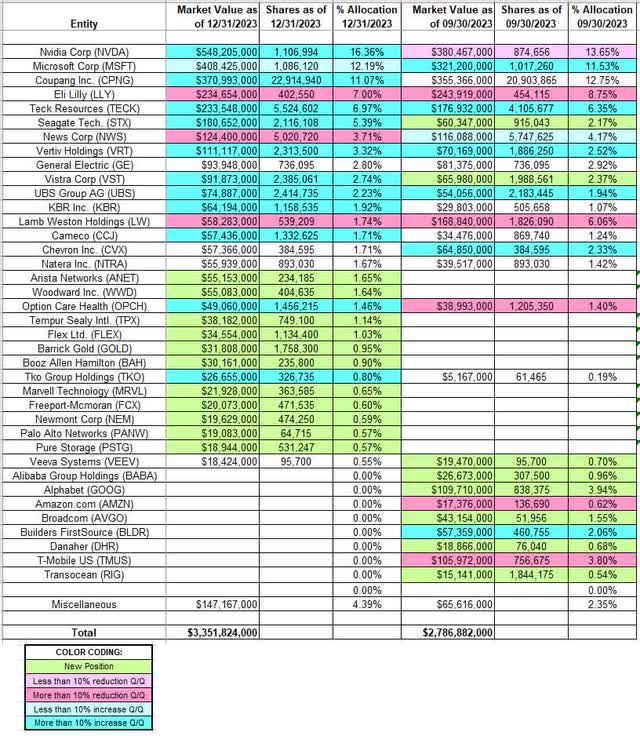

This article is part of a series that provides an ongoing analysis of the changes made to Duquesne Family Office’s 13F stock portfolio on a quarterly basis. It is based on Stanley Druckenmiller’s regulatory 13F Form filed on 2/14/2024. The 13F portfolio value increased from $2.79B to $3.35B this quarter. The holdings are concentrated with recent 13F reports showing around 50 positions, many of which are very small. There are 30 securities that are significantly large (more than ~0.5% of the portfolio each) and they are the focus of this article. The largest five stakes are Nvidia, Microsoft, Coupang, Eli Lilly, and Teck Resources. They add up to ~53% of the portfolio. Please visit our Tracking Stanley Druckenmiller’s Duquesne Portfolio series to get an idea of their investment philosophy and our previous update for the fund’s moves during Q3 2023.

Stanley Druckenmiller started the family office in Q4 2011 after closing his hedge fund Duquesne Capital in 2010. Prior to that, he managed George Soros’s Quantum Fund between 1988 and 2000. He follows a trend-following trading style that is similar to George Soros.

New Stakes:

Arista Networks (ANET), Woodward (WWD), Tempur Sealy International (TPX), Flex Ltd. (FLEX), Barrick Gold (GOLD), Booz Allen Hamilton (BAH), TKO Group Holdings (TKO), Marvell Technology (MRVL), Freeport-McMoRan (FCX), Newmont (NEM), Palo Alto Networks (PANW), and Pure Storage (PSTG): These are small (less than ~1.65% of the portfolio each) new stakes established during the quarter.

Stake Disposals:

Alphabet (GOOG): GOOG was a ~4% of the portfolio stake established last quarter at prices between ~$117 and ~$139. The disposal this quarter was at prices between ~$123 and ~$143. The stock currently trades at ~$140.

T-Mobile US (TMUS): The 3.80% TMUS stake was established in Q2 2020 at prices between ~$82 and ~$107. The position has wavered. Recent activity follows. Q4 2022 saw a ~37% selling at prices between ~$132 and ~$152 while in Q2 2023 there was a ~140% stake increase at prices between ~$127 and ~$151. There was a ~35% reduction last quarter at prices between ~$133 and ~$143. The position was sold this quarter at prices between ~$136 and ~$160. The stock is now at ~$163.

Builders FirstSource (BLDR): The ~2% BLDR position was purchased in the last two quarters at prices between ~$86 and ~$152. The elimination this quarter was at prices between ~$106 and ~$171. The stock is now at ~$195.

Broadcom (AVGO): The 1.55% AVGO position was purchased last quarter at prices between ~$808 and ~$918 and sold this quarter at prices between ~$815 and ~$1147. The stock currently trades at ~$1301.

Amazon.com (AMZN), Alibaba Group Holding (BABA), Danaher (DHR), and Transocean (RIG): These small (less than ~1% of the portfolio each) stakes were dropped during the quarter.

Stake Increases:

Nvidia (NVDA): NVDA is currently the largest 13F stake at ~16% of the portfolio. It was established during Q4 2022 at prices between ~$112 and ~$181. There was a ~35% stake increase during Q1 2023 at prices between ~$143 and ~$280. That was followed by a ~20% further increase next quarter at prices between ~$262 and ~$438. This quarter saw another ~27% increase at prices between ~$403 and ~$501. The stock currently trades at ~$791.

Microsoft (MSFT): MSFT is a large (top three) ~12% of the portfolio position established during Q1 2023 at prices between ~$222 and ~$288. There was a ~14% stake increase during Q2 2023 and that was followed by a ~23% increase last quarter at prices between ~$312 and ~$358. This quarter also saw a ~7% increase. The stock currently trades well above those ranges at ~$414.

Coupang (CPNG): CPNG had an IPO last March. Shares started trading at ~$49 and currently go for $18.52. Druckenmiller had a 10.5M share stake that went back to funding rounds prior to the IPO. There was a ~50% stake increase in Q3 2021 at prices between ~$28 and ~$44.50. Q4 2021 saw another ~15% stake increase at prices between ~$26 and ~$31. It is currently their third-largest stake at ~11% of the portfolio. This quarter also saw a ~10% stake increase.

Teck Resources (TECK): TECK is a large (top five) ~7% of the portfolio stake purchased in Q1 2022 at prices between ~$29 and ~$42. The next quarter saw a ~55% reduction at prices between ~$26 and ~$46. There was a ~200% stake increase in the three quarters through Q1 2023 at prices between ~$26 and ~$44. That was followed by a two-thirds further increase over the last three quarters. The stock currently trades at $38.42.

Note: TECK has seen a previous recent roundtrip. It was a 2.47% of the portfolio position built in Q4 2020 at prices between ~$12.25 and ~$18.85. The bulk of it was sold in Q3 2021 at prices between ~$19.50 and ~$26.80.

Seagate Technology (STX): STX is a 5.39% stake purchased last quarter at prices between ~$57 and ~$73 and the stock currently trades at ~$93. This quarter saw a ~130% stake increase at prices between ~$63 and ~$87.

Vertiv Holdings (VRT): VRT is a 3.32% of the portfolio stake established during H2 2022 at prices between ~$8.25 and ~$15 and it now goes for $67.62. The two quarters through Q2 2023 saw a ~80% reduction at prices between ~$12 and ~$25 while the last quarter saw a ~53% stake increase at prices between ~$24 and ~$40. This quarter saw a ~23% further increase at prices between ~$35 and ~$49.

Vistra (VST): The 2.74% VST position was purchased last quarter at prices between ~$26 and ~$34 and the stock currently trades at $54.54. This quarter saw a ~20% stake increase.

UBS Group AG (UBS): UBS is a 2.23% stake built during the last two quarters at prices between ~$19 and ~$27 and the stock currently trades at $28.45. There was a ~11% stake increase this quarter.

Option Care Health (OPCH): OPCH is a 1.46% of the portfolio position established during Q4 2022 at prices between ~$28 and ~$35. There was a ~50% reduction in the next quarter at prices between ~$28 and ~$33 while Q2 2023 saw the position rebuilt at prices between ~$27 and ~$33. Last quarter saw a ~72% selling at prices between ~$31 and ~$36. The stock currently trades at $32.27. There was a ~20% stake increase this quarter.

Cameco (CCJ), KBR, Inc. (KBR), and TKO Group Holdings (TKO): These very small (less than ~1% of the portfolio each) stakes were increased this quarter.

Stake Decreases:

Eli Lilly (LLY): LLY is a large (top five) ~7% of the portfolio position purchased during Q2 2022 at prices between ~$279 and ~$327. There was a ~150% stake increase during H2 2022 at prices between ~$296 and ~$375. The two quarters through Q2 2023 saw a ~27% reduction at prices between ~$311 and ~$469. That was followed by a ~15% selling last quarter at prices between ~$433 and ~$598. This quarter also saw a ~11% trimming. The stock currently trades at ~$754.

News Corp. (NWS): The 3.71% NWS stake was purchased during Q1 2023 at prices between ~$16 and ~$22. There was a ~55% stake increase in the next quarter at prices between ~$17 and ~$20. Last quarter also saw a ~9% further increase while this quarter there was a ~12% trimming. The stock is now at ~$28.

Lamb Weston Holdings (LW): The 1.74% LW position was built during H2 2022 at prices between ~$73 and ~$90. There was a ~20% increase during Q1 2023 at prices between ~$87 and ~$105. This quarter saw the original large stake sold down by ~70% at prices between ~$83 and ~$108. The stock is now at ~$102.

Kept Steady:

General Electric (GE): GE is a 2.80% of the portfolio position purchased during Q2 2023 at prices between ~$94 and ~$110 and the stock currently trades at ~$157.

Chevron (CVX): A large CVX stake was purchased during the two quarters through Q1 2022 at prices between ~$102 and ~$171. There was a ~28% selling in the two quarters through Q3 2022 at prices between ~$136 and ~$181 while the next quarter saw a ~42% stake increase at prices between ~$144 and ~$188. Q1 2023 saw the position sold down by 75% at prices between ~$152 and ~$188. The stake was rebuilt last quarter at prices between ~$151 and ~$171. The stock currently trades at ~$152.

Natera (NTRA): The 1.67% NTRA stake was established over the three quarters through Q1 2023 at prices between ~$32 and ~$58 and it is now at $86.49.

Veeva Systems (VEEV): The very small 0.55% stake in VEEV was kept steady this quarter.

Below is a spreadsheet that highlights the changes to Stanley Druckenmiller’s Duquesne Family Office 13F stock portfolio as of Q4 2023:

Stanley Druckenmiller – Duquesne Family Office Portfolio – Q4 2023 13F Report Q/Q Comparison (John Vincent (author))

Read the full article here