One of our largest positions on the taxable bond side has been with FS Credit Opportunities (NYSE:FSCO), a relatively new listed closed-end fund (“CEF”) from FS Investments. Prior to November 2022, the fund was unlisted, providing only quarterly liquidity to shareholders up to 5% of shares.

The conversion from a quarterly liquidity to intraday liquidity vehicle allowed investors to sell out late in 2022 when bonds were falling precipitously as rates rose and investors positioned for recession. As a listed CEF, the fund’s share price can deviate from the net asset value (“NAV”) and trade at a discount.

One advantage of investing in CEFs is the ability to purchase $1 worth of assets for less than a dollar.

We wrote up this fund a little more than two months ago, FSCO Is My Favorite Opportunity In the Taxable CEF Space – 12.4% Yield.

The Fund’s Portfolio – A Mix Of Public and Private Debt

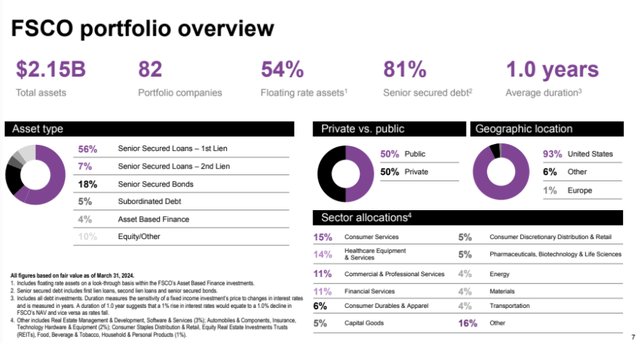

Private debt is all the rage right now, and this fund gives the retail investor access to it in a ’40 Act wrapper. The total assets in the portfolio are now over $2B.

The portfolio is a credit vehicle, meaning it won’t be affected by interest rates as much as credit spreads, or the additional yield earned above the same maturity US treasury (‘risk free’) rate. The fund holds loans, bonds, and structured credit securities.

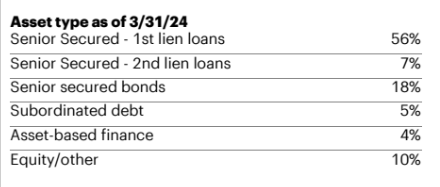

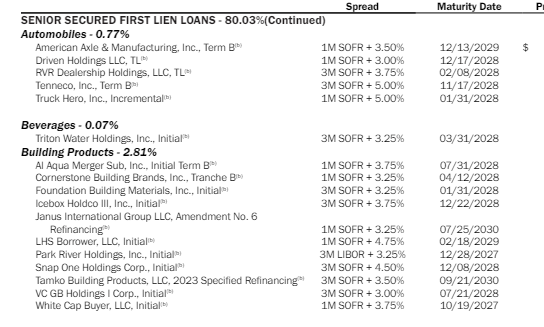

Just over half of the portfolio is in senior secured, first lien loans, with the second-largest allocation being to fixed coupon bonds (~18%).

FS Investments

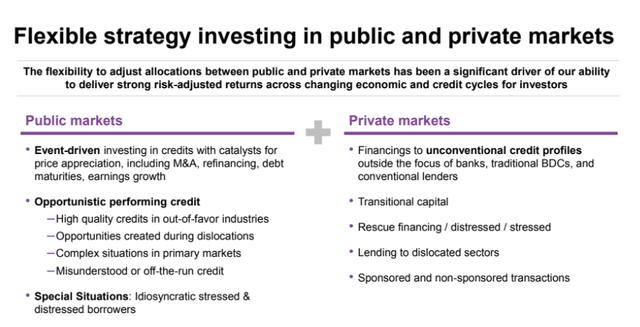

This is a rare fund that is allowed to invest across BOTH public and private markets within the same mandate. Typically, you are either in one or the other.

FS Investments

As of quarter end, the portfolio consisted of 82 companies across 20 different industries, most of which are US-based. The top 10 companies account for 24% of the portfolio’s fair value.

The profile of the loans are below, with most being senior secured debt. As you can see, the duration is just 1.0 years, meaning there is almost no interest rate sensitivity.

FS Investments

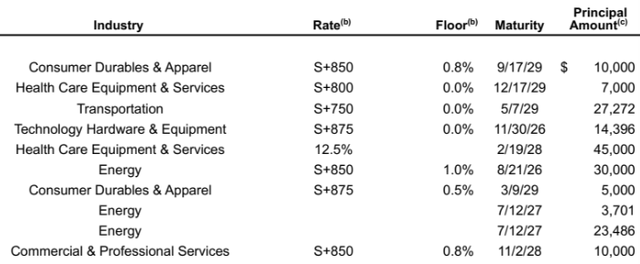

Overall, when you see the rate at S+800 or more, you know you are lending to companies that are CCC or worse type of credit quality. ‘S’ refers to the SOFR rate, the replacement for libor, or the short-term (usually 30 days) interest rate.

FS Investments

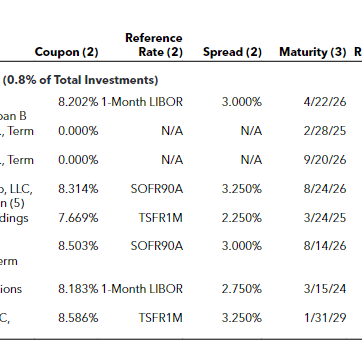

If you compare to XAI Octagon Fr & Alt Income (XFLT), you will immediately see a difference. For example, in their senior secured first lien loan bucket, the reference rate is the same 1M or 3M SOFR rate, but the spreads are much lower.

Most of the spreads are around 3.75%-4.75%, significantly below that of FSCO’s spread level. Now, one of the big differences is the size of the companies, with FSCO lending primarily to smaller, private companies.

FS Investments

The same could be said for Nuveen Floating Rate Inc (JFR) which has mostly 3.0%-4.0% spreads on the same reference rate.

Nuveen

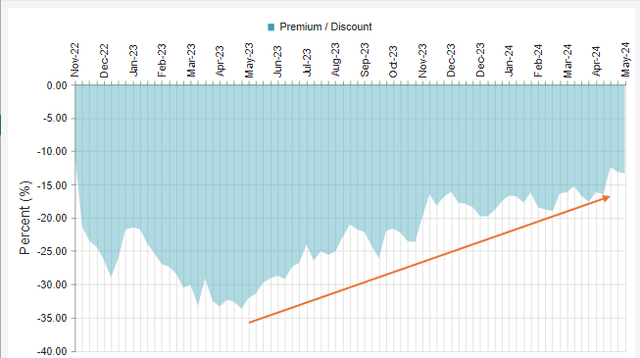

The CEF Wrapper | Increased Distribution Discount Slowly Closing

When the shares were listed in late 2022, the existing shareholders used the “liquidity” to exit at any price believing that a credit event (read recession) was ahead. This caused the share price to fall dramatically relative to the NAV and the discount of the shares to reach over -30%.

Approximately one year ago, the discount reached its widest levels of -34.6%, Since then, it has been a slow, methodical pace of discount tightening to the current -11.4% level.

CEFConnect

The main reason for the discount widening cessation was the last tranche of shares unlocked for the shareholders in the original unlisted fund. When they listed, they unlocked the shares in three pieces with shareholders being able to sell 1/3 of their shares in November 2022, February 2023, and May 2023.

Once that last tranche opened up in May 2023, the shareholders who desperately wanted out were able to sell out and the over-supply of shareholders selling out was exhausted.

The fund also raised the distribution twice since then, with the first being in June 2023 (+15.1%) and the second in March 2024 (+5.3%). This helped draw in new investors and close the discount.

The current yield on NAV is approximately 10.12%. When you buy the shares at an -11.3% discount, the yield rises to 11.4%.

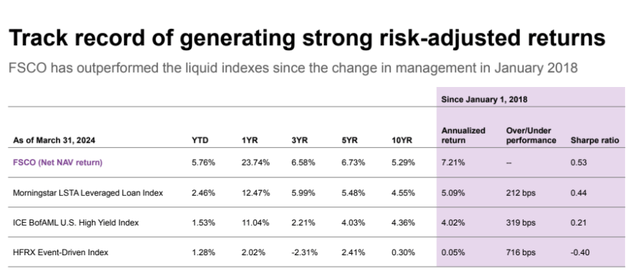

Q1 2024 Earnings Highlights | Another Strong Quarter

The end result says it all. The fund outperformed the passive high-yield bond benchmark by 4.29% and the passive loan benchmark by 3.28%, with a 5.76% total return for the quarter.

Net investment income (“NII”) was 19c in the quarter, covering the 18c distributions (6c paid monthly). Net asset value increased by 22c per share to $7.14 as of March 31st and $7.12 as of May 20th.

Leverage remains fairly low, which is why I believe that the distribution has not been raised more aggressively. Once spreads widen out, and they can take advantage through their $135mm of available borrowing capacity, that will produce a decent amount of added net investment income of approximately $8.5mm.

That’s an additional 24% of NII that could be paid out, potentially. That would be a best-case scenario.

FS Investments

Yes, The Fees Are High But Not That High

A lot of investors get hung up on the fees. I’m against paying high fees like the next guy, but not when you get something unique and high-performing.

Management Fees: $26,413,000

Incentive Fees: $16,622,000

Total Management Fees: $$43,035,000 or 3.13% of Net Assets in 2023.

Then we have interest expense on the leverage. The fund has a weighted average effective cost of debt of 6.23%. Interest expense totaled $43,924,000 in the year ending 2023. If we add in those costs, total ‘expenses’ before fund operating fees totaled $86,959,000 or 6.33%.

A 6.33% fee is high. Yes. But remember, this is not that atypical for a BDC CEF that sources their own loans and charges an incentive fee.

Also, consider the performance and yield. Those are NET or after those fees are paid. To generate top performance and gain access to private debt, which is most often only accessible to accredited or qualified investors, you have to pay up.

Concluding Thoughts

No, it’s not too late to buy shares of this fund. I still think that the distribution will likely be raised again, despite a couple of increases already. A lot will deepen on how much they are able to exploit good buying opportunities that may materialize over the next several months.

My position is quite large, when should I begin selling?

For those of us who got in early when the discount was at or above -30%, I think single digits is a good time to begin to start taking some off the table. That doesn’t mean the fund is an outright sell at a -8.5% discount, but to start to think about reducing overall exposure.

I think it’s possible that this fund eventually reaches a premium valuation, so consider that when selling at a -8.5% or thereabouts.

For those with minimal or no exposure, I certainly think you can buy shares around a -12% discount to NAV.

—————–

Read the full article here