround outlook.

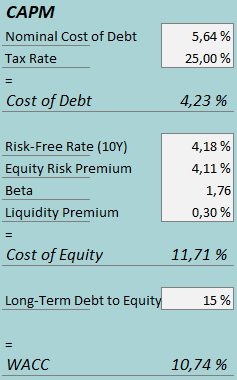

CAPM

A weighted average cost of capital of 10.74% is used in the discounted cash flow, or DCF, model, down from 11.84% previously. The used WACC is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

In Q1, Gap had $21 million in interest expenses, making the company’s interest rate 5.64% with the current amount of interest-bearing debt. The company continues operating with a moderate amount of debt, and I estimate a long-term debt-to-equity ratio of 15% once again.

To estimate the cost of equity, I use the 10-year bond yield of 4.18% as the risk-free rate. The equity risk premium of 4.11% is Professor Aswath Damodaran’s estimate for the US, updated in July. I have kept the beta estimate at 1.76. With a liquidity premium of 0.3%, the cost of equity stands at 11.71% and the WACC at 10.74%.

Takeaway

Gap’s Q1 results exceeded Wall Street’s, and my, estimates clearly. The company showed a good performance across the brand portfolio through successful marketing and product lines, and raised the FY2024 outlook to reflect a more successful turnaround despite lower consumer spending weighing on the industry.

With the brand turnaround looking incredibly more likely now, also enabling higher margins, I presently estimate the stock to have a slight undervaluation compared to my estimated overvaluation previously. With the stock giving a chance to revisit my rating at a similar price level from my previous bearish rating despite the incredibly strong Q1, I have upgraded my rating on The Gap, Inc. stock to Hold.

Read the full article here