I think the Materials sector is enormously underowned. Relative to the S&P 500 (SP500), it’s actually as of writing below the Covid crash levels of 2020. And yet, as China’s economy likely bottoms here, and as infrastructure spending wraps up globally, I think it’s clear that commodities and those companies that are in the materials sector thrive. If you are of the same mindset, you may want to consider the Vanguard Materials Index Fund ETF Shares (NYSEARCA:VAW).

This is a passively managed exchange-traded fund that invests in the materials segment of the US equity market. It aims to replicate the movements of the MSCI US Investable Market Materials 25/50 Index. It’s a fairly large fund, with around $4.2 billion in assets under management. And of course because it’s coming from Vanguard, it’s cheap at 0.1% fee.

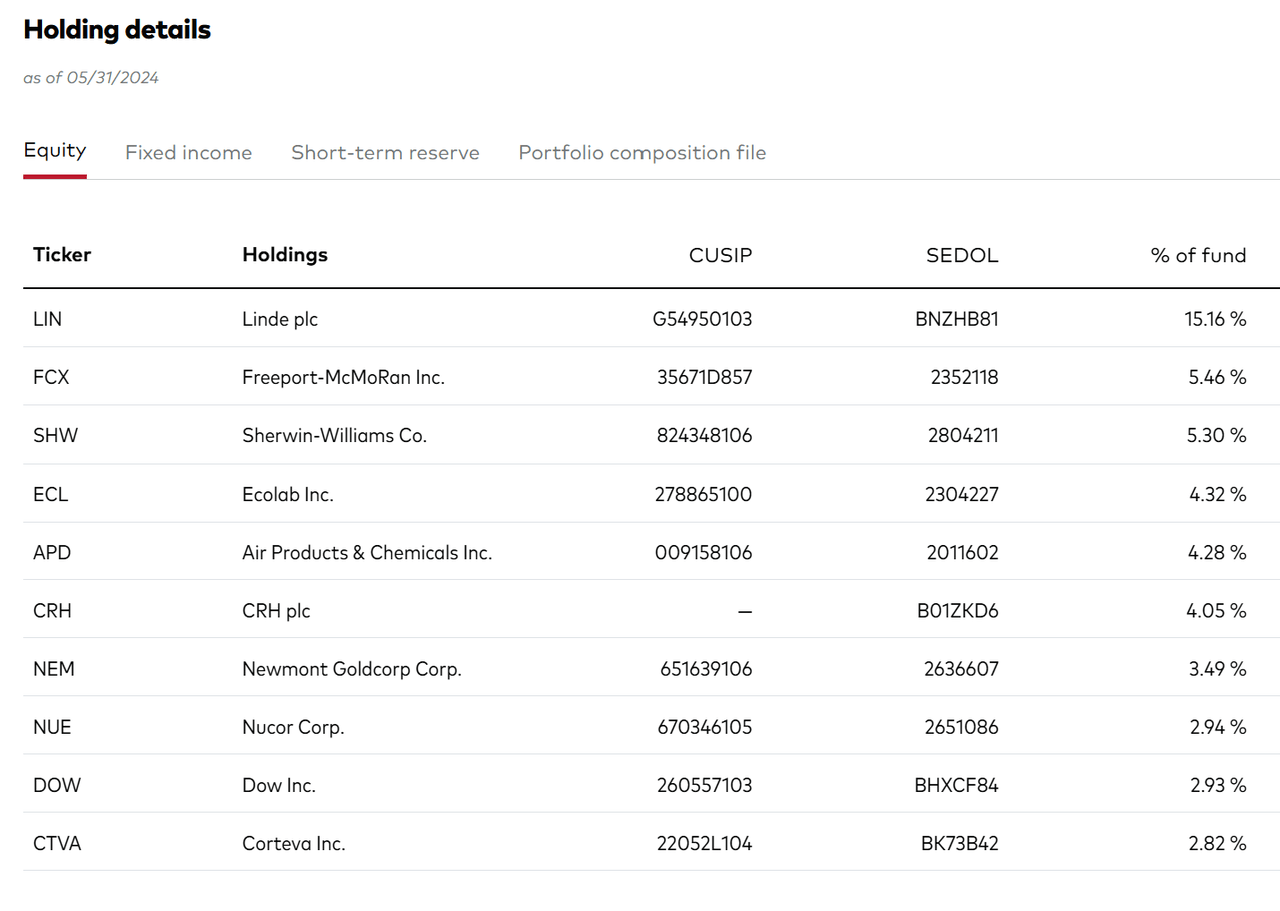

A Look At The Holdings

VAW’s portfolio is well-diversified, with an allocation across 120 stocks. No position makes up more than 15.16%, making this have some idiosyncratic risk at the top.

vanguard.com

That idiosyncratic risk comes from Linde plc (LIN), which is an industrial gas and engineering company, operating in healthcare, energy, electronics, manufacturing and more. Other companies with a considerably lower weight than Linde include stocks like Freeport-McMoRan Inc. (FCX), which is a global mining company that specializes in the exploration and production of copper, gold and molybdenum. Following Freeport-McMorRan is Sherwin-Williams Company (SHW), a manufacturer of paints, coatings and related products for professional, industrial, commercial and retail customers.

These top holdings result in VAW having broad exposure to diversified materials-related businesses like industrial gasses, mining, coatings, chemicals, and so forth. Investing in the companies that make up the portfolio offers an easy way to gain exposure to the entire materials sector – and participate in its growth and performance.

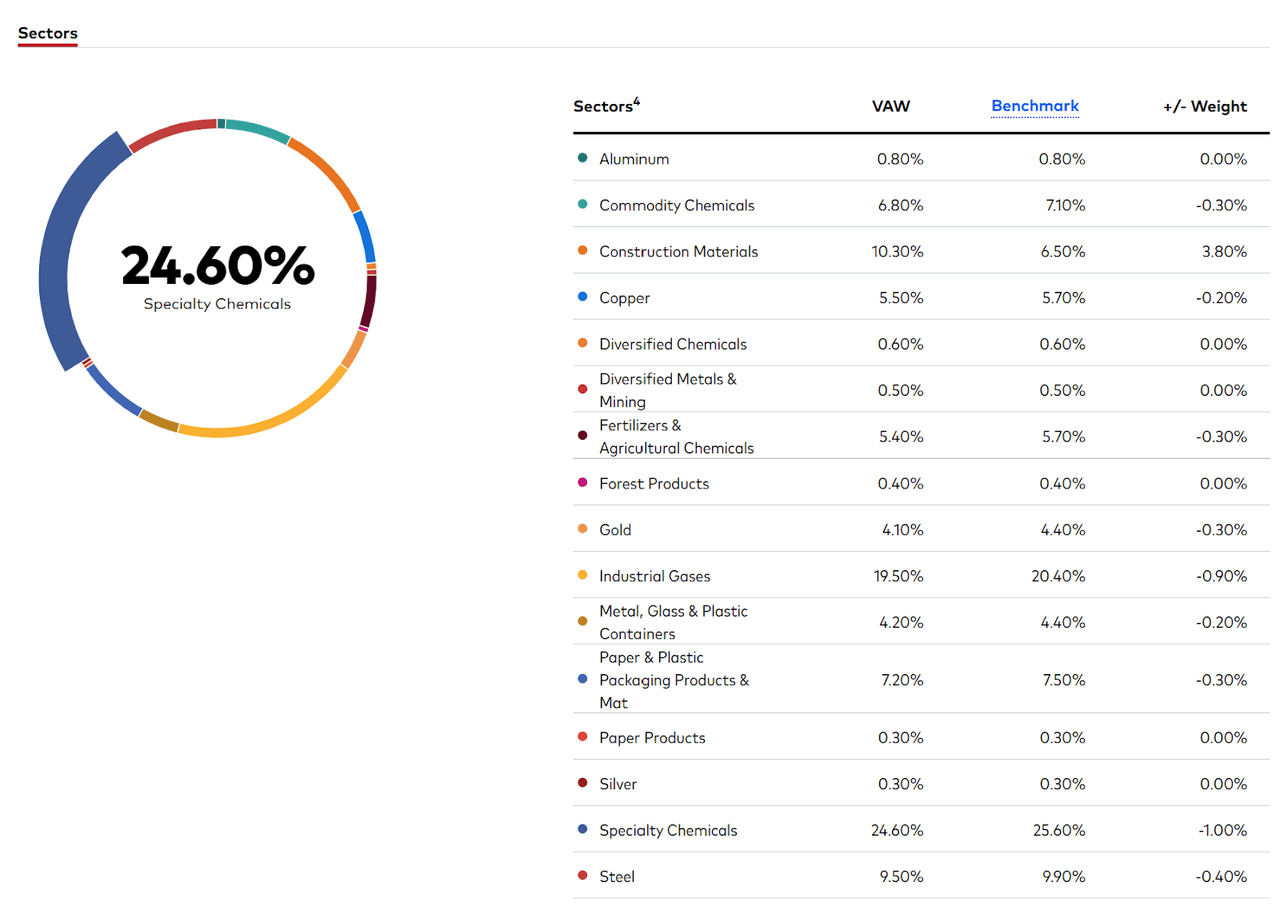

Sector Composition

Chemicals and Industrial Gases comprise the 2 largest industry groups at 24.6% and 19.5% respectively. More traditionally-thought-of material plays like Copper and Steel make up a considerably smaller overall allocation.

vanguard.com

This isn’t uncommon among broad Materials sector ETFs. Personally, I’d prefer the holdings include more industrial commodity related companies, but I get why the composition looks like this.

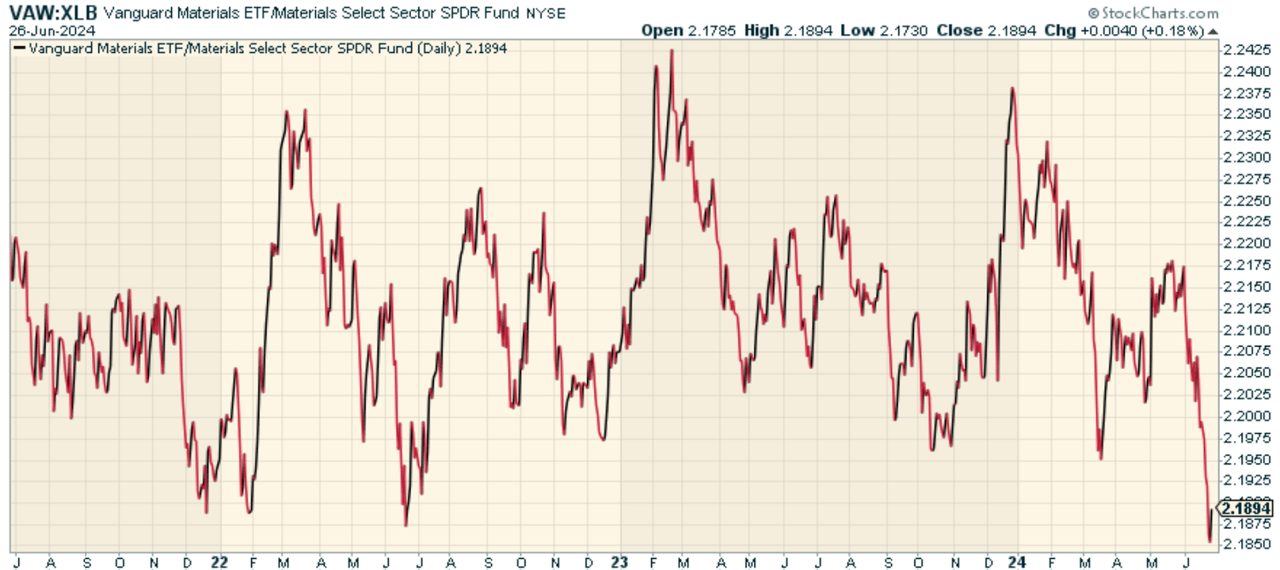

Peer Comparison

The closest fund to VAW is The Materials Select Sector SPDR® Fund ETF (XLB). This fund tracks the Materials Select Sector Index, and it has a comparable expense ratio. The industry allocations are very similar between the two funds. When we compare the price ratio of VAW to XLB, we find that the two have largely been in a wide range relative to each other over the past three years. No real advantage from a relative strength perspective.

stockcharts.com

Pros and Cons

On the positive side, VAW offers a holistic but diversified exposure to the materials sector which, in an environment of increasing inflation and growth, can be a good thing because materials companies tend to move in sync with commodities. Furthermore, VAW has a low expense ratio and Vanguard’s reputation for cost efficacy is well-regarded.

At the same time, the materials sector is cyclical – that is, its performance depends on the state of the broader economic cycle. If demand for goods and services stalls or contracts, for example during a downturn or a recession, it can have a negative impact on profitability. Moreover, VAW’s concentrated focus in chemicals and industrial gasses may be problematic if there’s something specific to each that results in a headwind.

This, to me, is the biggest question mark, for whatever it’s worth. We still have an inverted yield curve, and the economy does appear to be slowing down on the manufacturing front. Materials have already underperformed, so perhaps a lot on a relative basis is already priced in. Still, this will very much be dependent on what happens to US, and global, economic activity overall.

Conclusion

I like the Materials sector, despite relative performance being as poor as it has been for the past several years. I think it’s under owned and underappreciated, and much prefer this sector over Tech. VAW is a quick and efficient way to get exposure and overweight the group relative to your core allocations. Worth considering, particularly if bullish on commodities here.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Subscribe to The Lead-Lag Report today.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Read the full article here