I’m bullish on Energy. It’s underowned, underappreciated, and relatively cheap compared to other sectors and even relative to its own history. The combination of economic recoveries from the pandemic slump, the re-emergence of industrial activities and global trade, and steady growth of major consumer economies have put energy consumption on a sharp upward trajectory.

And if you see opportunity in the sector like I do, you may want to consider owning the Vanguard Energy Index Fund ETF Shares (NYSEARCA:VDE).

Launched in 2004, VDE takes a passive approach that is cap weighted and meant to provide broad-based exposure to the entire energy sector. It comes from Vanguard, which of course means it’s cheap at 0.1%.

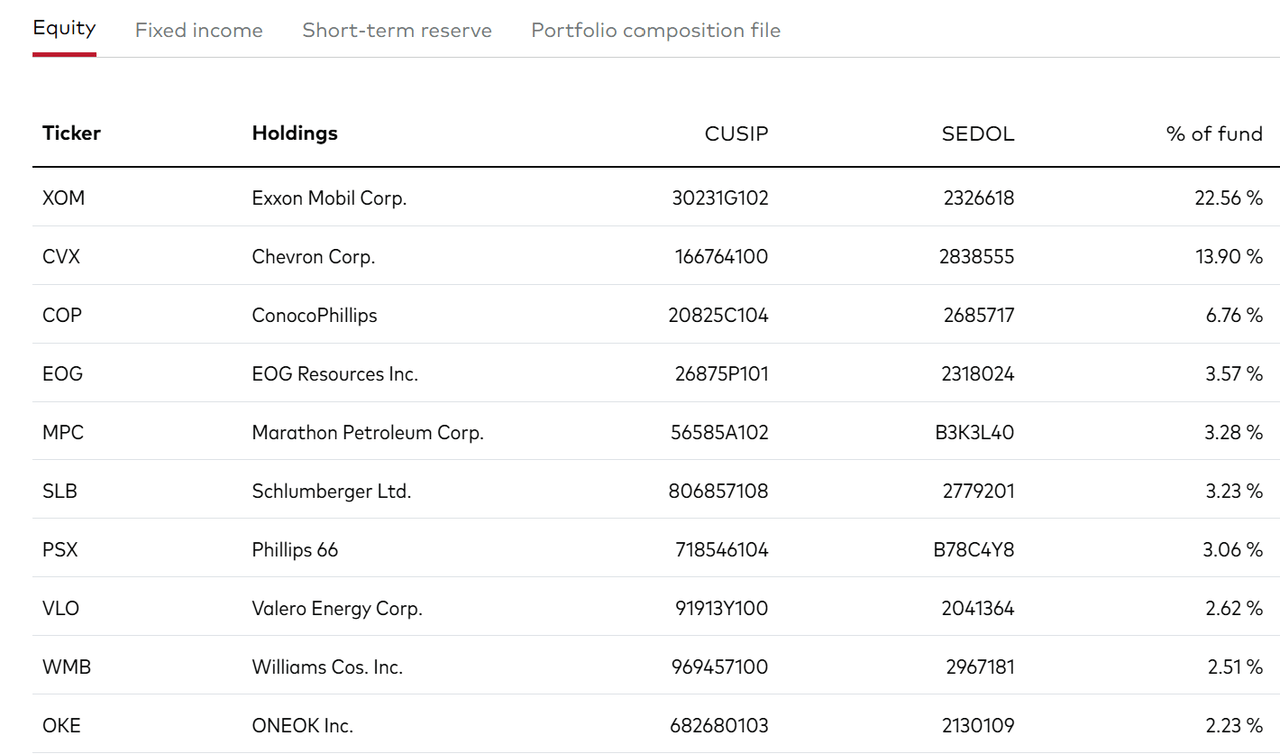

A Look At The Holdings

There are 115 positions, with the biggest 10 positions comprising a whopping 63 percent of total assets. This is very top-heavy, which shouldn’t be surprising given its market-cap weighted.

vanguard.com

The holdings cover every aspect of the sector. Exxon Mobil (XOM) is at the top, and as I’m sure you know, is an integrated energy company engaged in the exploration, production, transportation, and sale of crude oil and natural gas. Chevron (CVX) is another integrated energy company, deriving revenue from upstream (exploration and production), midstream (transportation and storage), and downstream (refining and marketing) sources. ConocoPhillips is a pure-play exploration and production company with exposure around the world. And EOG Resources is an independent crude oil and natural gas exploration and production firm with a dominant position in the major shale plays of the US.

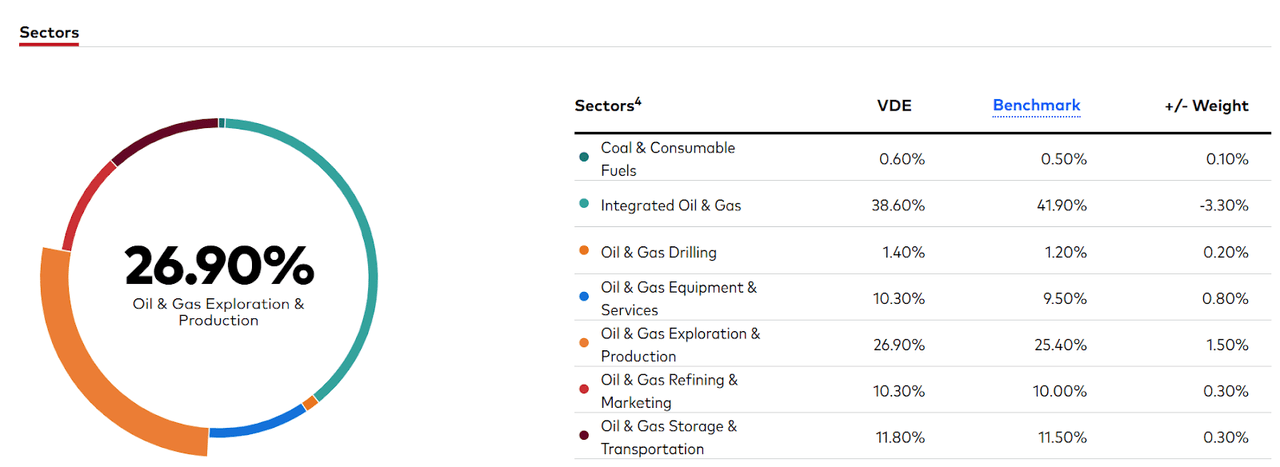

Sector Composition and Weightings

The biggest allocation goes to Integrated Oil & Gas at nearly 40% of VDE.

vanguard.com

The overall mix of sectors here is well-rounded, and again reflective of market-cap weighting overall. Note that the weightings match the benchmark, reflecting the passive nature of the fund.

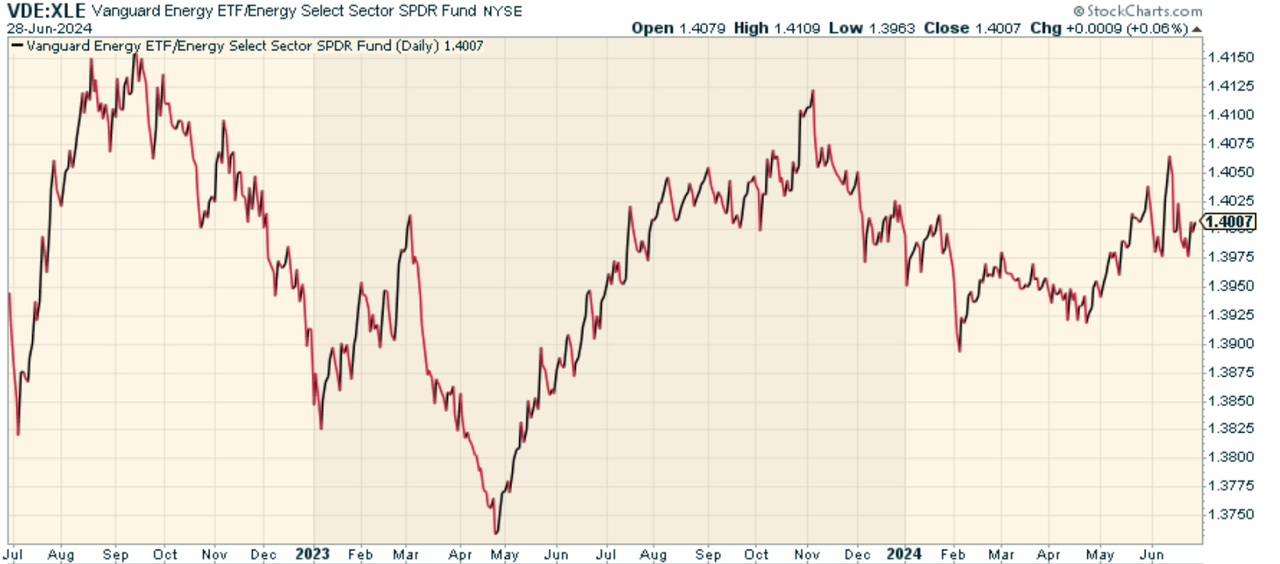

Peer Comparison

Although the Vanguard Energy ETF is a prominent player in the energy ETF space, it is far from the only game in town for investors interested in the energy sector. The big one to compare against is The Energy Select Sector SPDR® Fund ETF (XLE). This ETF is the largest and most heavily traded energy fund out there. It’s more concentrated than VDE, but still representative of the sector. When we look at the price ratio of VDE to XLE, we find that the two have stayed in a tight range overall. No clear advantage in one over the other.

stockcharts.com

Pros and Cons

Buying the Vanguard Energy ETF could turn out to be a great way to profit from a reinvigorated energy sector – but there are risks and trade-offs to consider before you do so. On the plus side, the fund provides low-cost, diversified exposure to the energy sector. It’s simple and effective. And if inflation pressure persists, it can serve as a beneficiary given the energy sector’s historical behavior to rising cost-push inflationary pressure through Oil prices.

But investors should also be aware that there is quite a bit of volatility in Energy. Changing geopolitical tensions, regulatory changes, commodity prices and other factors all make for multiple sources of risks that can be difficult to model. Furthermore, the industry’s carbon emissions, and the slow and steady movement toward clean energy, are challenges with long-term implications that could disrupt the sector altogether. I’m also not a fan of how big the weighting of Exxon and Chevron have in the fund. I recognize they have a large position because the fund is market-cap weighted, I just don’t like so much exposure in a select number of stocks.

Conclusion

All in all, there is a lot to be said for the Vanguard Energy ETF as a way for investors to capitalize on the rebound of the energy sector and, thanks to Vanguard, through a cost-effective and passive approach. Good fund overall in my view for a blunt force way of expressing a bet on Energy. And if I’m right that we are on the verge of a major secular cycle shift away from growth style investing to value investing, there should be a major tailwind for the energy sector overall given that the sector has a higher weighting to value style indices more generally.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Are you tired of being a passive investor and ready to take control of your financial future? Introducing The Lead-Lag Report, an award-winning research tool designed to give you a competitive edge.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high yield ideas, and gaining valuable macro observations. Stay ahead of the game with crucial insights into leaders, laggards, and everything in between.

Go from risk-on to risk-off with ease and confidence. Subscribe to The Lead-Lag Report today.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Read the full article here